Sparton Resources Inc. (TSX.V: SRI): Developing World Class Primary Vanadium Deposits in China with a Direct Interest in Flow Battery Manufacturing, Interview with Lee Barker, President and CEO

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, US

on 12/26/2017

Sparton Resources Inc. (TSX.V: SRI) is developing world class primary Vanadium deposits in China. These

are high grade, easily exploited, and a preferred source of vanadium for electrolyte manufacturing in PRC. We

learned from Lee Barker, President and CEO of Sparton Resources, that the energy storage industry in China is

blossoming and, as a result of a huge spike in the price of vanadium in China, they are now developing new

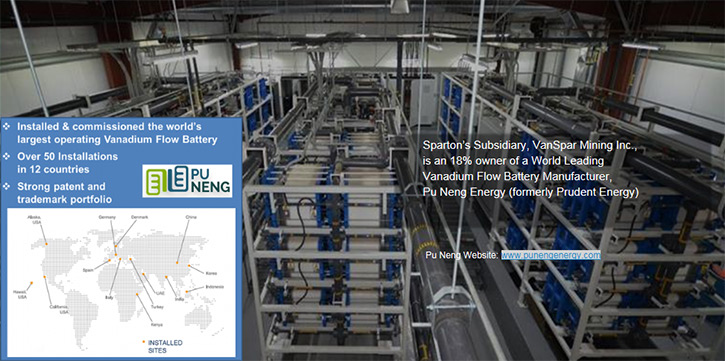

domestic production of vanadium. We also learned from Mr. Barker that Sparton has a subsidiary called VanSpar

Mining that owns 18% of the battery manufacturing company with the factory in China. That factory has been

reactivated and is now producing new batteries and engaging in clients to have new contracts for selling more

batteries in Australia, Taiwan, and China. According to Mr. Barker, Sparton has patents on the processing

technology, and is currently looking for investors to acquire the high-grade vanadium deposits inside China

and develop them, and tap into the under-supplied Chinese vanadium market.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Lee Barker,

President and CEO of Sparton Resources Inc. How is the battery business in China developing?

Mr. Lee Barker: Very well. We've made a lot of progress over there. Certainly there have been a lot

of very positive developments, both in the energy storage side and the vanadium market side. On the vanadium

side, about 4 months ago, the Chinese government banned the import of waste from their steel mills and waste

piles from various types of processing plants, coal plants, etc. About 25% of China's vanadium actually comes

from reprocessing that kind of imported waste, most of which comes from South Africa or Russia. That

represented a huge spike in the price of vanadium locally and internationally, which I think augurs well for

raising funding and for developing new domestic production in the country, because they're not going to be

able to have these outside sources now. Vanadium product prices have fallen to more realistic levels now, but

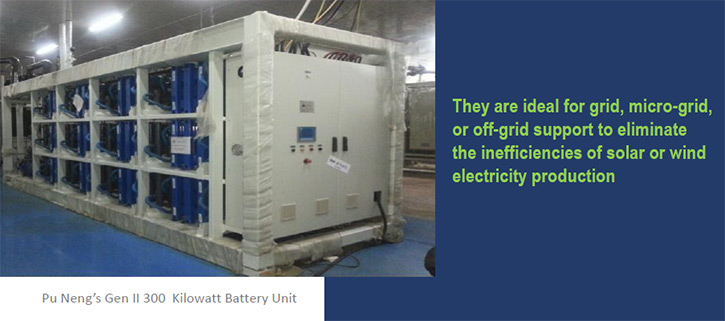

are still in a favorable range for consumers. That was one of the bigger developments. More recently the

central government has mandated large energy storage components for all renewable electricity projects like

wind and solar and provided a policy statement encouraging the use of vanadium flow batteries for this

purpose.

The battery business is going well. The energy storage industry in China is blossoming. There have been a lot

of new proposals and new mandates by the Chinese government for energy storage, including in September, a

guideline for the use of vanadium flow batteries in the 100 megawatt hour capacity range for all new energy

storage programs. Along with this, they are mandating at least 10% minimum of renewable energy projects as

storage, so 10% of the capacity of that project has to be set up as some form of energy storage. That's very

positive for the battery industry, as well. Most recently, Pu Neng, the battery company, has announced a

large 12megawatt hour battery contract which may be expanded to 40 megawatt hours. This represents

significant value for Pu Neng and obviously Sparton through VanSpar.

Dr. Allen Alper: I understand the Chairman of Pu Neng’s holding company is Robert Friedland,

who is a member of the Canadian Mining Hall of Fame.

Mr. Lee Barker: I’ve known Robert for a long time. I was associated with him a few years ago

regarding a company doing gold exploration in China. For the last five years I’ve been working on vanadium

mining opportunities in China. I understood grid scale Vanadium Flow Batteries would be the future of

electrical energy storage.

We were looking for markets for the very high purity vanadium from our projects. Our vanadium was

perfect for making electrolyte for flow batteries. We contacted Prudent Energy, as a potential vanadium

customer. But in 2014 the company was dysfunctional and I successfully negotiated a contract to buy it and

began looking for investors to finance the acquisition. Early in 2016 Robert Friedland showed interest and 8

months later we finalized an agreement with HPX TechCo, part of the privately owned advanced technology

company, I-Pulse Group, chaired by Mr. Friedland. I-Pulse has strong Asia connections and a very strong,

innovative technical team. They decided vanadium Flow batteries for large scale grid level energy storage are

currently the best option available and his organization is supporting our business. 70% of the market for

vanadium flow batteries in the world for the next 5 years is expected to be in China and Pu Neng is well-

positioned to support this demand.

Dr. Allen Alper: That sounds great. Could you give our readers/investors an overview of Sparton

Resources, what you're doing in the vanadium space, and also what you're doing with your battery investment?

Lee Barker: Certainly. Sparton Resources has a subsidiary called VanSpar Mining, which is a

private BVI subsidiary company. VanSpar owns 18% of the battery manufacturing company that has its factory in

China, but is actually owned by a Cayman Islands company. That factory has been reactivated and is now

producing new batteries and encouraging customers to have new contracts for selling more batteries in Asia.

They are negotiating contracts in Australia, Taiwan, and a number inside China, as well. That's all very

positive. It's moving forward. The company is actually looking very good now.

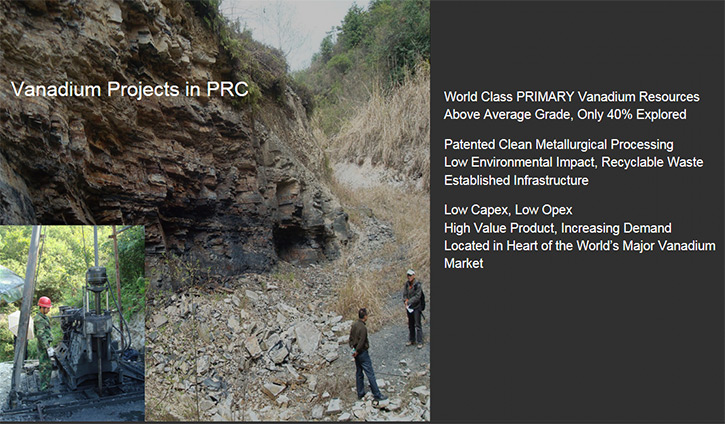

In the vanadium business itself, we have identified several world-class vanadium deposits in south

China. We're in the process now of seeking financing to acquire one or more of those resource bases. They

represent world-class resources of vanadium, very high-grade and easy to process. We have patents on the

processing technology, and we're in the process now of seeking investors that will allow us to acquire those,

and develop them, and try and feed into this market now, which is definitely under-supplied now, inside

China.

Dr. Allen Alper: That sounds excellent.

Lee Barker: It's a very positive development. It's something that, because it's a niche situation

for a commodity, has been tied to the steel industry. We're not concerned about it being tied to the steel

industry, because we can feed both the steel industry and the battery business simultaneously with any

production we can generate from these deposits. It's not restricted to one thing or the other. There are

about three different products we can produce and sell from these deposits.

These deposits have been drilled. They have 43-101 reports. We've done a lot of work ourselves on

them, as have others. They're ready for acquisition. We just have to assemble a financing package for them.

Dr. Allen Alper: What kind of financing are you looking for?

Lee Barker: Initially, probably in the range of about $2 million to $3 million. The acquisition

cost of one of them will probably be very cheap, because it will relate to a leasing situation we expect. The

acquisition of one of the other two or three that we have on our plate may involve a series of cash payments

over time, but we're in the process of starting to negotiate those. Ultimately, the total amount of money

needed to get from acquisition up to the production stage is anywhere from $10 million to $25 million,

depending on which one of the deposits we actually begin with. It's not a lot of money in the context of what

capital costs are for most mining projects. Part of the infrastructure's already available and the deposits

have been well drilled off. They're easy to mine because they're flat-lying and they've been partially

developed in small pits previously, so we have a lot of positive things going for us that don't have to be

redone or started from scratch. It's almost a reactivation situation of some existing mining pits that were

developed previously.

Dr. Allen Alper: They're located in China?

Lee Barker: Yeah, these are in south China. These deposits are in black shale rather than

magnetite iron ore, and so the processing technology is much cheaper and much cleaner. The product that you

produce is a much higher grade of vanadium, so that allows it to be used for the chemical industry as opposed

to just producing ferrovanadium for steel alloying. The price for the high-purity vanadium material is about

40% higher than the standard grade, and the only material we would produce from these deposits would be the

high grade, so we're looking at something that really is worth in the range of two to three times the value

of a copper deposit. If we have a 1% vanadium deposit, which these are close to being, you're looking at a 3%

copper deposit. There are not very many 3% copper deposits in the world.

Dr. Allen Alper: That sounds excellent. Could you say a little bit more about the outlook for

vanadium?

Lee Barker: I think it's very positive. The steel industry is reviving itself. There are no

stockpiles in China only 3 main producers who are also sellers and consumers. There is room for more domestic

production and prices are in a reasonable range now. It's coming back slowly with the rest of the world

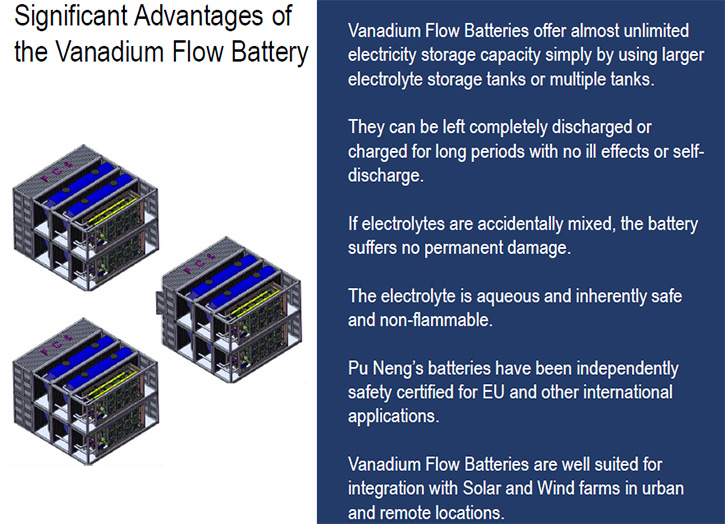

economy. The demand for vanadium and vanadium flow batteries we believe over the next three to five years is

probably going to consume as much as 10-20% of the vanadium market, whereas today it's only about 3%. That

growth is going to be tied to a more widespread acceptance of vanadium flow batteries for energy storage.

Over 70% of the world’s flow battery market is expected to be in China and Asia for the next 5 years. At the

moment, probably the usage of the vanadium flow battery as opposed to other forms of storage is relatively

modest, but the technology has been proven and is starting to be recognized as probably the only

commercializable technology right now that exists. Our company has proven that because we've built very, very

large flow batteries that have been operating for over two and a half, almost three years now. Once this

recognition starts to come forward and we start to get new business and new installations, I think there's

going to be a much, much wider acceptance of this technology.

Lithium batteries only last three to five years. They can be dangerous. They can explode. They’re quick to

build and quick to install, but on a cost-of-storage basis over time, a vanadium flow battery will last 20

years and a lithium battery will last four to five. The actual cost of vanadium batteries is about one-

quarter of the cost of the lithium batteries, and in fact, the vanadium battery is 100% recyclable at the end

of its life, whereas the lithium ones aren’t. It’s a very positive thing that, I think, the energy storage

industry is starting to recognize now. As more and more units are used, and they’re used positively, and

they’re proven to be acceptable, I think we’re going to see a much, much larger demand.

Dr. Allen Alper: That sounds excellent. Could you elaborate a little bit on Robert Friedland’s group?

Lee Barker: Yeah. Robert Friedland’s group is the main investor in this battery business, in

which we own the minority interest. The company is called HPX TechCo. It is part of a group of technology

companies that Robert Friedland and his partners have financed, called the I-Pulse Group. There’s a website

for the I-Pulse Group where you can see all the people behind it and the various subsidiary companies.

This group is involved in a number of mining and non-mining-related technology developments that are

actually very exciting. They have a system for producing metal parts and fusing metal parts together, using

pulses of electromagnetic energy as opposed to using conventional welding methods, where you have to have

fluxes and heat. They have contracts with Airbus and some other companies, auto companies in Europe. The HPX

company has a subsidiary called CleanTech in Australia that’s developed a process for extracting both cobalt,

nickel, and a metal called scandium, which is very highly used for alloying with aluminum. It can make an

aluminum-alloy material that’s nearly as strong as steel but of course about 40% lighter. It is developing a

large nickel-cobalt -scandium deposit. If you go on the I-Pulse website, you’ll see a lot of this

information.

I-Pulse is a wide-ranging technology organization. One of its subsidiaries is the majority owner of

the Prudent Energy, now named Pu Neng Energy, the battery builder in China in which we have the minority

interest. It’s a rather exciting company. It’s worth looking on their website to see the various things they

do in terms of technology development and evolution.

Dr. Allen Alper: That sounds excellent. Could you update our readers/investors on your background,

your team, and your board?

Lee Barker: Our company has evolved. My background is mineral exploration and project development

for the last I guess 55 years now. I’ve been involved in exploration and development projects all over the

world for a number of commodities, base metals, precious metals, diamonds. I was involved in one of the large

diamond discoveries here in Canada.

Working in China for the last 12 or 14 years, we’ve developed a number of projects for what we call

specialty metals. We started off with a gold project. We actually owned and operated the sixth-largest

germanium mine in the world at one time, which we sold. We became involved in the vanadium business through

our connections with one of the large Chinese state-owned organizations. For the last seven or eight years,

we’ve been focusing on developing these vanadium resources. As you know, the early timing was probably not

very good with the 2008 meltdown, and things have never really fully recovered from that yet, but getting the

battery company contract sewn up and getting the Friedland group of people involved in the acquisition was

very positive for us. We see that as a very strong support group that will help things move forward very

positively.

Dr. Allen Alper: That sounds excellent. Could you tell me a bit more about your board?

Lee Barker: Right now we have three people on our board. One of our board members retired from

all his boards last month. But we have a gentleman named Rick Williams, who’s a former securities lawyer,

also an entrepreneur in the mining industry for over 30 years. He runs a company called Waseco Resources, who

has a very nice gold project in Nevada near Newmont’s producing Phoenix deposit. He’s been involved in

international projects in Indonesia and various other countries including Mexico.

We have Wes Roberts, who’s a mining engineer, formerly with the Heenan Blaikie Mining Group here in

Toronto, and subsequently with a law firm that also set up its own mining group independently. Wes is working

with a merchant bank now called Gravitas. Wes is a very practical guy. He has hands-on mining experience.

He’s actually worked in mines plus he has an MBA that allows him to look at the financial and commercial side

of things as opposed to just the technical side.

We’re probably bringing another board member in soon, who will possibly have some relationship with

the energy storage business, but certainly with the commercial financing industry. I’m a board member as

well.

Our CFO is a Chinese-Canadian, with experience both in China and North America,

as the CFO and director of a number of listed companies both backed by Chinese investors and by Western

investors. We have a good backbone. We have a director on our advisory board who's in China and has worked

with us for 14 years. He's also a fluently bilingual Chinese lawyer, involved in Canada for eight years. He

worked with Smith Lyons, the Chinese government, and the Ned Goodman group of companies back in the 1980s. We

have a pretty well-rounded group of people, with expertise in most fields that can keep us in line rather

than just an exploration guy like myself, who loves to find things.

Dr. Allen Alper: That sounds like a very well-balanced and experienced board. That sounds great. Could

you tell our readers/investors a bit about your capital structure?

Lee Barker: Yes. The company has about 120 million shares issued right now. Including 5.3 million

10 cent warrants. There also are some options of about 2.75 million shares at 10 cents. The company has been

trading in the four to eight cent range for the last two or three months. A major shareholder has recently

disposed of his position, and created a lot of liquidity, but it's depressed the share price a bit. We're

quite confident, now that stock is gone, that we'll be able to move that share price up into a more favorable

range.

The Company is clean. We did a shares-for-debt transaction in the last couple of months that has

cleaned up the balance sheet. The outstanding moneys that we owe on a short-term loan basis are with

investors that actually invested in the vanadium project for us in the VanSpar private company, so we have no

pressure from anybody to deal with that. We're hoping to be able to show significant value once this battery

company business starts to flourish. There’s a reasonable expectation that the company will be listed on a

stock exchange and we'll be able to have liquidity for our share ownership, cash in and then pay dividends to

everybody, or dividend the shares out, depending on what makes the best sense for all the shareholders.

Dr. Allen Alper: That sounds good. How would our high-net-worth readers/investors, invest in your

company, if they wanted to?

Lee Barker: Right now, they can buy stock on the public market. We're listed on the TSX Venture

exchange. The stock's trading between nine and eleven cents. It's quite liquid. There are buyers and sellers

available every day. If they are U.S. investors, they can do their trades through a broker that has a

corresponding trading partner in Canada, or if they're investors in Canada, obviously they can trade through

their own personal accounts.

Dr. Allen Alper: What are the primary reasons our high-net-worth readers/investors should consider

investing in your company?

Lee Barker: I think the share price right now is very depressed because of this past overhang of

the shares that this gentleman has disposed of in the marketplace. We see the growth and the value of the

battery business in the multiples of the share price at the moment. The thing is, you can be a trader or an

investor. I think we're looking two to three years out for this now, but at the current share price of four

to five cents, there isn’t a lot of risk in the context of where the company is likely to go. We have a

strong ability to generate new projects with the right financing, and at the share price we're at now, we

feel the company is clearly undervalued.

Dr. Allen Alper: That makes sense.

Lee Barker: The energy storage industry right now is just starting to take off. At the conference

in San Diego for the Energy Storage National Association. There were probably over 150 players, and wind and

solar people there, and battery builders, and various related businesses, so there is a growing market now.

It's politically correct. It's government-sponsored. Governments have dictated these things. The state of

Massachusetts is putting in storage. New York State is putting in storage with their wind systems along the

lakes and various places, California is a leader in renewables and storage, so its time has come. Now is

hopefully the time that we're going to be able to reap the rewards from this. We may have been a little bit

early in getting involved in it, but now hopefully it'll come to fruition.

Dr. Allen Alper: That sounds very promising.

Lee Barker: Yes, thank you!

81A Front Street E, Suite 216

Toronto, Ontario, M5E 1Z7

Telephone/Fax: 647-344-7734

E-mail: info@spartonres.ca

Web: www.spartonres.ca

|

|