Ascot Resources Ltd: (TSX.V: AOT): A Near-Term Producer, High-Grade Gold, Advanced Exploration Project with Large Upside Potential in the Golden Triangle of BC. Interview with Derek White, President and CEO

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, US

on 4/16/2018

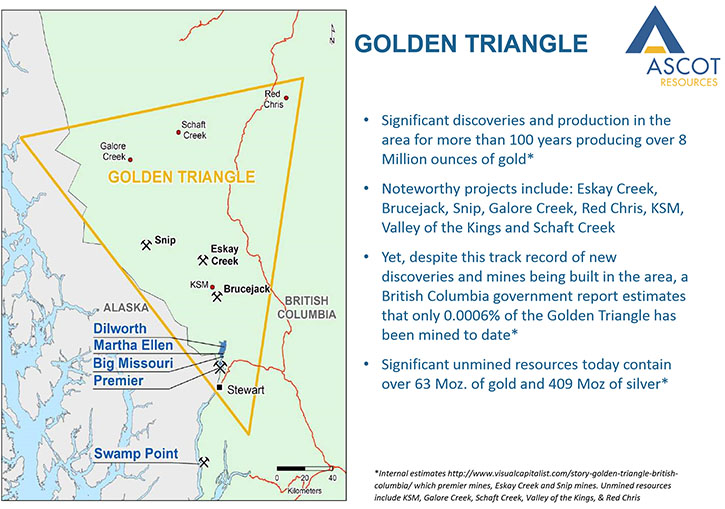

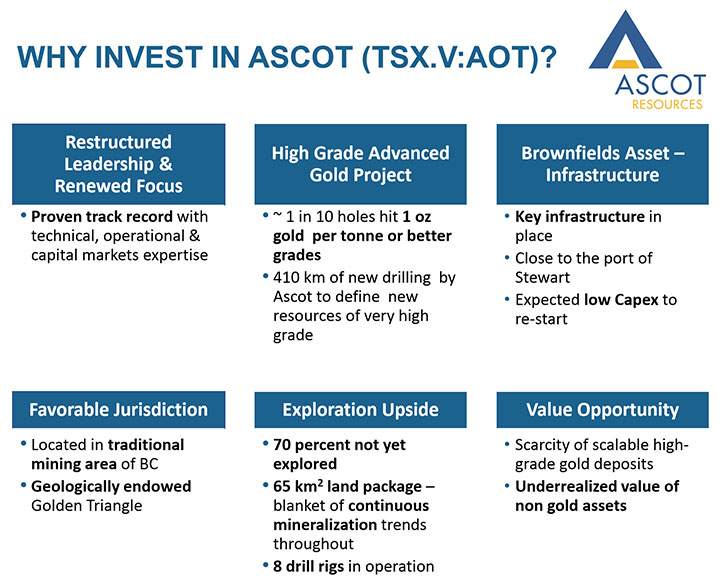

Ascot Resources Ltd (TSX.V: AOT) is a focused gold and silver explorer and near-term producer in Northern British Columbia, with a portfolio of advanced and grassroots projects in the Golden Triangle region. Ascot’s flagship Premier Project is a near-term, high-grade, advanced exploration project with large upside potential and a historic mine. We learned from Derek White, President and CEO of Ascot Resources, that plans for 2018 include an infill-drill program at the Premier Project beginning in May, with the end-goal to restart the mine. According to Mr. White, Ascot's team is made of experienced mine builders, who really know how to do this. Mr. White believes Premier is a very attractive, high-grade opportunity, in the proven Golden Triangle, with existing infrastructure of the past-producing mine.

Lisa Chapman, VP Communications, Kristina Howe, VP Investor Relations, Lars Beggerow, Mineral Exploration, Derek White, President and CEO at PDAC 2018

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Derek White, President and CEO of Ascot Resources. Could you give our readers/investors an overview of your company, your focus and current activities?

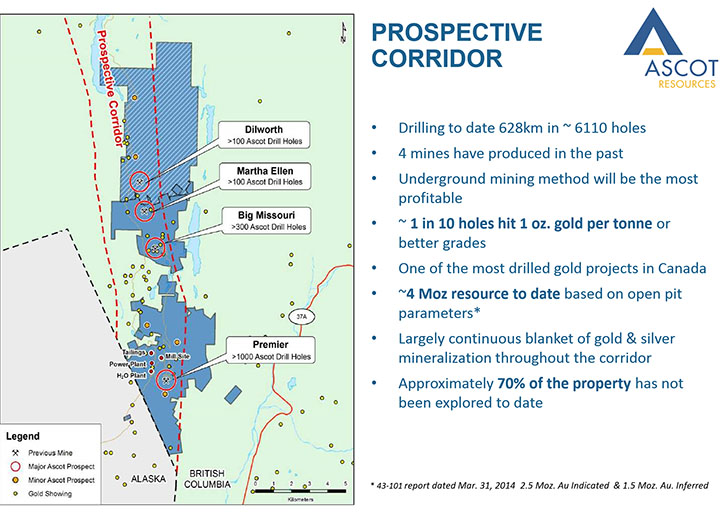

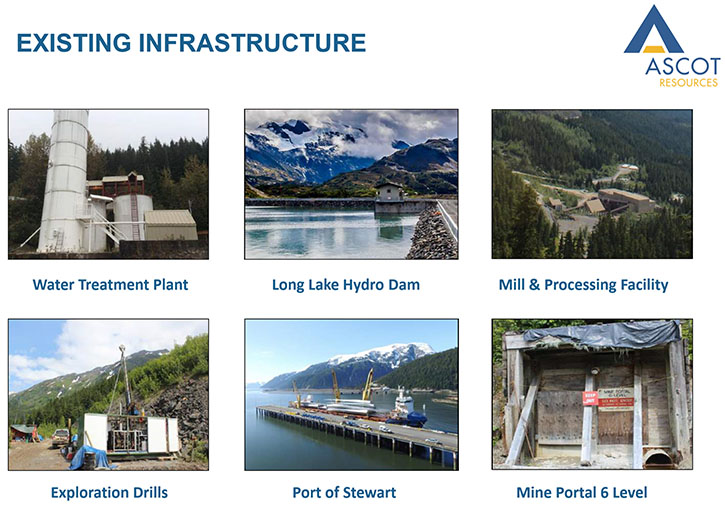

Mr. Derek White: Thank you, Dr. Alper. In October of this year, a new team came over to Ascot. We come from an extensive background of building mines and operating mines. We were very, very interested in this opportunity because we saw a situation where we had a lot of infrastructure in the Golden Triangle, where we had a mill, and a tailings dam, and an underground mine, and a power plant. We also saw a huge amount of drilling, where one in every 10 holes hit over an ounce a tonne. They had about 625,000 meters of drilling, which is a lot of drilling.

We saw an opportunity to focus on building a high-grade mine and restarting this mine. We saw the advantage of having all this infrastructure in place and having all this drilling. In this part of the world, Mother Nature has given some unbelievably high-grade deposits, especially for gold and silver, but it's challenged by the fact that it's located with glaciers, and mountains, and very difficult access. What's really interesting about Ascot, is that it is close to the town of Stewart, and a lot of this infrastructure had already been built. There were three mines on this property before. The Premier underground mine opened in 1918 and was the largest gold mine in North America until its closure in 1952 producing 2 million ounces of gold and 45 million ounces of silver. Then the former Cominco built a small mine in 1938, and then another open-pit mine was built by a company named Westmin in 1989, which was then bought by Boliden. Ascot came in and did a lot of drilling from about 2006 until about 2017. When new management came onboard last year, 118,000 meters of drilling had been done and three new zones were discovered: The Ben, Prew and Northern Lights area.

There is a core coming through an area, called the Lunch Room, which grades at 14,394 grams a ton of gold and 6,830 grams a ton of silver, so we have really, really high grades. The trick for us, as miners, is to find high-grade hits, but with volumes that we can mine. When we came in, we wanted to focus on the zone called the Premier Northern Lights area, where we see the first level of resource. In the areas up in the middle, where a lot of drilling was done in the past, Ascot put out a four-million-ounce resource in 2014, however it was lower grade for open pit. Because of the mountains here and the high level of stripping, we're much more focused on the high-grade underground zone.

On the engineering side, we brought in a group called Roscoe Postle Associates (“RPA”). We started to focus on the property in three ways. The area down in the south of Premier North Lights, is an area where we'll try and build our first resource. We're hoping to come out with that in April of this year. We've only been involved for five months, but we need drill spacing of about 25 meters for underground, and this is an area where you have this large volcanic area that's been stretched and then faulted with east-west trending faults, which have then been filled with quartz breccia, which have then been mineralized by hydrothermal and epithermal fluids. Where they find areas of high faulting, they tend to deposit, and so we get a lot of small zones of high grade. To mine this and to make it profitable, we need to figure out how to take all these small zones and put them together in a mine.

Our first area of high-grade resources will be in the Premier Northern Lights area. In the second area, where Ascot's previous management had done a large lower-grade resource, we see some very high-grade opportunities, but we need 25-meter drill spacing, so we're going to go back and infill drill that starting in May. From May until about the end of June, we'll infill drill the area called the Big Missouri. In the Big Missouri area, we hope to bring out our second resource, probably by about the end of September. That will really allow us to focus on this area.

I'm going to jump down now into the Premier area. There are eight zones here, which we've identified with tight drilling. Because we have underground infrastructure here, and it is de-watered and ventilated, we can go underground. It gives us some advantages people drilling just from the surface don't have. This is where we'd like to start the first phase of the mine, because we can take these zones, drop them down to the sixth level, and then take them to the mill.

The area in the Big Missouri, where we're going to infill drill, comes off from an old pit that Westmin had mined in the 1990s. We like this because we can see the mineralization on the side of the wall and we can wrap down from the side of the wall along this area. We still have to do the drilling, but we're quite hopeful that we'll be able to get the second part of our resource. In this area, we're trying to utilize the infrastructure. So Westmin built a mill that can run up to 2800 tonnes per day. We've gone up there and taken a look at it, and really the mill needs to run between 1,000 and 3,000 tonnes a day. Our ideal situation is to find between three and ten million tonnes of high-grade, 10-gram equivalent material. If we can do that, the mine becomes extremely valuable for cash flow, this would be a mine producing probably over 200,000 ounces a year. In Canada, we really only have maybe 13 or 14 mines, with a ten year mine life, that can produce over 200,000 ounces. So that's one of the reasons we are quite attracted to it.

By the mill we have a tailings' facility, and also a water treatment plant. The British Columbia government, in probably the middle 2000's, was really looking to improve independent power producers. So, a group called Regional Power put a power plant approximately 500 meters from our mill, and that power plant services Pretium’s Brucejack mine. We have a power line from Stewart already to the mill but having one that's only 500 meters from your mill makes it much more attractive because we don't have to take care of the snow and weather conditions in the winter on that.

We're blessed with infrastructure, which a lot of people in the golden triangle don't have. Having a 2800 tonne a day mill site that was built by Westmin in the mid to late 80's and early 90's. There is a hydro-dam where the power plant comes down on the penstock, a water treatment plant, which treats about a 130 liters per second. We have eight of our own drills, six fly drills and two skid drills. We've been able to drill at around eighty dollars a meter. For this part of the world that's quite cheap.

Dr. Allen Alper: That's amazing.

Mr. Derek White: That's because we don't necessarily have to use helicopter support, because we have enough roads. The portal for the number six mine is near the Port of Stewart. The Port of Stewart is quite nice; it's Canada's most northerly ice-free port.

We're quite excited about trying to do this. It costs a lot for junior mining companies to build this kind of infrastructure, so we are really excited about planning to utilize it and having the mill go up to three thousand tons a day. It will happen in stages for us, because the geology here tends to lead us. Once in a while you find really big zones, but you find a lot of smaller high-grade zones, and if you put enough of them together you can feed the mill. So, we'll probably have a series of resources that come out.

Even though we've had 628,000 metres of drilling we have only explored thirty percent of the property. So, we have a number of targets we want to continue to try and explore for a lot more resources in 2018. We are also in discussions with some of our neighbors, who have resources, but don't have a mill, so we can try and make that work.

Ascot also has two other projects, which are a little unusual and probably don't fit within the gold company. In the early two thousands, Ascot put about twenty-five million dollars into building and mining an aggregate gravel mine for the LNG plant that was supposed to be coming.

That didn't happen. But California is extremely short of gravel close to the big urban centers of Los Angeles and San Francisco. There was a gravel company sold for three hundred million dollars, in November of 2017, to a big construction company, because construction companies have to have gravel to make concrete and it's cheaper to send it by Panamax ship from the coast of British Columbia to either Los Angeles or San Francisco, than it is to drive it fifty kilometers away. So, we're quite interested in trying to find a buyer for our gravel mine, which is a similar size to the one that was sold. We think there's an attractive opportunity because there were a number of unsuccessful bidders, who might be interested in our asset.

In addition to that, Ascot also own a large copper gold porphyry deposit in Washington State. This was drilled out by the Duval Corporation, late 80's, early 90's. They determined it to be a non-compliant 43-101 resource of five hundred and twenty-three million tonnes of 0.56 % copper equivalent. Ascot came and drilled this in 2011 and found that the grade was about fifteen percent higher and they may be able to increase that all the way up to a billion tonnes, which makes it a fairly large copper porphyry at a pretty good grade.

When they drilled it in 2012, they wanted to go back and expand their drilling. Its land is owned by Ascot and the US government. The United States Forest Service (USFS) controls the surface rights, and the Bureau and Land Management (BLM) controls the mining rights. There was an environmental group that challenged whether we should be allowed to do that, and there was a long process that the US Forest Service has gone through. In February of this year, they decided there was no environmental damage by this drilling. They said the recommendation is for Ascot to go ahead and continue to drill.

So that's something else that we're looking at trying to do, probably over the next little while. The BLM still has to make their decision on this, and that's expected to happen in the next four to five months. So that's another thing that we're trying to do.

Dr. Allen Alper: That's great.

Mr. Derek White: The Company, right now, has gone through a lot of changes. We've brought in a lot of people that are more mining people. We're working on building minable resources. We've changed a lot of the board and we're focused on making sure that we can restart the Premier/Dilworth mine.

We just did a financing that we announced last week, where we raised another C$6.5 million dollars for the drill program for 2018. We're continuing to work right now on the engineering studies, for the mine restart and water treatment in perpetuity, as part of the bonding arrangements for taking our mine license from decommissioning back into an operating status.

Dr. Allen Alper: Excellent! Really great! Could you tell us a bit about your background, your management’s and your board’s?

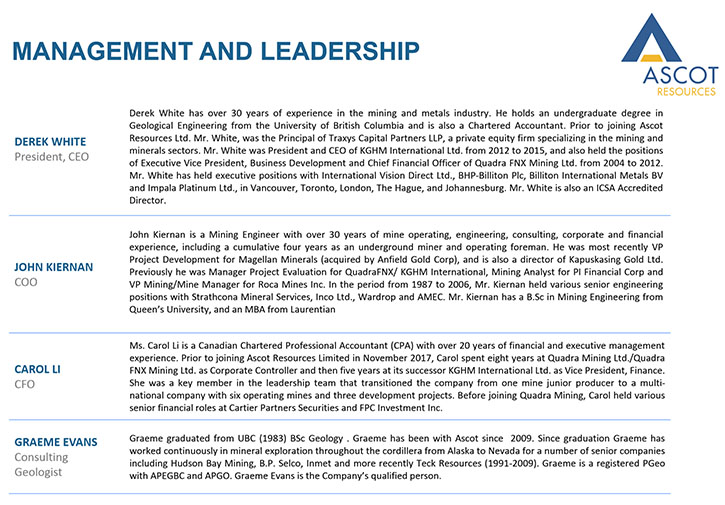

Mr. Derek White: I have a degree from UBC in Geological Engineering. I grew up in Vancouver then I left and worked in different parts of the world. I worked in South Africa for four years for a group called Impala Platinum, and then I was involved with Gencor, their shareholder, in acquiring the Billiton assets from Shell in the early 1990s. I then worked for Billiton. In the 90's I was involved with Billiton globally. It became a very large mining company.

I've had a lot of mergers and acquisitions experience, operated a lot of mines and plants, undertook a number of development projects, did exploration; and then we merged together with BHP to form BHP Billiton around 2000.

In 2004, I joined just before the IPO of a company called Quadra Mining. We had bought the Robinson mine, a little bit like Ascot, which was a shutdown mine that we wanted to restart, which we did. We restarted that, and then we were involved in developing the Carlota mine and a number of other mines, before merging with a company called FNX in 2010.

In 2012 we sold that company to the polish mining company, KGHM Polska Miedź S.A., and then they asked me to be the CEO of the international division, KGHM International, where I was involved in Chile, with building the Sierra Gorda mine, a multi-billion dollar large copper-molybdenum mine.

I left KGHM in 2015 and began working with a group called Traxys Capital Partners, a private equity group looking for different mining opportunities around the world. Now, most recently, I've become involved with Ascot. A lot of the people that worked with me at Quadra have also joined the team here at Ascot including our COO, John Kiernan, a mining engineer with a lot of underground mining experience.

Graeme Evans, Lars Beggerow and Lawrence Tsang are the geologists that have been working on putting our resources together for the exploration targets. Graeme comes from a long history of working with Teck, Lars with BHP and Lawrence has been working with Ascot for some period of time. We also brought other former colleagues from Quadra, including Carol Li, our CFO and Kristina Howe our VP of Investor Relations. Combined with other supporting mining engineers and metallurgists that we have worked with in the past, I think we have the key skill sets required to take a mine back into production.

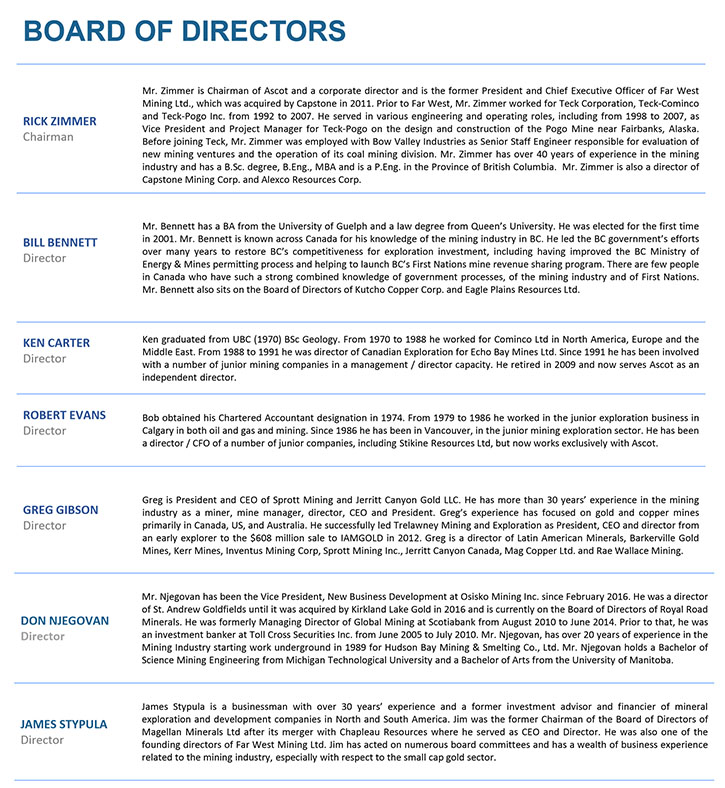

On the new Board of Directors, we have Rick Zimmer, a mining engineer as our Chairman, who is retired from Teck. We also have Don Njegovan from Osisko Mining, just appointed to the board, who is also a mining engineer. We have a retired geologist, Ken Carter who was involved with Cominco in running Pine Point. Another gentleman, who's been involved with the marketing, is James Stypula, along with Ascot’s former CFO Bob Evans. Our most recent appointment to the board is the former minister of mines for British Columbia, Bill Bennett. We have a pretty good mix of financial, technical and politically experienced people on the board.

Dr. Allen Alper: That sounds great, very strong team, very strong board, very mining focused.

Mr. Derek White: Yeah very mining focused. All of this has happened in the last five months. So, we are really just getting our feet wet. Ascot does not enjoy a lot of awareness, as the former management didn’t do a lot of marketing. Part of our job is to let people know we have a good story. We've had a lot of collective history in mining. We like things where somebody else has put in the capital and the infrastructure and has shut it down for the wrong reasons. If there's the potential to have high-grade resources there, we think it's quite attractive to investors and other stakeholders.

Dr. Allen Alper: Could you tell our readers/investors a bit more about your capital structure?

Mr. Derek White: We have about sixteen million dollars in the bank right now, and with the other five to six million we'll be in the twenty-one million range. We have no debt and most of that capital is going to be used for the development of the mine and the drilling program that we're expecting to do in 2018.

Common Shares Outstanding: 152,251,614

Stock Options: 17,305,000

Warrants: 10,160,994

Fully Diluted: 179,717,608

Market Cap: ~$190,000,000

*As at March 29, 2018

Dr. Allen Alper: Excellent! What are the primary reasons our high-net-worth readers/investors should consider investing in Ascot?

Mr. Derek White: Number one is experience. Twenty percent of the people create eighty percent of the value in mining. If you have a team that has a proven track record, has built mines before, and really knows how to do this, it makes a big difference. A lot of the lessons learned, during thirty years of experience, can apply in this case.

We have six hundred twenty-eight thousand meters of drilling, showing a very high-grade opportunity, which we think is very, very attractive.

The golden triangle is a tremendous area. Tremendous shareholder wealth has been created in Eskay Creek and some of the more recent mines. There is a lot of opportunity in the golden triangle, but the infrastructure is challenging. One of the reasons this is so good, is because the infrastructure has already been built. This existing infrastructure significantly reduces the capital requirement necessary to restart the mine.

Jurisdictionally, it is good. The First Nations have a treaty, which is unusual here, so they've been generally quite friendly, working with mining companies and I think that's also attractive.

The value proposition is good, three to ten million tonnes, which is a ten year mine life, mining one to three thousand tonnes a day, even at twelve-hundred-dollar gold, at ten grams a ton is significant. It's probably five to ten times the value of what we see today. In a relatively short period of time, investors may be able to realize good capital appreciation.

Dr. Allen Alper: Sounds great, very compelling reasons! What is your time table?

Mr. Derek White: Well the first thing we want to do is put out the resource for the first area, near Premier Northern Lights. That's expected in April. Secondly, we plan to do the drilling in May and June to identify the second resource. We'll probably finish the technical report by September. At the same time, we plan to be getting the engineering work done, related to restarting the mine and water treatment. That's also expected to take place between now and the end of September.

Once that all comes together, and we can see that there's an opportunity to restart the mine, we'll raise the capital, from the investment community, that we'll need to restart the mine and put it back into production.

Dr. Allen Alper: Do you have any feel for what kind of capital you'll need?

Mr. Derek White: We don't have an engineering report yet, but we're talking about a little bit of rehab, building the primary crusher, the SAG mill and ball mills in the mill. I don't know the exact number, but probably between thirty and forty million for that. For the underground rehabilitation of the mine, I can't give you any definitive numbers, but from what we know historically, we're probably talking about another twenty or thirty million dollars. I can say more after the engineering studies have been done.

Dr. Allen Alper: Exciting story.

Mr. Derek White: Yeah, we think so. Thank you for letting us share it with you, Dr. Alper.

http://www.ascotgold.com/

Kristina Howe

VP, Investor Relations

T: 778-725-1060

E: khowe@ascotgold.com

|

|