GoviEx Uranium Inc. (TSX-V: GXU; OTCQB: GVXXF): 120 Million Lbs. of Uranium, Strong Sponsors and Capital Structure, Demand for Uranium Increasing, Interview with Daniel Major, CEO

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, US

on 4/3/2018

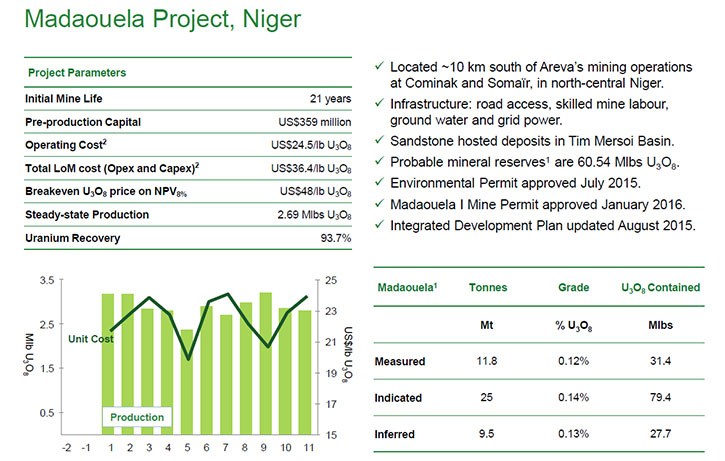

GoviEx Uranium Inc. (TSX-V: GXU; OTCQB: GVXXF) is a mineral resource company focused on the exploration and development of uranium properties in Africa. GoviEx’s principal objective is to become a significant uranium producer through the continued exploration and development of its flagship mine-permitted Madaouela Project in Niger, its mine-permitted Mutanga Project in Zambia, and its other uranium properties in Africa. We learned from Daniel Major, CEO of GoviEx Uranium, that the company is focused on reducing cost through technical innovation, structuring project debt financing, and exploring possible offtake opportunities in the market. Based on the company’s published technical report, the Madaouela Project has about 120 million pounds of uranium in the ground and has a mixture of open-pit and underground potential, with average grade of 0.14%. The project has a 21-year mine life with a US$360 million capital and a cash-cost of US$25 per pound. GoviEx’s plans for 2018 include advancing their projects, and they just announced an agreement with the Toshiba Corporation to buy out GoviEx’s debt.

GoviEx Uranium

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Daniel Major, CEO of GoviEx Uranium.

Could you give our readers an overview of your company, your focus, and your current activities, Daniel?

Mr. Daniel Major: Yes – just to remind your readers, we are an African-focused uranium exploration and development company.

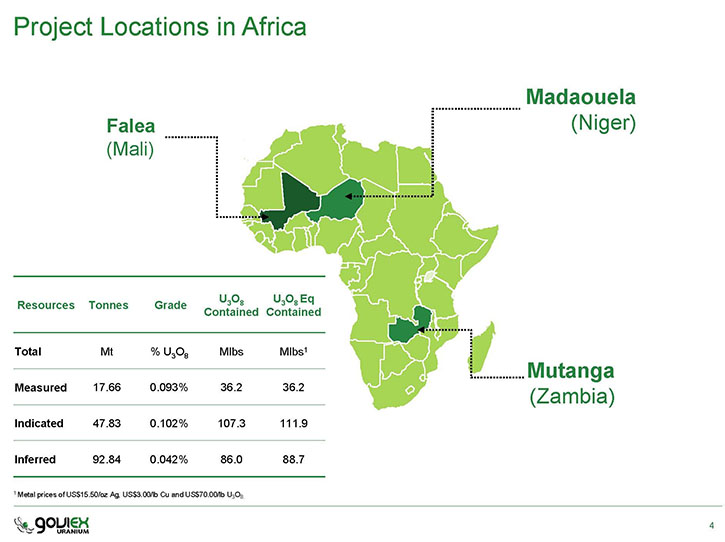

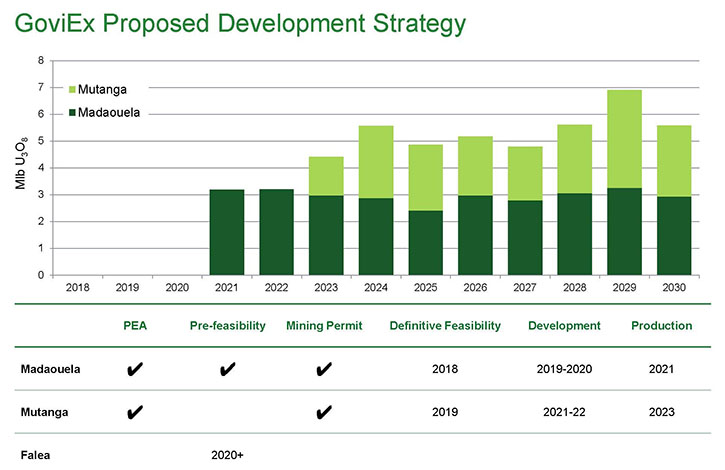

We have three projects, one each in Niger, Zambia, and Mali. Two of these projects are fully permitted and ready for development, with a rising uranium price. The company has been focused on reducing operating and capital costs through technical innovation on its major project (the Madaouela Project in Niger). We've been structuring the project debt and are in the first stages of that process, having received expressions of interest from a number of lending banks and export credit agencies for debt associated with Madaouela, and we are starting to look at the offtake potential in the market.

Dr. Allen Alper: Sounds exciting! Could you tell us a bit more about your deposits and your resources?

Mr. Daniel Major: The largest of the deposits at the moment is in Niger, with roughly 108 million pounds of measured and Indicated and 28 million pounds Inferred uranium in the ground. It has a mixture of open-pit and underground potential. Based on the project’s exploration potential, the resource potential could be considerably larger. We turned our exploration drilling program off when we went over 100 million pounds uranium. We could do a lot more exploration, but the project already has a 21-year mine life with a US$360 million capital and a US$25 per pound cash-cost.

So, really, it doesn't need to be made any bigger at this time. Now our focus is on how to improve the economics of that project for construction, because it's already permitted.

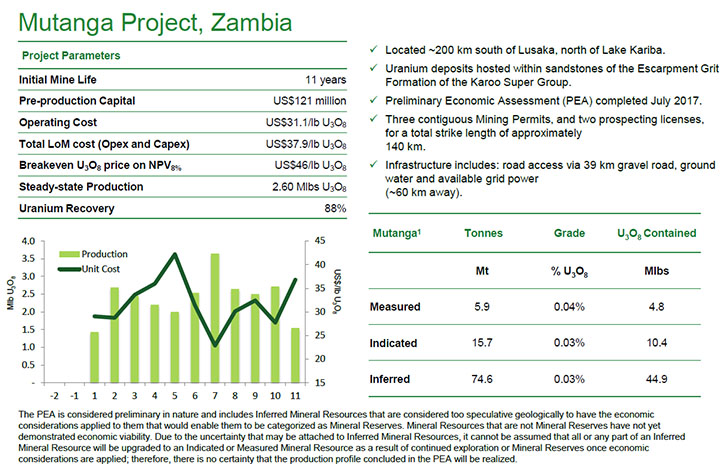

In Zambia, we have the Mutanga project.

In 2017, we acquired a pre-feasibility stage, mine-permitted project called Chirundu from Africa Energy, which is adjacent to the pre-feasibility stage, mine-permitted Mutanga project we acquired from Denison Mines in 2016. Chirundu added to the existing Mutanga Project to create a larger Mutanga Project, which now has approximately 15 million pounds Measured and Indicated, and 45 million pounds Inferred uranium resources. This larger Mutanga Project is fully permitted for mining, with three mining permits.

A Preliminary Economic Assessment (PEA) for this larger Mutanga Project was published in late November 2017, and the PEA indicated a capital cost of US$120 million. Both the Madaouela and Mutanga projects are forecast to produce over 2.5 million pounds of uranium per annum, and both projects have all-in costs under US$38 per pound of uranium. And then we have, in Mali, the Falea Project, with about 17 million pounds of Indicated and 13 million pounds of Inferred uranium in the ground – but that comes with quite high silver and copper credits.

Falea is more than an advanced exploration play. It does have substantial technical studies, including process design and costing, which gives us a lot of guidance on where to go on the technology side.

Dr. Allen Alper: That sounds excellent. Could you tell me your plans for 2018?

Mr. Daniel Major: We will continue to advance the projects. We set out a four-prong strategy. Continued optimization – what technologies can we find? How can we think outside the box and improve the economics?

In the coming months, we'll continue to advance the project debt financing. We're very proud that we have been able to show that we have the potential to achieve debt financing in Africa at a time when traditional project financing is almost non-existent.

We will continue to work on the offtake. We do need the price of uranium to start to move a bit more to really justify that work.

We'll continue to add value where we can in the company. For example, we recently announced that we agreed with Toshiba Corporation to buy out a uranium bond debt that they hold for $4.5 million, which is a considerable discount to face value.

Dr. Allen Alper: Wow – that's great! What are people saying about uranium?

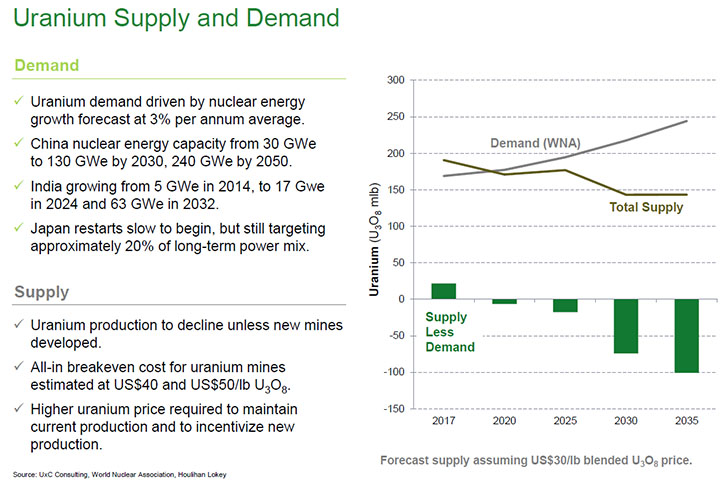

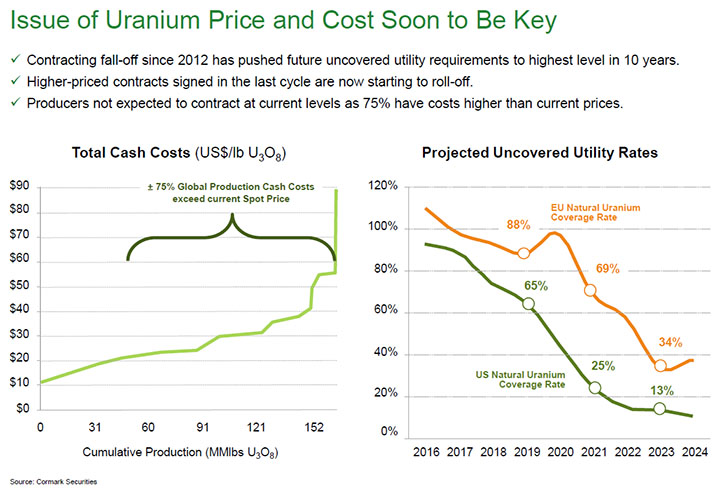

Mr. Daniel Major: We've seen a lot of negatives that were pushing down the price – over-supply, inventory pressures – that are all gradually easing away. UX Consulting is forecasting supply to be in deficit this year and increasingly going into a wider deficit. Certainly, the secondary supply has declined.

I think we still see some inventory pressure, more because guys who have inventory do not need to come in and buy. I think the actions in the US on the section 232 application have caused the US utilities to hold back on their buying, and that buying has been taken from the market. Once that is clarified, I think you'll see upward pressure on price as the US utilities have to come back to buy.

We're still waiting to see where Cameco goes with their strategy. My sense is that they will initially start meeting their contract sales commitments from their inventories. At some point, they will decide that they have reduced inventory enough, and at that point, they will come into the market to buy material.

I guess what's important for your readers to realize is that the long-term contract price is all about resource replacement, and the ability to keep replacing it.

Dr. Allen Alper: Sounds like very good insight for our readers. Could you update us on your background, your team, your Board?

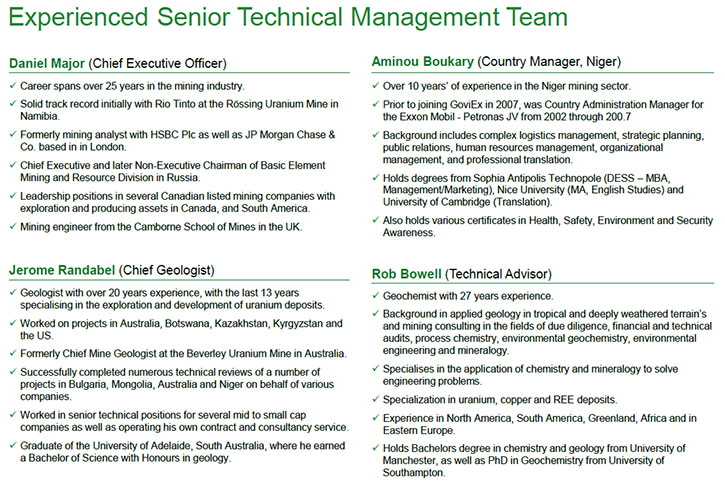

Mr. Daniel Major: My background is a mining engineer. I've worked in Africa, South America, Russia, and Canada. I've worked in multiple commodities, and have also been an equity analyst. I joined GoviEx in 2012, when the company wanted to move from being an explorer to being a developer.

The founder of the company is Govind Friedland; he's the son of Robert Friedland. He's a geologist by background.

In addition, we have a very well-structured Board with a lot of experience in legal, debt, Africa, and in uranium and construction projects as well.

I have a relatively small team at this time, with very wide skillsets, who have worked in a wide range of countries and regions and geologies.

Dr. Allen Alper: Sounds great. Could you tell me a little bit about your share structure, your capital structure?

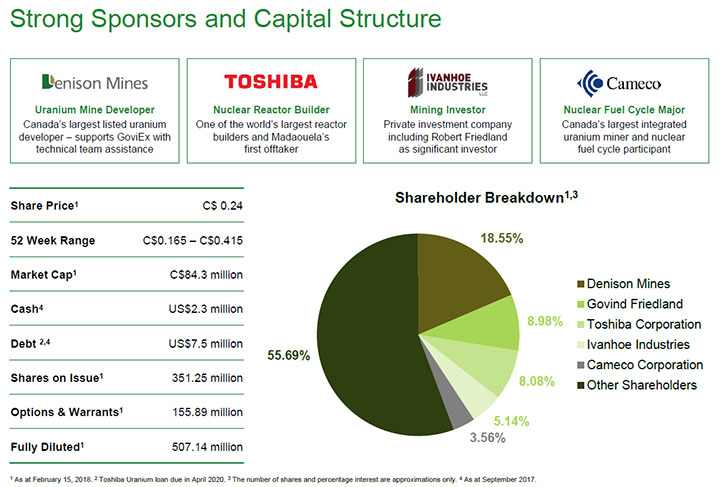

Mr. Daniel Major: Currently, we have roughly 351 million shares on issue. Current market capitalization is approximately C$84 million. We have a combined aggregate of approximately 155 million options and warrants out there, of which approximately 27 million are options, which range in exercise price from US$2.15 to C$0.10. There are approximately 100 million warrants outstanding exercisable between US$0.12 and US$0.15 and approximately 23 million warrants exercisable between US$0.23 to US$0.28. We'll have no debt soon.

Dr. Allen Alper: That's great, that's a good position to be in.

Mr. Daniel Major: Yes, absolutely.

Dr. Allen Alper: What are the primary reasons our high-net-worth readers should consider investing in GoviEx?

Mr. Daniel Major: One: you have to believe in the uranium market. Obviously, we are well leveraged to the uranium price; it speaks to the quality of the assets we have. They're large and potentially expandable resources and very, very importantly, they're permitted. We're already well on our way getting them ready for development with an improving market. Our team has a lot of experience in the industry. They’ve done this before and are eager to do it again.

Dr. Allen Alper: Those are all compelling reasons. Excellent!

Mr. Daniel Major: Thanks Allen.

Dr. Allen Alper: Thank you. I enjoyed learning about everything your company is doing.

http://www.GoviEx.com/

Govind Friedland, Executive Chairman

Daniel Major, Chief Executive Officer

+1-604-681-5529

info@GoviEx.com

|

|