Sandstorm Gold Ltd. (NYSE American: SAND, TSX: SSL): A Gold Royalty Company, Portfolio of 188 Royalties, Interview with Nolan Watson, President and CEO

|

By Allen Alper, Jr., President, Metals News

on 8/6/2018

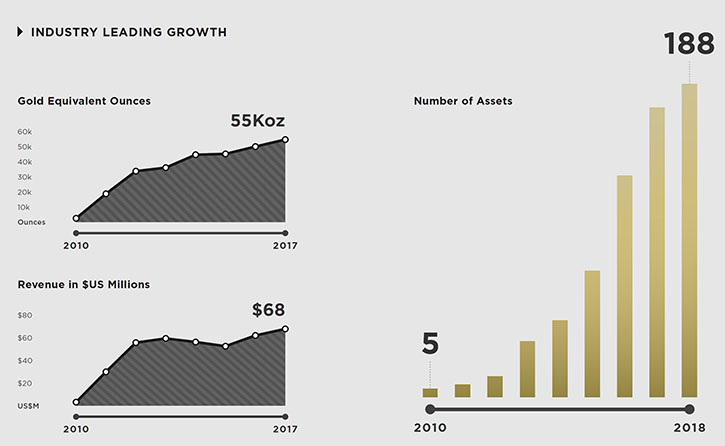

Sandstorm Gold Ltd. (NYSE American: SAND, TSX: SSL) is a gold royalty company that provides upfront financing to gold mining companies that are looking for capital, and in return, receives the right to a percentage of the gold produced from a mine, for the life of the mine. Sandstorm has acquired a portfolio of 188 royalties, of which 20 of the underlying mines are producing. While at the Sprott Natural Resource Symposium in Vancouver, Canada, we learned from Nolan Watson, President and CEO of Sandstorm Gold, that the company found an incredibly profitable niche for itself in deal sizes that range from 100 thousand up to 200 million dollars. Sandstorm's key focus is finding assets that have absolutely enormous exploration upside, and the company succeeded in building a portfolio that is providing huge amounts of capital, so there is no need to raise equity. According to Mr. Watson, the current market conditions are favorable for royalty acquisitions and Sandstorm plans to grow and diversify its low-cost production profile, through the acquisition of additional gold royalties.

Nolan Watson, President and CEO of Sandstorm Gold was Interviewed at the Sprott Natural Resource Symposium

Allen Alper Jr: This is Al Alper, Jr., President of Metals News. I'm here with Nolan Watson, President and CEO of Sandstorm Gold Royalties. We are here at the Sprott Natural Resource Symposium in Vancouver, Canada.

Nolan, tell us a bit about yourself, and then we'll talk more about Sandstorm.

Nolan Watson: I am the President and CEO of Sandstorm. I was one of the founders of the company nine years ago, when we first started up. My background is finance and I’ve spent my whole career in the mining industry.

Prior to Sandstorm, I was Chief Financial Officer of Wheaton Precious Metals, and was, at one point in time, the youngest CFO in the world of any New York Stock Exchange listed company that had a multi-billion dollar market cap. I've spent the vast majority of my entire career doing nothing but streams and royalties.

Allen Alper Jr: So, streams and royalties really are the place to be right now in the gold market. Tell me what Sandstorm is doing and how they are positioning themselves to go against the giants in the industry?

Nolan Watson: Well, one of the benefits that we have, is we don't have to go against the giants in the industry. Their market caps are upwards of 15 billion dollars, and they're doing transactions that are 500 million to a billion dollars per transaction.

We found an incredibly profitable niche for ourselves in deal sizes that range up to 200 million dollars, but down all the way to 100 thousand dollars.

In fact, we recently bought a royalty for 10 dollars, because we made an equity investment in a company at the same time.

We've created a very important niche, where we try to find assets that have enormous exploration upside. That is the key focus, of our technical team and of our corporate development team. We think that we've put together a portfolio of 188 streams and royalties that has huge amounts of exploration upside.

Allen Alper Jr: How do you accomplish this? This must be a very competitive industry.

Nolan Watson: You'd be surprised actually. A lot of people think about how many streaming and royalty companies there are to determine whether or not our industry is competitive. The reality is that our competition isn't streaming and royalty companies, it's any form of capital, whether it be streaming and royalty companies, or debt providers or equity capital markets.

For the first half of Sandstorm's life, the equity capital markets seemed to want to provide almost unlimited amounts of capital to mining companies. That was our main competition. It was really hard to compete.

Those equity markets have completely shut off. Companies can't raise money by equity for the vast majority of situations. Because of that, the number of companies willing to do streams has gone up, and the availability of equity capital has gone down.

So, it's actually less competitive when you consider all forms of capital, then it was five years ago.

Allen Alper Jr: So, is this current market environment actually beneficial for you?

Nolan Watson: Oh, it's fantastic. It really is the best of both worlds in the sense that we have been able to build a portfolio that is providing huge amounts of capital, so we do not need to raise equity.

We can do all the deals we want to do with capital from operations and with the debt facility that we have, which is totally undrawn right now, but we can draw up to 150 million dollars of debt.

And, because all of these other companies can't raise money, it's amazing the deals that we're getting right now. We recently acquired eight royalties. The grand total cost of acquiring those eight royalties was approximately 300 thousand dollars on massive exploration projects.

The reason was because we became a lead order in the equity of these companies, because they can't get any lead orders anywhere else on the equity side of things. So, we're building this fantastic portfolio of royalties with huge amounts of exploration upside, for very cheap because of this market environment.

Allen Alper Jr: Could you explain to us, our readers/investors, how that process works for the mining company.

Nolan Watson: A mining company wants to go out and do exploration on their asset.

They need six million dollars to do it for the next drilling campaign.

The vast majority of bankers are unable to find those companies that six million dollars.

But, if we're willing to put in a million and a half dollars of equity, all of a sudden, they're not looking for six million anymore. They're only looking for four and a half million, and they might be able to scratch and claw that together.

There's also a reputational benefit having Sandstorm in a transaction. So, if they can get Sandstorm as a lead order into an equity financing, then they'll have a much better ability to close that financing and get their six million dollars.

Allen Alper Jr: That's really exciting. What's your cash position right now?

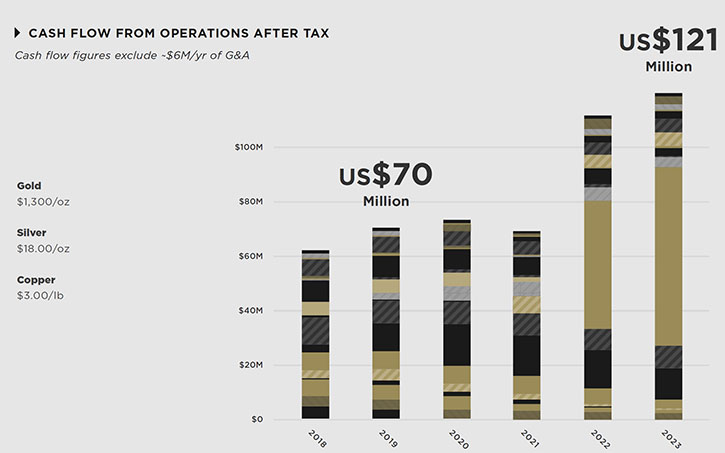

Nolan Watson: We did a massive transaction last year that was 190 million dollars. It used up most of our cash. We then did another 45 million dollar transaction, with cash flow operations, early this year, and that used up most of that cash flow, so we're sitting here with about 10 million dollars of cash, 150 million dollars of available credit and we're cash flowing about 90 million dollars Canadian a year right now. That should be increasing to about 170 million dollars a year Canadian by 2022.

Allen Alper Jr: So, that's just because there're so many bargains out there right now?

Nolan Watson: Well, no that's based on things we've already purchased. That's a great question. That increase assumes we sit on our hands for the next four years, we do absolutely no work. We could lay off the entire company, and you would still see that same cash flow growth.

If we continue to do what we've been doing, which is use our cash flow to grow, that 2022 number of 170 million dollars of cash flow Canadian should be even higher.

Allen Alper Jr: Tell us a bit about your share structure.

Nolan Watson: We have 183 million shares outstanding. We have a few warrants, but they're not very much in the money right now. It's a pretty simple share structure.

Allen Alper Jr: What do you have as far as inside investments?

Nolan Watson: I own quite a bit of stock personally, between my wife and me, we probably own 12 or 13 million dollars’ worth of stock. The rest of management and the board all have significant equity ownership interests.

In fact, our Company policy requires that people have several multiples of their annual compensation as ownership in stock for all leadership positions and all board positions.

We truly believe that management teams and boards need to be substantial owners in stock and be aligned with investors. Rather than be, like many other mining companies, where the CEOs’ interests financially are mostly just their salaries. They don't really care what happens to the equity price.

Allen Alper Jr: So you have skin in the game?

Nolan Watson: Absolutely.

Allen Alper Jr: What do you see as your biggest challenges and what are you trying to do to address those challenges?

Nolan Watson: Candidly, we're sleeping pretty easy at night these days. Right now, in fact, we have so much cash flow coming in that not only are we buying royalties and growing, we're actually doing share buy-backs.

Having too much cash flow to have to buy back your shares is a nice problem to have. I would say if there's one thing that I would like to see eventually, it is higher gold prices so that our shareholders can really truly benefit from our portfolio.

So, maybe my greatest problem right now would be President Trump. He certainly has not been good for the gold price, and we're in the gold business

Allen Alper Jr: Okay. So we're sitting here at the Sprott Natural Resource Symposium, and that means that Rick Rule has a very high regard for Sandstorm. What is Sprott's involvement with Sandstorm?

Nolan Watson: The Sprott organization, through various channels are shareholders at Sandstorm. They largely became shareholders because they loved this asset in Turkey, called Hod Maden, of which they were very significant shareholders. We acquired Hod Maden and once we did, they became shareholders of Sandstorm and have continued to increase their ownership position through that.

I've also known Rick for a very long period of time, and he's actually well acquainted with a number of the geologists and engineers on our technical team. So, I think he has a high regard for the quality of work our team does.

Allen Alper Jr: What are the primary reasons our high-net-worth readers/investors should consider investing in Sandstorm?

Nolan Watson: I would say if they are inclined to invest in gold companies, I truly believe that royalty companies are the best form of investment, because you can get all of the exploration upside and get all of the price upside, but you eliminate a lot of the downsides.

Within the royalty companies, the reason I believe Sandstorm is the best investment, is because number one-we have the most growth, out of any in streaming royalty company in the world, on a percentage basis. Two-we have the most exploration upside, meters per drilled into our properties for every dollar that you invest in Sandstorm, out of any company in the world for streaming and royalties. Three-we trade at the lowest multiples currently on an enterprise valued basis out of any streaming and royalty company, with a market cap at around a billion or higher, and because we have an exceptional team.

Allen Alper Jr: Do you have anything you'd like to add in summary?

Nolan Watson: Just thank you. How are you finding the company overall so far?

Allen Alper Jr: It seems excellent. Very interesting.

https://www.sandstormgold.com/

Nolan Watson

President & CEO

604 689 0234

Kim Forgaard

Investor Relations

604 628 1164

|

|