Continental Gold (TSX: CNL; OTCQX: CGOOF): Developing Large High-Grade Precious Metals Properties in Colombia , Supported by Newmont Mining, Interview with Paul Begin, CFO

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, U7

on 5/20/2018

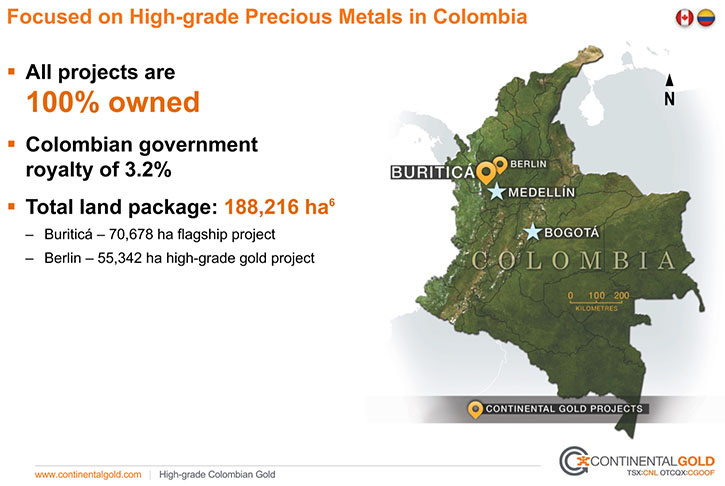

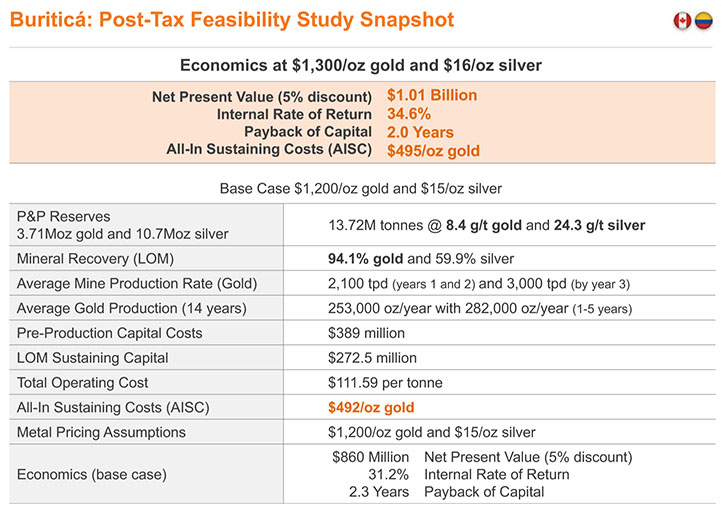

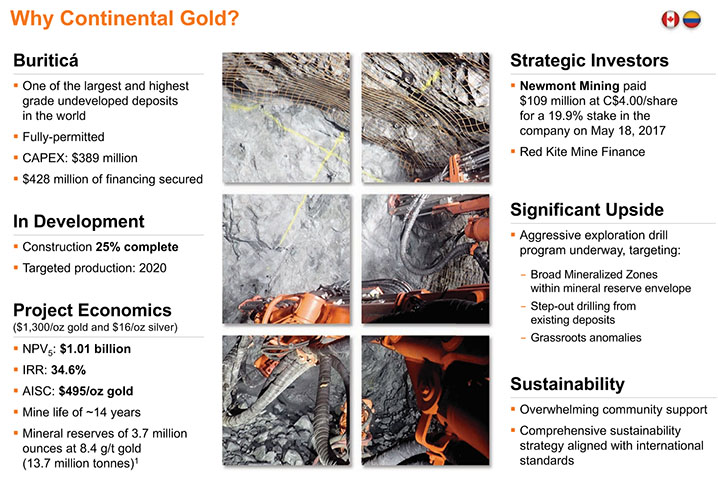

Continental Gold (TSX: CNL; OTCQX: CGOOF) is an advanced-stage exploration and development company with an extensive portfolio of 100%-owned gold projects in Colombia. The Company’s flagship, Buriticá project, is a high-grade and multi-million-ounce precious metal project, boasting mineral reserves of 3.7 million ounces at 8.4 g/t gold (13.7 million tons), with production scheduled for 2020. We learned from Paul Begin, CFO of Continental Gold, that the Buriticá project is a high-grade vein system and the feasibility study shows robust economics and rapid return on investment. According to Mr. Begin, there's significant upside to growing the resource at Buriticá, and he believes that it is the best undeveloped gold asset in the world today. In May 2017, Newmont Mining invested US$109 million at a 46% premium to market to purchase a 19.9% interest. The company is advancing on schedule with construction of its Buriticá mine and is commencing an aggressive 137,000-metre drill program on the property.

Buriticá Project Underground Development

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Paul Begin, CFO of Continental Gold. Could you give our readers/investors an overview of Continental Gold, your focus and current activities?

Paul Begin: Certainly. Continental Gold is a company that focuses on high-grade deposits in Colombia, South America. We have a number of projects, but our flagship project is called the Buriticá Project. It's a development stage asset with a large resource. We are roughly halfway through the construction period of building a 3,000 ton per day mine, with targeted production in 2020.

Dr. Allen Alper: Sounds great. Could you tell our readers/investors a bit about the economics of the project and feasibilities? It's a very robust feasibility study, very rapid return on investment. Could you update our readers/investors on that?

Paul Begin: Sure. The Buriticá mineral resource estimate is just under 10 million gold equivalent ounces. JDS Energy & Mining Inc. of Canada did an independent NI 43-101 feasibility study back in 2016 and it produced some robust economics. The biggest plus for the project is the grade, which is just under 10 grams per ton. This is a high grade vein system. The feasibility study produced an after-tax IRR of 31.2% with a capital payback 2.3 years using 1200 gold and $15 silver, and at an NPV perspective, using a 5% discount, it was USD $860 million.

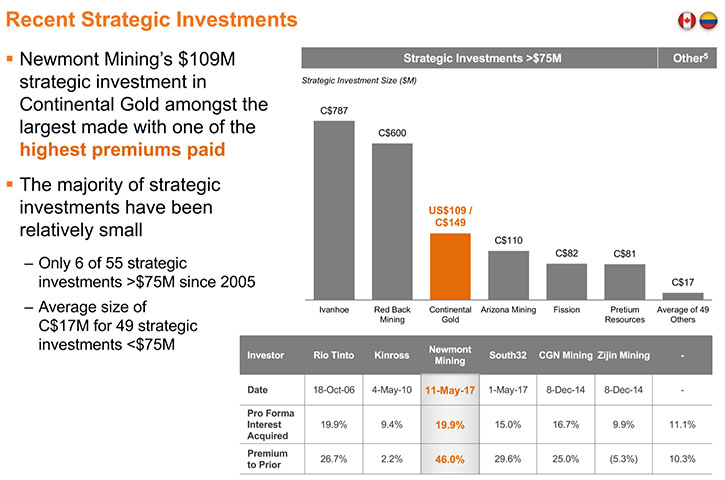

Dr. Allen Alper: Amazing project you have there! I can understand why Newmont Mining has become a strategic investor. Maybe you could tell our readers/investors a bit about the Newmont investment, how much they invested, a little more about it, what percent they got.

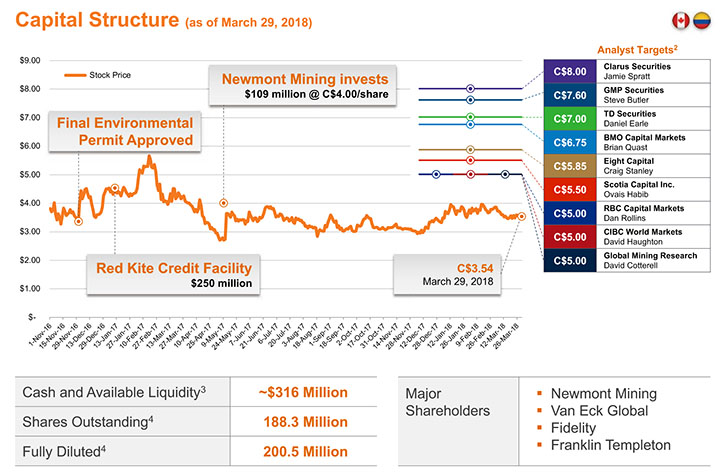

Paul Begin: We received our final environmental permit late in 2016 near the end of the year. We needed to raise equity and debt. The debt piece materialized in early January 2017, with the Company successfully closing a $250 million senior credit facility with Red Kite Mine Finance. To our knowledge, we got the lowest cost of capital for private debt in the mining industry. To this day, I believe this still holds true and that is a testament to the project.

On the equity side, we ran a fairly robust process, trying to find the right strategic investor and Newmont took the lead in that respect. In May of 2017, we closed the private placement with Newmont. They invested USD $109 million for 19.9% of the company. We're really excited about this, for a number of reasons, we believe that Newmont's investment is a validation of the project, Colombia and our management team.

As part of the Newmont Investment, we also agreed to form three non-binding management committees. These are: a social and environmental committee, a technical committee, from a mine building point of view and the last one is an exploration committee. These committees study various issues, make recommendations to the board of directors and are non-binding. We liked that idea because it was an opportunity for us to capitalize on Newmont's vast experience.

Dr. Allen Alper: That sounds excellent. Very good. Could you tell us a bit more about Continental's management team and board?

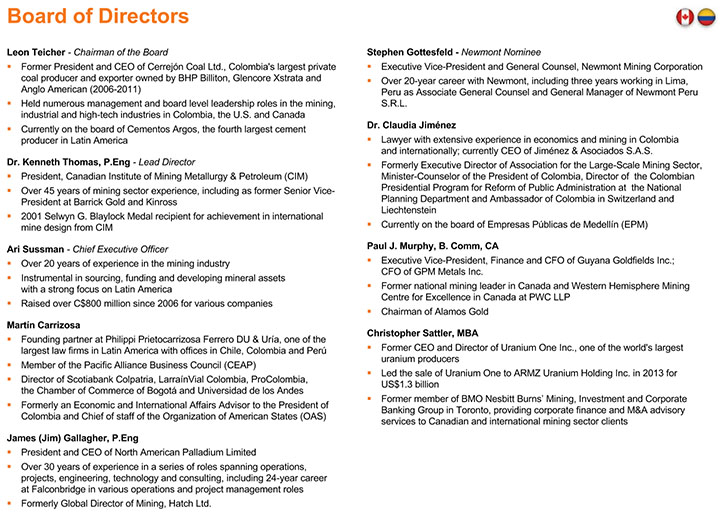

Paul Begin: Sure. Let's start with the board of directors. Our chairman is Leon Teicher. He's a Colombian and Canadian, with dual citizenship. He was the former President and CEO of Cerrejón Coal, which is Colombia's largest private coal producer and exporter. He's been retired for some time, but he's been involved with the Company now for five years.

On the technical side of things, we have Ken Thomas, who's our lead director. Formerly he was Senior Vice President of Projects at Kinross. He was also one of the founders of Barrick Gold. Ken's been an invaluable help on the technical side of things along with Jim Gallagher, the President and CEO of North American Palladium. Both of these individuals are adding invaluable expertise to the building process.

On the Colombian side, which is also very critical, we have Martin Carrizosa, the founding partner at Philippi Prietocarrizosa Ferrero, which is one of the largest law firms. We also have Dr. Claudia Jiménez, a Colombian based lawyer, with extensive experience in economics and mining. We also have Paul Murphy, the former PricewaterhouseCoopers mining lead as our audit committee chairman.

We round out the board with Chris Sattler, the former CEO and Director of Uranium One and Stephen Gottesfeld, who is the Newmont’s nominee. On the management side, we have Ari Sussman, whom I believe you've met before. In Colombia we have three key individuals, Luis Germán Meneses, who just recently joined us as Country Manager. He was the former COO of Cerrejón Coal. We also have Mateo Restrepo as President of the Company. He was formerly Vice President of Corporate Affairs at Prodeco, which is a Glencore subsidiary. Finally, we have Don Gray, who's our Chief Operating Officer, who came to us from Tahoe Resources where he built Tahoe's Escobal mine in Guatemala.

Dr. Allen Alper: Amazingly strong board and team! Really excellent! Could you say a few words about your background, Paul?

Paul Begin: I've been with the company for seven years now. I joined the company at an early stage before we published our maiden resource. I met Ari through a mutual friend. I joined the company and helped guide its growth, through multiple resources and multiple economic studies through to development. Prior to Continental, I was in the fertilizer and green energy industry.

Dr. Allen Alper: That's very good. My understanding is there's a significant upside to growing your resource, is that correct?

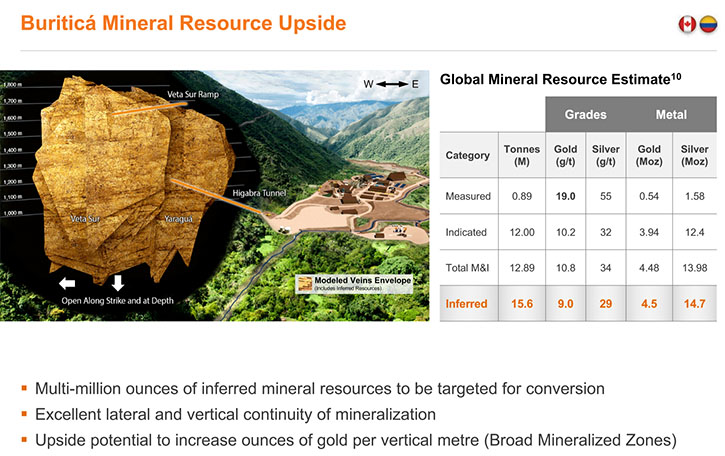

Paul Begin: That is correct. We just released a press release yesterday morning, where we released seven drill holes. That gives you a flash of that potential. Our combined Yaraguá and Veta Sur mineral reserves at Buriticá have just under 3.7 million ounces of gold (13.7 million tonnes), at 8.4 grams per ton. Both Yaraguá and Veta Sur are CBM veins systems, which stands for carbon base metal vein system, which is a bad name because there are no base metals in it of any significance.

However, one of the key characteristics of these systems is that they go extremely deep. Ore bodies that you may be familiar with around the world, that are CBM veins systems are the Porgera mine in Papua New Guinea and Penasquito, in Mexico which is bulk mined as an open pit. We have drilled approximately 1.4 kilometers deep on both ore bodies and they're wide open at depth (including all direction).

The drill results that we just released intercepted mineralization and extended the Veta Sur system by 300 meters at depth. It intercepted some significant grade, 300 meters below the lowest portion of the mineral resource at Veta Sur. We also have a number of satellite targets in and around the greater Buriticá area that are very exciting as well. We'll be drilling those later on in the second half of this year. We're hopeful that we'll hit mineralization there as well, which would be an added bonus.

Dr. Allen Alper: Excellent! Could you tell our readers/investors a little bit what your company is doing with sustainability?

Paul Begin: Sure. We take our sustainability practices extremely serious. We've had some challenges in the past, not on sustainability, but on illegal mining. That caused us all a lot of stress, including the local communities. However, the government intervened a couple of years ago and virtually eradicated that challenge. In conjunction with that, we put a lot of effort into our sustainability efforts.

We have published two annual sustainability reports that are available on our website. We're proud of that, particularly for a company of our size and our development stage. As a result of our efforts and working with the local communities, we enjoy very good relationships with the local communities in and around the area of influence.

Dr. Allen Alper: That's excellent. Could you tell our readers/investors a bit about your capital structure?

Paul Begin: We have roughly 188 million shares outstanding currently. The major shareholder is Newmont Mining with 19.9%. Other significant shareholders are Van Eck Global, Fidelity and Franklin Templeton.

Dr. Allen Alper: You're listed in both Canada and the US, is that correct?

Paul Begin: We're listed on the TSX and on the OTCQX in the US.

Dr. Allen Alper: That's very good. What are the primary reasons our high-net-worth readers/investors should consider investing in Continental Gold?

Paul Begin: It's very simple. Buriticá is a rare combination of size, grade, growth potential and straightforward metallurgy. It simply ticks all the boxes for an economically significant deposit. It is, in our view, the best undeveloped gold asset in the world today. That's very compelling when you consider the macro environment of declining reserves, with very few major discoveries being made in the last decade.

We're in development. We've raised roughly $400 million between debt and equity. The capex in the feasibility study was roughly USD $389 million. That excluded a number of things like exploration, drilling and working capital We are not fully funded, but we're not in any rush to raise capital anytime soon. There's significant upside to the project. We think we'll be able to grow our reserves and resources significantly over time.

We're also aggressively drilling the deposit with 14 drills currently on site. You're going to see continuous exploration news flow from us, for the foreseeable future.

Dr. Allen Alper: Excellent! Outstanding performance, outstanding deposit, and wonderful grade! It's great to have the financial support, the gold in the ground, the grade and the extensive project that you have. Really amazing! Is there anything else you'd like to add, Paul?

Paul Begin: I think we've covered it all.

Dr. Allen Alper: Thanks, that's great.

http://www.continentalgold.com/en/

Investor Relations

info@continentalgold.com

T +1-416-583-5611 | T +1-877-273-8228

|

|