Grenville President and CEO Paul Gill

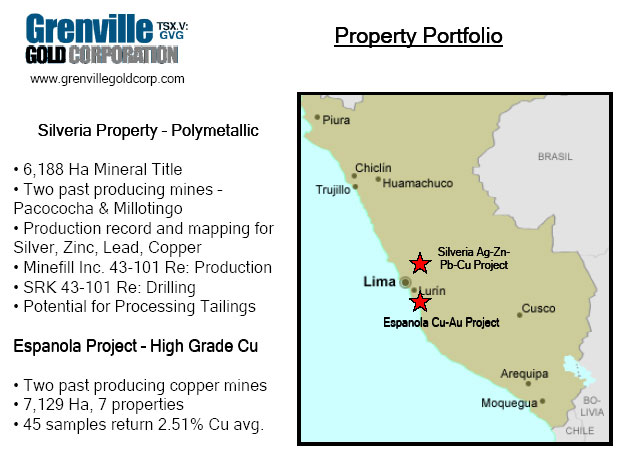

Grenville Gold Corporation is a budding mining junior operating out of Vancouver, British Columbia. Grenville has been focusing its ace resources on two historically proven projects located in the historically mineral-rich San Mateo Mining District near Lima, Peru. In gearing up operations over the past few years, Grenville appears to be on the fast-track toward engaging investors on the global market as an essential player in base and precious metal production. Metalsnews.com recently took an opportunity to interview Grenville President and CEO Paul Gill who was very informative regarding Silveria and Española, his company’s two major projects in at the moment.

Gill first entered the mining industry back in 2003 when he took over International Norsemont Ventures (Now called Norsemont Mining) and immediately sought and found a serious management team. After bringing folks like Marc Levy and Art Freeze onboard, the new team was integral in sending the stock of NOM soaring from $0.06 to $4.00 during his participation with the company. Although currently trading around $1.70, NOM is proving up a resource of almost three billion pounds of copper and counting.

Flash to 2006 at which point Gill, reeling from that success story, left Norsemont to join with Grenville in his quest for high-grade properties in polymetallic domains. Not one to pass up a potentially lucrative opportunity, Grenville began staking two sets of properties with attractive acquisition costs in a rural mineral district to the east and south of Lima. He recognized a distinct opportunity to expand the company’s assets, considering both the landscape and who his new neighbors would be.

“Candente Resource Corp., run by Joey Freeze, sustains a shrewd management style and is keenly aware of good properties. It's reassuring to know you're in the right neighborhood; that was one of the tip-offs for us to stake our Espanola Property. What we've done up to this point is we've taken old mines or portals that had been in high-grade production, staked over top of them and added additional prospective land that looks promising.”

That’s exactly what Grenville did with its Española property, now at 7,000 hectares, whose average sample over 45 specific sites is approximately 2.51 copper and a trace of gold, according to Gill. With its second property, Grenville staked 1700 hectares at $30,000 USD from what were originally four former performing mines: Pacococha, Millotingo, Germania and Silveria. But would the past performance of the mines indicate guaranteed returns considering how old these claims were?

“Our concern was, of course, being old mining districts, were they mined out? As management, you always run through the gamut of questions: Are there environmental hazards? What about other people in the area? After the initial staking we felt we had the heart of the play, and we took it from there. Now the property's about 6,000 hectares. Along the way we’ve spent about $3.5 million acquiring and developing the property, and we're very happy with what we have, and still have more to do.”

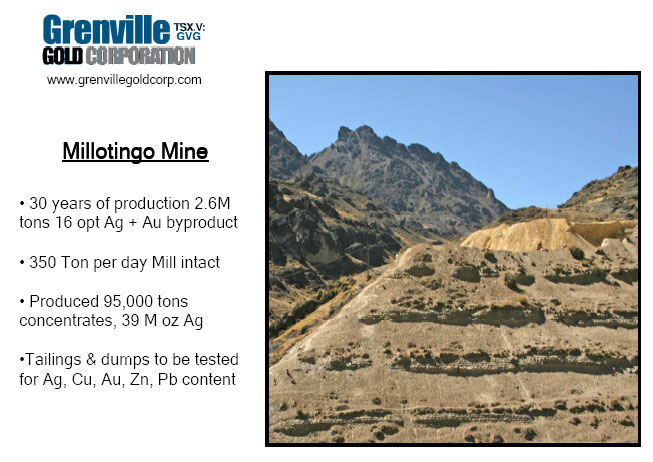

Gill continues to add that the fantastic part of both Grenville’s properties, “and specifically Silveria,” is that they’re both staked over top of former mines. One in particular, the Millotingo Mine, operated at 24 ounces a ton silver for ten years.

“Very solid production numbers,” reinforces Gill. “A trace of gold as well. It produced 39 million ounces of silver and 90,000 ounces of gold. That’s a very rich mine, and in fact, was reputed to be the richest silver mine in Peru.”

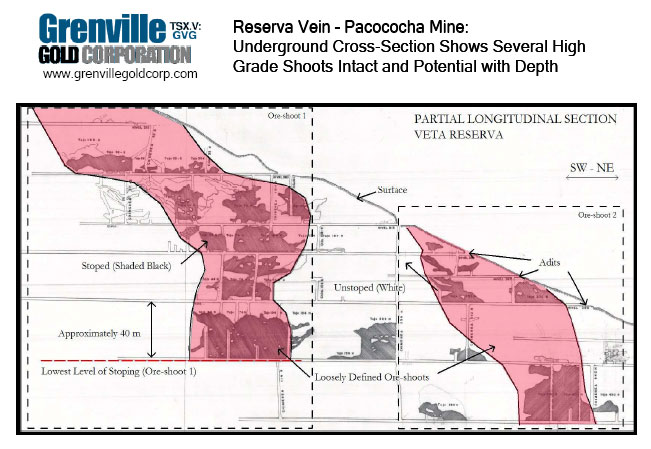

With an estimated 92 kilometers of underground workings in the whole area, Pacococha, the larger mine of the two, also had high-grade shoots. In order to extract the premium stuff, the original miners went all out, operating a number of stopes simultaneously on varying levels to where there’s currently 42 kilometers worth of workings. With their work cut out for them, Grenville took to sifting the area.

“They dug it all out for us, did all the work,” notes Gill. “They took out the high grade, sure, but left all the breccias untouched. There were a number of different disseminated deposits unexploited and overlooked because they were mining 20 or 30-ounce silver, and when you get to that, that's very exciting.”

Just in examining the leftover material outside Pacococha, a mine with 30 years of production, Gill and his team came up with some fantastic samples. Now, with two 43-101 geological reports completed on the property, Grenville is ready to sample the underground and produce a resource. To see a 3-D model of that production as well as mapping above the stokes, check the front page of their website at http://www.grenvillegoldcorp.com /.

“In a varying market like this, you want to be able to produce out of a specific area at a specific time and be able to know which metal you have in that particular rock so you know which one to process should copper spike or silver spike, etc,” cautions Gill.

“I'm not at all opposed to following good examples. I think that's what you have to do. Up the road from us Pan American Silver is in production now under the Maracucho mine area which they bought for $25 million USD 2004. Their shareholders would scream if they sold it for under $ 500 million because it's a very high-grade producer. Right beside that mine is the 20-billion-pound Toromocho deposit Peru Copper sold to Chinalco, a Chinese aluminum firm that fetched $840 million U.S. in 2007.”

Also in the neighborhood of Grenville’s two properties and staking substantial claims are Barrick, Glencore, Volcan and GoldHawk Resources, which, up until recently ran a permitted mine pulling a quarter of the revenue from zinc, a quarter from lead, a quarter from silver and a quarter from gold, Gill tallies. “That kind of polymetallic line is very indicative of the area, so, we've got a number of revenue streams that mitigate risk.”

The acquisition, Silveria, has already stirred interest within Peru and around the mining world. The company’s anticipated listing on the Peru stock exchange is an important move toward encouraging local participation, as Gill concludes the obvious advantages of such fortuitous proven properties.

“We have some significant ROI potential; point by point this is an opportunity head and shoulders above the rest: high grade mineralization, past production, 52-week low in the stock price, near the majors, and interest on the buyout side and the potential for high-grade production and a revenue stream.”

For more information: http://www.grenvillegoldcorp.com