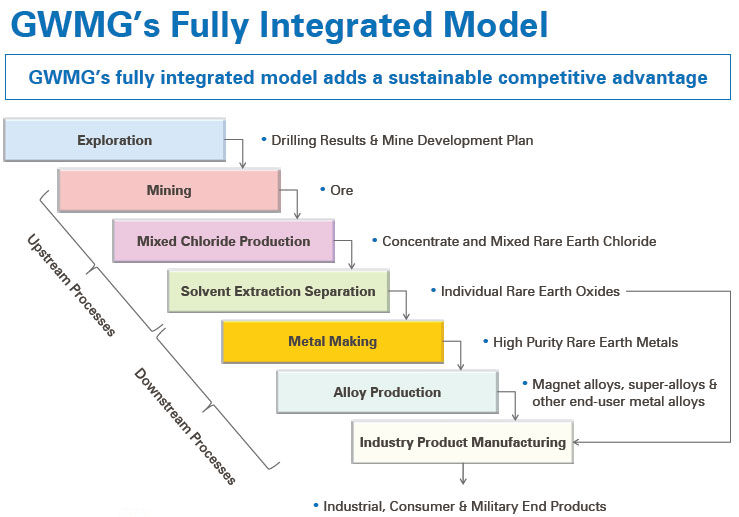

There are many rare earth metals companies in the market right now, but one of the biggest problems facing the rare earths industry is the lack of companies that turn rare earths into usable material. Experts are advising investors to watch for companies who are focused not just on exploration but also on production.

One of the up-and-coming companies in exploration AND production of rare earths is Great Western Minerals Group (TSX-V: GWG). Their mine-to-market approach puts them among some of the "rarest" rare earth companies that mine rare earths and process them into alloys.

At the recent PDAC Conference in Toronto, we spoke to Gary Billingsley, Executive Chairman of Great Western Minerals Group. He told us about the company and their plan to continue their mine-to-market approach.

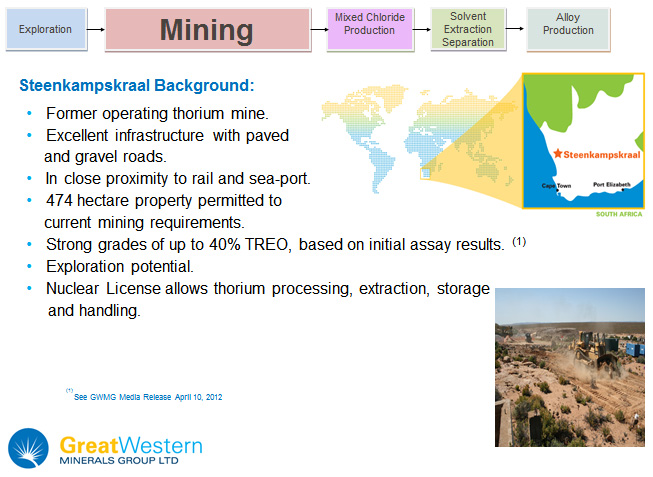

Great Western Minerals holds 5 exploration projects – 4 in Canada and 1 in South Africa – and they are currently focusing on their South African property, Steenkampskraal Mine.

Mr. Billingsley described what the mine is like: "Steenkampskraal is a relatively small resource compared to other projects that some of the bigger companies are working on, but it was really only mined to a depth of 300 feet so we have two drill rigs on the project right now. We're drilling and we're using structural geologists to test the depth and plunge extensions of the ore-zone, and testing at depth as well. We feel that there is significant potential to increase the resource. We're aware of other outcrops and showings within the permitted area that the previous owner had identified."

From this project, Great Western Minerals is looking to produce the following rare earths: Neodymium, Praseodymium, Samarium, Dysprosium, Cerium and Lanthanum products. Mr. Billingsley added: "We're determining whether we need to produce a mixed heavy product first that we may have to stockpile in order to make it economic to run a heavy line. We want to produce dysprosium. As for the rest of the heavy rare earth minerals, we are talking to groups who might be interested in them. If we can produce those, we would like to produce those."

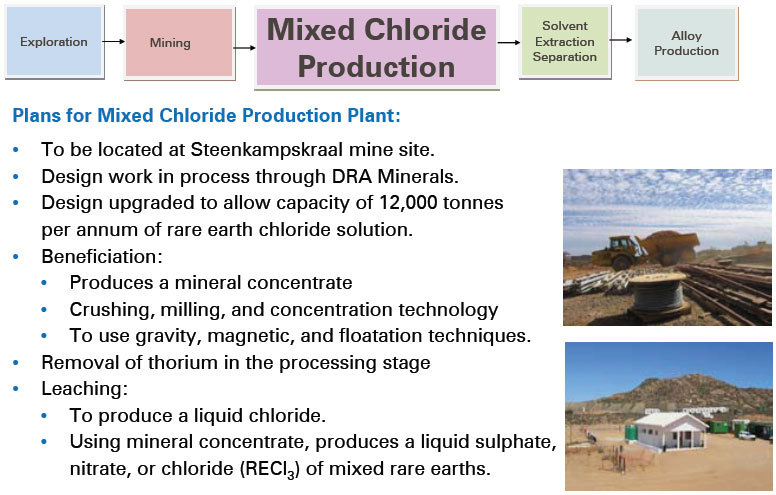

Next, Mr. Billingsley told us what the company's timeline is for the near term and walked us through their mine-to-market set-up at the same time. "Our contractors will be building plants and we'll be producing monazite concentrate in the early part of 2013"

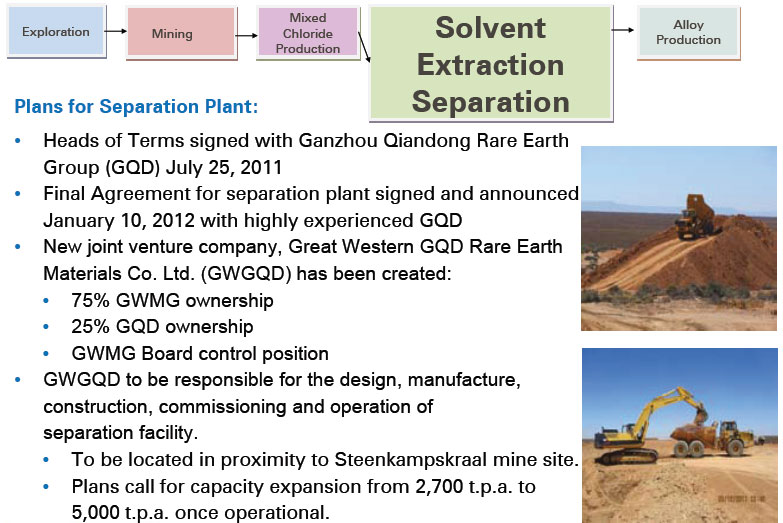

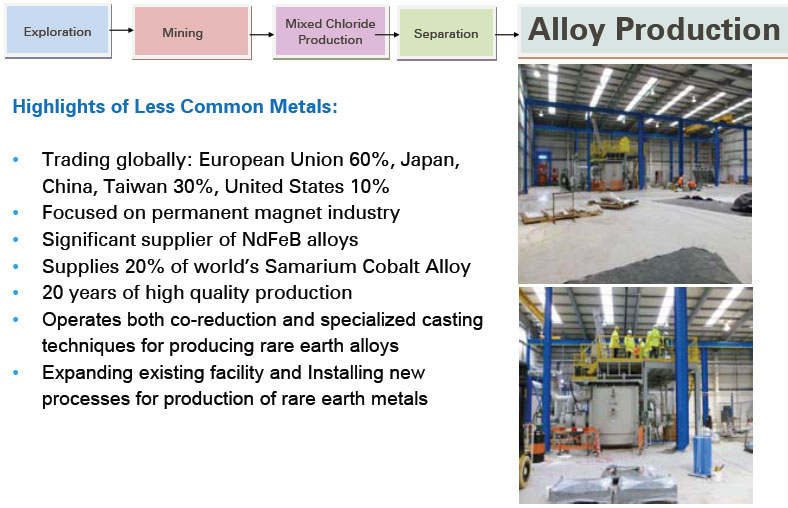

Then in 2013, the company continues moving forward with the production side of their business: "We'll be producing rare earth chlorides in the first part of 2013. With our partner GQD [a Chinese rare earth company], who is helping us with the separation facility, we plan on having that operational by mid-2013 and we should be able to do all of the internal supply steps from the mine through to separated rare earth oxides. The separated oxides will be sent to “Less Common Minerals” [a wholly owned subsidiary] to be processed into the various rare earth metals."

Although detailed compliant projections won't come out until April, Mr. Billingsley gave us a rough idea of what the expectations were: "We plan to produce between 3,000 and 4,000 tons of alloy once everything is up and running. Most of that is neodymium-iron-boron alloy so the revenues and cash flows are very significant and I think they will surprise a lot of people at the amount of cash you can generate by having control of the project."

Once they reach production, Mr. Billingsley believes the company will be one of the top mine-to-market companies in the world, second only to Molycorp.

The company has a clear path forward, so we wanted to know about their financing. GWMG just completed a financing that saw the company raise $90 million in a secured convertible bond. We were very pleased to see that the original $80 million was fully subscribed and then followed up with a $10 million over-allotment. That spoke volumes about investor confidence in GWMG being able to proceed through to production."

One advantage is that they are able to offer a low-cost operation: "The expected capital costs at Steenkampskraal for the mine, the mill, and the separation facility, is in the order of $70 to $80 million," said Mr. Billingsley. "It's quite small compared to the much larger projects that are on the scene right now."

Along with its financing being completed, the company has entered into an agreement with GQD to build the processing plant. Mr. Billingsley explained: "The joint venture will own the separation facility but Great Western Minerals will own the product moving in and out of the facility. GQD owns 25% of the plant and the plant will receive a tolling fee for product moving through it. QGD will also get an incentive bonus of Great Western Minerals stock spread over 3 years, dependent on meeting certain specifications for the product. We feel it's a win-win situation."

There are hundreds of rare earth companies out there but investors might like Great Western Minerals because of its unique mine-to-market approach. "We already have customers in place and those customers have us in an expansion mode right now," said Mr. Billingsley. The company is able to mine the rare earths, send them to their on-site facility for production, and turn them into marketable alloy products. That drives down costs for shipping, infrastructure, and middle-man mark-up, which helps to increase profit while keeping products competitively priced.

Investors who are looking to add a rare earth company to their portfolio might want to take a closer look at Great Western Minerals and its unique mine-to-market approach to determine if it is the right fit for their portfolio.

REFERENCES

www.gwmg.ca

Great Western Minerals Group Ltd.

219 Robin Crescent

Saskatoon, SK, S7L 6M8 Canada

(306) 659-4500

http://www.pdac.ca/pdac/conv/