Westhaven Ventures Inc. (TSX-V: WHN):Exploring British Columbia’s Newest Gold Belt; Interview with Shaun Pollard, Director and CFO

|

By Allen Alper, Jr., President, Metals News

on 2/16/2019

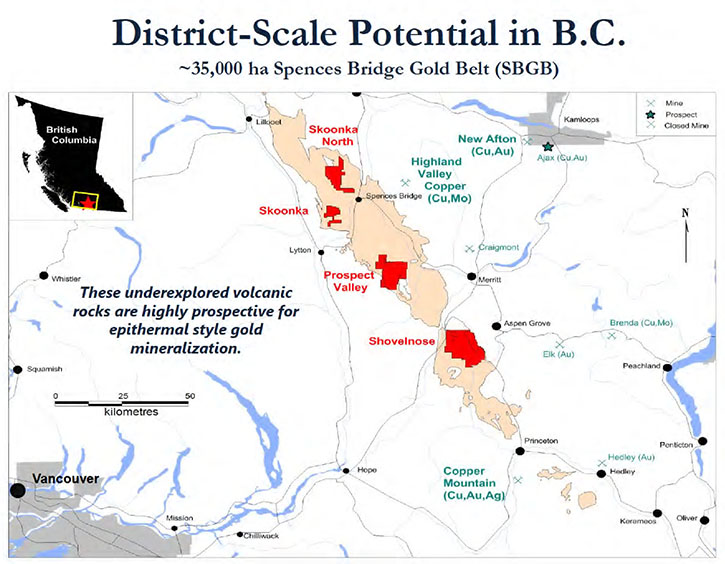

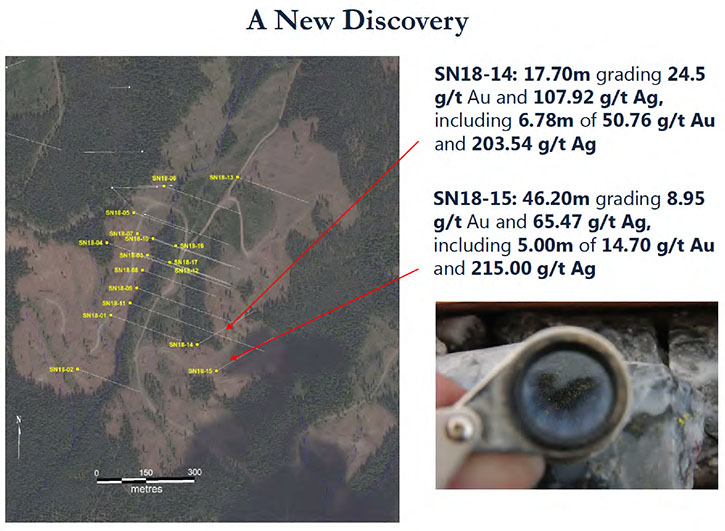

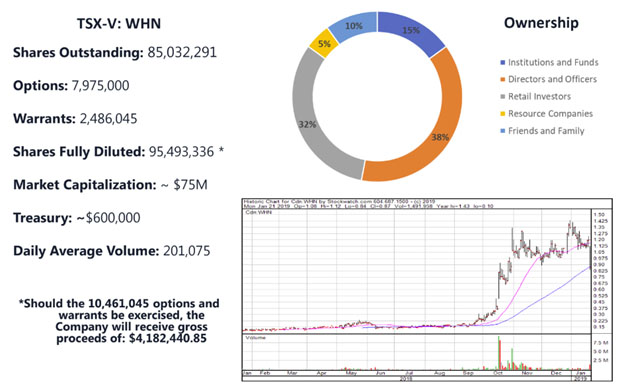

Westhaven Ventures Inc. (TSX-V:WHN) is a Canadian based exploration company focused on advancing its wholly owned Shovelnose, Prospect Valley, Skoonka and Skoonka North gold projects covering over 35,000 hectares within the prospective Spences Bridge Gold Belt in British Columbia. The projects are situated within a geological setting like those which host other significant epithermal gold-silver systems. There is evidence of a significant mineralized alteration system within the property. The proximity to great infrastructure lowers the drilling costs. Recent drilling intersected 17.77 metres of 24.50 g/t Au, including 6.78 metres of 50.76 g/t Au. At the 2019 Vancouver Resource Investment Conference, we learned from Shaun Pollard, Director and CFO of Westhaven Ventures, that their management team has been very successful, to date, making multiple discoveries and creating billions of dollars in market value. The company was the best performing resource equity on the Toronto Venture Exchange for 2018 going from a low of nine cents to a high of $1.43. Plans for this year include a 5-7 million dollars of exploration drilling across the company's properties with the goal to define the size of the discovery before starting the infill drilling.

Shaun Pollard, Director and CFO of Westhaven Ventures at the 2019 Vancouver Resource Investment Conference

Allen Alper Jr: This is Allen Alper Jr., President of Metals News, interviewing. We are here at the Vancouver Resource Investment Conference in Vancouver, Canada, and I'm interviewing Shaun Pollard, Founder, Director, and the Chief Financial Officer of Westhaven Ventures, Inc.

Shaun Pollard: We trade in the Toronto Stock Exchange Venture under the ticker symbol WHN.

Allen Alper Jr: Would you like to give us and our readers/investors an overview of Westhaven Ventures?

Shaun Pollard: Happy to. Westhaven Ventures was formed, and we went public in 2011 with a specific focus on grassroots exploration. Grassroots exploration is the life blood of the resource industry. If new deposits aren't discovered, we'll eventually run out of metals to mine. The people behind Westhaven Ventures and advisors have been very successful, to date, making multiple discoveries, creating in excess of a billion dollars in market value.

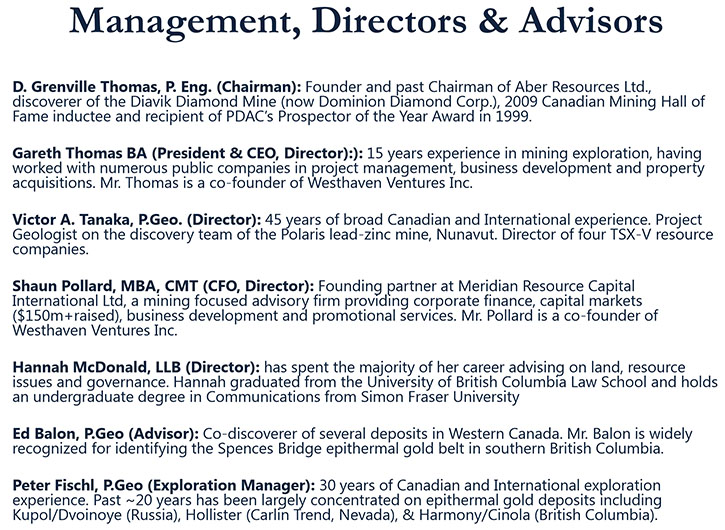

The Chairman, Gren Thomas, is in the Canadian Mining Hall of Fame. He's a “Prospector of the Year Award” winner. Vic Tanaka and Gren Thomas, between them, have about 100 years exploration experience. Ed Balon, Technical Advisor, is responsible for discovering the belt of rocks, which is called “The Spences Bridge Gold Belt” in which we have built our project portfolio.

We have four projects across this belt, about 35,000 hectares across those four projects. This belt is located in southern British Columbia, Canada. It's about a 2 1/2 hour drive from Vancouver, a major international city and hub. We have a six lane highway running through the western portion of our Shovelnose property, and our Shovelnose property is the property for which we've been garnering a lot of attention recently.

We've just announced a high-grade gold discovery. Given its proximity to infrastructure such as access, energy, and housing (only a 30 minute drive from the city of Merritt) we can work this property year-round. We just finished a drill program at the end of December, and we'll be starting another drill program here come February. As it relates to exploration, it's drilling that drives share price. Given our proximity to infrastructure, we can explore and drill for a lot less than it costs to drill and explore in places off the beaten path. This means that we can a lot of work done for a lot lower costs than many places.

Access, energy and housing are three large cost inputs into building a mine. As our Shovelnose gold property is literally off a major highway, close to hydro and natural gas lines, and only a 30 minute drive from the city of Merritt, these input costs are greatly reduced. And given that this infrastructure is already in place, it also means that the time to develop an operation could be greatly reduced, too.

We've recently been generating, what some people are saying are some of the biggest gold drill holes year-to-date in Canada. In fact, we were just informed that we were the best performing resource equity on the Toronto Venture Exchange for 2018.

We went from a 52 week low of nine cents to hitting a high of $1.43. We're currently trading around a buck right now. Why should people consider Westhaven Ventures? Well, drilling success is what drives share price appreciation and we know more now about this particular discovery than we did during the last drill program. We believe the best drill holes are ahead of us; and, we will be drilling again here in about two weeks' time. If you needed a reason to buy, that's it.

Allen Alper Jr: Really Excellent! Tell us a little bit about your drill budget, coming up.

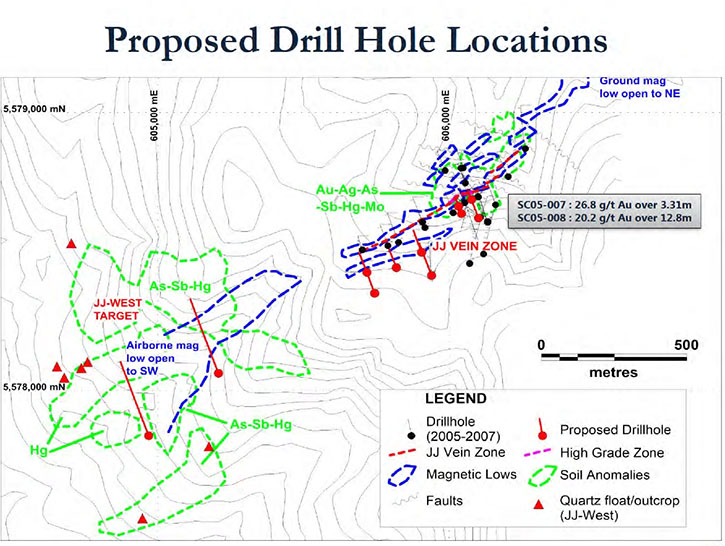

Shaun Pollard: Because of our location, its low-cost drilling compared to a lot of British Columbia. You're looking at just south of $200 a meter for diamond drilling, all in. Last year we drilled about 9,000 meters. This year, we'll likely drill closer to, say, 20,000 meters on this one property, the Shovelnose Gold property. We have another property, too, that is just begging to get drilled. At our Skoonka gold property we have generated 13 targets which would be roughly 3,000 meters of drilling. The Skoonka Gold Property has been able to generate some world-class drill intercepts, such as 20 grams over nearly 13 meters. This year, realistically, we'll spend anywhere from five to seven and a half million bucks across our project portfolio, which is four properties, 35,000 hectares.

Allen Alper Jr: Can you tell us about your share structure?

Shaun Pollard: We've a little over 85,000,000 shares out. Directors, officers, myself included, we own about 33% of those shares. We have Plethora Precious Metals Fund, which is a Netherlands-based resource-focused fund that owns about 15% of our stock. Friends, family, and other resource companies, with which we've done deals to acquire our projects, own about another 15%. So, the float is approximately 35% of our shares outstanding.

Allen Alper Jr: To what do you attribute the increase in your stock price?

Shaun Pollard: Well, because we announced a hole in mid-October that was nearly 18 meters of 24.5 grams, which is about 435 gram-meters, which is an absolute phenomenal drill interception. You don't come across those every day, especially so close to a highway, so close to a city, so close to power. We followed that hole up quite quickly. Only two weeks later, we announced hole 15 of this year's program that ran 46 meters of nearly 9 grams, and within that, we have a 20 meter quartz vein that ran 10 grams. You don't have two holes like that, a hundred meters apart, unless you're dealing with a very large gold endowment and a powerful hydrothermal system. People, I think, are recognizing that.

Allen Alper Jr: What are your plans for the future, as far as putting together your 43-101 and reporting?

Shaun Pollard: We don't have plans to do a 43-101 right now, because it's a new discovery; and, we have to define the size of the discovery first. We’ll continue to drill out from the discovery holes. Once we've defined the extent of this particular zone, we can infill drill. Right now, the world's our oyster.

We have no idea how big this zone could be. In fact, in the most recent drill program, we discovered a second vein zone that runs subparallel to the first. So, whatever tonnage we had before, it looks like we very well could have just doubled that tonnage, with the discovery of the second gold mineralized vein zone. Our geologist seems to think that we're going to have multiple subparallel vein structures.

Allen Alper Jr: So, you're completely open.

Shaun Pollard: Well, we're open to the north, southeast, and east. We have kilometers of potential strike on this. We're not open to the west. The west is where we came from to end up where we are today.

Allen Alper Jr: That’s great! What do you see right now as your biggest challenge?

Shaun Pollard: Our biggest challenge really is advancing this at speed. We've only ever had enough money in the treasury to do small programs. Because of recent success, people are expecting us to go from running one drill to possibly two drills or four drills, et cetera. We want to make sure we grow at a speed that allows us to continue to generate and drill great exploration targets. Finding good people is difficult. Finding good drillers is difficult. We’re very fortunate to have the expertise we have across our geological team. Nobody knows the Spences Bridge Gold Belt better than Ed Balon. He’s the one that, nearly 20 years ago now, arrived at the hypothesis that this belt had the potential to host this style of gold mineralization. He’s spent more time on this belt than anybody else. Peter Fischl, our exploration manager, joined us in mid-2016. Peter’s expertise as it relates to this specific style of mineralization is a key driver in recent discovery success. He has spent considerable time working and discovering ounces at similar style deposits like Kupol and Hollister. And we’ve been working with a great drilling company, too, for a majority of our time on this property called Titan Drilling.

Right now, we have the capabilities. We've demonstrated we can run one drill, one program, successfully. We've just hired a new geologist. We've have another one in the pipes. So, we'll likely move to two drills here in the late-spring. And, maybe, we'll move to four after that. But, right now, it's just really making sure we grow at a speed that suits our access to excellent people.

Allen Alper Jr: So, are you talking about minimizing dilution?

Shaun Pollard: We have no shortage of people offering us money, whether it's corporates or capital markets teams. We also don't need to raise money right now. That’s not to say we aren’t considering it. If the right term sheet came along, then it could make sense. But our next drill program is fully financed from working capital. Also, all of our properties fall within what's called the pine beetle kill area. Pine beetles destroyed forests up and down the province here. The government, to incentivize resource work, gives us 30 cents back on the dollar for every dollar that we spend on exploration across our projects. So, we spent roughly two million bucks last year on exploration. We'll be getting a check here in the first quarter for approximately $600,000 back from the government, which obviously helps with regards to dilution. It will finance the next drill program, because the drilling is sub-200 bucks a meter. That's another 3,000 meters of drilling right there.

Allen Alper Jr: That leads to my next question, because there's a lot of perception that it's becoming more and more difficult to mine in British Columbia. What's your take on that?

Shaun Pollard: I think it would be difficult to get a large open pit permitted right now. We are targeting a high-grade underground mine. Fortunately, with the grades and widths we're getting, recently, it looks like that's a very, very good possibility.

Allen Alper Jr: Okay. Do you have any concerns with permitting?

Shaun Pollard: All of our projects are permitted. Two of the projects have five year permits. At the Shovelnose Gold property, we're permitted up until 2020 as we got our last 5 year permit nearly 5 years ago now. We’ve already begun the process of getting the Shovelnose permit expanded, too. We are considered a high-priority project because of the potential jobs created from a mine coming online in here. We work with the First Nations in the area, we work with the government in the area. We’re focused on being transparent and upfront and keeping people informed as to what we’re doing.

Allen Alper Jr: Can you tell us more about your background?

Shaun Pollard: My background is capital markets. In late 2002 I went into corporate finance, capital markets, investment banking, specifically focused in the resource space. So, I've been fortunate to work, from an advisory perspective, with a lot of companies that have been successful in developing projects that eventually get taken out by major mining companies. But I've never seen a feeding frenzy for a company based on drill results like what I've seen for Westhaven.

Since mid-November, since we put these holes out, we've had approximately a dozen major mining companies come to our core shack in Merritt to look at these recently announced drill holes; because, they needed to see it to believe it themselves. Every single person that's seen the drill core that's been to our core shack and met our geologist, comes back with, "This is the real deal. This could be a multi-million ounce, high-grade deposit." So, we just have to keep our heads down. We have to keep drilling; and, hopefully we keep putting out results like we have in previous holes.

Allen Alper Jr: Excellent! Can you give me the top reasons that investors should be looking at West Haven right now?

Shaun Pollard: Yes. We have a new high-grade gold discovery, easily accessible, with fantastic infrastructure. As previously touched upon, its drilling that drives share price movement in exploration stories and we’ll be drilling again in February. In an ideal world, Westhaven will eventually be acquired by a major mining company. What are major mining companies looking for? They are looking for projects capable of generating big margins that drive big returns. High-grade, multi-million ounce deposits, near infrastructure are certainly capable of generating big margins that drive big returns. We believe that with continued drilling we’ll be able to demonstrate that the Shovelnose property is just that. Continued drilling will eventually prove us right or wrong. Time will tell. So, it's really just keeping our heads down, keeping the drilling going and, hopefully, continuing to hit those high-grade intercepts over sizable distances.

Allen Alper Jr: And you have an excellent management team.

Shaun Pollard: We have a very experienced management team. There are a small number of people that make a large number of the discoveries and our management team is responsible for a lot of discoveries that have produced, are producing, or are going into production.

Allen Alper Jr: Thank you very much. Very exciting! Do you have anything else you'd like to add?

Shaun Pollard: Thank you for the opportunity to be interviewed for Metals News.

Allen Alper Jr: It was a great pleasure, listening to your exciting progress. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

http://westhavenventures.com/

1056 - 409 Granville St.

Vancouver, BC

Canada V6C 1T2

Tel: (604) 681-5521

Fax: (604) 681-5528

Email: info@westhavenventures.com

|

|