Anaconda Mining Inc. (TSX: ANX): About 1.6 Million Ounces, plus Recently Acquired High-Grade Goldboro Project in Nova Scotia, Very Good Economics, Interview with Dustin Angelo, President and CEO

|

By Allen Alper, Jr., with MetalsNews.com

on 4/2/2018

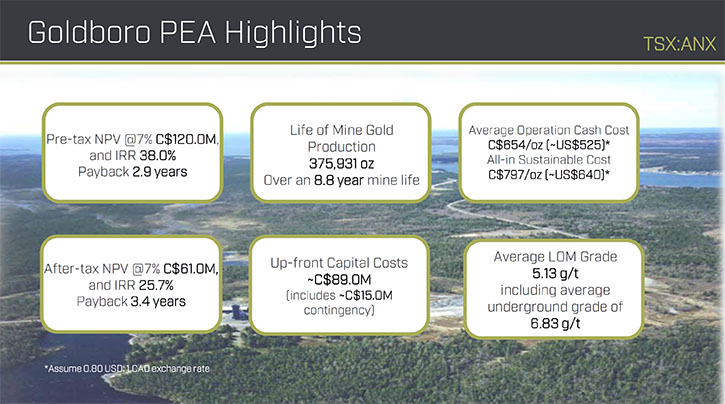

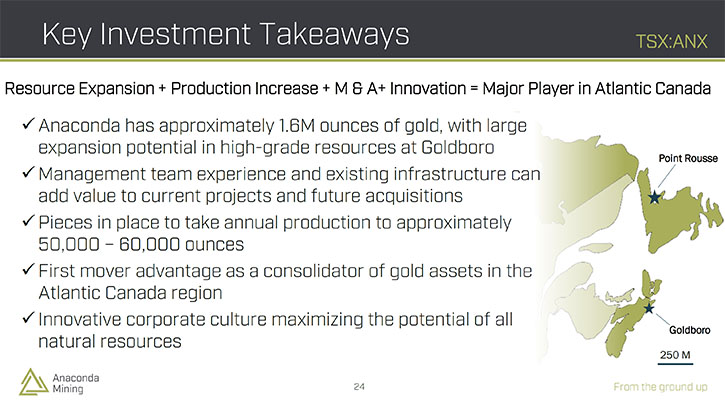

Anaconda Mining Inc. (TSX: ANX) is a gold mining, development and exploration company, focused in the prospective Atlantic Canadian jurisdictions of Newfoundland and Nova Scotia. The company operates the Point Rousse Project located in the Baie Verte Mining District in Newfoundland, and is currently focused on developing the recently acquired, high-grade Goldboro Project in Nova Scotia. We learned from Dustin Angelo, President and CEO of Anaconda Mining, that they put out a new PEA on the Goldboro Project that shows very good economics with just under $800 in all-in sustaining cash cost, about a nine-year mine life, producing about 41,000 ounces a year. According to Mr. Angelo, they will be able to put the Goldboro Project into production by 2021.

Dustin Angelo, President and CEO of Anaconda Mining at PDAC 2018

The Point Rousse Project, Newfoundland

Al Alper, Jr.: This is Al Alper, Jr. with Metals News. I'm here at PDAC 2018 with Dustin Angelo, President and CEO of Anaconda Mining. We talked with you last year. You're a gold producer. Is that right?

Dustin Angelo: Yes, we've been a gold producer for several years.

Al Alper, Jr.: Could you remind our readers/investors a bit about your background?

Dustin Angelo: I'm a CPA from the United States. I've been a part of Anaconda for about nine years on the board. About eight years of that has been as President and CEO. I have a background in mining, about 13 years between coal mining, aggregates, and gold mining.

Al Alper, Jr.: Excellent background! Now, tell us a bit about what is new and exciting with Anaconda Mining.

Dustin Angelo: Sure. Last year when we spoke, we had just announced the acquisition of the Goldboro Project by buying Orex Exploration. This year we're excited because we've had nearly a year of development work on it, and we put out a new PEA on the project. It has 120 million dollar net present value, pre-tax, at a 7% discount rate and IRR 38% and a Payback in 2.9 years. Very good economics. It's about $650 per ounce Canadian for operating cash cost, and just under $800 all-in sustaining cash cost. We have about a nine-year mine life, and are producing about 41,000 ounces a year. So we're off to a great start in 2018 with respect to Goldboro, doing some drilling as well.

We're in the middle of an 8,000-meter drill program that we started back in October. We're achieving a lot of our goals, an infill program and an expansion program. Through some of the initial results we've put out, we've been able to demonstrate that the deposit does extend down-plunge and down-dip. Even some of the infill drilling has discovered some other mineralized areas that weren't previously modeled. So we're pretty excited about being able to expand the deposit as well put it into production by about 2021.

Al Alper, Jr.: Congratulations! Excellent! Tell us a bit about your share structure.

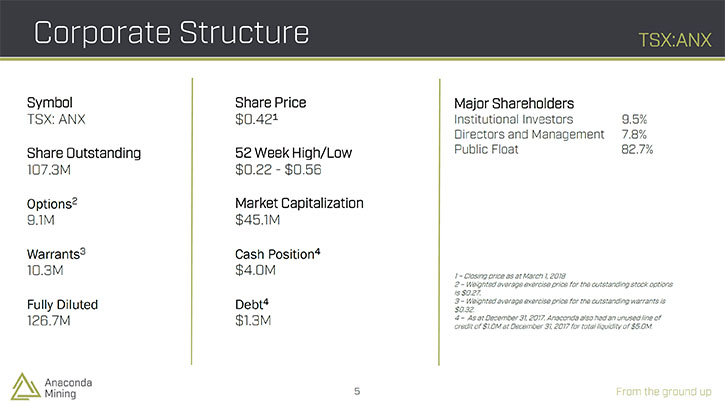

Dustin Angelo: Presently, we have about 107 million shares outstanding. We have a trading price now of roughly 42 cents, so we're about a 43 million dollar market cap company with very little debt. About 1.3 million dollars in debt, primarily in government loans at very low interest rates. We have about four million dollars in the bank as of the end of December. We did a raise back in October, where we raised two million dollars in flow-through and a million dollars in hard dollars. So we're pretty well capitalized right now, and we've been using that money to do our expansion and our development at Goldboro.

Al Alper, Jr.: I understand you have a great management team. Can you tell us more about them?

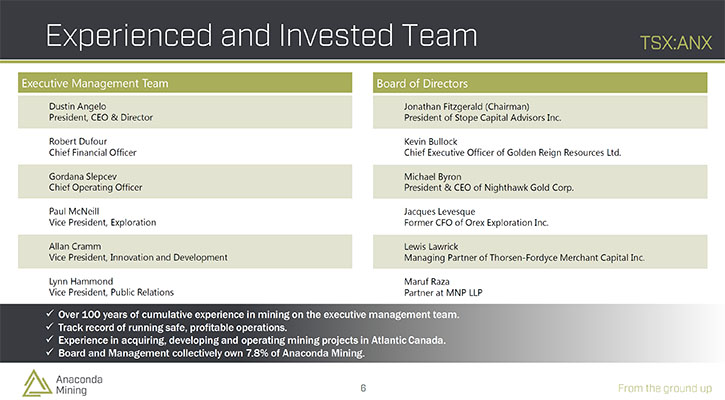

Dustin Angelo: Sure. Our management team consists of myself and our CFO, Rob Dufour, who was formerly with Crocodile Gold and Newmarket before it was acquired by Kirkland Lake. Our COO, Gordana Slepcev has been in the industry for 20 plus years, with various different projects across Canada. A lot of development experience, and certainly a lot of experience in Atlantic Canada.

Al Alper, Jr.: Tell me. Do you have skin in the game? What's your stake in Anaconda?

Dustin Angelo: Yeah, I certainly have skin in the game. I've bought shares ever since I started at Anaconda. I have nearly 1% ownership of the company, and I also have options that also give me a lot of skin in the game.

Al Alper, Jr.: That’s very important! An excellent way of judging a company and its leadership! What do you think are the major challenges for your company and your plan going forward?

Dustin Angelo: I think primarily the big challenge for us as at Goldboro is putting the mine in on a timeline of about three years. We are working very efficiently on the permitting side, which is always the toughest area. We're doing everything we're supposed to do, in terms of community engagement, filing our environmental assessment on-time and going through the necessary process in Nova Scotia.

As far as the Point Rousse Project goes, we've been working our way to creating some more life there. We have a new resource on that project called Argyle. We've historically had a challenge demonstrating the fact that the Point Rousse Project has longevity. Now, we're off to a really good start there.

We're also going to address longevity through acquisitions. We think we're in a very good spot as a company to be an acquirer of additional assets within Atlantic Canada. We can buy projects with already known resources on them, similar to what we've done with Goldboro. We have the ability get those into production in a fairly short timeframe.

With Goldboro coming on, the company as a whole certainly demonstrated the longevity now with a PEA that shows nine years of mine life just on the outset before we even talk about the expansion that we're seeing through our drill bit right now.

Al Alper, Jr.: Excellent! What do you think are the main reasons investors should be interested in Anaconda Mining?

Dustin Angelo: Well, I think we're a value play, we're still undervalued when you look at our peer group. We have roughly a 46 million dollar market cap with little or no debt. Very clean balance sheet! We have a PEA with a pre-tax NPV on just one project, the Goldboro Project, at 120 million dollars Canadian. At a 1,550 gold price. We just sold gold the other day at 1,700. So there's a lot of leverage to the gold price there, as well, in terms of the valuation. We have an existing cash flowing entity, producing at the Point Rousse Project, for the last several years. It generates anywhere from roughly six to eight million dollars a year in cash flow. Additionally, the accretive acquisitions that we potentially could do within Atlantic Canada. Combining all that together, and our market cap relative to our peers, I think it's an attractive opportunity for investors.

Al Alper, Jr.: Very good. Can you think of anything else you'd like to add?

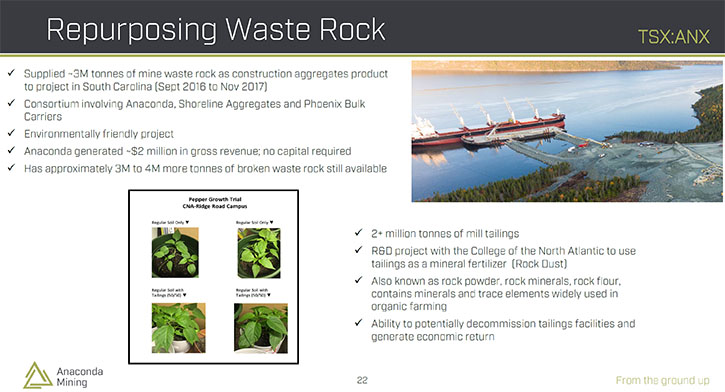

Dustin Angelo: I think one of the things that sets us apart is our innovative mindset and resourcefulness. We do a lot of different projects that are not traditional. In the last year or so, we've actually sold three million tons of our mining waste rock, as a construction aggregates product. We have more rock that we could sell, so we have the potential to do that again in the future. We're also looking at repurposing our tailings and are currently doing an R&D project there to see whether we can make it into a fertilizer enhancer.

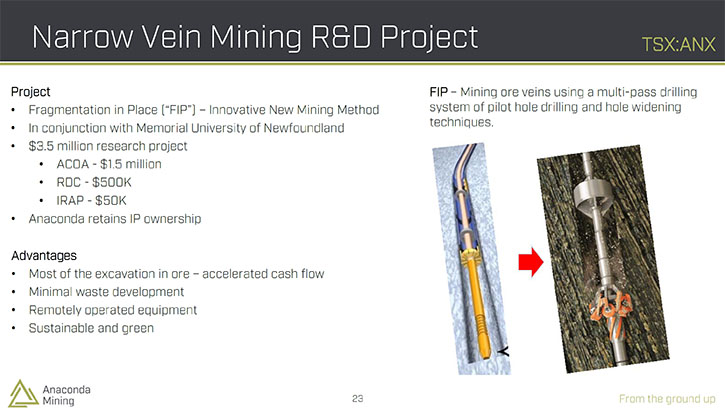

We have a significant project, with Memorial University at St. John's and a couple different funding agencies, to create a new narrow vein mining technology that could potentially make certain deposits economically minable; whereas right now, they're not minable using conventional methods. We would have the IP on that.

Those are some of the things we're doing outside of the box - not typical with junior mining companies. It's all about our mindset, how we look at our company and how we want to grow it.

Al Alper, Jr.: It's all very exciting. Where should people go to learn more about your company?

Dustin Angelo: The primary place is our website at www.anacondamining.com. You can find a lot of information there and in our press releases, on a fairly frequent basis, covering what we're doing up-to-the-minute. Within those press releases are my email and telephone number. I’ll be happy to answer any questions. We’re also covered by M Partners and Red Cloud Klondike Strike in Toronto, if you would like to contact them for a third-party opinion.

Al Alper, Jr.: Excellent! Thank you very much.

https://anacondamining.com/

Dustin Angelo

President and CEO

(647) 260-1248

dangelo@anacondamining.com

|

|