EMX Royalty Corporation (TSX-V: EMX, NYSE American: EMX); Growing Royalty Portfolio - David Cole, President and CEO, PDAC Booth # 2651

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, US

on 3/1/2018

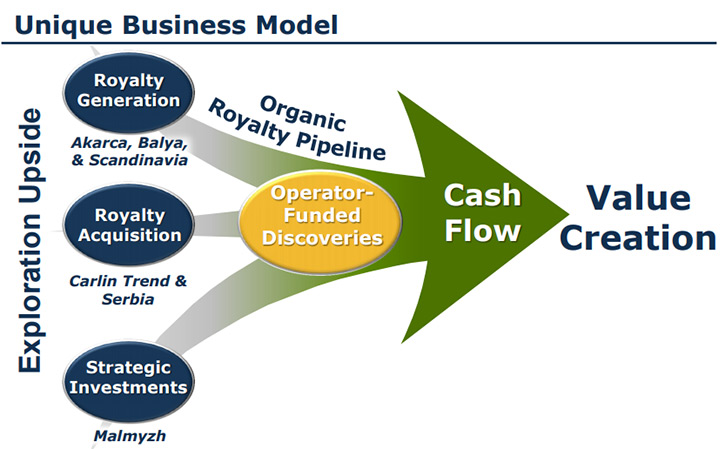

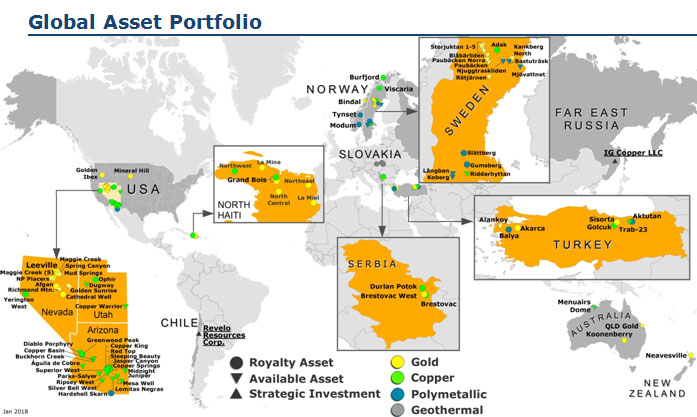

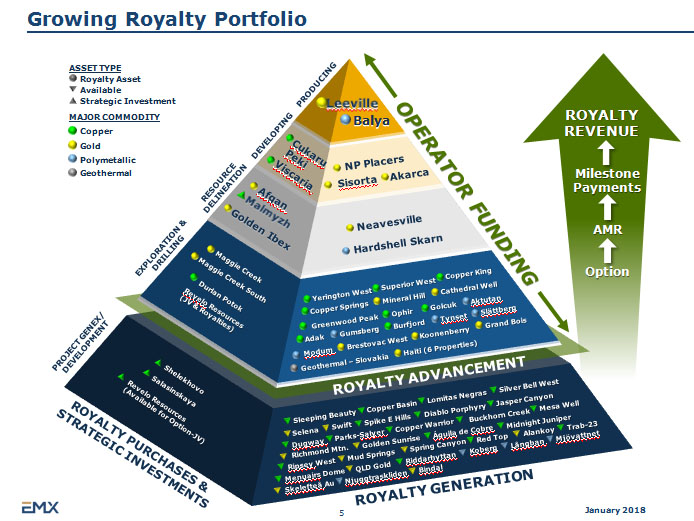

EMX Royalty Corporation (TSX Venture: EMX, NYSE American: EMX) is focused on a core business strategy of developing cash flows from a growing portfolio of royalty property interests. We learned from David Cole, President and CEO of EMX, that the Company not only developed royalties organically through generative exploration, but also by prudently purchasing royalty interests. As a complement to the royalty generation and royalty acquisition initiatives, EMX makes strategic investments in upside exploration opportunities, with exit strategies that can include taking royalty positions, equity sales, or a combination of both. According to Mr. Cole, EMX's diversified business model has resulted in a worldwide portfolio of mineral assets designed to build shareholder value as we enter into a robust and resurgent metals market.

EMX Royalty Corporation

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing David Cole, President and CEO of EMX Royalty Corporation. Could you give our viewers an overview of your company and tell them about your business plan and model?

Mr. David Cole: I'd be happy to, Dr. Alper, and thank you for having me. EMX Royalty Corporation was formerly known as Eurasian Minerals, a prospect generation company. We started in the prospect generation business over fourteen years ago. We have evolved over time, and we renamed the Company EMX Royalty to reflect the core focus of our business. With more and more of our assets converting to royalties and beginning to cash flow, we thought the new name better represented our business of royalty creation and value capture through the royalty ownership process.

Our approach to the royalty business, as you know, is somewhat unique, in that we do this predominantly through organic royalty generation. First, we acquire large tracts of highly prospective mineral rights, selected from the best opportunities available from around the world. We add value by performing good, early-stage geologic work, and then selling those assets to major companies and well-funded junior companies to advance the projects at their expense, by testing the geological targets that we've developed.

We are rewarded via pre-production share and/or cash payments, in addition to, very importantly, a production royalty. We have been generating exploration projects successfully now for more than fourteen years and have over 1.5 million acres of mineral property interests worldwide. It is very rewarding to see the fruits of our labor coming in as cash flow and production royalties. We believe strongly in this business model.

Secondly, to augment the royalties that we generate organically through exploration, we also occasionally buy royalties. But I'll be perfectly honest, buying royalties is a tough business. Royalties trade at a premium and that speaks to the value of the product that we are creating through the organic process. We have purchased some nice royalties in our history and we're happy to have those on the books. I believe it's very synergistic with our early stage royalty generation activities.

Thirdly, we also make strategic equity investments when our business and geological intelligence tells us there is a particularly interesting opportunity. We are large shareholders resulting from a strategic investment that we've made in a private company called IG Copper. IG Copper actually controls, in a joint venture with Freeport-McMoRan, one of the largest ongoing copper-gold porphyry discoveries in the world, which is located in southeast Russia. We're delighted to be participants in that exciting project.

Dr. Allen Alper: Sounds excellent! I know you have properties all over. Maybe you could give us a broad brush on some of these properties and some examples of your royalty generation.

Mr. David Cole: EMX is my passion and I'm very proud of the assets that we have in our portfolio. For new acquisitions, we've been concentrating on Sweden and Norway. We see some fantastic geological opportunities regarding copper and gold properties, as well cobalt and lead-zinc-silver projects. We've become large landowners in Sweden and we're seeing strong interest in those assets. We've sold five projects to Boreal Metals, of which we've become a large shareholder, thanks to that business deal. That's a good example of our business model, where we acquire prospective mineral rights, add value, and sell them when they reach the appropriate stage. We're at 19.9% of the issued and outstanding shares of Boreal Metals and that’s in addition to 3% NSR royalties on the back end.

So that gives us exposure to the excitement of the exploration process and advances our interests through share ownership, in addition to pre-production milestone payments and a production royalty.

Another great example is our royalty portfolio in Serbia. We were the first foreign exploration company to enter Serbia after the Balkan Wars. This was during the Company's early formative years. At the time, EMX became the first company granted a metals exploration license in Serbia in over forty years. Subsequently, we sold our mineral property interests as a merchant banking transaction to Reservoir Capital, which later morphed into Reservoir Minerals. Importantly, we kept royalties from the Reservoir deal. Reservoir went on to make a fantastic discovery at the Timok Project's Cukaru Peki deposit. We subsequently bought additional royalties on nearby properties to add to the royalty portfolio.

Ultimately, Reservoir was bought out by Nevsun who is now doing a great job of advancing the Cukaru Peki discovery, over which we have a royalty. It has a significant high-grade copper-gold deposit in the Upper Zone, and a large Lower Zone porphyry copper-gold target. Nevsun came out with a very positive Upper Zone PEA in Q4 2017, and continues to drill-delineate the Lower Zone in a joint venture with Freeport-McMoRan. We are proud to have royalty exposure to the Timok Project, and our enviable position serves as a great example of the execution of two prongs of our business model - growing royalties organically in addition to buying royalties.

Another region of the world where we organically build the portfolio is in the western United States. EMX has conducted project generation in prospective extensional terrains where we're quite familiar with the geology. We've been working on copper systems, and have developed an understanding of the anatomy of those systems. We are applying that knowledge to the region to identify high priority targets, and then acquiring properties on open ground and selling them to major companies. Of note, Rio Tinto, which is the largest mining company in the world, has done five different deals with us within the last three years and we are very proud of that. It's great to have them as a partner.

One interesting aspect of our business model is that not only do we get the money from the major companies, which is a big plus, but we also get the advantage of their expertise. We have learned a lot over the years and years of working with these major companies with respect to exploration technologies and the application of those concepts to advance our mineral property interests.

Dr. Allen Alper: Sounds excellent! It sounds like you have a fantastic team. Could you refresh the memory of our readers/investors about your background?

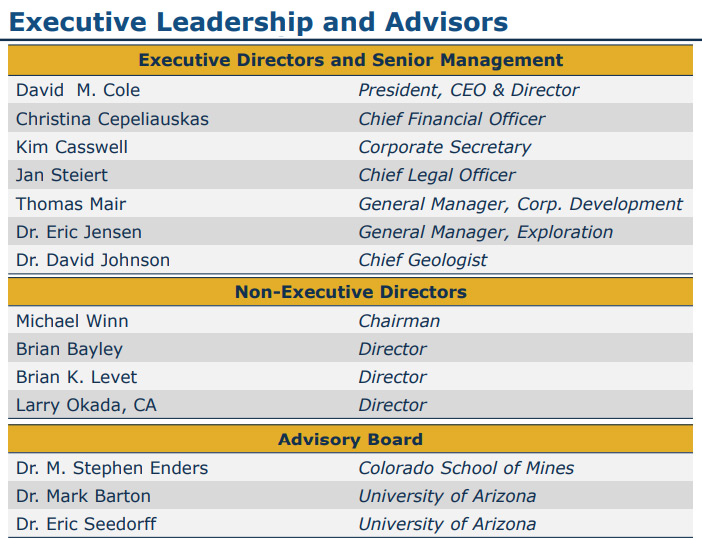

Mr. David Cole: I'd be happy to. I have a bachelor's degree in geology and a master's degree in economic geology. We like to joke that I have a PhD in hard knocks of international business, being a doer and going out and getting the job done. I worked for Newmont Mining Corporation for 18 years and was at the pointy end of the stick of their exploration efforts. I have worked around the world. I worked in the Andes Mountains, the Nevada Deserts, and in Eastern Europe for just a few examples. I wanted to pursue my passion of value creation through the discovery process, so I left Newmont with that experience and knowledge base to become the founder of Eurasian Minerals, now EMX Royalty Corporation.

I have the pleasure of working with some phenomenally well-educated, well-experienced and good-to-work-with folks. At the top of the list would be Dr. David Johnson, who manages the Americas for us and does such a fantastic job. Dave is a PhD out of the University of Arizona and has a passion for geology and discovery. He is particularly well-versed with respect to the geology of the western United States, and has used that knowledge to acquire valuable property positions, add value, and execute deals. Dave's programs and accomplishments have become very important to our Company.

A longtime business partner and former grad-school contemporary to Dr. Johnson is Dr. Eric P. Jensen. Eric manages everything outside of the Americas for EMX. It is Dr. Jensen's leadership that has built the phenomenal portfolio that we have in Sweden and Norway. He manages our assets elsewhere in the world, including Turkey, New Zealand, and Australia, where we have projects that are being advanced as well.

A very important member of the EMX teams is Jan Steiert, our Chief Legal Officer. Jan's the past President of the Rocky Mountain Mineral Law Foundation, and is extremely knowledgeable and experienced, with a phenomenal history of working in the natural resource sector. It is very good for us to have that type of experience on staff, helping us in all the legal aspects of the different deals that we do and answering whatever legal questions we may have. It's fantastic to have an in-house attorney, particularly one with such sage experience as Jan.

Those are just a few examples. Really, we have an amazingly brilliant team.

Dr. Allen Alper: That sounds excellent. Would you like to say anything about the advisory board?

Mr. David Cole: We have some very interesting people on our advisory board, including Dr. Steve Enders. Steve was previously the Chairman of the Board of Eurasian Minerals and also the Chief Operating Officer for a period of time. He has contributed to our progress over the years, and is now the Head of the Department of Geology and Engineering at the Colorado School of Mines in Golden, Colorado. He remains on our advisory board. The excellent reputation of the Colorado School of Mines is well deserved. They are conducting extremely important research projects of value to the mining community.

In addition to Dr. Enders, on the academic side, Dr. Eric Seedorff and Dr. Mark Barton are both professors at the highly respected University of Arizona. Both are economic geologists with leanings toward structural geology. We have a fantastic opportunity to be able to brain storm with these gentlemen and have access to their expertise.

Dr. Allen Alper: That sounds excellent. Could you tell us about the ownership and the corporate structure of EMX Royalty Corporation?

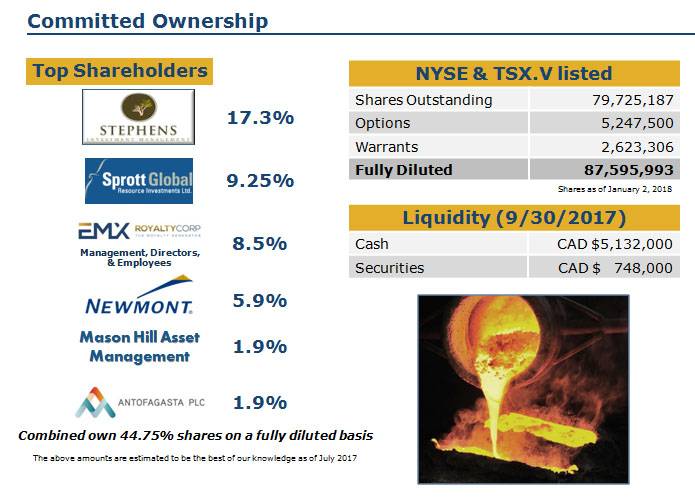

Mr. David Cole: EMX ownership has been slowly changing over the years as we see increased "insider" buying. We've had growth in insider buying for the last three years. That's been led by Paul Stephens, who now is up to over seventeen percent of the Company and is EMX's largest shareholder. Insider ownership, including management, directors, and employees is approaching thirty percent at this point in time. Rick Rule, who has been a strong supporter of EMX from the very beginning, is a large shareholder through different funds. Many of his clients are also stockholders in EMX and have followed us since we went public fourteen years ago, valued at thirty cents per share at that time. Newmont Mining Corporation has participated in three different financings that we've done and they own about six percent of the Company. Antofagasta also owns a few percent of the stock that was tied to a deal we did in the past. We've actually done multiple deals in our history with "Anto" and I'm happy to have them as a shareholder and as a prospective partner for our projects. They maintain a healthy interest in our copper portfolio.

Dr. Allen Alper: Excellent! Could you mention how many shares are outstanding?

Mr. David Cole: We're at seventy-nine million shares, maybe a little more than that. We're traded on the TSX Venture Exchange under the ticker symbol EMX, as per our name, EMX Royalty Corporation, and likewise we trade on the NYSE American under the ticker symbol EMX.

Dr. Allen Alper: Sounds great! Your team is doing an excellent job, delivering highly prospective properties to your partners and building future royalty cash flow. I'm very impressed with what you are doing. What are the primary reasons our high-net-worth readers/investors should consider investing in EMX Royalty Corporation stock?

Mr. David Cole: I'm happy to answer that question. We have a great business model that continues to grow and build a diversified portfolio of mineral rights around the world. We manage that portfolio for the singular benefit of our shareholders. Our stock price has seen wide swings, yet this is not representative of the fundamentals of the Company. Rather, it's representative of the business cycles, to which we are exposed, that have an effect on the stock price. It's true of entire sectors of course. You want to use business cycles to your advantage, you don't want to be used by the business cycles. It's easier to say that than it is to actually execute on that concept. It becomes a three step process - buy low, sell high, and buy low again. It's important to take advantage of the downturns of the market cycles and certainly we saw a pronounced downturn from 2011 into 2016. We have the beginnings of a recovery that has been in place for about 18 months, and we're seeing what looks to be a bull market correction. With strong metal prices, mining companies doing well, and increasing consumption of natural resources around the world, our prospective mineral properties are in strong demand.

All in all, the mineral business is now doing very well. I believe that will continue to push our share price as we head into a more robust market in 2018. I'm putting my money where my mouth is. I've been a buyer of EMX shares for three years.

Dr. Allen Alper: Sounds like strong reasons for our high-net-worth investors to consider purchasing your stock. Is there anything else you'd like to add, David?

Mr. David Cole: Since we have a worldwide business, there's always something exciting going on. I'm particularly bullish on the Scandinavian assets in Boreal Metals. They have gone public and we have shares in Boreal and royalties on those projects. I look forward to seeing the drill results that come out as the projects in Sweden and Norway are advanced.

Dr. Allen Alper: Sounds excellent!

https://emxroyalty.com/

David M. Cole

President and Chief Executive Officer

Phone: (303) 979-6666

Email: Dave@emxroyalty.com

|

|