Craig Williams, President and CEO and Co-Founder of Equinox Minerals Limited at PDAC 2009

The country of Zambia in Africa has been well known for copper production for 80 years, achieving peak commercial output of 720,000 tons per year in the early 1970's. Through nationalization and the later divestiture of national mining companies, interest has remained strong. More recently, favorable tax status given to investors has contributed to the resurgence.

Equinox Minerals Limited (EQN on TSX and ASX) is an international mine development and exploration company that is in the forefront of this growth, having brought its Lumwana mine in Zambia into production during 2008.

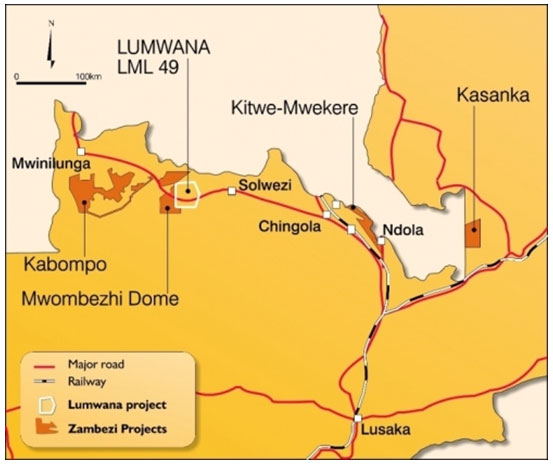

Lumwana, owned 100% by Equinox, is situated 220 km northwest of the world-renowned Zambian copper belt. With proven and probable reserves totaling 321 million tons of ore grading at 0.73% copper, Lumwana represented one of the largest fully permitted copper projects in the world when under construction and the largest new mining project seen in Zambia in 40 years.

The Lumwana mine is expected to process 20 million tons per year of ore to produce copper concentrates containing an average of 172,000 tpa of copper metal (or 380 million lbs of copper per year) in the first six years. Average production of 156,000 tpa of copper metal (340 million lbs/year) is anticipated over the mine’s expected 37 year life.

Established in Australia

The Lumwana copper project was acquired from Phelps Dodge in 1999.

Craig Williams, President and CEO of Equinox Minerals Limited co-founded the company in 1993 in Australia. In 2004, a Canadian listing was added, in recognition of the Canadian market’s receptivity to off-shore risk in Africa, specifically, Equinox’s large copper project in Zambia.

“In the last few years we’ve raised nearly half a billion on the North American market, so it’s certainly been a great move for us to get in an environment that’s a bit more receptive,” said Williams.

Equinox’s key project is its 100% owned Lumwana copper project in Zambia that was acquired from Phelps Dodge 10 years ago, in 1999. The 20 Mtpa plant became fully operational in early December 2008 making it the largest copper mine in Africa and one of the largest in the world to achieve production in the last few years.

Lumwana became operational in 2008, at a capital cost of $814 million.

“Is to produce about 170,000 tons of copper this year, at a cash cost of $1.15 per pound. So it’s a very large mine. It’s been a long haul to get there; the total capital cost was about US $814 million so it was a large project to finance and a large project to build,” he said.

“Obviously I’m disappointed that when we finally commissioned after all these hard years, the copper price was around the $1.50 mark. But we should operate comfortably at that copper price and repay our debt, and I think position ourselves well for the inevitable turnaround in the cycle,” Williams said.

Innovation Achieves Long-Term Benefits

A profitable operation also relies on innovative ways to spend more capital upfront to achieve long-term operating cost benefits. Since oil costs are always a large expense in any big open-pit mine operation, Equinox has employed a technique that is a little bit unusual in North America, but quite common in Southern Africa.

Booth Hybrid Lumwana Trucks

They use mining fleeters, a hybrid diesel electric truck. Because electricity in generated cheaply in Zambia through hydroelectricity, trucks operate on diesel at the bottom of the pit, but run on overhead wires up the ramp to the crusher and waste bin. “It’s just like a trolley bus drawing on electricity,” explained Williams. “And of course, running up the ramp is really where they chew the gas. And so that saves us quite a lot of operating costs. While oil prices are low for the moment, they inevitably rise again, and we will not be as badly affected as a lot of other open-pit mining operations.”

When Successful Explorers Go Independent

Craig Williams is a geologist, having graduated in 1974 from the Australian National University in Cambria, Australia. His first job was with Falconbridge, which was then called Pancontinental Mining. Later he was the exploration manager of Hunter Resources, a very successful explorer. “We found a number of quite large mines in Australia. And in fact Bruce Nisbet and I won the Prospector of the Year Award in Australia back in 1994 for significant discoveries,” Williams recalled.

When the two partners decided to become independent, Williams and Nisbet formed Equinox in 1993 and floated it in 1994. Dr. Bruce Nisbet died of cancer May 9, 2006, while he was serving as executive director and vice president of exploration. Sadly, he was unable to share in the realization of actually commissioning the copper mine.

Building a Strong Management Team

However the management team at Equinox remains outstanding, having met many of the challenges of financing and building a world class mine in Zambia. Harry Michael is the chief operating officer, and is based on site in Lumwana with his family. “He has a tremendous background in building big mines in Africa before, having built and operated Gator Goldmine, in Tanzania,” said Williams. “He’s done an outstanding job of driving the process to build this mine and is now operating it.”

Lumwana Production Dec08

Robert Rigo, another critical part of the team, is vice president of project development, managing the feasibility, the EPC contracts and offtake agreements. He is an engineer with over 30 years mining experience, particularly the management of major open pit mining operations and feasibility studies.

Ralph Gibson, vice president project finance, is managing a $660 million debt component in Equinox’s project financing, largely from London and Europe. “He’s doing a great job there,” Williams said. Gibson has worked for financial institutions in Australia and the UK providing debt and hedging facilities to mining companies in Australia, Africa, the former Soviet Union and the Americas.

Mike Klessens, vice president finance, chief financial officer and company secretary, heads the accounting and the operating financials. He has over 20 years in financing and developing mining operations.

“Kevin van Niekerk is our vice president in investor relations and corporate development in Canada, and he’s also the spokesperson for the organization,” added Williams. He is an engineer with substantial African experience who also manages the Toronto office.

Serving as chairman of the board is Peter Tomsett, the former president and chief executive officer of Placer, appointed following the Barrick takeover. “He’s a guy with a wealth of experience in the business and has made a tremendous contribution on the board of Equinox.”

Operations in Zambia

Williams has been comfortably operating in Zambia since 1996, growing familiar with the country, the logistics, and operational expectations. “We’ve built very strong relationships there and get a lot of support from the government. It’s a pretty good place to operate.”

Equinox benefits from the fact that Zambia was once an English colony, and established a strong framework for both the bureaucracy and the legal system. “They’re a very peaceful people; there’s never been a coup, there’s never been a violent uprising in history in Zambia,” Williams said.

One of the world's great copper provinces, Zambia’s copper belt has seen limited exploration since the 1970's and 40 percent of the country is still not geologically mapped.

Equinox has applied modern technology and concepts to its exploration, including high-resolution aeromagnetics and detailed induced polarization (IP) geophysical surveys.

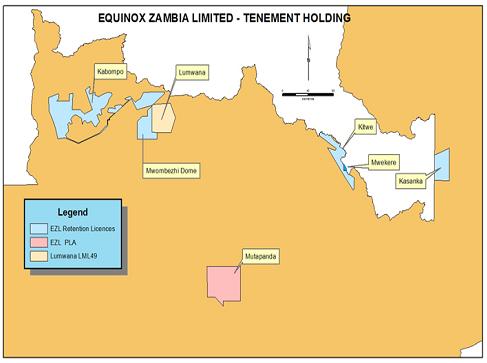

These have been critical in Equinox's success in exploring Zambia since 1996. It has properties with outstanding copper potential on the copper belt and in the North Western Province, covering 3 of the 4 mineralized ‘domes’ in Zambia.

At the Kanga Prospect, Equinox has drilled 28 RCP holes totaling 4,916 m along two km of strike during 2007. All RCP holes intersected the ore schist horizon with intercepts ranging between 5 - 20 meters in width encountered at the predicted down-hole position.

The Malundwe deposit, the first to be mined, remains open to the north and south, with the southern extensions now appearing to merge with the Kanga Prospect;

At the Kababisa Prospect Equinox undertook a time domain IP program that identified significant, coherent, strike parallel IP anomalies extending for over 3km. Recent RCP drilling intercepted this zone of mineralization with strong similarities to the nearby Malundwe ore body.

The Demand for Copper

Copper demand has been driven by industrial growth the China, India, Russia and Brazil. Availability of copper is especially tight in China, due to rapid urbanization and consumer products growth. On the supply side, we see that dominant copper-producing regions like the Southwestern US and Chile are reaching maturity, and their output growth is declining. The lack of exploration in the 1990s further limits the supply. Because it can take eight to 10 years to advance a project from discovery to development, Equinox, with a new, large, operational mine like Lumwana, is in a unique position to deliver this highly sought-after metal.

Asked why investors should take an interest in Equinox, Williams offered four strong distinctions that make the company stand out.

Asked why investors should take an interest in Equinox, Williams offered four strong distinctions that make the company stand out.

He described a scenario for the near future, when markets emerge from this current situation, a low point in our history. At that point, investors will be very selective about what they go into. They will, he said, consider what commodity is going to be performing well in the coming years.

“Now I know gold is going well at the moment, and uranium is showing signs of recovery, but I think of all the base metals, copper is by far the best. This is because the supply side is very constrained, and the demand is flat. I think that supply side is really going to bite within the next 12 to 18 months.,” he said.

Equinox also has the financial strength to repay its debt. “In a difficult time like we’ve been through, a lot of companies are stressed on the financial side, and the market looks very closely at the ability of companies to make their payments,” he said. “I believe that we will meet our debt repayments, and achieve that out of cash flow.,”

Further, Williams believes that investors are going to look for companies that have long life, low-cost mines of international scale that are going to survive through the cycles.

“Lumwana is one of those mines that has a scale and cost structure that will enable it to survive through the cycles. There will be ups and downs and you’ve got to be able to survive through that. With a 37-year mine life, we’ll be one of those survivors,” he said.

When the Market Rebounds

With a cornerstone project in Lumwana, Williams expects that Equinox will be in good shape when the market rebounds, enabling it to possibly acquire other projects from companies that haven’t been as fortunate.

Asked what kind of projects he would be looking for, Williams confirmed that the company would continue to focus on copper. In addition, it will:

Continue to ramp up copper concentrate production at Lumwana

Continue to assess the development of a 0.8-1.0 mtpa uranium process plant with a view to producing U3O8. “I think there could well be some geographic diversification, whether it be Latin America or whatever. I think there are definitely opportunities, and we’ll be looking for those opportunities,” he said.

“Our objective is to grow into a mid-tier producer with a diversification of projects within two to three years,” he continued. “At the moment we are basically a one-mine company, albeit a big one. But I think in time we’ll be an operating company with a number of operations.”

For more information: http://www.equinoxminerals.com/

Perth Office

Ground Floor, 50 Kings Park Road

West

Ground Floor, 50 Kings Park Road

West Perth WA 6005

Tel: +61 (0) 8 9322 3318

Fax: +61 (0) 8 9324 1195

Toronto Office

155 University Avenue, Suite 1701

Toronto, Ontario Canada M5H 3B7

Tel: +1 (416) 865 3393

Fax: +1 (416) 865 3394

Email: equinox@equinoxminerals.com

Join our mailing list

Click here to join our mailing list and keep up to

date with all the news at Equinox

(0) 8 9322 3318

Fax: +61 (0) 8 9324 1195

Toronto Office

155 University Avenue, Suite 1701

Toronto, Ontario Canada M5H 3B7

Tel: +1 (416) 865 3393

Fax: +1 (416) 865 3394

Email: equinox@equinoxminerals.com