Giga Metals Corporation (TSX.V: GIGA, FSE: BRR2): Developing One of the Largest Undeveloped Nickel-Cobalt Deposits, Focused on Key Metals Used in Electric Vehicle Batteries, Interview with Mark Jarvis, President

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, US

on 3/28/2018

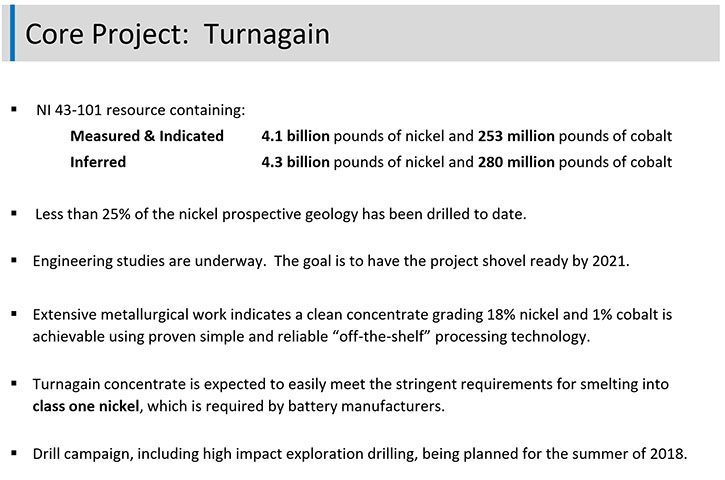

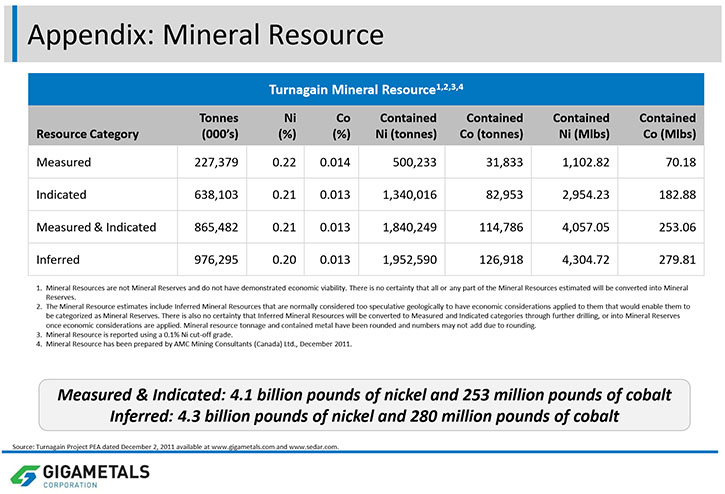

Giga Metals Corporation (TSX.V: GIGA, FSE: BRR2) aims to be a premier supplier of the battery metals that will be needed as the world progresses to a future powered by clean energy. They are currently focused on two of the key metals, used in the batteries of electric vehicles: Nickel and Cobalt. Their Turnagain Project, located in north central British Columbia, is among the largest undeveloped nickel-cobalt sulphide deposits in the world, in terms of total contained nickel. The NI 43-101 compliant resource contains 4.1 billion pounds of nickel and 252 million pounds of cobalt, in the measured and indicated categories, plus a further 4.3 billion pounds of nickel and 279 million pounds of cobalt in the inferred resource category. We learned from Mark Jarvis, President of Giga Metals, that Turnagain is a large, low-grade, open-pittable deposit that the company plans to bring to the shovel-ready stage by 2021, with quite good projected recoveries for this deposit type. According to Mr. Jarvis, they plan to produce a very clean nickel-cobalt concentrate, which will be a very desirable concentrate from a smelter's perspective. With an A-team of mining engineers and with significant exploration potential, Giga Metals Corporation is well equipped to be shovel-ready by the time the nickel shortages really start to hit.

Turnagain Camp aerial view

Mark Jarvis, President of Giga Metals

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Mark Jarvis, President of Giga Metals. Could you give our readers/investors an overview of your company?

Mr. Mark Jarvis: I certainly can, but do you know what's interesting, Al? Do you know Mike Beck?

Dr. Allen Alper: Yes, I have great respect for him.

Mr. Mark Jarvis: Mike discovered us. Do you know Mike's history?

Dr. Allen Alper: Yes, but could you elaborate on Mike's history for our readers/investors?

Mr. Mark Jarvis: Mike, in 2005, became very bullish on uranium for all sorts of fundamental reasons. To express his bullishness, he and a partner, Steve Dattels, bought a large, low-grade uranium deposit in Namibia for $4 million U.S. in a private company. It had been drilled and they did some internal engineering studies. In 2007, two years later, uranium was going to the moon, and they floated the company. Later the same year, they sold the company to Areva, the big French utility, for $2.5 billion. To make a long story short, they converted four million into two and a half billion in two years. It's the best pass I've ever heard of.

Dr. Allen Alper: That's fantastic.

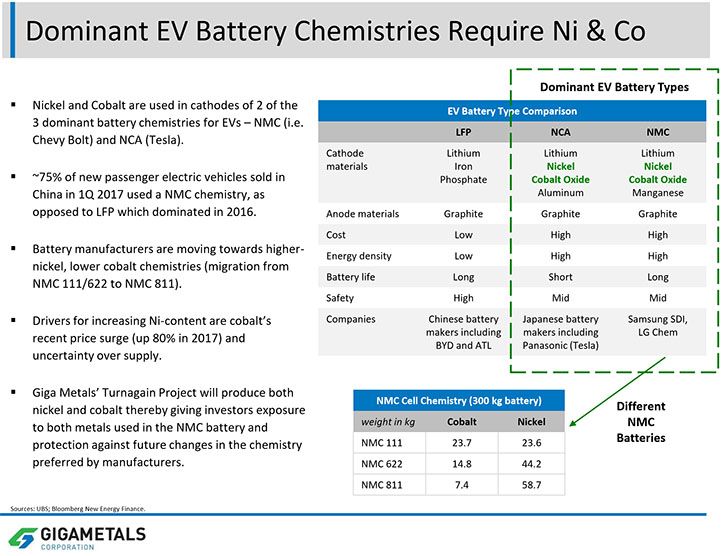

Mr. Mark Jarvis: It's amazing, isn't it? That’s what Mike does. He'll take a macro view of the world, and he'll think, "Okay, how do I make money out of this macro view?" Sometime ago, I don't know, a year ago, maybe a bit more, he decided that this electric vehicle revolution was the real thing. He started thinking about, "How do I make money out of this? Do I buy Tesla?" He thought, "No." He started looking at batteries, and he started looking at what the dominant battery technologies were, and what they will be, and started looking at the materials that go into them.

First of all, they floated a company called LSC Lithium. They cherry-picked what they think are the best lithium salars in Argentina, which was good timing, because Argentina is turning around after a couple of decades of poor management. Then they put together a company called Cobalt27. He did that in association with Anthony Milewski, the CEO. Cobalt27 is a brilliant piece of financial engineering.

Dr. Allen Alper: Yeah, it's very impressive. I'm very impressed with Cobalt27.

Mr. Mark Jarvis: Holy smokes. They created a vehicle for people to express an opinion about cobalt in the market, which was lacking. They're doing extremely well with that, as you know. They just did another $200 million financing. Just quite remarkable.

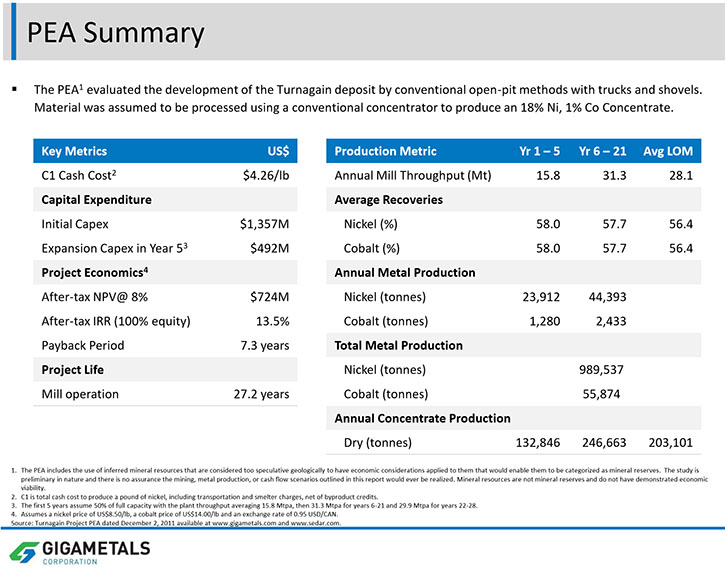

Mike then called us out of the blue last summer. We have a deposit that we drilled off, and in December of 2011, we came up with a preliminary economic assessment. That preliminary economic assessment looked quite robust at the time. Nickel was at $11 a pound, cobalt at 14. However, nickel just started this long slide towards $4 a pound. As the nickel market crumbled, I elected not to spend any more money on this project at the time.

Al, I decided not to fight the market. We just hunkered down. I stopped collecting a salary. We had to lay off almost all the technical staff, got down to a part-time CFO and a part-time corporate secretary, and just kept our listing alive, and kept our asset alive. The downturn lasted a lot longer than I thought, and I have to tell you, we just squeaked through.

Then last summer, Mike called us. I'd never heard of the man, but we had exactly what he was looking for. His thesis is, and this is from uranium or from UraMin, if you are bullish on a commodity price, the most leveraged way to play that is with a deposit that has high option value. That's what we have.

People compare us most of all to Royal Nickel, to the Dumont deposit. In my mind, it's really difficult to find an analogy. There's Dumont. There's Sheba Ridge in South Africa, there's Yakabindi in Australia, and these are all large, low-grade nickel sulfide deposits. The producer of this type is Mount Keith in Australia.

The difference is this. Our deposit is 185 million years old, whereas our peers are all on the order of a billion years old. What that means is they've had a lot more time to become altered, and the alteration products never seem to help the metallurgy. Our peers all have difficult metallurgy, whereas we have a very simple metallurgical flow sheet, which is very competitive.

We get quite good recoveries for this deposit type, in the 56 to 58% range, whereas Dumont is about 42%, I believe, presently.

Mike discovered us, and started financing us, and started helping us finance. We have $4.2 million in the treasury as of today, and we have become active again.

From a standing start, we've put together a technical team. I have a gentleman named Tom Milner as an in-house mining engineer. Tom was responsible for the restart of the Gibraltar Mine for Taseko Mines, and then was involved with a company called Corriente, run by Ken Shannon. They had a large copper deposit in Ecuador, and Tom ran the engineers and put together the model. They sold the whole thing to the Chinese for something like $20 a share. He's quite excited about our project. He's put together a team that he's selected of individuals from Hatch, and we're restudying the engineering, and looking at how to make a smaller startup then what we modeled before.

Dr. Allen Alper: That is a very strong organization, so you have a great team there.

Mr. Mark Jarvis: Tom is absolutely first-rate. When a small company deals with a large engineering firm, you don't always get the A-team. In fact, you almost never do. Tom has hand-picked the A-team from Hatch, and they're all really interested in this project. I'm really pleased with the team that he's pulled together.

We're redoing the engineering and looking at ways that we can make the startup smaller, because it's my perception that the majors are quite wary of high capex projects. 20 years ago, that's what they looked for, projects big enough that they could move the needle. Now they want a giant deposit, which we have, but they also want the smallest possible startup within that giant deposit, so very controlled upfront capital risk. Then they've got the liberty, because it's a giant deposit, to double up later, and then perhaps double up again, when market conditions are right. You can do a small startup, and debug it, and get all the risks worked out before you start going big. That's the model that we're trying to create.

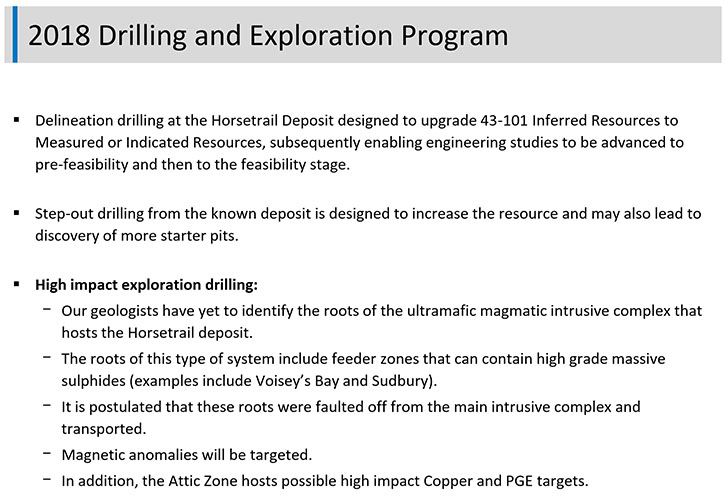

We're starting a program of metallurgical testing, we've done more than 300 metallurgical tests over the years. We're also planning a drilling campaign this summer, 23 shallow infill holes in the starter areas. That will upgrade inferred resources into measured plus indicated, and it will give us 23 years of production at a 42,000 ton-per-day mill rate, all in the measured plus indicated category, which will then enable us to advance the engineering through pre-feasibility into feasibility. Our goal is to have a bankable feasibility report by 2021. By bankable, I mean have permits attached, so it's shovel-ready.

Dr. Allen Alper: Excellent! Very good!

Mr. Mark Jarvis: Yes.

Dr. Allen Alper: It sounds like a very aggressive program that you have mapped out for your company.

Mr. Mark Jarvis: You've got to hit when the iron's hot.

Dr. Allen Alper: Correct. It looks like the right time.

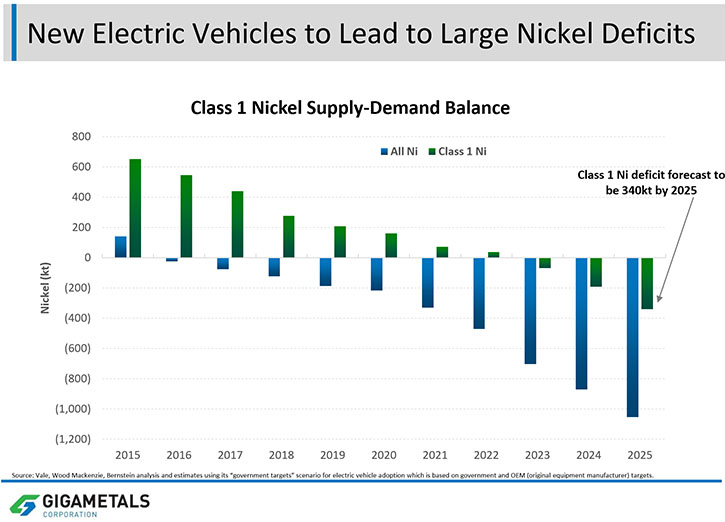

Mr. Mark Jarvis: I think 2021 is when the nickel shortages are really going to start to bite. If we can be shovel-ready by 2021, that should be the beginning of the frenzy. We want to be ready for that.

Dr. Allen Alper: That sounds great. Could you tell our readers/investors why your nickel deposit is so important, and what differentiates it from others as far as quality and the battery market you're going after?

Mr. Mark Jarvis: Okay. All of our metallurgical test work tells us we can reliably make a clean concentrate at grades 18% nickel and 1% cobalt. By clean, all the deleterious elements that a smelter might object to are mostly undetectable. This is a premium product, from a smelter's perspective, you can buy our product, and you can also buy cheaper, dirtier concentrates from other sources, and blend away their problems with our concentrate. This would be a very desirable concentrate from a smelter's perspective. It's just very easy.

We'll be selling a concentrate, but it'll be a very desirable concentrate. Then the smelters and refineries can smelt and refine this to anything they want, including nickel sulfate or cobalt sulfate. They can produce any kind of Class I nickel they want from our concentrate.

Dr. Allen Alper: That sounds very good.

Mr. Mark Jarvis: We have exploration potential as well. If you look at the slide deck, towards the end there's a magnetic anomaly map. The intriguing thing here is we've never found the roots of the system. This was a magma chamber, probably about four kilometers deep that would occasionally erupt through one or more volcanoes. The magma came in from feeder zones below, that's where you find high grade in these systems. That's where you have chokepoints, and the sulfides will accumulate and concentrate into massive sulfides. That's where you get the Voisey's Bay-type deposits.

This deposit gradually cooled and froze, and it was transported, rolled over, and the bottom of the system was cut off by a fault. We have three mag targets, that are properly located that could be the feeder zones. We're going to drill those targets this summer. We've been looking at them for a few years, but in the last few years, you couldn't raise money for exploration. We finally get to drill these targets that we've been wanting to drill, and it's important that we do drill them. We either hit, in which case that would be an explosive result. If we hit significant intercepts of high grade, suddenly this whole project changes. If we don’t, we have to eliminate these targets, in which case we simply proceed with what we already know we have. Either way, we're going to drill them this year. There's some real blue sky in this story.

Dr. Allen Alper: That sounds excellent. Could you tell our readers/investors a little bit about the resource you have, measured, indicated, and inferred?

Mr. Mark Jarvis: In terms of nickel and cobalt, in measured and indicated, the global resource is 4.1 billion pounds of nickel and 253 million pounds of cobalt. In the inferred category, you basically double that. It's another 4.3 billion pounds of nickel and 280 million pounds of cobalt. We've drilled less than 25% of the nickel area of this ultramafic intrusive. It looks like it just goes on and on. You reach a point where you go, "Okay, we've got enough." Look at the slide below.

Dr. Allen Alper: That's a huge resource you have there.

Mr. Mark Jarvis: Yes, it is.

Dr. Allen Alper: That sounds excellent. Could you tell our readers/investors a bit about your board and yourself, Mark?

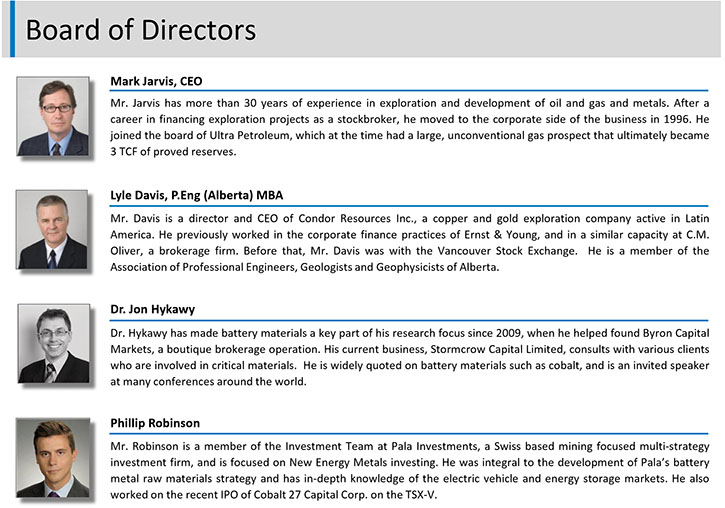

Mr. Mark Jarvis: Years ago, I was a broker in Vancouver, financing exploration plays, both mining and oil and gas. In '96, I crossed the street to join the board of a little oil and gas company that had just taken on a play I really liked. That company was called Ultra Petroleum. We had a tight gas play that was the first play that used multiple-stage fracks. We were on the forefront of that technology.

These were vertical wells. Everybody know that there was a lot of gas there, but nobody had figured out how to make it economic. There were a couple of bright young engineers, who said, "Okay, we'll drill to the bottom of the hole. Frack that, put in a bridge plug, move up to the next, and we might do four to six fracks in one hole." We were making really good wells. They started off at 10 or 12 million feet a day, with a good condensate cut.

Like all these resource plays ... In fact, I believe that I'm the one that invented the term resource play, because at that time, we would have analysts ask, "What's your PV10?" I would say, "It's not very much right now, because we're early, but this is a resource play. You have to analyze this more like a mining play. You have to look at the resource and look at future cash flows" People were very skeptical at the time, but we ended up developing three trillion cubic feet of proven reserves of gas, just a giant resource.

Dr. Allen Alper: That's excellent!

Mr. Mark Jarvis: Here's another lesson that I took from all this. That play was a bit marginal at the time. Gas at the time was $2 a thousand. At $2 a thousand, these wells would have about a four-year payout. They'd go basically forever, so that was acceptable, but you would rather have a two or three-year payout on that sort of a well. Ultra Petroleum was 35 cents a share when I crossed the street. When gas took off over $10 a thousand, it peaked at $16 a thousand, Ultra went to $150 a share. Again, there's another example of a huge marginal resource. It's just an example of the leverage that'll give you when a commodity really performs. That's where you make the big money. That's where the option value is.

Dr. Allen Alper: You have that with your nickel and cobalt. Is that correct?

Mr. Mark Jarvis: Exactly. This is perhaps the most leveraged option you will ever see.

Dr. Allen Alper: That's excellent. Could you tell me a little bit more about your other board members?

Mr. Mark Jarvis: Lyle Davis has been with our board for years and years. He's the Chair, and he's very good at that job. He used to work for the old Vancouver Stock Exchange, chasing the bad guys. He was manager of trading when the old Vancouver Stock Exchange moved from the open outcry trading floor to the computer-based trading. It was a remarkable, remarkably smooth transition. Everybody was predicting doom, but Lyle pulled it off. He's an excellent manager. He's just a first-class citizen.

Dr. Allen Alper: That's great.

Mr. Mark Jarvis: Dr. Jon Hykawy you probably know.

Dr. Allen Alper: Yes, I do.

Mr. Mark Jarvis: He's an expert on battery metals, and just a very smart guy. He speaks at a lot of seminars around the world, and he has a business going, advising mostly large companies about supply and demand for battery metals, and how to secure supply in battery metals.

Phillip Robinson is part of the investment team at Pala Investments. He is a very, very bright young man. He really brings a lot to the table. I'm very pleased to have him as a director. Pala Investments owns something like 6.5% of our stock.

Dr. Allen Alper: That's very good.

Mr. Mark Jarvis: Phillip Robinson also worked on the IPO of Cobalt27. He was involved in structuring that whole transaction, which again I think was a brilliant, brilliant bit of financial engineering.

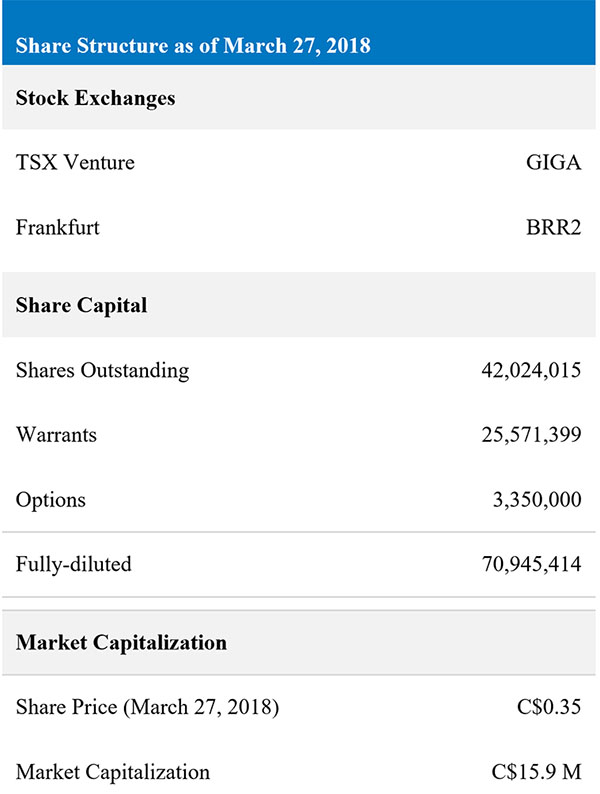

Dr. Allen Alper: Could you tell our readers/investors a little bit about your share structure?

Mr. Mark Jarvis: We currently have about 42 million shares issued and outstanding. We have about 25 million warrants outstanding as well, just from the various financings that we've done recently. We did three financings in a row very, very quickly at ever higher prices.

Mr. Mark Jarvis: We're currently sitting on about $4.2 million in the treasury, and our market capitalization is about $15 million Canadian right now. The stock is trading below the price of our last private placement, but it's turning over quite well. I think anybody that wants to sell can sell, and we're marketing a story, and basically attracting open-market buying. Gradually, we'll tighten this market up again.

Dr. Allen Alper: I see you're on the TSX Venture and Frankfurt Exchange.

Mr. Mark Jarvis: That's right.

Dr. Allen Alper: That's great. What are the primary reasons our high-net-worth readers/investors should consider investing in Giga Metals Corporation?

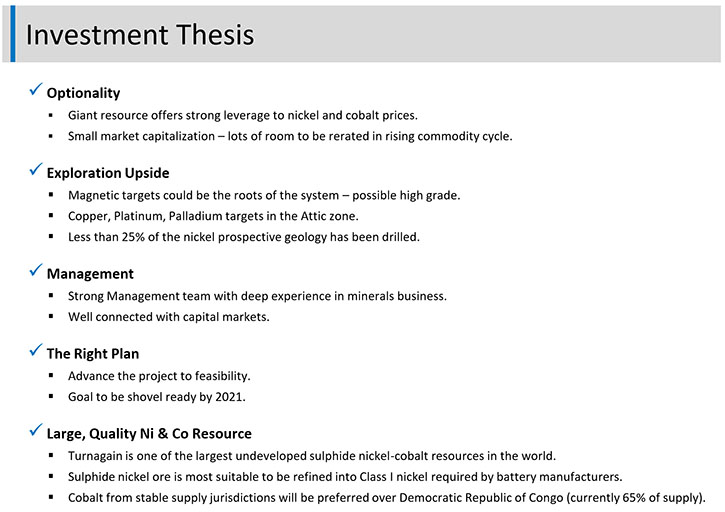

Mr. Mark Jarvis: The overwhelming reason is optionality. We have amazing leverage to the price of nickel and cobalt, and we currently have a very small market capitalization, so there is lots of room for upside.

Another reason is we have exploration upside. We have three different targets that could be the roots of the system, where the high grade is hiding, and we're going to test those targets this summer.

We've also have another area of the property that I haven't talked about much, but it's predominantly copper, platinum, and palladium. We have some exploration ideas there. We're going to spend a bit of money there.

We have a good management team. We have a good technical staff and good consultants, but also, we're well connected with the capital markets. We're not going to go broke, which is a good thing in this business. I think we have a good plan. If we can get this thing shovel-ready by 2021, which is our goal, I think we'll be one of the first large projects built in the new nickel cycle.

Dr. Allen Alper: That sounds excellent, very aggressive plan, and it sounds like it's very well thought out. It's good to have backing. It's good to be connected with the capital markets. You have some rather strong people on your board, and you yourself have those connections, so excellent. You'll need the money to go forward, and it sounds like you'll be able to do that.

Mr. Mark Jarvis: I think so. Plus, we're working on other ideas all the time, both corporate ideas and exploration ideas.

Dr. Allen Alper: That sounds exciting. You're aiming at the right market, the lithium-ion battery market. That's growing and taking off, and it sounds like you'll be there when the market really takes off and there's a deficit in nickel for batteries. That sounds great.

Mr. Mark Jarvis: That's right. It's a deficit of Class I nickel, in particular. Class II nickel is for stainless steel only, and most of the nickel production in the world today is Class II. It's Class I nickel that's going to have a real deficit, and that's what we have. I think we're sitting in a sweet spot.

Dr. Allen Alper: That sounds excellent.

https://www.gigametals.com/

MARK JARVIS, President

Suite 203, 700 West Pender Street

Vancouver, British Columbia

Canada

V6C 1G8

Phone: (604) 681-2300

Email: info@gigametals.com

|

|