Mirasol Resources Ltd. (TSXV: MRZ, OTCPK: MRZLF): A Premier Gold/Silver/Copper Project Generator Focused in Chile and Argentina, Interview with Stephen Nano, President and CEO

|

By Allen Alper, Jr., President, Metals News

on 8/5/2018

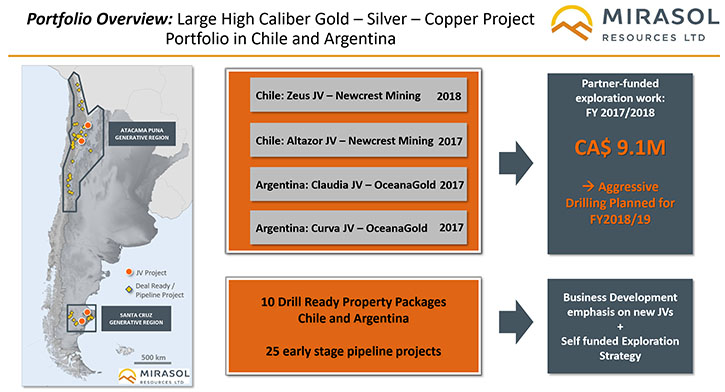

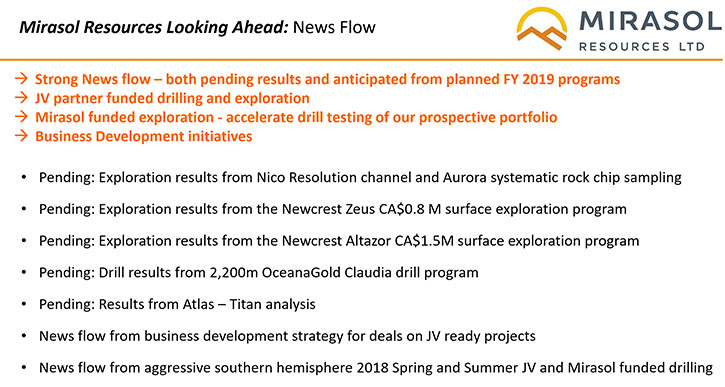

Mirasol Resources Ltd. (TSXV: MRZ, OTCPK: MRZLF) is a premier gold/silver/copper project generator focused on the next discovery in Chile and Argentina. We learned from Stephen Nano, Director, President and CEO of Mirasol Resources, that the company's objective is to discover a world-class mineral deposit. Mirasol uses leading edge geoscience to identify and secure a large portfolio of 100% owned mineral properties that haven't been sampled or drill-tested before. In the last 12 months, Mirasol did four new deals, two of them with Newcrest Mining, in Chile, and two of them with OceanaGold in Argentina. The company and its joint venture partners are evaluating, and planning exploration and drilling programs on its joint venture projects and with CAD 25 million in the bank, Mirasol is also planning to drill two very high-grade, gold-silver projects in Argentina, starting in the spring and summer months of this year (in the southern hemisphere). Rick Rule personally owns a significant position in Mirasol. Combined with Sprott, they own about 10% of Mirasol's issued capital. A really important thing about Mirasol, according to Mr. Nano, is that they are one of the few project generators out there that have gone from a grassroots discovery, with a joint venture partner, all the way through to the sale of the project.

Stephen Nano, President and CEO at the Sprott Natural Resource Symposium

Altazor Gold JV with Newcrest Mining

Allen Alper Jr.: This is Allen Alper Jr., President of Metals News, interviewing Stephen Nano, who is Director, President and CEO of Mirasol Resources. They are a premier project generator, focused on the next discovery in Chile and Argentina. Tell us a bit about your background, Stephen, and then we'll go on to Mirasol.

Stephen Nano: I’m a geologist by trade, with about 30 years’ experience. I started out with, Newmont, Newcrest, MIM, working throughout the Asia-Pacific, North and South America, which is where I built my knowledge base for what we've done with Mirasol Resources, for the last 15 years. I'm one of the founders of Mirasol serving as Vice President of Exploration, until four years ago, when I became the CEO. All of our projects are located in Chile and Argentina, which is where I've spent a large part of my career exploring for other companies. It is a very prospective part of the world for new mineral discoveries.

Allen Alper Jr.: Tell us a bit about your projects.

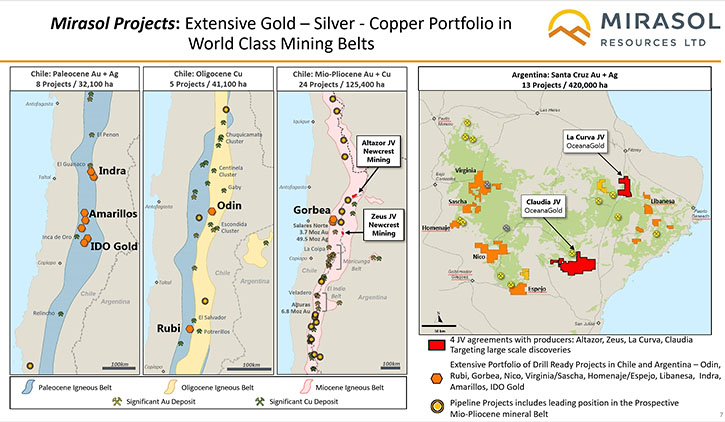

Stephen Nano: That’s a long story for Mirasol, because we really have a very large project portfolio. What we do that's different from other project generators is we use geoscience to actually go out and discover new mineralization. So, 99% of the projects that we have on our books, we've actually discovered from first principals. We find new mineralization that hadn't been sampled and hadn't been drill tested before. Also, our objective is to secure large scale mineral districts.

The advantages of this approach are two-fold. One is that, with large districts, you can attract substantial industry partners to work with you. But also, we generally own 100% of the project, which means we don't have underlying property payments or royalties to other companies or individuals. So, when we do a joint venture with a major, we can get strong deals for our shareholders, and that's a really critical thing, because a lot of joint venture companies don't end up with very much retained equity in the project at the end of the day.

In all of the joint venture deals that we have at the moment, we could hold 20 to 25% of the project funded to production, or if we elect 25 or 30%, that we'll fund ourselves. It is really a substantial position in any success. In addition, the partner has very strong exploration spends, strong cash payments and must deliver fully funded feasibility studies. We can choose not to have to dip our hands in our pocket all the way through to production.

Another really important thing about Mirasol is that we're one of the few project generators out there that have actually gone from a grassroots discovery with a joint venture partner all the way through, and actually vended a project. We made a discovery with Coeur d'Alene a few years ago, just before the major downturn in the industry, so we had a really strong treasury before the market went bad. And that meant that we've been able to counter cyclically build this large project portfolio that we're now leveraging out, now that the majors are back in business looking for projects. In the last 12 months we've really seen an upswing in demand for projects from big gold and copper companies that need to replace resources, because they haven't been exploring for four or five years.

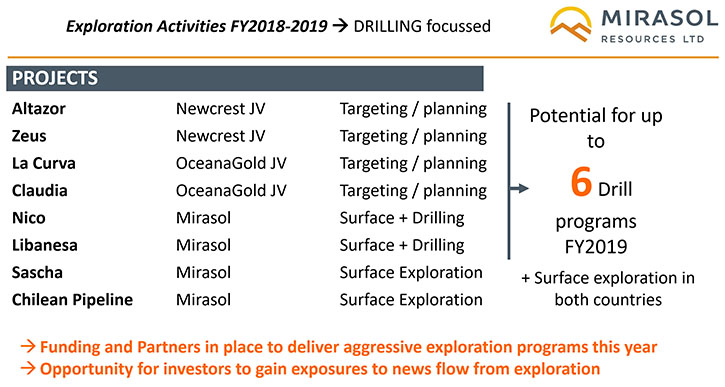

In the last 12 months we completed four new deals, two of them with Newcrest Mining, in Chile, and two of them with OceanaGold in Argentina. The deals that we have with Newcrest in Chile, are eight months old. Together we've just completed about a two and a half million (Canadian) dollar surface exploration program. We're now getting the results in, and we'll be potentially drilling in the southern hemisphere spring on these two projects with Newcrest. With OceanaGold in Argentina, we've completed a first round of drilling on both projects, and planning to go back in for further drill testing in the southern hemisphere spring, at these projects as well. We've also recently raised 8.5 million dollars and now have 25 million dollars in the treasury. The primary reason that we raised this money was to start drilling some of our high-grade projects ourselves. So, on top of the four projects that we may be drilling under joint venture, we are planning to drill two projects that are near mining infrastructure and have very high-grade gold and silver numbers for surface rock chip samples.

In summary, this is going to be an extraordinarily busy year for us at Mirasol, and probably the largest year in the history of the company. We will have multiple drills programs running this year.

Allen Alper Jr.: How were those raises structured?

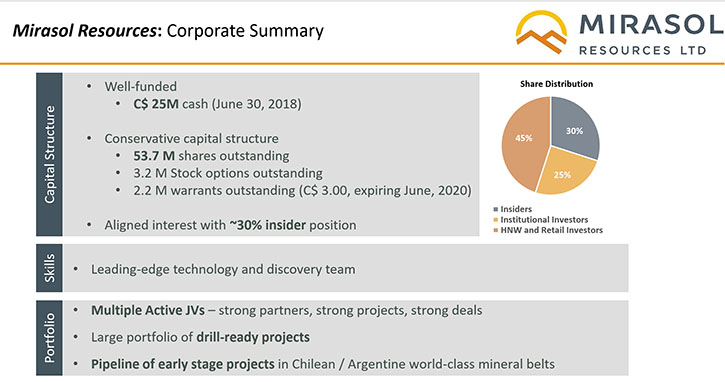

Stephen Nano: It was a single non-brokered, private placement. The majority of those funds came from four institutions, and that was a big step change for us, because Mirasol had been, until this time, almost exclusively a retail investor company. Now we have some quite substantial institutional positions in the company as well. It was really pleasing, as these are very selective funds that cautiously and selectively choose the companies, in which they invest. All of them are institutions that are there to build value with us. We think that's a really good addition to the shareholder base of the company, and of course, a potential source for further funds should we have a discovery.

Allen Alper Jr.: You're here at the Sprott Natural Resource Symposium, so obviously Sprott must think rather highly of you.

Stephen Nano: Yeah, Rick personally owns a significant position in Mirasol, and he has been since the IPO in 2005, and Sprott owns about 10% of Mirasol's issue capital. So, substantial investors, long term investors for the company, and very good supporters. They also participated in many of the raisings that we've done over time.

Allen Alper Jr.: Tell us a bit about your share structure, and also tell us a bit about insider investment.

Stephen Nano: This is a bit of a discriminator for Mirasol, something that sets us apart. We IPO’d in 2005, but still have a very conservative share structure. We have a total issued capital of about 54 million shares, and 25 million dollars in the bank, so really quite a tight share structure for a company that's been out for that amount of time. That really reflects the exploration success and the discoveries that we've had. We've had two discoveries over that time, including a high-grade silver resources that is still in the company, our Virginia project. The project that we discovered under joint venture with Coeur D'Alene, we vended to them. Our share structure continues to be a really significant focus for us. Obviously if you're a shareholder you want your shares to be worth a lot more if we make a discovery, and by keeping that dilution low, we ensure that a significant discovery will deliver a substantial return to our shareholders on a per share basis.

Mirasol has a position of about 30% of the shares held by insiders. There's a bunch of people in this company that get up every morning and are motivated by making sure that we add value for our shareholders.

Allen Alper Jr.: What are the primary reasons our high-net-worth readers/investors should be interested in investing in Mirasol?

Stephen Nano: We have a phenomenal team of people, and this is a people business. We have very capable geoscientists, very capable business people, a very experienced Board, so solid capable decision-making and leading-edge geoscience working together. We have a very, very strong project portfolio, four projects under joint venture, 10 other projects with drill targets defined on them. We have a very strong business development push to bring in new joint venture partners, so we expect flow of new deals coming through the pipeline. Finally, we have about 25 other early stage projects in our pipeline that we continue working up.

For a junior, having 25 million dollars in the bank gives us a longevity and long pathway that you don't normally see with a junior company. That recent fund raising also gives us the capacity to drill test some of these really high-grade, near mine infrastructure projects that we have. We are also partnered with major companies like Oceana and Newcrest. So, it's a really rounded package.

The catalyst for Mirasol is that a significant amount of news flow is coming through from the field. We closed off the southern hemisphere summer season now, and all of those results are flowing in, from a range of projects. We had 9 million dollars spent by our joint venture partners on our projects this year, plus our own work. In addition, there will be multiple drill programs in the pipeline this season, starting in the southern hemisphere spring. So, there are lots of catalysts here for share price increase, and importantly for us, for discovery because that's what will bring the long-term value and the creation of value for our shareholders.

Allen Alper Jr.: What are your biggest concerns, and what are you doing to address those?

Stephen Nano: Obviously we'd like to see a stronger share market, but we're not terribly exposed to that, like a number of the other companies here that need to finance, or need a higher share price to actually go out and try and raise capital. We have a very strong cash position in the bank. Obviously a more responsive market would be a very encouraging thing, but it's not an immediate issue for us, and we really believe that we'll create our own market through discovery. Obviously, everywhere that we explore now, we have to make sure that we are working hand in hand with communities, and working diligently to be environmentally responsible, but we really try to do that right from the start. From the perspective of Mirasol, this is looking like a very exciting year, and we're actually very upbeat about what's in front of us, rather than terribly concerned. This is a real opportunity to see a number of really exciting projects aggressively explored.

Allen Alper Jr.: So, your management team is a plus, tell us a bit more about your team.

Stephen Nano: We have a combination of people, a big focus here is making sure we have the best people, because people drive this business. We have some really high caliber exploration and business development teams, in Chile, Argentina and Vancouver. Mirasol also has a long-term relationship with a consulting group, out of Australia, that does our project generation and geoscience support. This combination means that, for a small company like Mirasol, we do a lot of leading edge science, and we do things that some of the majors can't do, because we can integrate that technology into the field. We are very proud of the team of people, with whom we work.

Allen Alper Jr.: Tell us a bit more about your location in Argentina. How is it working there?

Claudia Gold Silver JV with OceanaGold

Stephen Nano: A large part of our property portfolio is in northern Chile, a safe long-term jurisdiction, lots of operating mines, a part of the world I think most people feel very comfortable with. When I look at Argentina, I compare it to a country like the US, or like Canada, in that, there are mining areas in all three countries and there are areas where you can't mine. Argentina is very much like that. We're focused in one specific province, the Santa Cruz province of southern Argentina, and it's a mining province. When I first started working there about 25 years ago, there was no previous mining history, no previous exploration. There're now seven operating mines, most operated by large scale international mining companies that have operated in Argentina now, some of them for nearly a decade and a half. Of course, Argentina has some political cycles that are challenging, but that province is a mining province. Even through all of the cycles that I've seen come and go through Argentina over the last few decades, those guys are there building new mines, making money, extracting ore or making valued returns for the shareholder. So, for us, Argentina's a prospective jurisdiction, because the province in which we're working, is mining friendly.

Allen Alper Jr.: Excellent. That's good news. So, is there anything else that you'd like to add in summary?

Stephen Nano: Thank you very much for this opportunity. Big year ahead of us. Please watch the space, there's going to be some strong news flow. Come and visit our new website, lots of good information there for people that are investors, or that would like to become investors.

Allen Alper Jr.: Okay, thank you very much for your valuable information. Very interesting!

Stephen Nano: Appreciate that.

http://mirasolresources.com/

Stephen Nano

President and CEO

or

Jonathan Rosset

VP Corporate Development

Tel: +1 (604) 602-9989

Email: contact@mirasolresources.com

|

|