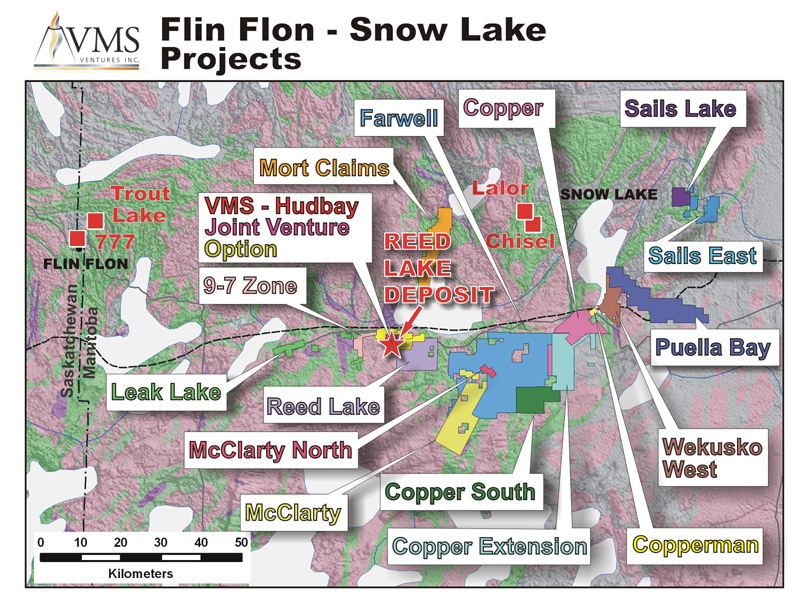

VMS Ventures Inc. is a mineral exploration company focused on high grade copper deposits with a large land position in the Flin Flon – Snow Lake volcanogenic massive sulphide belt in Manitoba, Canada.

We recently caught up with John Roozendaal, President and Director, VMS Ventures Inc. Mr. Roozendaal, a native of Manitoba, is a geologist and a founding director of VMS Ventures Inc.

VMS Ventures started as Rare Earth Metals Corp. in 2000 and listed on the TSX Venture Exchange in 2002. To reflect their refocus from rare earth metals to copper-zinc-gold-silver deposits found in the volcanogenic massive sulphide (VMS) belt in Manitoba, the company changed their name to VMS Ventures Inc. in 2007. "VMS deposits are a common source of copper, zinc, gold and silver in Canada,” stated John Roozendaal.

Reed Lake Project

VMS Ventures’ first drill hole in 2007 made a discovery in the Reed Lake deposit, located half way between the two mining communities of Swan Lake and Flin Flon. “The Snow Lake – Flin Flon greenstone belt has been productive for 80 years and is one of the richest of its kind in the world,” exclaims Mr. Roozendaal.

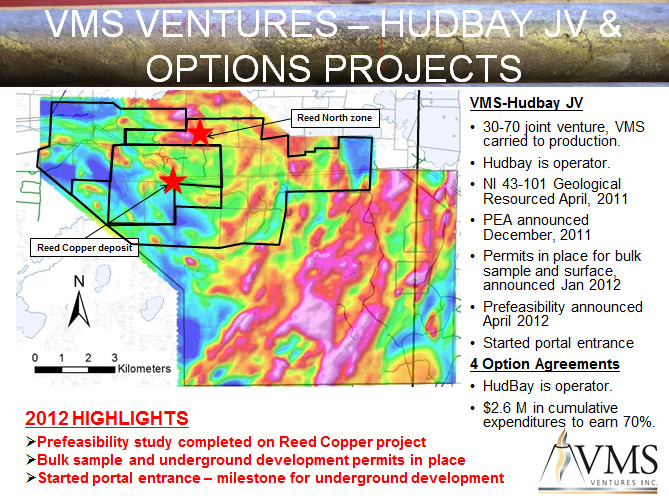

The discovery led to a joint venture partnership with HudBay Minerals Inc. in 2010. HudBay Minerals will provide funding to production in return for 70% in the project. “So, we don’t have any risk on the financial side,” clarifies Mr. Roosendaal.

Mr. Roozendaal provides a few numbers explaining that over 100 million tonnes of ore has been discovered in the Snow Lake – Flin Flon belt over an 80 year period with an average of 2.5% copper, 4.5% zinc, about 2 grams of gold and an ounce of silver per tonne.

HudBay Minerals has facilities, personnel and 80 years expertise in the belt; giving them an advantage mining the project. “The mine will cost about $75 million to go into construction, which is a low capital expenditure for a mine,” explains Mr. Roozendaal. “It’s based on the style of mine using ramps and not having to put in a shaft and using HudBay Minerals’ existing facilities.” The property is permitted to go under ground starting in August with production to begin in the third quarter of 2013.

Financial Information

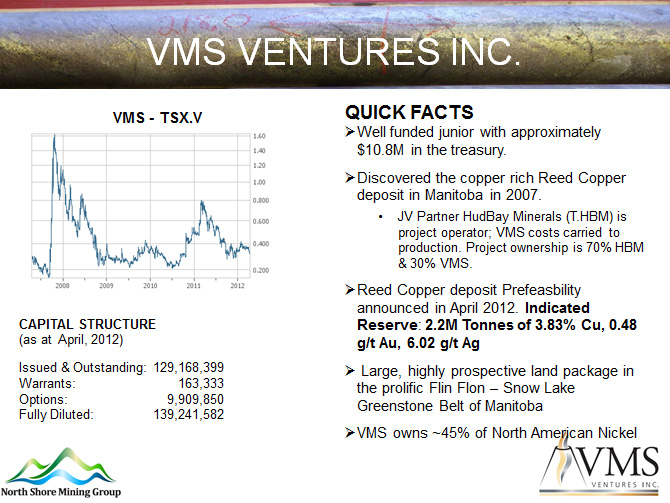

Mr. Roozendaal admits that the stock price has depreciated in the recent past along with every other resource company, but he adds that they have about $11 million in the bank, so VMS Ventures is well-financed. Again, he clarifies, “We don’t need that cash for development of the mine, so we have that cash available for us to seek out and explore other properties.”

Mr. Roozendaal also adds that VMS Ventures has an experienced team and about a $35 million market cap. Mr. Roozendaal calculates, “we’re getting 12 cents per share for 30% of the Reed Lake Mine. So, current copper metal prices of $3.75 would generate about $100 million in cash flow over a 5 to 6 year period. So, right now we’re at quite a discount.”

Investing in VMS Ventures

“It’s a four-fold checklist that investors will like,” provides Mr. Roozendaal. “The first is that we have a near term online production from a high-grade copper deposit. It will presumably be a very profitable deposit and it’s one where the financing is off the table and the expertise is off the table because HudBay will handle both of those.”

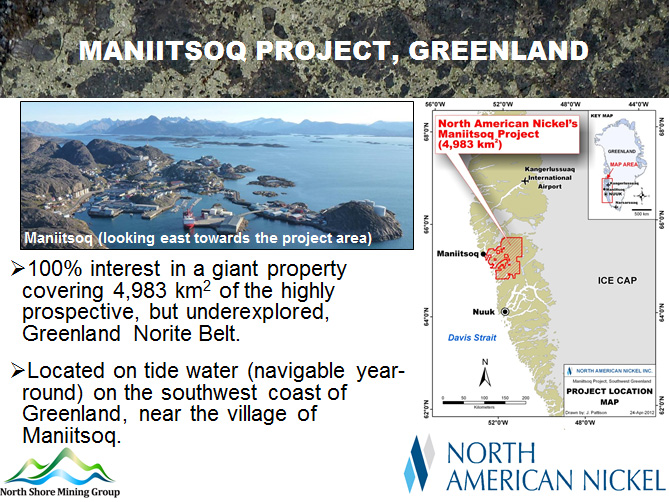

He continues, “So, we have near term production, we’re well-financed with $11 million of our own money that isn’t needed for the construction of the mine. We can use that to develop and expand the company. We’re not looking to the financial markets to raise money. Thirdly, we have a very experienced management base from both the technical side and the business side. Fourthly, we have other assets too.” VMS Ventures’ other assets include approximately 45% ownership of North American Nickel, which has a large nickel project in Greenland.

“So, we have a number of ways to develop and build the company and could have some very positive news arise over the next 12 months.” VMS Ventures is currently trading at about 20 cents with 129 million shares outstanding.

“The world market is the biggest risk that VMS Ventures faces,” concludes Mr. Roozendaal. “The deposit has been drilled off and a prefeasibility study has already been published. So, there’s not a lot of uncertainty with the deposit. We’re somewhat sheltered from the markets for the short term because we don’t need to go to the market for money. But that’s not going to shelter us from where our share price is going to stray. That’s going to go up or down based on the enthusiasm of investors to invest in ventures such as us.”

http://www.vmsventures.com/

|

Head Office : |

|

|

VMS Ventures Inc.

301-260 West Esplanade,

North Vancouver, BC

Canada V7M 3G7 |

|

Toll Free: 1-866-816-0118

Phone: (604) 986-2020

Fax: (604) 986-2021

eMail: info@vmsventures.com