West Red Lake Gold Mines Inc. (CSE: RLG, FWB: HYK, OTCQB: RLGMF): Focused on High-Grade Gold Exploration and Development in Canada’s Prolific Red Lake Gold District, Interview with John Kontak, President

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, US

on 4/11/2018

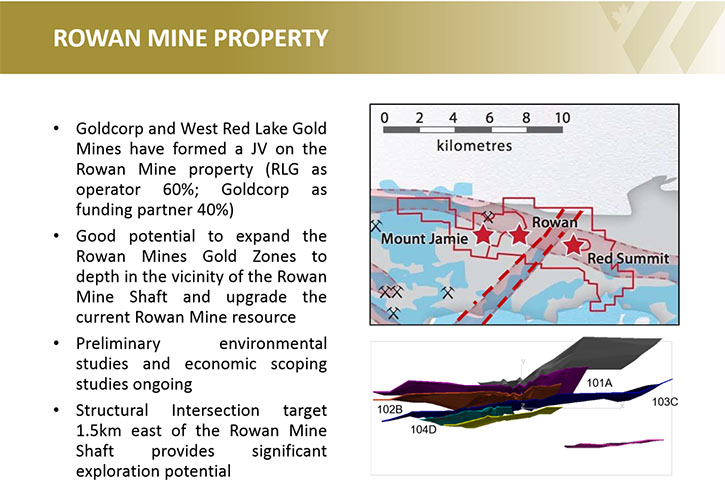

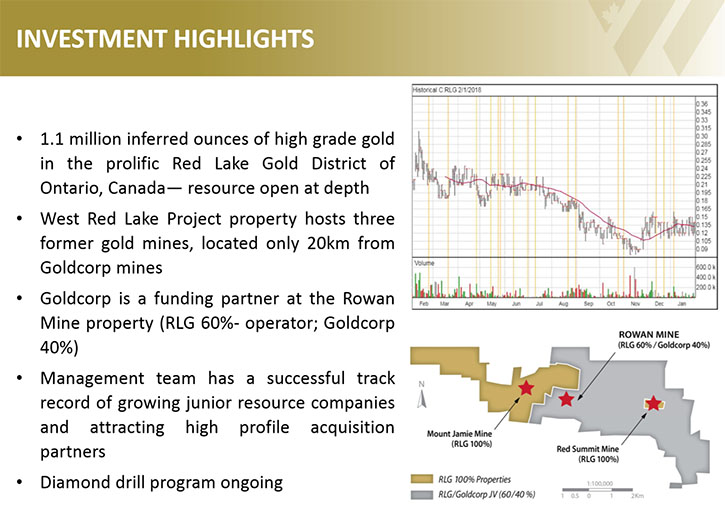

West Red Lake Gold Mines Inc. (CSE: RLG, FWB: HYK, OTCQB: RLGMF) is based in Toronto and focused on gold exploration and development, in the prolific Red Lake Gold District of Northwestern Ontario, Canada. The Red Lake Gold District is host to some of the richest gold deposits in the world and has produced nearly 30 million ounces of gold, from high grade zones, including 18 million ounces from the nearby Red Lake Mine and Campbell Mine, operated by Goldcorp. West Red Lake Gold Mines has assembled a 3100 hectare property, which has a 12 kilometre strike length and 3 former gold mines. We learned from John Kontak, President of West Red Lake Gold Mines, that their most advanced deposit is the high grade, underground, close-to-surface Rowan Mine - 60% JV with Goldcorp – with an existing NI 43-101 resource estimate of 1.1 million ounces of 7.57 gram ore. The company is looking to expand and deepen the mineralized envelope at the Rowan Mine deposit and at the same time doing internal scoping studies and baseline environmental studies, with the goal of ultimately making it a valuable asset for Canadian gold miners.

John Kontak, President of West Red Lake Gold Mines at PDAC 2018

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing John Kontak, who is West Red Lake Gold Mine's President. John, Could you give our readers/investors an overview of West Red Lake Gold, your focus and current activities?

Mr. John Kontak: Well, West Red Lake Gold Mine has a gold exploration and development property in Red Lake, Ontario, near the Manitoba border. It is a prolific gold district by any standard. It has produced about 30 million ounces over time. We have a 3,100 hectare property on the west side of the Red Lake gold district. There are three former producing underground gold mines on the property. We own 100% of the Mount Jamie Mine and the Red Summit Mine. Goldcorp is a funding-partner with us on the Rowan Mine property. In our joint venture, we own 60% and operate, and Goldcorp has 40%

The Rowan portion, where we're joint ventured with Goldcorp, is also the most developed portion of our property. We have an NI 43-101 inferred resource estimate of 1.1 million ounces of 7.57 gram ore. It's the typical sort of thing that is mined in Red Lake; high-grade, underground, close-to-surface, within about 500 meters of surface.

Dr. Allen Alper: Sounds great! Could you tell our readers/investors a bit more about the deposits?

Mr. John Kontak: We have about 600 drill holes in the 43-101, so we have a lot of data, the goal zones are well-defined, vertical, and east-west trending. We are drilling in March and plan to take a look at that data and drill again this summer. We plan to go to depth under the resource area. It's all within 500 meters of surface. We intend to drill to see if we can extend the mineralized envelope down to about a thousand meters. That's still relatively close to surface for Red Lake. Mining has been done well below that in Red Lake so we're looking to expand the mineralized envelope at the Rowan Mine deposit and at the same time we're doing internal scoping studies and baseline environmental studies. All of which are the type of things that can add value for shareholders, and ultimately make it more valuable to the mining industry, because what we are is an experienced team.

Our team includes, Tom Meredith, the Executive Chairman, myself, and Ken Guy, our Exploration Manager. This will be the third time that we've taken Ontario exploration and development properties and built value in them. We've sold the other two. One's now owned by Osisko Mining, another by McEwen Mining. We're endeavoring to do the same with this property, explore and develop it and make it a value to the Canadian gold mining sector.

Dr. Allen Alper: Sounds excellent! Could you tell us a bit about your share structure and capital structure?

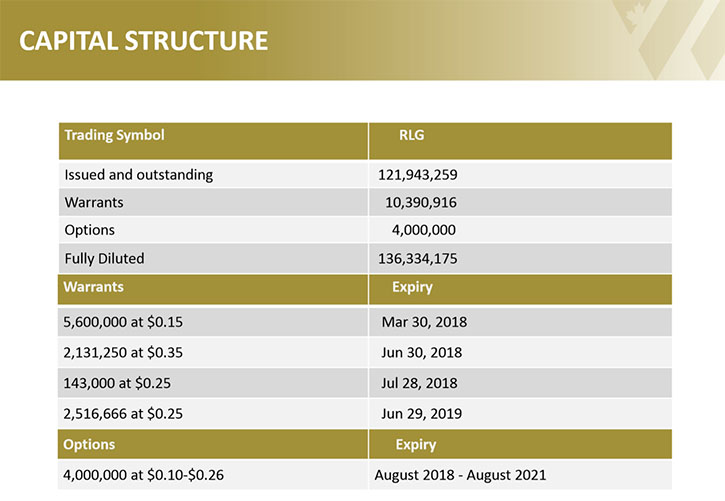

Mr. John Kontak: We have about 121 million shares outstanding. We have two institutional backers who funded our drilling during the 2014 - 2015 time frame. These backers also backed our two other companies, which were sold and now owned by other industry players. These institutional backers were backers of West Red Lake Gold Mine. They wanted a management change, so we were brought in in 2014 as an experienced management team. We worked to clean up the company, build the relationship with Goldcorp for example, clean up accounts payable, and other things that had to be fixed. In 2016 we were ready for the first leg up in the gold market. We filed our 43-101 resource estimate in February of 2016, and we had a very good year in 2016, probably because we were experienced and we were ready to take advantage of the money moving into the gold sector.

2017 was kind of sideways, we drilled and developed the property. But the gold market wasn't as favored then, so we're looking forward to 2018. We think that the timing's right to have another good run in the sector, capital would flow and we can develop the property further, and ultimately make it a valuable asset for Canadian gold miners.

Dr. Allen Alper: That sounds great. Could you tell our readers/investors how your stock is listed and how many shares there are?

Mr. John Kontak: Of the 121 million shares outstanding, the institutional shareholders, I mentioned, have about 38% between them. The management team has about 10% of the stock. I have over three million shares myself, and there are some other people, who have histories with the company. So I can talk with shareholders who control over 50% of the stock with only three or four or five phone calls, which is good.

Our stock does trade. We're listed on the Canadian Securities Exchange in Toronto, we're listed on the OTC QB in New York, and we're listed on the Frankfurt Stock Exchange, and we have investor relations and marketing activities in all three of those jurisdictions to support those listing and support the market capitalization, ultimately.

Dr. Allen Alper: That sounds very good. What are the primary reasons our high-net-worth readers/investors should consider investing in West Red Lake?

Mr. John Kontak: I would say two things. One, at the Rowan Mine we have a resource, and we're going to depth under that resource area. That's the type of drilling our Exploration Manager Ken Guy has been doing his whole career. It's the type of drilling that we think could expand the mineralized envelope, so that we have a larger deposit at the Rowan Mine. Also the investors should keep in mind that, right now, in our market capitalization, we're getting less than $20 per ounce in the ground. In a good market in Red Lake you can get $80 to $100. In a bull market you can get $180 per ounce in the ground in Red Lake, Ontario, for a high grade deposit, with all the infrastructure in place, mills with capacity etc. So if there's a lift in the sector, where your ounces are getting revalued, and we're adding ounces by going deeper in Rowan, then an investor can see the potential. Of course, it's a cyclical business and hopefully the cycle is going to be our friend in 2018.

Dr. Allen Alper: I hope so too because I'm an investor.

Mr. John Kontak: Well thank you Al, thank you very much.

Dr. Allen Alper: Is there anything else you'd like to add?

Mr. John Kontak: I'm sure you remember in 2016, when the gold and precious metals sector took off, and maybe that'll happen again. It's been about 18 months from the original leg up in the market so it's due if one knows the cycles in the mining industry, also commodities in general are sort of late business-cycle players. The present business cycle began in 2008 - 2009, so it's getting late in the cycle now and that's when commodities tend to do better. I think investors should keep that in mind.

Dr. Allen Alper: Sounds very good! Thank you.

https://www.westredlakegold.com/

John Kontak, President

416-203-9181

jkontak@rlgold.ca

|

|