Roy MacDonald, the Vice President of Investor Relations for Gran Colombia Gold (TSX: GCM) visited with Metals News at the recently held Cambridge Vancouver Investment Show to discuss the newest advancements of the company.

MacDonald, a relatively new addition to Gran Colombia Gold, has been working to understand more about the company and to get additional information out to investors. He said, “I’ve been with the company for a year, so I’ve been learning about Colombia, gold and our investors.” After a year, MacDonald has learned that investors are patiently waiting for results before acquiring Gran Colombia’s stock aggressively. Said MacDonald, “Gran Colombia is in the ‘show me’ stage right now.”

One area that MacDonald is confident of is Gran Colombia’s team. He said, “If you want to get something done in Colombia, we have the best people in place. We have very strong Board of Directors that includes former ministers and highly successful Colombian business people. We also have a lot of management and mining talent on the team and a passion for the communities where we work.”

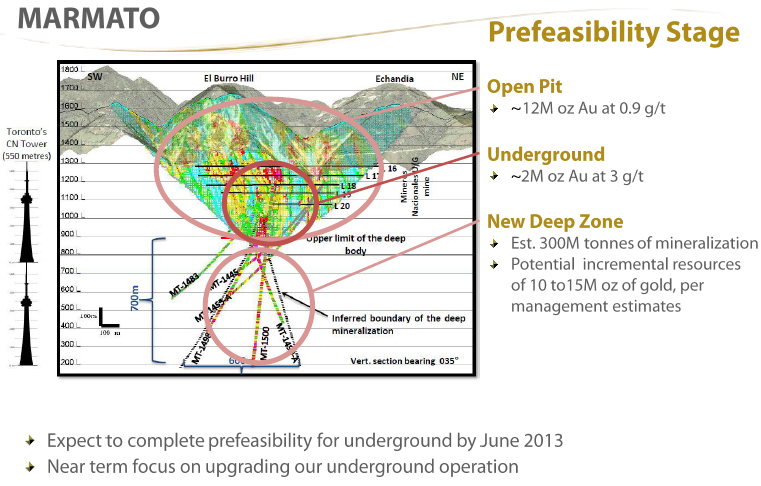

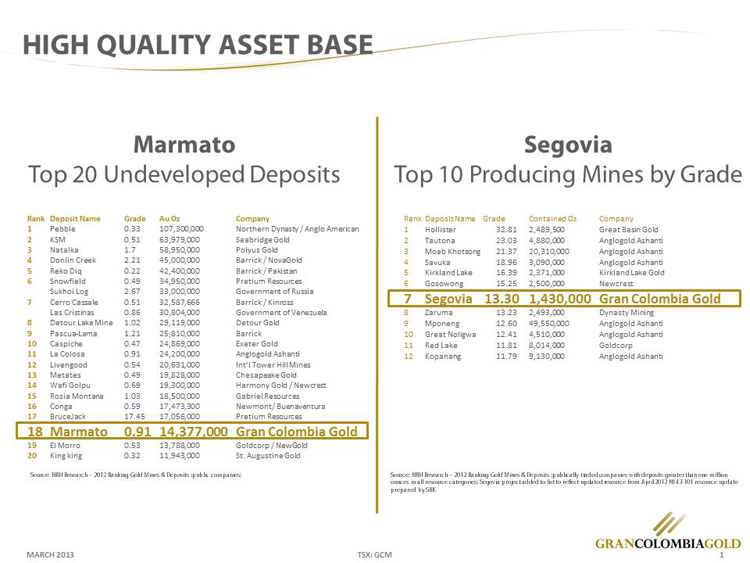

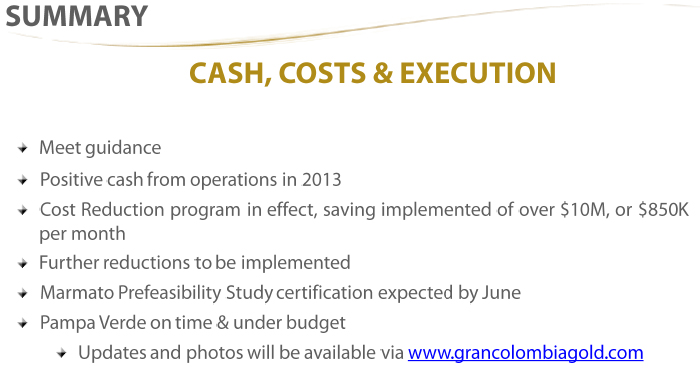

Gran Colombia has two major projects: Marmato and Segovia that they are currently pursuing. MacDonald said, “In terms of where we are with our two main projects, at the Marmato project, we are working towards filing a prefeasibility study.” To date, the company has identified a significant amount of gold at the project site. Said MacDonald, “We have 14.4 million ounces of gold and 90 million ounces of silver with an average gold grade of 0.9 grams per ton.” Discoveries have not ended, though, with these results. Said MacDonald, “We found a new deep zone with very exciting results. We may have another 300 million tons of mineralization down there.” Currently, the company is working on certifying the results of their Prefeasibility study at Marmato. Said MacDonald, “We completed the internal work in 2012, so now we are working with a consultant to get the certification done. It should be done in the next few months.”

The Segovia project is a historical resource that holds a great deal of promise for the future. Said MacDonald, “Segovia is a well-known project. It is the former Frontino gold mines.” Gran Colombia has control of the project in its entirety and is now in production. MacDonald said, “We acquired the land and the mineral rights. With only four of 27 known vein structures currently included in our resource estimate, we believe that we have a significant amount of exploration upside to the project.” At Segovia, the company produced almost 80,000 ounces of gold in 2012. Given the current production at Segovia, the company is now working on making sure the facilities are up to date. Said MacDonald, “Our focus at Segovia is on modernizing the operations to lower our costs. We are taking a 500 ton a day mill to 1,000 tons per day and are working to bring our cash costs down.” Future plans involve additional construction. MacDonald said, “Stage two at Segovia will be to build a new modernized plant and mining operations. We have the cash in the bank and work is underway to get that moving. We are very excited about the opportunity.”

MacDonald and the Gran Colombia staff are enthusiastic about working in Colombia and their mining friendly jurisdiction. Said MacDonald, “Colombia is a fantastic market. It has phenomenal GDP growth, a young, educated population and a growing middle class.” Recently, the Colombian government has made changes that have improved the working conditions for companies in the area. MacDonald said, “The government is serious about security and opening up for business. Mining is going to be one of their locomotives for growth. There is a lot of upside in the area.”

Why should investors consider Gran Colombia as an investment option?

MacDonald believes they are attractive to investors due to the quality of their assets and a low market valuation. He said, “We are currently producing over 100,000 ounces of gold annually, we have the cash and are implementing the Pampa Verde project to significantly lower costs, we have significant exploration upside and our valuation metrics are incredibly low. With a share price of $0.35 and an enterprise value of $220 million dollars, compare our enterprise value to our M&I gold ounces in the ground and we are trading at $14 per ounce. You’d have a hard time finding anything that cheap anywhere in the world.”

He said, “We are a well-established company. We are ready to start generating some impressive cash flow from our operations. Investors should take a good look at Gran Colombia Gold and look at who owns the stock. Here at the Cambridge Gold Forum, both Frank Holmes from US Global Investors and Thom Calandra spoke of our potential in their presentations; US global is our largest shareholder and Mr. Calandra is a noted resource journalist and investor who toured our Segovia operations in November. It is also important to note that insiders at Gran Colombia bought almost 12 million shares and over 7,000 units of our notes in 2012.”

Mr MacDonald added, “We have a silver-linked note that trades on the TSX, it pays 5% interest and the principle repayments are linked to a $15 per ounce silver price. If you are bullish on silver and like to get paid while you wait, with an IRR for investors of approximately 30%, you need to take a look at this note.” The company’s silver-linked note trades on the TSX as GCM.NT.U.

“You couldn’t put together a better group of people to build a successful company in Colombia. We are currently generating cash flow from production and we have the funding in place to take our business to the next level.”

http://www.grancolombiagold.com/

Head Office

333 Bay Street, Suite 1100

Toronto, Ontario M5H 2R2

Telephone:(416) 360-4653

Fax: (416) 360-7783

investorrelations@grancolombiagold.com