Eastmain Resources Ltd. President and CEO Don Robinson Ph. D & P. Geologist

For Eastmain Resources Ltd., the Toronto-based junior with a proven track record of excellence, a summer of diligent hard work has inevitably given way to basking in autumn’s golden hue, a color that can be said to directly reflect the bright future of this ever-promising exploration company.

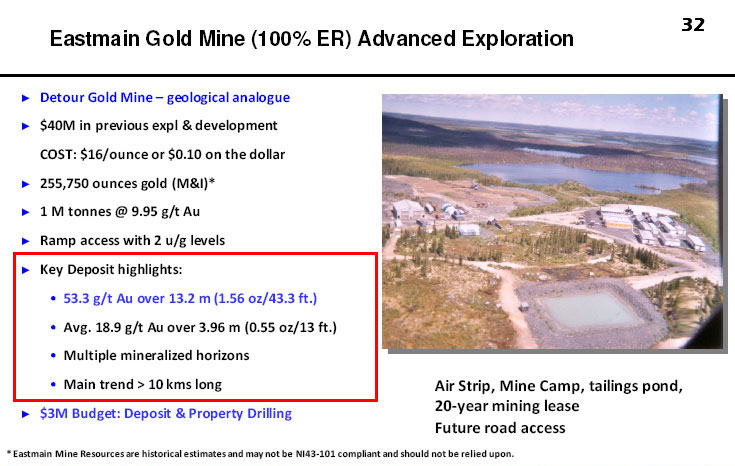

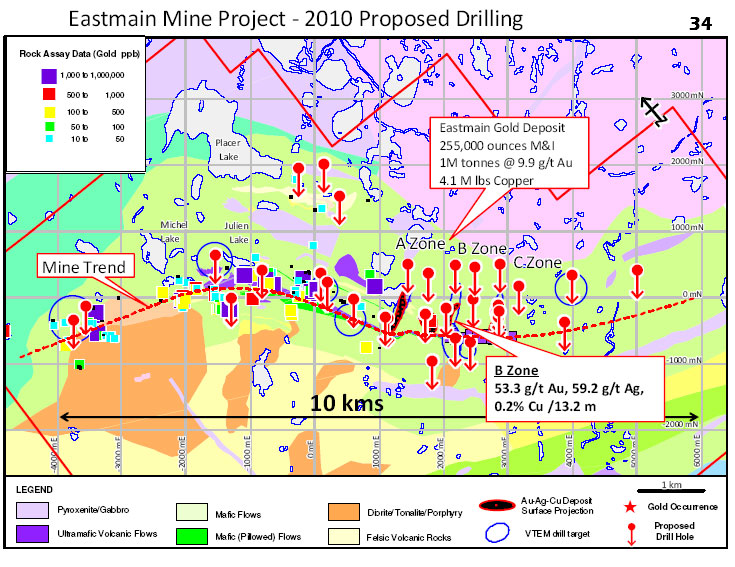

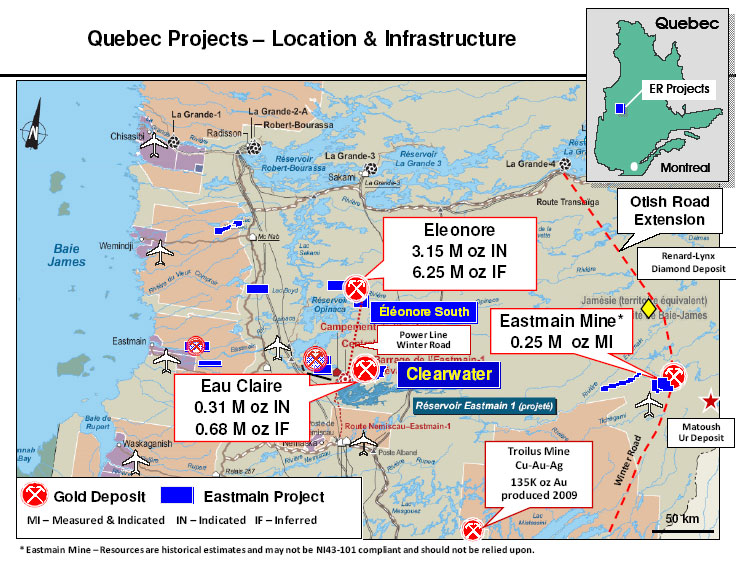

Case in point: Over the past six months, the outfit completed a 14,000-meter drill campaign on its, 100-percent owned Eastmain gold deposit. Covering a couple hundred square kilometers at the eastern end of the Eastmain River Greenstone Belt in James Bay, Quebec, the project, which was bought originally from a bankruptcy, just recently proved up some very encouraging partial results at the mine on the property.

According to the company’s website a drill hole “intersected a 9.5 meter-wide zone of gold-silver-copper mineralization grading 12.2g/t gold within the B Zone Mine horizon rocks. This intersection, which occurs from 217.5 to 227.0 metres down the hole, includes 17.4 g/t gold over 5.0 metres and 24.1 g/t gold plus30.1g/t silver over 2.5 metres.”

Eastmain has since determined there are more zones of gold outside the known limits of the three main zones of the deposit on this burgeoning project, which hasn’t experienced any exploration in almost 15 years.

To help fortify its mission to explore and unearth profitable, cost-effective ore deposits, Eastmain propped up its treasury to $20 million at a 75% premium to the stock with no outstanding warrants. This private placement financing will ensure that the company is in a well-funded prime position to fully advance exploration on its two other solid projects — Eleonore South, a joint venture with Goldcorp, and flagship gold project Clearwater.

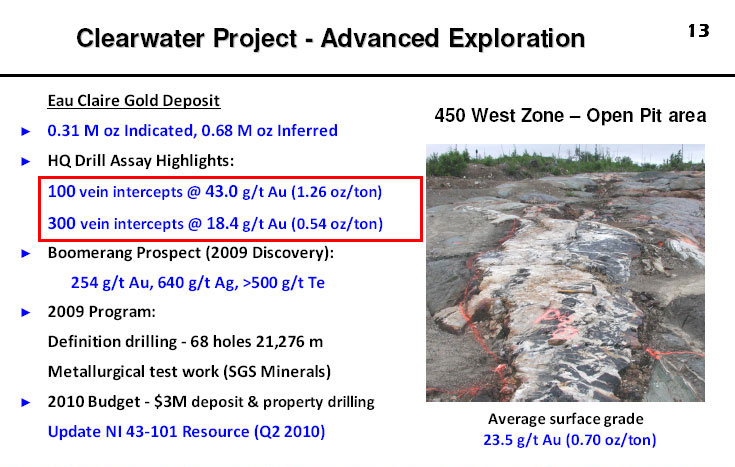

As of 2005, Eastmain had outlined almost a million ounces at its Eau Claire deposit, where it holds a 100-percent interest in the project. The company’s premium James Bay Lowlands property resource is currently comprised of approximately 313,000 ounces of gold indicated and 680,000 ounces inferred.

SRK Consulting is currently auditing a resource update on the project and is in the process of optimizing the pit and the ore that has yet to be included in the known resource calculation. Earlier this year, Eastmain discovered some new gold-bearing zones to the north and east of the deposit and has announced that drilling is in progress.

The recent activity surrounding the Clearwater project has shown grades anywhere from 18.1 to 118 grams per ton experienced to almost 1000 metres.

Before coming on board with Eastmain in 1994, the geologist and Ph.D. from University of Western Ontario successfully owned and operated Robinson Exploration Services Limited, his own private consultation firm. While in charge of an integrated base and precious metal program for Westmin Resources, Robinson, a man truly in love with his work, acquired the Clearwater project (including the Eau Claire Gold Deposit).

Nearly two years and more than 1000 near-surface occurrences of high-grade gold deposits later, Robinson and crew are elated to divulge the discoveries they’re confident will take them to the next step in the evolution of this exciting company.

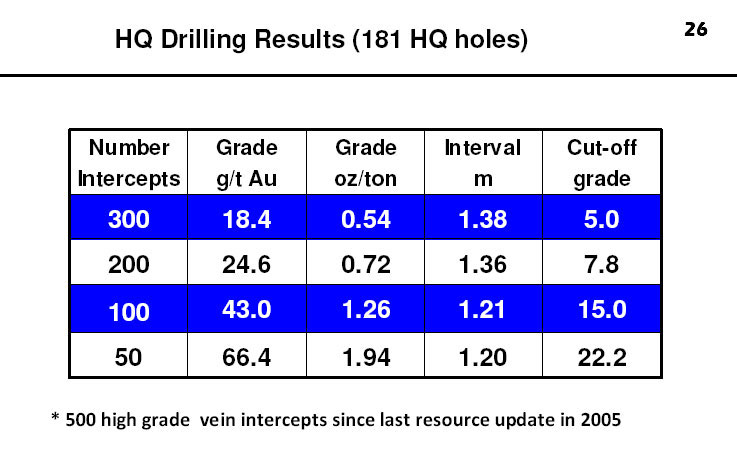

“Essentially we have completed180 holes drilled into the top part of the deposit that have encountered more than 500 gold bearing vein intercepts, some of which have been very good in terms of the grade,” according to Robinson during a recent dialogue we shared with him. “For example, the average of a 100 of those intercepts is an ounce and a quarter, about 43 grams. So the deposit has an average grade of ten grams, when you have another 100 intercepts at 43, that’s going to improve the grade overall.”

He continued, “What’s also notable about Eau Claire is that from time to time you turn up what I like to refer to as bonanza grades, where instead of grams we’re measuring it in kilograms. So, with a typical deposit ten grams is mineable for these high-grade deposits, multiply that by hundreds. That’s going to sweeten the deposit grade overall.”

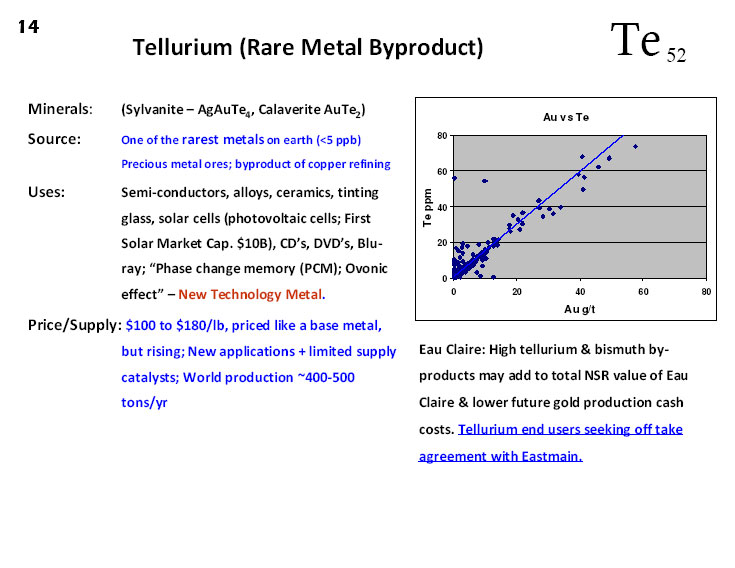

Another detail of the project Robinson revealed, which promises to make things even sweeter for Eastmain, is the news of tellurium being discovered in the deposit.

“The end-users of the metal contacted us and said, ‘Well, how much tellurium is in the deposit, and is it throughout the deposit,’ to which I replied, there’s more tellurium than gold in the deposit and yes it is throughout the deposit. So this is an added value to the project since now there’s a byproduct that is being sought after.”

Because the supply of tellurium is so limited, and because of its increasing use in everything from digital media to solar energy and new technologies, the price of the metal is expected to increase. This is even more good news for the company. Their bonus discovery will not only add value to the Clearwater project, but will also help in lowering the costs associated with extracting the metals from the Canadian Shield.

Eastmain’s $1.6 million joint venture with Goldcorp on the Eleonore South project is a shining example of effective cost sharing between two mutual partners currently drilling on proven ground.

“The Goldcorp property is approaching 10 million ounces so it’s obviously a good place to explore, where we’re essentially drilling for grade on that gold zone,” Robinson commented. “We have identified a gold anomaly more than a kilometer long that is geologically similar to the mine and it’s a case of just keep turning the drill bit until you get ore grade.”

Robinson maintained, however, that as far as management is concerned, Eastmain’s responsibility, first and foremost, is to its stockholders. So in consideration of the company’s $21.3 million in debt-free, working capital, and 100% ownership of both the Clearwater project and its Eastmain Mine, he and his hard-working team most assuredly are in possession of the numbers to back up the rhetoric.

The only challenge and the biggest hurdle in all this, according to Robinson, is not the financing or the project, but finding the technical people capable of overseeing an exploration project at the advanced stage. “They are few and far between,” he shrugged. “We’ve actually brought over two PhD geologists from France and hired them full-time to address that issue. If there were more advanced people, we’d be more than happy to talk to them!”

Research Recommendations

In the Gold Report Interview with Roger Wiegand (05/26/10) "We know [Eastmain's] management; we know the geologists; we know what they're doing. One thing I'd emphasize about Eastmain is that they're in Quebec, and that's probably one of the best mining-friendly locations anywhere in the world. They give them tax breaks. They have trained employees; they've got geologists. They have the infrastructure. “

The Gold Report Interview with Éric Lemieux (05/17/10 “My target for Eastmain is $2.25 based in great part on the Eau Claire deposit but also on the Eleonore South and Eastmain mine projects.”

ER-T: $ 1.65 Jan 22, 2010

Target: $2.00 Michael Gray, MSc – 604.694.6961

Recommendation: BUY michael.gray@genuitycm.com

Risk Rating: Speculative

Eastmain has strategically located, high-grade gold resources in Quebec, Canada

For more information visit http://www.eastmain.com

CORPORATE ADDRESS

50 Richmond Street East

Suite 101

Toronto, Ontario

M5C 1N7

EXPLORATION OFFICE

834572 4th Line, EHS

Mono Twp,

RR#1

Orangeville, Ontario L9W2Y8

Canada

Tel: 519-940-4870

Fax: 519-940-4871

Email:info@eastmain.com