Millennial Lithium Corp. (TSX.V:ML, FSE:A3N2, OTCQB:MLNL) is an emerging exploration and development company, focused on world class lithium assets in Argentina. Millennial Lithium controls over 20,000 hectares of prime land, in the heart of the famed Lithium Triangle – home to the world’s most prolific lithium riches. In Argentina, the Company is advancing two lithium projects to a production decision. Both are located within an emerging mining district that is home to several world-class lithium mines and in-development deposits. We learned from Graham Harris, Chairman and Director of Millennial Lithium, that their flagship project is Pastos Grandes, which is located in the Salta Province of Argentina. Subsequent to the drilling that they undertook last year, they came out with a very substantial 43-101 resource, in November, of close to three million tons of lithium carbonate reserves. They followed that up with a PEA, released in January of 2018, showing that the Pastos Grandes project is probably one of the biggest and best lithium brine resources in all of the lithium triangle. With a significant Chinese investor, GCL Poly, and 65 million dollars cash in the bank, Millennial Lithium plans to complete a bankable feasibility study during 2018, then enter into some strategic off-takes.

Pastos Grandes Lithium Project

Dr. Allen Alper:

Pastos Grandes Lithium Project

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Graham Harris, Chairman and Director of Millennial Lithium. Could you give our readers/investors an overview of your company, your focus and current activities?

Mr. Graham Harris: Certainly, Dr. Alper. We are a lithium-focused company. Our projects are brine projects in Argentina. Our flagship project is Pastos Grandes, which is located in the Salta Province of Argentina.

Dr. Allen Alper: Well, great. Could you tell our readers/investors a bit more about what makes this project so significant in the Lithium Triangle? Why is this area and your properties so important?

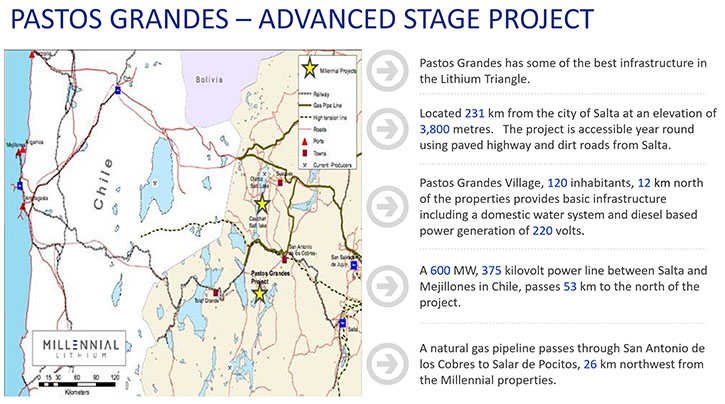

Mr. Graham Harris: Certainly. The Lithium Triangle is comprised of the area in the northwest of Argentina and it comprises areas in Chile and Bolivia. The area hosts 80% of the world's known lithium resources. We're fortunate to be in Argentina. Bolivia has a nationalistic government, so private enterprise is not encouraged. It's very difficult to do business there. And in Chile, lithium is deemed a strategic metal, which means you'll have to do a deal with the government, sometimes an onerous proposition.

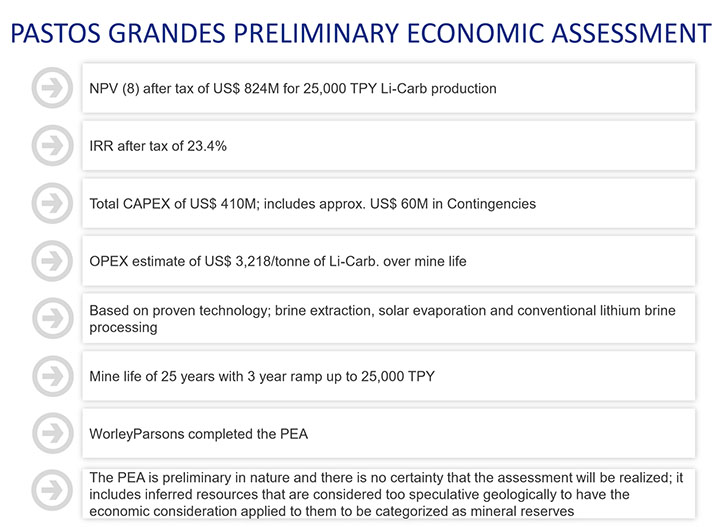

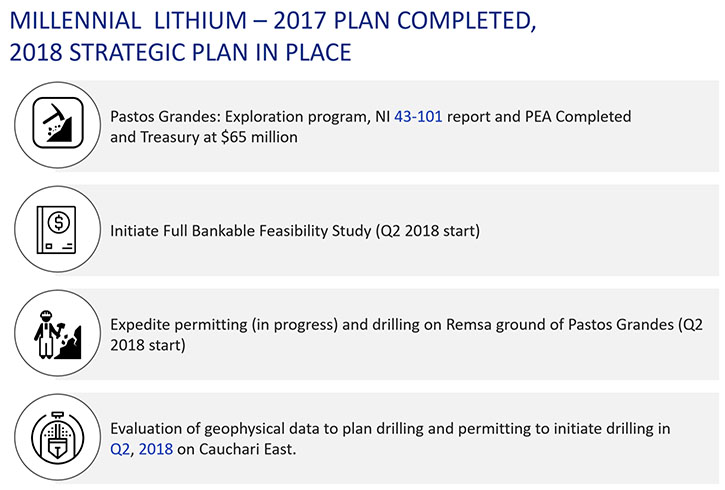

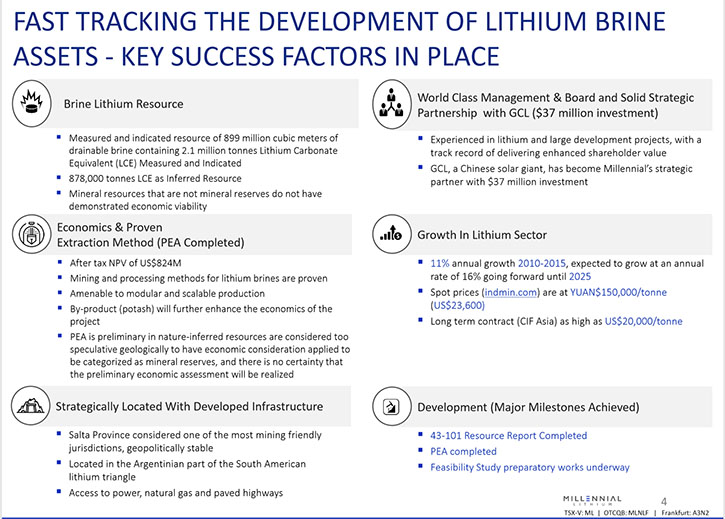

We're fortunate to be in a very mining-friendly Country, in a friendly provincial jurisdiction, the Salta Province of Argentina. Last year when we first spoke, we talked about the project and what our plans were. I'm happy to say that subsequent to the drilling we undertook last year, we came out with a very substantial 43-101 resource, in November, of over three million tons of lithium carbonate. We followed that up with a PEA, preliminary economic assessment, which we just released in January of 2018. Which shows that the Pastos Grandes project is probably one of the biggest and best lithium brine resources in all of the lithium triangle. For your readers, who followed along last year, I'm happy to report that we're able to deliver a significant resource, where the grades are very good and the quality is excellent.

Dr. Allen Alper:

Dr. Allen Alper: Such fantastic news! That's really great. Our readers/investors will be very interested. It's outstanding that you were able to deliver on what you were going after. Could you tell us a little more about your plans for 2018?

Mr. Graham Harris: We attracted a significant Chinese investor, GCL Poly, who came in and invested 37 million dollars and owns 17% of the company. We also just finished a recent equity raise for another 32 million dollars. We currently have 65 million dollars cash in the bank, to be used for this year's activities. Primarily, completing a bankable feasibility study, which will take us a full year. We are well funded to do that. During the bankable feasibility study, we plan to engage in discussions regarding potential strategic off-take partners.

Dr. Allen Alper:

Dr. Allen Alper: That's fantastic. You've made extremely great progress in a very short time. Sounds like an outstanding property.

Mr. Graham Harris: Yeah. Thanks, Dr. Alper. It has been better than expected. I think for your readers/investors, they were very well rewarded. The stock had a very good move in the later course of last year so hopefully we have happy shareholders amongst your readers. We look forward to executing on this year’s plan to deliver a robust bankable feasibility study.

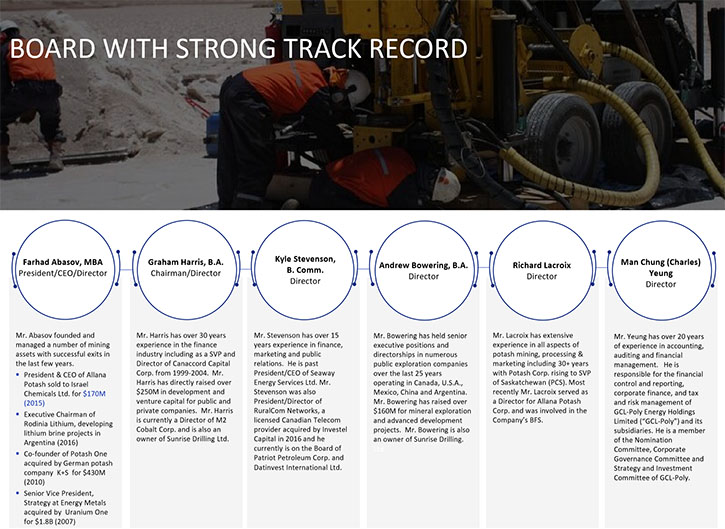

Dr. Allen Alper: That's excellent! Could you update or refresh the memories of our readers/investors on your background, your teams and your board’s?

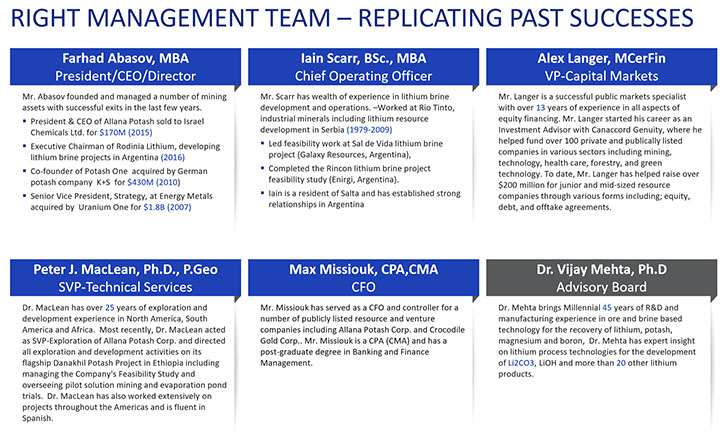

Mr. Graham Harris: Certainly. I've been in capital markets for over 30 years holding numerous senior titles. Fortunately, last year we attracted our President and CEO, Farhad Abasov. Farhad has been successful in advancing his previous companies through to merger and acquisitions. His most previous company was Allana Potash. Similar in nature to the lithium brines, it was also a solution mining process. He was able to sell that to an Israeli company. He is spearheading our efforts in developing the project and initiating discussions regarding strategic and potential M and A transactions.

We also have a very competent technical team in Argentina. My hat goes off to them, as they've been largely responsible for delivering on the resource and the PEA. Ian Scarr, our Chief Operating Officer is well known in the lithium circles. He's been involved in a number of major lithium projects in the last 10 years, including Galaxy and also Energi. On our advisory board, we have Vijay Mehta. Vijay, if people Google him, is known as the guru of lithium processing. He's very involved in determining how we will process the brine and end up with the lithium carbonate.

Lithium production is not a traditional mining exercise, Dr. Alper. Lithium production is more of a chemical engineering process. So you definitely need people who've had extensive experience in this field. We're very lucky that the project itself has attracted a world-class team to help us develop it.

Dr. Allen Alper:

Dr. Allen Alper: Extremely impressive team and board you put together! Very experienced, very knowledgeable! Outstanding! That's really great to know. I imagine our readers /investors will be very happy with them as well. Could you tell our readers/investors a bit about your capital stock?

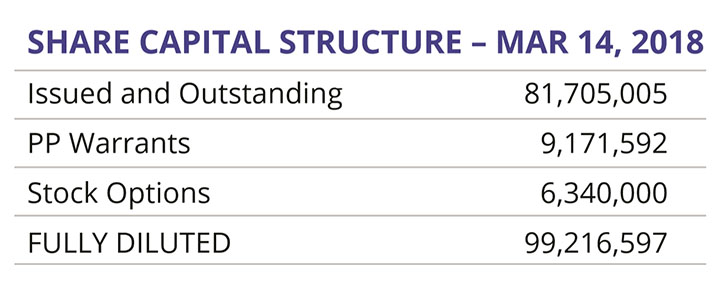

Mr. Graham Harris: Yeah. Fortunately for us, we've managed to keep the dilution to a minimum. We have about 82 million shares outstanding, after our last raise and after the investment from the Chinese company, GCL. So, a Canadian Market Cap of around 200 million. I think that number is important because one of our neighboring companies, called Lithium X, was just bought by a Chinese company, about one month ago, for 260 million. It's important to note that their resource was about half of what we currently have. And I expect our resource to grow, as we drill some of the new ground that we acquired last fall.

So I think at this point, there's still good upside in the company, in terms of valuation. One other important thing to note, Dr. Alper, is that we've been very focused on not having entered into any strategic off-takes or any other deals that dilute the ownership of the company. We still own and control 100% of the property and 100% of the output. That's very important, as you look at some of these companies that have had to give up early off-takes to attract capital.

We've also fortunate that we're well capitalized. When we enter into off-take discussions, we will have more control of the terms because we're well-financed at this point.

Dr. Allen Alper:

Dr. Allen Alper: Excellent! I think all your years’ experience has helped you and your team position your company in a very strong way. Well done.

Mr. Graham Harris: Yeah. I appreciate that. Sometimes it's a bit of luck and timing, but it's been important to recognize when to go to the market and to make sure to keep the company in a strong position. We're not at the mercy of needing money and having to take it on whatever terms it's presented.

Dr. Allen Alper: That's excellent! What are the primary reasons our high-net-worth readers/investors should consider investing in your company?

Mr. Graham Harris: Certainly the valuation metric of a company very similar to ours was just acquired for a price that is a premium to our current price and has half of what we have in terms of lithium content. Good value looking ahead, and we will be drilling some of the ground that we acquired from REMSA, which is a state mining agency. That was not included in the previous 43-101 report and this should add further tonnes.

I think your readers/investors can expect some significant upside, in terms of an updated resource that will be able to deliver to the market this year. Also I expect we'll be announcing some very significant additions to our technical team, along with procuring some of the lead items that are going to be required to build the pilot plant. This year will see us transitioning from an exploration company to a production company. And I think that metric, when I look at some of the other producers in the lithium space, should result in another revaluation of our market capitalization.

Dr. Allen Alper:

Dr. Allen Alper: That's excellent. Graham, is there anything else you'd like to add?

Mr. Graham Harris: I'd just like to say thanks to you and your readers/investors who followed the story. Hopefully they've had a positive experience. I continue to think that we have the team and place that can deliver. As long as the market for lithium stays robust, I think your patience will be rewarded.

Dr. Allen Alper: That's excellent. I'm very, very impressed with what you and your team have done in an extremely short time, how well-executed and how well you positioned your company. That's why I think you and your team have done an outstanding job.

http://millenniallithium.com/Farhad Abasov

President, CEO and Director

(604) 662-8184

info@millenniallithium.com