Predictive Discovery Limited (ASX: PDI): A Prospect Generator Focusing on Gold Exploration in West Africa, Interview with Paul Roberts, Managing Director

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, US

on 4/11/2018

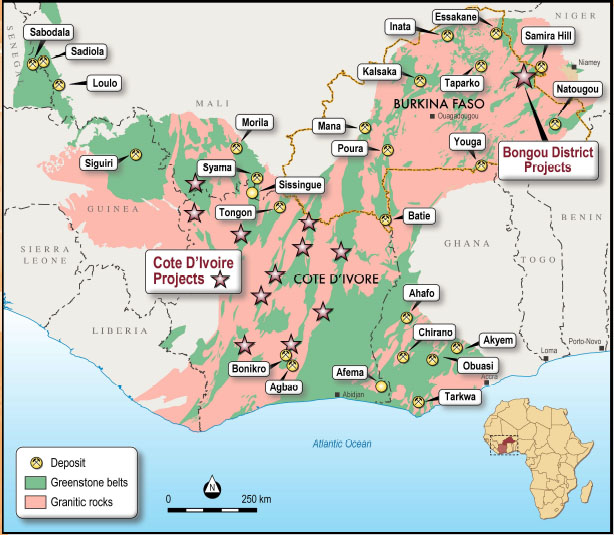

Predictive Discovery Limited (ASX: PDI) is a prospect generator, focusing principally on exploration for gold in West Africa, with one additional project for gold in Australia. The company has a distinctive technological capability, known as Predictore®,that sets it apart from its peers. We learned from Paul Roberts, Managing Director of Predictive Discovery, that the company is currently operating in Burkina Faso, Cote d'Ivoire and Mali. According to Mr. Roberts, the prospect generator model allows them to hold a lot of ground, but with most of the money on that ground being spent by JV partners. The company has a very large portfolio of properties and offers investors a unique opportunity to be exposed to the possibility of finding large gold deposits across West Africa.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Paul Roberts, Managing Director of Predictive Discovery Limited. Could you give our readers/investors an overview of your company, your focus and current activities?

Mr. Paul Roberts: Okay. Predictive Discovery Limited is an ASX listed junior explorer. We've been listed since late 2001. We operate in West Africa. Over the last couple of years, we've changed our exploration strategy to become a prospect generator of the Canadian type, focused on discovery of gold deposits in West Africa, particularly the Birimian Belt in French West Africa, which covers a range of countries.

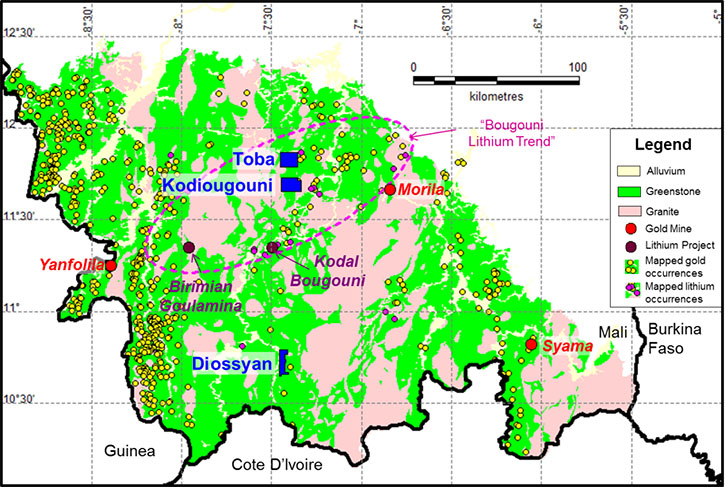

We're currently operating in Burkina Faso, Côte d’Ivoire and Mali. We currently hold about 7,000 square kilometers of tenements and use the prospect generator model on all of them, as of today. We have joint venture partners on a lot of the ground, but we have new areas as well, which we are adding progressively to our portfolio. We have six applications, covering two and a half thousand square kilometers in Côte d’Ivoire and we hold three exploration authorisations in Mali covering 250 square kilometers.

Dr. Allen Alper: That sounds great. Could you tell our readers/investors a bit about what you found to date on your properties, the deposits, your results? Any more information about them?

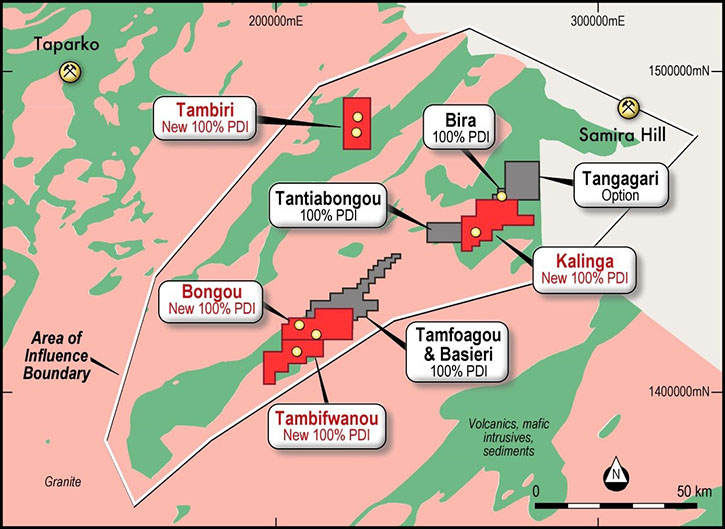

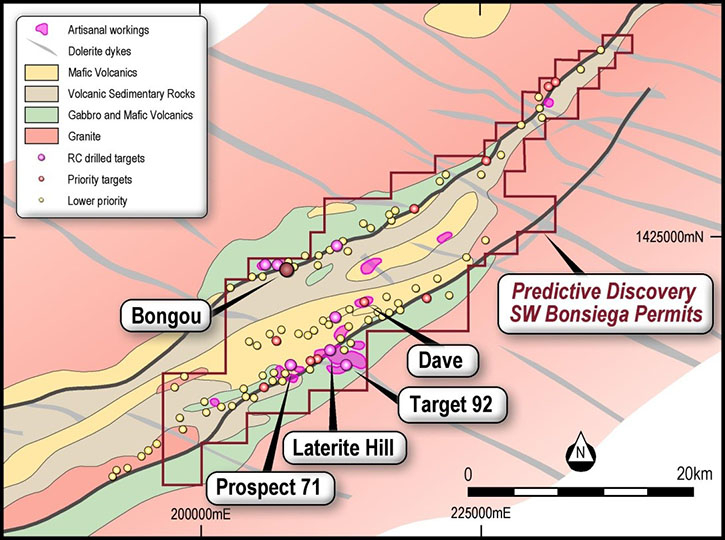

Mr. Paul Roberts: The longest living project is in north-east Burkina Faso, where we've discovered mineralization on a large range of prospects. We hold about 90 kilometers of strike length of mineralized ground, with many, many artisanal workings on them. We've defined a global resource on the Bongou Prospect, with a little less than 200,000 ounces, pretty good grade, very nice metallurgy, good width, essentially all mineable. This is a good start, but not sufficient to initiate the kind of development for which we're looking, on the order of 100,000 ounces of gold a year. Along the belt, within 10 kilometers of Bongou, we've also identified an exploration target of about half a million ounces at about 1.6 grams. This is lower in grade than Bongou, but certainly there is a lot of mineralization there.

Farther up along the belt, within a broader radius from Bongou, there are a series of other highly interesting prospects, one of which is very interesting, where we've seen nice mineralization from historical drilling at a prospect called Bira, with widths of about 20 meters, good continuity in steep dipping mineralization. That has now been drilled by our joint venture partner, Progress Minerals, which is a Canadian private company. Thus far, we have good results from about 200m of strike drilled on 50m centers. There is gold mineralization in every hole, all of which appears to join up well from hole to hole. Best intercepts so far have been 27m at 1.8g/t Au, 20m at 1.6g/t Au and 17m at 1.7g/t Au. We are expecting more results soon from 500m to 600m of strike in the coming weeks.

The objective, of the joint venture, is to identify at least a million ounces in reserves, so that we can look at 100,000 ounce per annum operation, over a decade, which is essentially a standard requirement for greenfields mine developments in West Africa.

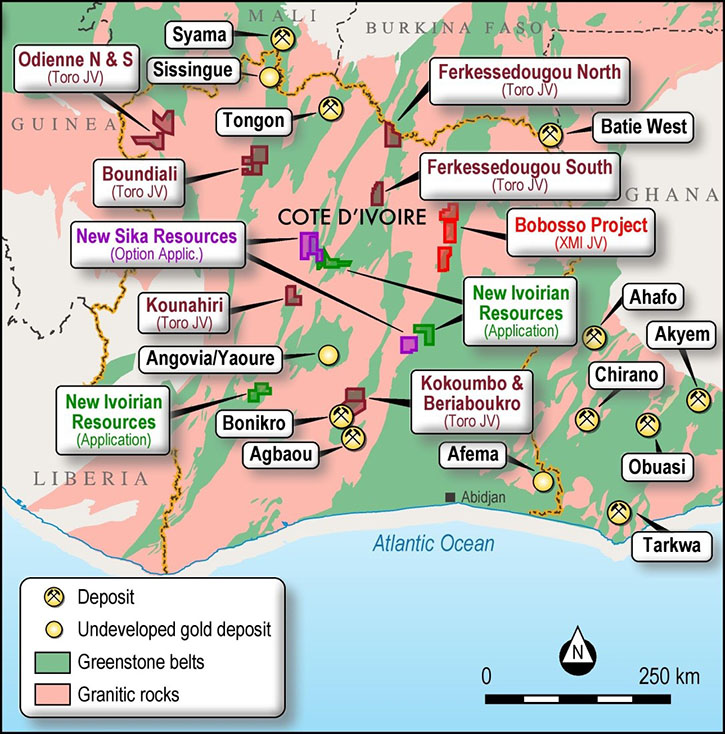

Elsewhere, in Cote d'Ivoire, we have a series of interesting properties. There's a new discovery on a property called Boundiali, where our joint venture partner is Toro Gold Limited, which is a UK private company that's poured gold at their Mako mine in Senegal in January. Here we have a strike length of about 1.2 kilometers of mineralization, some very good grades and some pretty good widths in the central part of that zone, and significantly, very interesting along strike potential. The best intercept was 30 meters at 8.3 grams, a very nice intercept. There is visible gold from surface even though this is a complete greenfields discovery, made by us initially and followed up by Toro subsequently. There are no artisanal miners and no one had any knowledge that there was gold there. So that's pretty exciting.

Also in the north of Cote d'Ivoire, we have the Bobosso Prospect, containing a very large gold mineralised system, covered by a 7 square kilometer gold soil anomaly, with an average value 0.4g/t recorded by previous explorers. So it's a very large soil anomaly, with multiple gold mineralized zones beneath it. We're generally seeing 10, 20 meter-wide zones in drilling with reasonable grade and continuity, generally in the one-and-a-half to two gram range.

It's a work in progress, there's interesting mineralization there, multiple zones, and we've recently reported some quite good results from Progress Minerals, our joint venture partner on that particular project.

Further to the south, within trucking distance of the Bonikro, an operating mine recently sold by Newcrest, we have the Kokoumbo project, with very widespread mineralization over the ground. The best drill intercept so far was 7-and-a-half meters of 16 grams, so there’s certainly nice gold there. It's really a question of doing more drilling. We're expecting more drilling in the next six to nine months and starting to develop some strike length and some resource potential.

We have quite a lot of other interesting properties with large soil anomalies. Soil sampling at Ferkessedougou North, in northern Cote d'Ivoire, right up against the border with Burkina Faso, has obtained a seventeen kilometers long zone of gold soil anomalies. Following that, we've done four thousand meters of trenching that identified shear hosted mineralization, in granites, that looks as if it could have some good potential. A five-and-a-half thousand meter drilling program has now been completed there, so we will see a lot of drill results coming out of there quite soon as well. Trenching is in progress and drilling will start soon on the Ferkessedougou South permit, where there is a four kilometer soil anomaly waiting to be drill tested.

Finally, we have recently started work in Mali, where we are doing low cost, early stage work assessing three areas for gold and lithium potential.

Dr. Allen Alper: That sounds excellent. Sounds like you're doing an extremely great job of exploration in a very fruitful area. Could you explain to our readers/investors the Predictore technology that you're using?

Mr. Paul Roberts: Predictore's evolved a bit since the company first started. Predictive started as a technology-driven exploration company, and it's not really that anymore. But we use a particular aspect of Predictore, all the time, to identify new opportunities at the scale of permit applications. The underlying understanding is that in these terrains, where we're finding orogenic gold deposits, there is deep structure, an essential ingredient for finding large gold deposits. Furthermore, there’s usually more than one controlling structure. Often in these environments, there is one very big known structure running through the area. Others ascribe all of the focusing of fluids carrying gold, and localizing the gold mineralization to that one structure. But that doesn't actually provide a complete explanation, as other parts of the same structure are un-mineralized. We think there is a second class of structure, which we believe runs deeper through the shallower part of the earth's crust and down into the deeper parts, which has channeled gold-bearing fluids up, and intersects with the visible large structures at surface. Where these two structure types intersect, that's where we think we're going to find the really big gold deposits.

Now the thing about that second class of structure, in the Birimian, is that it's very difficult to see in normal geophysical data sets. So we use our own techniques to identify those structures. We use a particular type of geophysical processing, which was pioneered in Australia, in addition to our proprietary methods, to extract from the data where these very deep crust structures are coming through from deep in the earth's crust. So, we're looking for those intersections and applying a number of other geological criteria to identify areas of high prospectivity.

As a prospect generator, our job is to put together all of the data and identify the best available ground. We put together all of the publicly available data from Burkina Faso in 2009. We've did it again in Cote d'Ivoire around 2011 and we've now done it in Mali. And we'll probably do it in other countries in the months and years ahead. We then apply this proprietary technology, identify the high prospectivity areas, pick those areas up where we can, or do cheap deals if someone else holds the ground. We do early stage work, and then will push forward for a time with conventional exploration. However, we are always conscious of the fact that when you have a very large portfolio, you generally need partners with deeper pockets to keep pushing the process forward.

Our model allows us to hold a lot of ground, with most of the money being spent on that ground by partners rather than ourselves.

Dr. Allen Alper: Sounds excellent! Could you tell our readers/investors a bit about your background, your team, and your board?

Mr. Paul Roberts: I'm a geologist. I've been in the business for a long time, and I've been involved in mining geology and exploration geology in Australia and overseas. More of my experience is in Australia, but I've been working in West Africa now for about 10 years. I've also worked in South America and, to a lesser extent, in countries like India and Ireland. So I have significant global experience. I have discovered gold and tin deposits including the Henty Gold Mine in Tasmania. I've worked as a mine geologist and been responsible for the geological component of feasibility studies. I've also worked on project generation across the world, which is what we specialize in in Predictive. So I have worked right through the whole gamut of exploration processes. In terms of commodities, I've worked on gold, diamonds, copper-lead-zinc, tin-tungsten, uranium, and even a bit of oil work following a chance oil discovery in Western Australia years ago. So I've covered a significant spectrum of mineral types, and essentially all aspects of mineral exploration, development and mining.

I speak English, Spanish, and enough French to work in Francophone West Africa. So I have three languages.

We have a small board, the minimum size that you can have on the ASX - three of us. The Chairman is Phillip Jackson, a resources lawyer. He's the corporate counsel for a large oil and gas company in Australia; he is a deeply experienced corporate lawyer and also Chairman of our largest shareholder. So he acts as a representative director for them.

The other director (apart from myself), the non-executive director, is Dave Kelly. He's a geologist and has worked in merchant banking, mine geology, business development and mine development. So he has a really good appreciation of those commercial aspects. He currently, also has an executive position with Resolute Minerals. So he's also very well informed on West Africa.

Dr. Allen Alper: You and your board have great backgrounds and experience. I can see why you're having such great results in West Africa. Could you tell us a bit about your share structure, your capital structure?

Mr. Paul Roberts: Currently we have 236 million shares on issue. The share price is quite low right now. So clearly I regard it as a very good buying opportunity. The amount of capitalization of the company is around $6 million Canadian. The largest shareholder is a company called Aurora Minerals. Aurora supported us very well during the difficult times that all of us in the junior sector experienced from 2012 through to 2016. They hold 27 percent of the company.

The second largest shareholder is Sprott. That's the Sprott branch from San Diego, the Rick Rule branch. And they've increased their equity significantly over the last year and a half. They took an initial equity in late 2016, and then in late 2017 they expanded it. We are very grateful for their support, and obviously they are interested in what we do because we're a prospect generator. We believe we're the only prospect generator focused in Francophone West Africa on gold. So that's obviously something that's been recognized.

The third largest shareholder is Lowell Resources, which until recently was a closed fund from Melbourne. They have been on our register since the very beginning, and subscribed to pretty much every capital raising since before we listed. So they're a very strong supporter.

Together these three shareholders constitute about 50 percent of the register. The other 50 percent of the register is mostly private investors. I myself hold about 1 percent. And I've contributed every year since inception. The top 20 shareholders have about 62 percent of the company.

Dr. Allen Alper: That sounds great. Sounds like you have some very strong, long-term supporters that you could rely on. Excellent! By the way, we have a close relationship with Rick Rule. We've done many interviews and articles on Rick Rule. We're very impressed with him.

Could you tell our readers/investors how it is working and doing mining and all that geological work and exploration in West Africa?

Mr. Paul Roberts: Firstly, it's an easy place to explore, for the most part. It gets a little bit more difficult as you go farther south into southern Côte d’Ivoire, just because the vegetation is heavier, and it rains a lot. So access can be an issue. And also there's more intensive farming, for example, cashew and cocoa. But as you move farther north into Northern Côte d’Ivoire, and Burkina, and Mali, there are very few of those issues. We can act quickly and decisively, when we identify a particular type of work that we need to do.

Obviously we do have to be careful about community relations. We operate in West Africa more as an African company than an Australian company. I run the exploration programs myself, but the staff has always been local. I like to have staff come from the country where we're working for the most part. Generally they're very sensitive to local issues, and make sure that all of the various people that you need to talk to are talked to and kept on board.

We also try, even as an explorer, to help with local communities. We provide employment, which is the most important assistance that we can offer, but we've also engaged in other projects over the years, assistance with schools, uniforms. There's a sewing school we funded in Gayeri, a town close to our Burkina Faso project. And we've refurbished wells, and so on. So there's a number of small things that we've done. And we've had no difficulty working with the local communities.

The governments have policies, which are clearly supportive of mining. And the evidence of that is that we know many new mines are being developed, particularly in Burkina Faso, but obviously Mali is a significant large gold producer, and people are able to make that transition from exploration project to mining relatively easily. Granting exploration permits can be a bit slow, so certainly some patience is required from time to time. But we work very hard at maintaining good relationships with the mining departments, and meeting the ministers on a regular basis, like all companies operating in Africa, and all of that helps.

So all in all, it's a good place to operate. There are some challenges. It is Africa. But generally we haven't found any obstacles to our work.

There have been some issues, with security in North Africa particularly and around the Sahara. In Burkina Faso, we ourselves have had no issues. We tend not to operate right in the very northern corner of Burkina Faso, where there have been some incidents, although they haven't affected mining operations in any significant way. There are some issues in the northern desert part of Mali, but in the areas where we're looking, apart from one or two incidents in Bamako itself, there have been no significant incidents. And certainly, mineral exploration is proceeding entirely normally in the gold prospective parts of Mali and Côte d’Ivoire.

Dr. Allen Alper: That sounds good. I'm sure my readers/investors are happy to learn about that. What are the primary reasons our high-net-worth readers/investors should consider investing in Predictive Discovery?

Burkina gold pan

Mr. Paul Roberts: The primary reason for investing in Predictive Discovery is that we offer a more or less unique opportunity for investors to be exposed to the opportunity of finding large gold deposits across West Africa. The issue that you have with most exploration companies (and I think many of them are very admirable and do excellent work) is that they tend to be focused on one or two projects. And that's simply because raising money requires you to focus. If you're carrying 100 percent of the cost on a project, then the value of the shares, and the opportunity depends on you taking the one or two projects, and converting them into a mine, or, waiting a long time before that whole process is repeated.

As with all prospect generators, we have a large portfolio, and hold a more modest stake. We're typically aiming for the 30 to 40 percent range of a project, however, we have many of these opportunities. If you believe, like we do, that the Birimian of West Africa is the best place in the world to look for new gold deposits, and then develop them - and I think the track record speaks for itself there - then here is a company which is exposed to many opportunities for discovery, and therefore the chances of success for you as a shareholder are enhanced by the fact that we keep moving and we keep on broadening our base and bringing in partners to ensure that a lot of money is spent to make that discovery that we're seeking.

Dr. Allen Alper: Sounds like very good reasons for our high-net-worth readers/investors to consider investing in your company.

http://www.predictivediscovery.com/

Paul Roberts

Managing Director

+61 402 857 249

paul.roberts@predictivediscovery.com

|

|