Investing in the minerals industry sometimes feels no more accurate than gazing into a crystal ball. Investors long to find the right opportunity at the right time; for many, the ideal investment is getting in on an investment just before a major success.

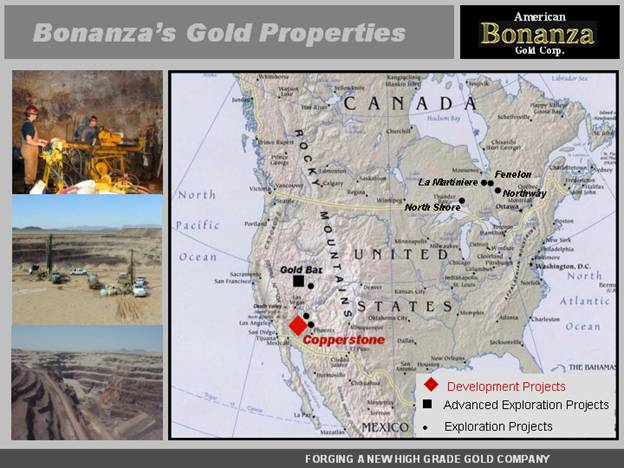

That could be the situation that investors find themselves in when they look at American Bonanza Gold Corp. American Bonanza Gold (TSX: BZA) is an exploration and development company focused on gold opportunities in the US and Canada. Although they have several properties right now, they are betting big on one particular property, the Arizona-based Copperstone gold property, which they are bringing into production in 2010.

We were privileged to speak with Brian Kirwin, President and CEO of American Bonanza Gold Corp recently. We spoke about a number of topics but his company's Copperstone project was at the top of the list.

We were privileged to speak with Brian Kirwin, President and CEO of American Bonanza Gold Corp recently. We spoke about a number of topics but his company's Copperstone project was at the top of the list.

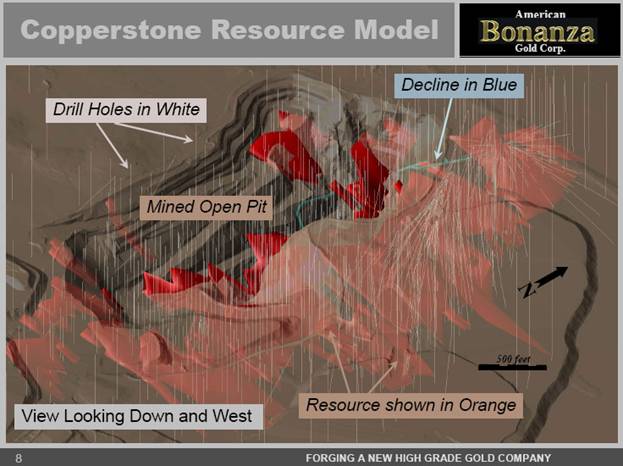

First, we talked about Copperstone's history. He says, "It was mined by Cyprus Minerals as an open pit mine from 1988 to 1993. It produced almost a half million ounces of gold out of the open pit. Subsequent to that, it was in the hands of a number of junior companies who did a little bit of drilling and that drilling exposed the potential that we recognized could build a reserve."

Brian Kirwin, President and CEO

Mr. Kirwin then mentions, "In 1999 and 2000, the gold markets were rough so I founded American Bonanza Gold Corp and acquired the Copperstone project [out of bankruptcy]. It was a big risk at the time but our belief in gold was well-founded and now it's turning up roses."

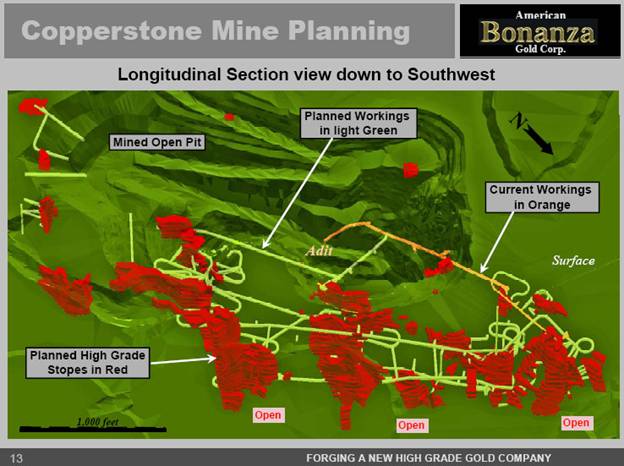

He goes on to describe the initial exploratory work they did: "We spent a considerable amount of time and money following the whole structure from the open pit to depth. We did some of our drilling from underground as well as from the surface."

There are many advantages to the Copperstone project, Mr. Kirwin points out. For example, he mentioned that "much of the infrastructure from the open pit mine is still there, thanks to a very active landowner who stepped in during the reclamation and removal process and secured a number of the buildings as well as the power supply – which is on the grid – and the water supply." That's an advantage which lowers development and preparation costs. "We have excellent infrastructure, we have access to the high grade underground, and we have power and water onsite now. So the development cost is quite manageable and is made up of half of the indirect costs, so it's an excellent site." Later he describes that they have power in excess of their needs and nearby roads that will be more than adequate for their needs.

This is an exciting opportunity for investors. "There are value increases when a company goes from an exploration company to a producing company. This is a very rare event: Gold mines the size of Copperstone or larger only number about 200 or so in the whole world and most of those are built by large companies as a third or fourth mine." So, how will American Bonanza Gold Corp seek to turn this property into a producing property?

When you want to succeed, sometimes it's best to diversify and sometimes it's wise to put all of your eggs in one basket. American Bonanza Gold Corp does have other projects but they are focusing nearly all of their resources and strengths on bringing Copperstone into production in the near future before they return their energy to looking at their other projects.

Other projects include Quebec-based projects Fenelon, Martiniere, and Northway; Nevada-based projects Gold Bar and Belmont; Arizona-based project Oatman, and Ontario-based project Northshore. These resources, while important, are not the primary focus of American Bonanza Gold Corp for the short term. As Mr. Kirwin explains, "At the moment the entire company is devoted to putting Copperstone into production, so all of our other assets are being optimized to help Copperstone. A good example of that is the sale of the Taurus project in British Columbia to Hawthorne Gold, which has been beneficial for us and has helped us get through Copperstone's permitting process and feasibility study."

Of course, that's just the short term plan. Mr. Kirwin talks about the company's long-term vision when he says, "On a longer term perspective, once we have achieved production at Copperstone, we have a number of projects that are exciting… there is quite a bit of discovery potential in our portfolio."

Of course, every company has risks, but Mr. Kirwin points out that "we have been working for ten years to bring down risks." Indeed, his experience is one key factor that will help. He has worked for Placer Dome in various senior roles from 1990 through 1997 and then became Vice President, Exploration of Vengold from 1997 to 2000. His entry into the industry is an interesting aside: "I started this business not really knowing I was going to get into this business! When I was 19 years old, my first job was as a sample prep summer job in an assay lab. I held that summer job for a few years. During that time, I would think about the assays and wonder who was at the other end of it – who was the guy in Alaska who was sending in these assays – and I thought it would be more fun to be that guy than to be the guy doing sample prep in the lab. That realization occurred while I was an undergrad and was thinking about my major. After that, I got a masters degree in mineral economics at Queen's University in Kingston. I've worked the entire range of project development, from grassroots exploration all the way through to production and mining geology, and from the smallest companies to the largest."

There is one challenge that the company has faced and is overcoming. "This property was acquired ten years ago knowing the chemistry and knowing certain things about this site and the permitting process…(it) is going very smoothly. The only challenge is going to be the capital cost. With only half of it being direct costs [because of the pre-existing infrastructure], we don't have to raise it all at once. We can chip away at it and try to minimize dilution and risk."

Mr. Kirwin sums up the situation for investors: "This is rare for an investor to run across an investment at this point when so much of the risk has been taken out and there is significant value of the operation. There are thousands of companies trying to do that and on an annual basis, it doesn't happen [often]."

References

http://www.americanbonanza.com

Corporate Office

Suite 305 – 675 West Hastings St.

Vancouver, British Columbia

Canada, V6B 1N2

Telephone: (604) 688-7523

Facsimile: (604) 681-0122

Email: info@americanbonanza.com

Investor Relations

Jim Bagwell at 1-877-688-7523

Email: info@americanbonanza.com