Nevada Copper (TSX: NCU): The Only Fully-Permitted, Shovel Ready Copper Project in the USA, Interview with Stephen Gill, Chairman

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, US

on 3/27/2018

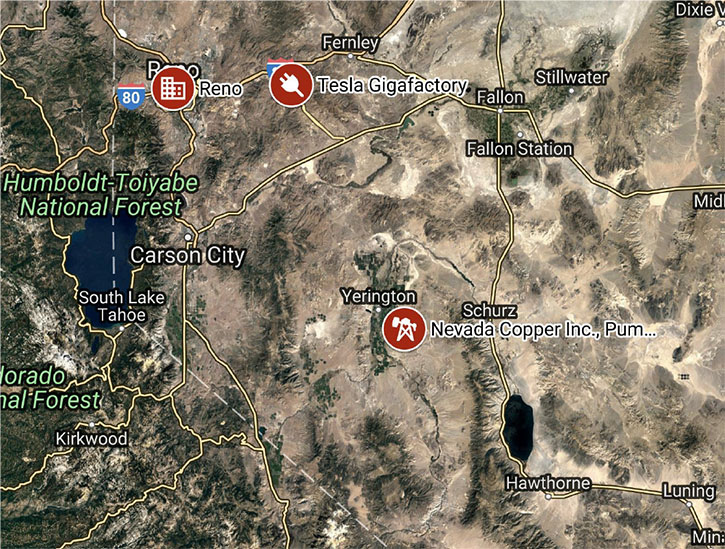

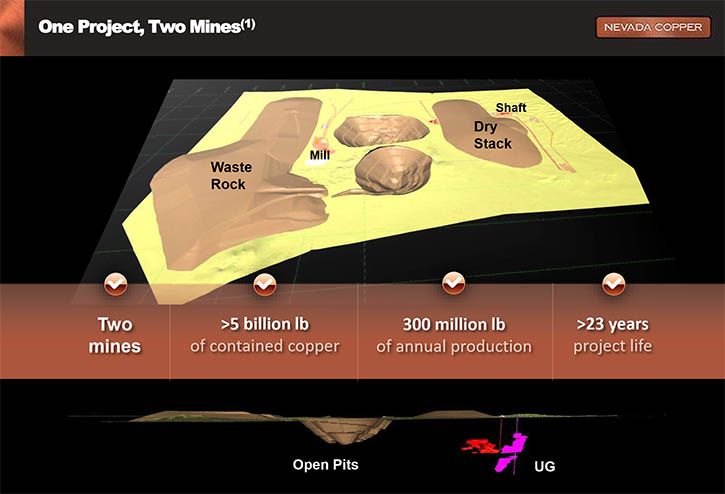

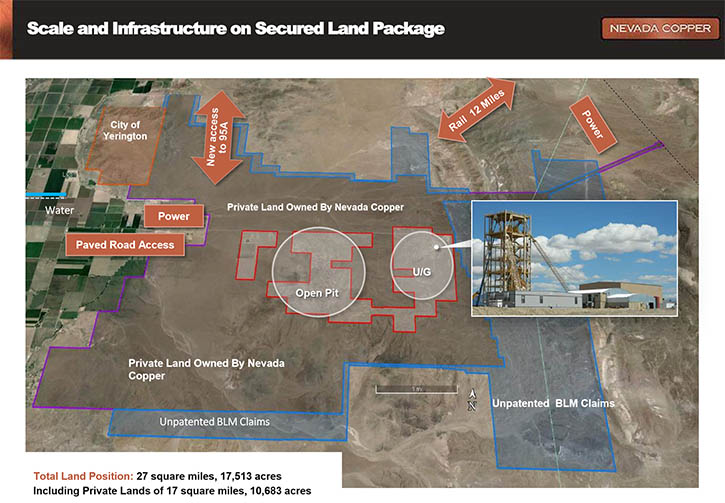

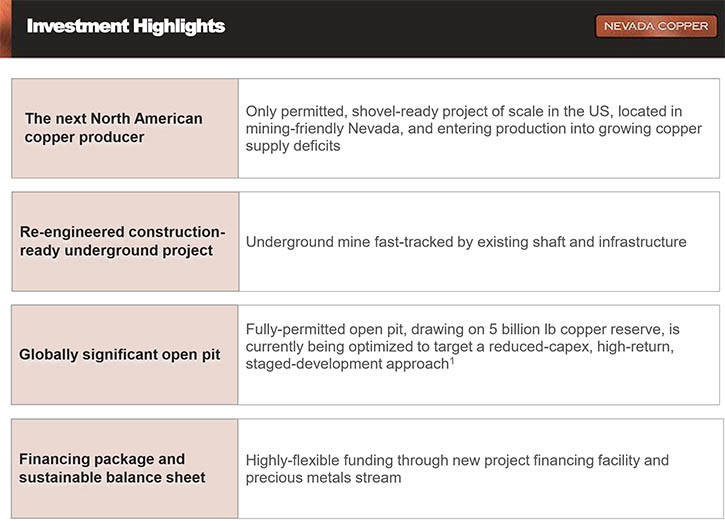

Nevada Copper (TSX: NCU) owns 100% of the Pumpkin Hollow Copper Development Property, located near Yerington Nevada, US. Pumpkin Hollow is a large, advanced-stage-development, copper property, with substantial reserves and resources including copper, gold, silver, as well as a large iron resource. Pumpkin Hollow copper project is located entirely on private land close to infrastructure with all required power and water supplies secured, all required Nevada permits for construction and mine operations are in hand for both and underground and open pit operation. We learned from Stephen Gill, Chairman of Nevada Copper, that the Pumpkin Hollow asset, in Nevada contains two mines in one project. They're the only two new sources of copper supply out of the US that are permitted today. Nevada Copper is focused on bringing Pumpkin Hollow into production first from its underground mine, which is partially constructed today and aims to be online by late next year. Behind that underground mine is a very large open pit mine, with around five billion pounds of copper reserved and substantially more resource potential. According to Mr. Gill, there's a desperate need for new copper supply in the world due to a period of underinvestment and new sources of demand associated with electric vehicles, and no major has a big project ready to go.

Nevada Copper Corp.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Stephen Gill, Chairman of Nevada Copper Corp. Could you give our readers/investors an overview of your company, your focus and current activities?

Mr. Stephen Gill: Nevada Copper is an exciting company at an inflection point and set to become the next copper producer in North America next year. Nevada Copper owns the Pumpkin Hollow project in Nevada, comprising two mines: an underground mine about to start production, closely followed by a large-scale open pit mine that has been re-designed for a low-capex accelerated start-up.

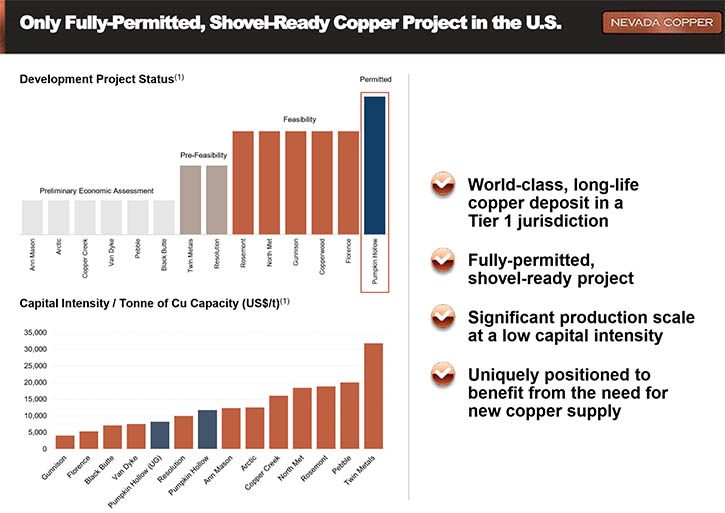

These are the only two new sources of copper supply in the US that are permitted today. This puts Nevada copper in a different position than any other copper development company, as permitting a new mine in the US takes an average of seven to ten years. So, in a world where new copper supply is desperately required, Pumpkin Hollow is a unique and strategic asset.

Dr. Allen Alper: Can you tell our readers why they should be excited about the copper market today?

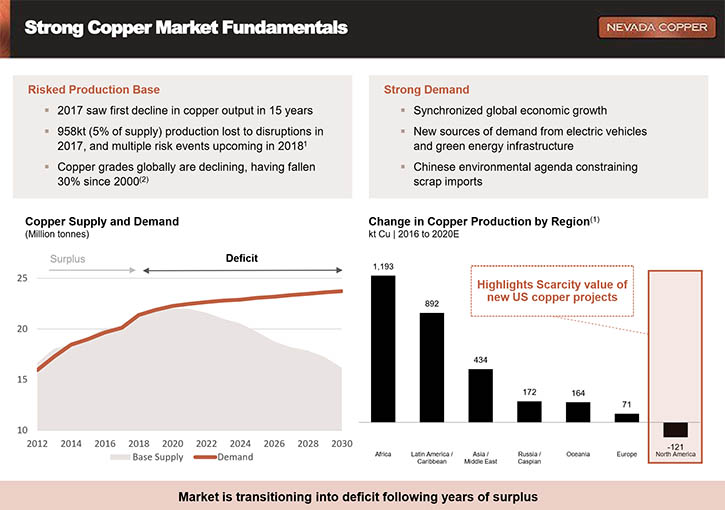

Mr. Stephen Gill: When we look at the copper space, we see the market on the cusp of a major inflection point. Following years of underinvestment, there is a shrinking supply base that is increasingly at risk. 2017 saw the first decline in copper mine output in 15 years, and around a million tonnes lost, on a 23 million tonne market, to unplanned disruptions, largely from wage negotiations in Chile and security issues in Indonesia. So, you have supply that is already insufficient to meet demand resulting in unsustainable deficits.

When you look at what little copper production has come online in the last five years in copper, it's all come out of Africa, Asia, and Latin America. North America has declined. If you break that down; in Asia, you essentially have expropriation of one of the world’s largest copper mines, Grasberg in Indonesia out of the Grasberg mine. In Africa, the DRC is in chaos. Chile is in structural decline, copper grades fallen 30 percent over the last 15 years, there is major wage inflation, labor tensions, and significant water shortages. So that's the supply base.

Dr. Allen Alper: How do you see the proliferation of electric vehicles impacting demand?

Mr. Stephen Gill: That is a great question, on the demand side there is generally agreement that we are in a comfortable with synchronized global growth which is very positive for copper price. However, our team of analysts have done extensive work on the incremental copper demand associated with the electrification of the global vehicle fleet. We have a strong view that over this year the penny is going to drop for the market, as people begin to do the real math on the effect of EVs, plus the grid storage battery overlay.

When people think about what impact the EV story has on the copper market, they tend to focus only on the intensity of copper usage in the vehicle. For example, your average internal combustion engine has around 20 kilograms of copper, versus an electric vehicle which has 90 to 100 kilograms of copper. So far, most projections just take that incremental copper and multiply it out by the projected future EV sales, and people say, "Well, that's the incremental impact." This really misses the big picture, the copper used in the vehicle is just the tip of the iceberg. Think of the huge amount of incremental copper required in the build out of the electric vehicle charging infrastructure. More importantly, the entire western world’s electrical distribution grids is not actually ready to support the power load required when everybody gets home from work at night and plugs-in their cars for the evening, dealing with this requires massive grid overhaul which is very copper intensive. Then you have renewables and grid storage batteries, all of which requires more copper.

The incremental demand of this new energy story is actually quite dramatic for copper. Compare that to lithium, cobalt or nickel, copper is a much larger more investible market. So, you can expect to see a surge of investor interest, as people appreciate the broad-based impact of EVs on copper demand.

Putting that together, a short and increasingly risky supply base and new sources of incremental demand, we see there's a desperate need for a new copper supply.

We also see an increasing focus on securing sustainable supply, with BMW, a major auto manufacturer, having recently entered into a framework agreement with a larger copper produce to secure a source of supply.

Pumpkin Hollow is located in an established mining district a short drive from Reno, and about an hour by highway from the Tesla Gigafactory, and close to domestic US copper smelters. This location becomes an interesting fact when thinking about building an integrated, secure, domestic source of American copper supply.

Dr. Allen Alper: So where do you see new copper supply coming from?

Mr. Stephen Gill: There is a real need for a renaissance in the US copper industry.

We’ve just come out of one of the worst seven-year downturn in copper price that we’ve seen in decades. There are few options available, and the majors haven’t spent a dollar on advancing new copper projects. Given the rising geopolitical risk and need for security of supply, people aren’t going to spend billions of dollars in Asia or Africa, Chile is in decline, so the world needs new copper production out of North American.

Now, when you look at the whole US copper space. Nevada Copper has the only two permitted new mines in the US, which makes it a truly strategic asset.

Dr. Allen Alper: Thank you Stephen it is really interesting to get a deeper understanding of what is driving the copper market. Can you tell our readers about the construction plans at Pumpkin Hollow?

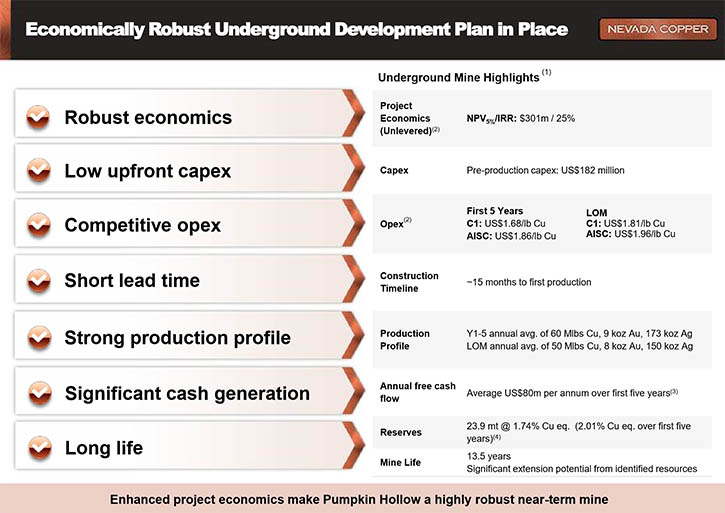

Mr Stephen Gill: Nevada Copper is focused on bringing Pumpkin Hollow into production first from its underground mine, which is already partially constructed today and aims to be producing by late next year. There is already $220m of invested capital and 18 months of construction work in place, including a 2,000-foot production shaft, underground development and significant site infrastructure. This will see Nevada Copper producing around 60 million pounds of copper per year, which at today’s copper prices equate to around $80 million in annual free cash flow.

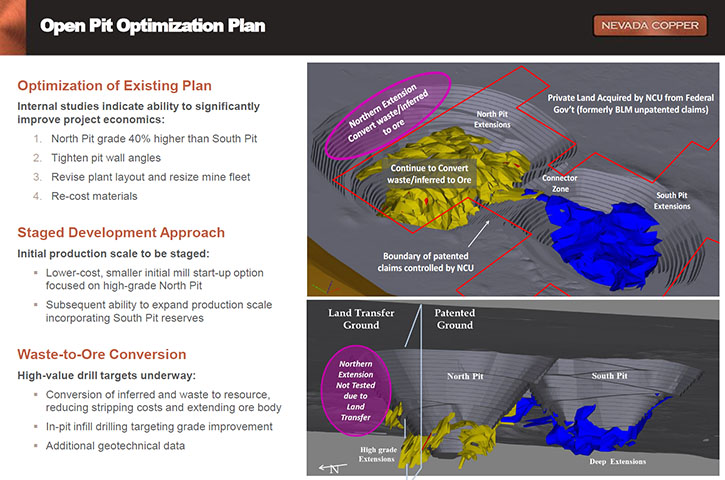

Close behind the underground mine, is a large open pit mine. The open pit has around five billion pounds of copper reserves and substantially more resource potential. Previously the open pit had been designed at the peak of the last copper cycle with a focus on maximizing scale and reserves, rather than focusing on economics. The same team that has re-engineered the underground mine into a low-capex, high-grade mine with a rapid path to production has also been working on optimizing the open pit, which results in a substantially lower cost and more robust open pit mine.

During the downturn in copper prices, the previous team a very complicated and extensive land swap and permitting process. They painstakingly moved 25 square kilometers of concessions from federal land to state and private land and completed the permitting process in a bill passed before Congress in the last days of Obama's administration. This strategic land holding and permitted status, puts Nevada Copper in a totally different place versus any other new copper mine in the US.

Mr. Stephen Gill: Now, there's a new team in place that is focused on construction of the mine.

The underground mine has been re-engineered by a highly experienced project-builder team; we reduced the scale, de-risked the construction approach, raised the cutoff grade, and created a lower operating cost operation, with lower capital and a focus on profitability over tons.

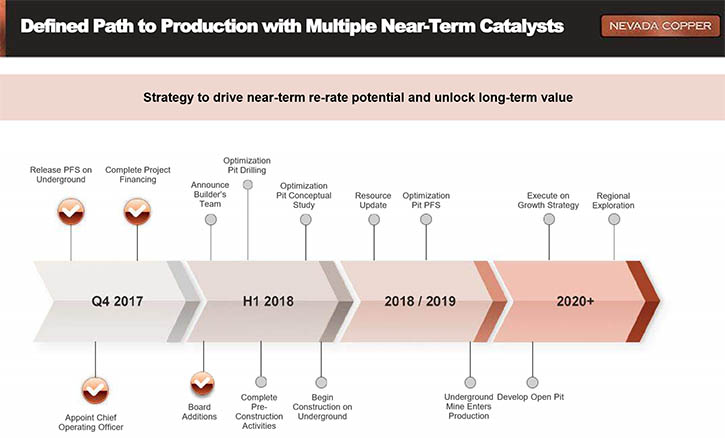

The new pre-feasibility was released November last year, we then moved on to complete a $380 million recapitalization of the company and project financing package, involving the restructuring of the existing lender, substantially reducing and de-risking the debt amount, bringing in a $70 million precious metals stream, and closing a $100 million equity raise in January 2018. So that's all in play. The company is cashed up and ready to go.

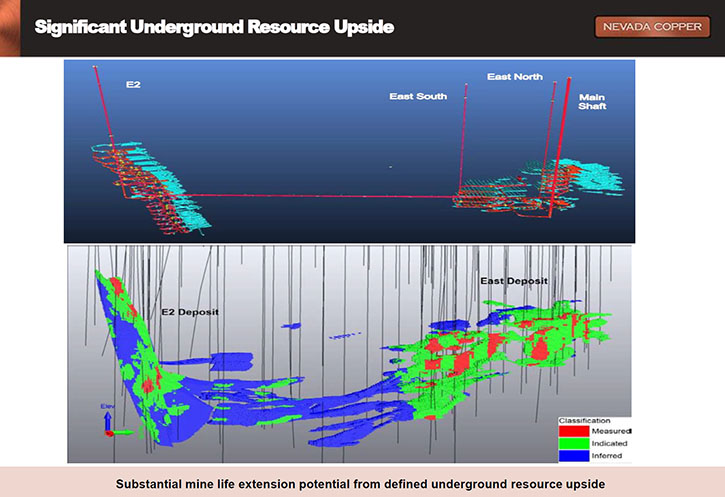

There is also substantial known upside to the pre-feasibility, in particular there is around 80 million tonnes of underground resources, but just 24 million tonnes included in the pre-feasibility study. These additional inferred resources are situated around planned mining zones, and may well be upgraded into the mine plan as underground drilling progresses, giving substantial potential to significantly further extend underground mine.

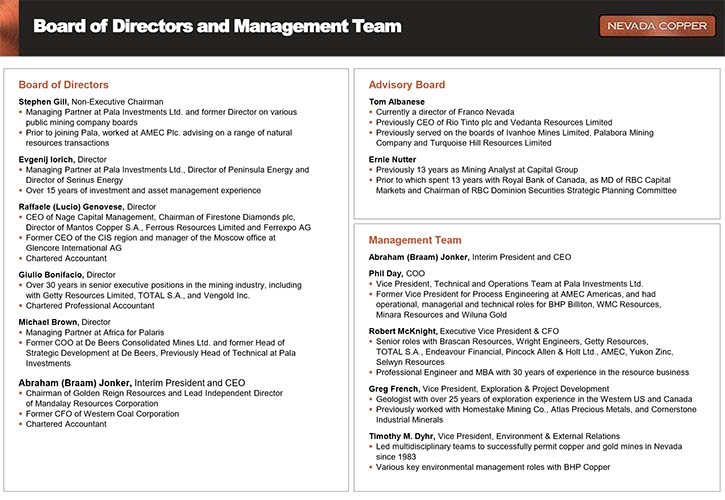

Moving into this year, we have added two new lead independent directors, Tom Albanese, the former CEO of Rio Tinto and Ernie Nutter, who was the head of RBC's global mining franchise and a senior PM at Capital Group. I took the Chairman position, and we announced a global search for the new CEO that will be a very experienced mine and company builder. We hope to announce his appointment shortly.

Now we have the team on the ground, filling out quickly with the key construction skills. The pre-construction activities and long-lead items are being pinned down now on the underground. We aim to kick off full construction in the summer, and we are targeting first production from next year, which makes us the first new source of copper production in North America, and likely the only one for a number of years to come.

Dr. Allen Alper: It sounds like the underground mine is well underway, can you tell our readers more about the plans for your second project, the open pit?

Mr. Stephen Gill: We’ve applied the same successful “margin-over-tonner” philosophy to re-engineering the five-billion-pound copper open pit project. So instead of just looking at scale, we focused on reduced capital, speed to production and profitability. We are concentrating on the North Pit, which is significantly higher grade, as our starting position.

We've done more geotechnical work since the original feasibility study, so we can move to tighter pit wall angles, which materially reduce the stripping costs and reduces sustaining and pre-production capital. That allows us to design an improved and smaller plant, targeting a 30,000 tons per day at the high-grade pit with reduced stripping. We still retain the optionality to expand subsequently into the South Pit. That allows you to take the capex from a billion dollars down substantially, while maintaining a significant production profile.

Summing up, focus on the underground first. It's 180 million of capital. We just did a big financing to restructure the company and bring in the funding to build it. That brings us to production next year. Whilst we're in construction, there'll be a huge amount of news to come out over the re-engineering of the open pit. We've appointed Golder Associates to formalize that open pit study, which we aim to release soon. There will also be drilling results will also come out on the previously untested Northern Extension zones of the open pit ore body.

Dr. Allen Alper: You look to be well financed to bring the underground mien into production, how do you think about financing the open pit?

Mr. Stephen Gill: When you understand the scale of the capex reduction achievable on the open pit you can see how this second project, which was previously thought to be too big to finance, can now be financed from debt and internally-generated cash flows from the underground mine, so this removes the overhang of needing to do a large equity raise.

Dr. Allen Alper: Excellent! You have two outstanding mines moving forward. Your team has done a great job lowering capex and improving the opex, and getting it financed. I can see you have very strong financial support.

Mr. Stephen Gill: Yes. Very strong; Pala Investments, Castlelake, and JP Morgan have all been strong equity supporters. And there is Triple Flag providing the stream, who also provided an equity investment.

Dr. Allen Alper: Well, it sounds like Nevada Copper is in a unique position and very well positioned towards the growing demand of copper and have an excellent project and a unique one. Could you tell our readers/investors a bit about your background and your board and your management team?

Mr. Stephen Gill: I was with AMEC, the engineering consulting firm, focused on natural resources for a number of years, before joining Pala Investments. I've been there for a number of years as a managing partner. Recently I joined Nevada Copper as Chairman.

Other key appointments are; Tom Albanese, who joined our board in the new year. Tom doesn't really need any introduction, he was the CEO of Rio Tinto and after that, CEO of Vedanta, he is also a director of Franco-Nevada. He has very deep technical roots, in some of the biggest mining companies in the world. So he brings a huge amount of knowledge and depth of experience.

Ernie Nutter is the other key independent director, both are new appointments. Ernie was the MD of Royal Bank of Canada's mining practice, following which he was a key member of Capital Group, one of the largest investment funds in the world. He is extremely knowledgeable and well-respected on Bay Street in Toronto.

In terms of the management team, Phil Day is Chief Operating Officer. He's an incredibly experienced project builder. He started with WMC, BHP Billiton, worked with AMEC, and has built several large and complex mining projects around the world.

Greg French is the head geologist, with many years’ experience in Nevada, in particular. Tim Dyhr is the head of permitting and environmental affairs. He has great connections in Nevada, and was instrumental in the land swap that was achieved and is a very important part of having deep roots in the local community. Those are a few of the key people, but the whole team is strong and quickly growing. Braam Jonker is acting interim CEO. We announced about a month ago that we have been running a global search for a new CEO, which is progressing very well.

The new CEO should be announced in the not distant future. The quality of that individual and the depth of his experience will be in-line with that of the two new directors. The aim was to find somebody who has a list of mines that they've built and operated successfully. When I think about our shortlist of candidates, I don't think they'll disappoint.

Dr. Allen Alper: Oh, that sounds like you and your group are building a very strong board and team to move NCU forward. Could you tell our readers/investors a bit about your capital and share structure?

Mr. Stephen Gill: Sure. There are 445 million shares outstanding. We recently completed a $380 million recapitalization of the company that included a significant reduction in the debt outstanding, now $80 million over a very long tenor and extremely limited repayments for the first half decade. A lot of time was spent on that because we believe in having maximum flexibility whilst ramping up mines. So, we have a huge amount of flexibility. We also have the ability to prepay that at any time and bring in additional or replacement development debt, which also positions us very well for the open pit.

There's a $70m precious metals stream with Triple Flag, a well-respected streaming company. This is only on the underground precious metal units, and we have the right to buy back about half of that up until March 2020. This is a very, creative, non-dilutive form of financing. We also just completed the 100 million US equity raise in January. For all intents and purposes, the company has access to the funding it needs to get through to positive cash flow from the mine. That's the capital structure in a nutshell.

Dr. Allen Alper: That sounds excellent. What are the primary reasons our high-net-worth readers/investors should consider investing in NCU?

Mr. Stephen Gill: Certainly. First of all, the copper market is entering substantial, and unsustainable deficits. The new supply that needs to come online actually needs to come out of North America. Nevada Copper owns the only permitted new projects available in the US today.

The two projects provide near-term production and a substantial growth profile: The underground mine aims to be in production next year, producing 60 million pounds of copper per year, which is $80 million of free cash flow. The open pit project sits behind that with a large, globally-significant project, that has been substantially re-optimized with the same “margin-over-tonnes”.

There is a huge amount of news flow to come from both the underground and open pit projects over the coming weeks and months. We are rapidly advancing the underground, we're completing the open pit optimization study, extension drilling results are coming out, and the team is quickly building out with extremely strong individuals such as Tom and Ernie and Phil and the new CEO that will be announced shortly.

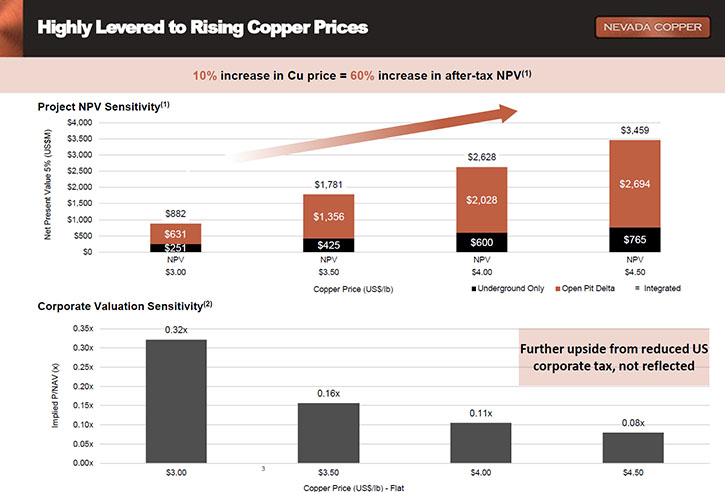

Finally, the leverage to copper prices is massive. Codelco, the largest copper mining company in the world, is predicting $10,000/tonne copper in the near future, and we are sitting around $7,000/tonne today. A 10% increase in the copper price results in a 60% increase in the value of the two projects. You have a billion dollar NPV today at $7,000/tonne, at $9,000/tonne, it's north of a $2 billion, at $10,000/tonne it is $3.5 billion.

There are a series of very significant catalysts, as we move forward, that I think will give a lot reason for people to position themselves in this company. The is substantial news flow and the plans are getting executed fast. It's a pretty exciting time.

Dr. Allen Alper: That sounds like a really fantastic opportunity because it looks like copper, as you pointed out, has a big supply and demand problem and a big opportunity for your company and the market.

http://www.nevadacopper.com/

Eugene Toffolo, VP, Investor Relations &Communications

Phone: 604-683-8266

Toll free: 1-877-648-8266

Email: etoffolo@nevadacopper.com

Robert McKnight, P.Eng.,

Executive Vice President & CFO

Phone 604-683-1309

Email: bmcknight@nevadacopper.com

|

|