Crocodile Gold Corp's president and CEO, Chantal Lavoie at PDAC 2013

In a typical portfolio of junior resource stocks, investors can expect some of their stocks to surpass the forecasts and predictions, some of their stocks to struggle to reach the forecasts and predictions, and some of their stocks to fall short.

So what makes the difference? For one company, Crocodile Gold Corporation (TSX: CRK), the secret is consistent execution. In the past two years, the company has transformed itself into a high-performance junior that has the execution of a potentially larger company.

At the recent PDAC Convention on March 3 to 6 in Toronto Canada, we spoke to Crocodile Gold Corp's president and CEO, Chantal Lavoie. Mr. Lavoie told us a bit about how he came to work for Crocodile Gold and some of the exciting successes that Crocodile Gold has seen in recent months and years.

Introducing himself first, Mr. Lavoie said: "I'm a mining engineer. I've been in the business for about 27 years. I started with Dome Mines, before it became Placer Dome, and now Barrick. I also worked in the base metal resources." His experience has connected him to some larger companies, giving him impressive hands-on and management experience: "I joined the Barrick Group in 1996 and worked at the Goldstrike property for six years. Then later on, I worked with de Beers Canada in various positions and then, at the end, was Chief Operating Officer."

Next came Crocodile Gold: "I joined Crocodile Gold in June of 2011. It's been a lot of work but it's been all positive. We have some good assets. When I joined Crocodile Gold we were a small junior company; we had one key asset that was just in the early stage of development. We were mining very marginal open pit, very low grade, very high cost. And I look at the Company today – we produced over 150,000 ounces last year. We're on our way to produce 175,000 ounces. We made a major acquisition last year. When I look at the Company moving forward, we're quite a different company from two years ago when I joined."

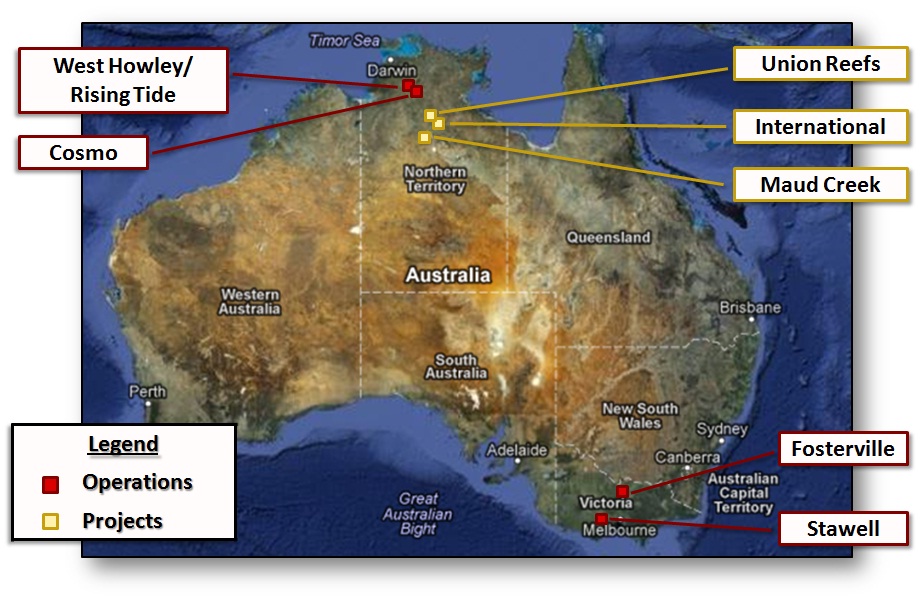

Next, Mr. Lavoie talked about how the company has evolved since he joined. One of the actions the Company has taken is to acquire 2 other operations –The Company owns 3 operations, 1 in Australia's Northern Territory and 1 in the State of Victoria. "We also have a very good land position," Mr. Lavoie reported.

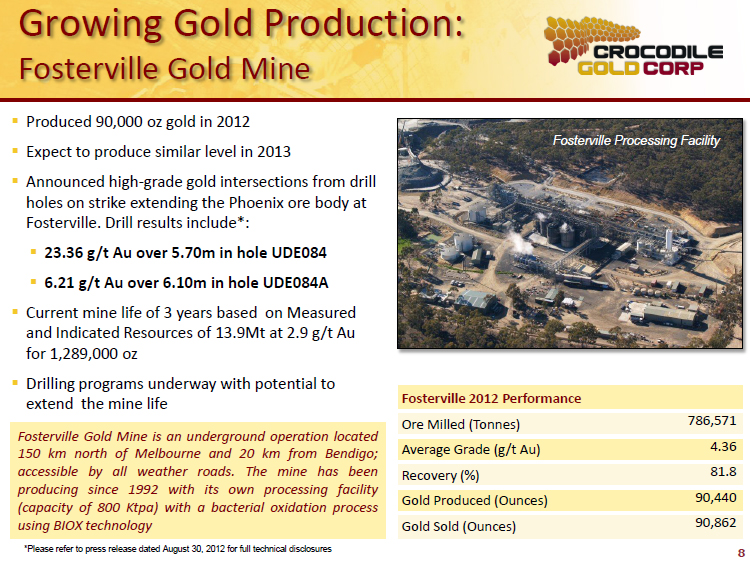

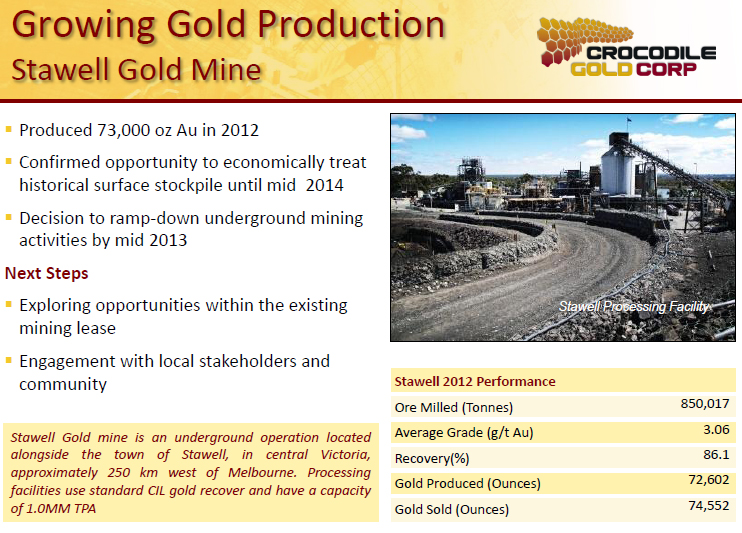

Among their land positions, they have two producing mines – Fosterville and Stawell. According to the Company's website, "Each underground mine operates with its own 1 million tonne per year production facilities. These properties contain an additional 3.732 million ounces of NI 43-101 reported measured and indicated mineral resources and 622,000 ounces of Inferred mineral resources." Mr. Lavoie also mentioned another project: "We just announced that we are taking the first step in the Big Hill project.”

Land position isn't the only change the company has made. They have also made some significant improvements in their financials as well: "looking at our quarterly results, you'll see that we had very high cash costs in the first quarter of last year – essentially $2,000 an ounce – so we weren't making any money. We stabilized that. Our average cash costs for last year was about $1,167, which is within the guidance. And for our last quarter, costs were below $1,000 an ounce. We're expecting the trend to continue this year. As we increase our production, we see on the long term our cash costs being below $900 and then $850 an ounce." Later he added referring to 2012: "For the first time, this company generated operating cash flow of $60 million."

Moving forward, the company has fixed its course on delivering even more good news in the future: "

"The approach of our Company moving forward is to maximize the financial aspect of our business – it's not only about producing ounces; it's about producing economic ounces," said Mr. Lavoie. "We see ourselves a position of becoming a quarter million ounces-per-year producer for the next 4 to 5 years. We have a good strategic plan in place that will see the company producing about 1.2 million ounces over that period – that's out of a measured and indicated resource of 4 million ounces. So we have a very solid, conservative plan. And one of the things I've learned over the two years with Crocodile Gold is that the market wants companies to under-promise and over-deliver and that’s what we're planning to do."

"We're really a turnaround story," said Mr. Lavoie. The secret to Crocodile Gold's growing success, he asserted, is its ability to execute on the promises they make. "Over the course of the last 3 quarters, we demonstrated execution. We said we were going to produce 150,000 ounces after the acquisition and that's what we did. We said we were systematically lowering costs and that's what we did. Our focus moving forward is about delivery and that's what should attract investors." He added: "We're focused on execution; we have a solid plan and a very big resource base to work from."

Value investors love turnaround stories because they have an opportunity to buy a stock when the price is down and ride the price as it goes up. The company's struggles, along with a market that isn't valuing juniors very well right now, make for an enticing stock price for value investors who believe that Crocodile Gold's turnaround story is only just beginning.

Disclosure

The Alper family has stock in Crocodile Gold.

REFERENCES

Crocodile Gold Corp.

65 Queen Street West, Suite 825, P.O. Box 75, Toronto, Ontario, Canada M5H 2M5

416-861-5899

http://www.crocgold.com/

Email: info@crocgold.com

PDAC: http://convention.pdac.ca/pdac/conv/