Osisko Gold Royalties Ltd (TSX & NYSE: OR): A North American Focused Portfolio of Over 130 Royalties, Streams and Precious Metal Offtakes, Interview Vincent Metcalfe, VP, IR

|

By Allen Alper, Jr., President, Metals News

on 7/30/2018

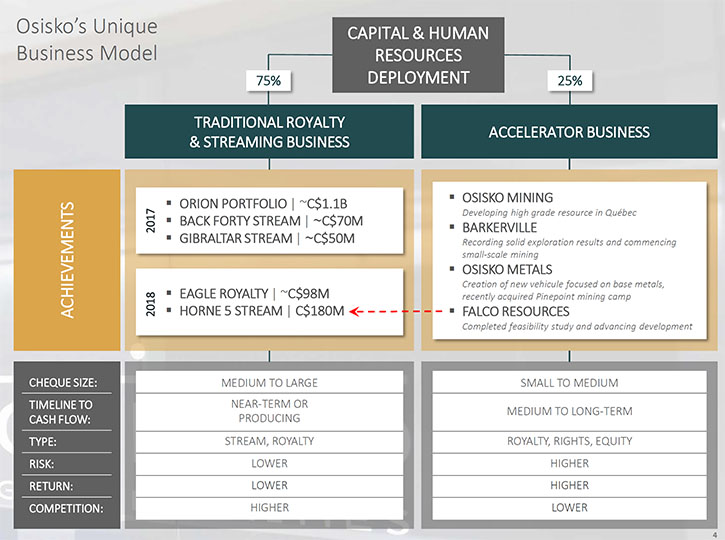

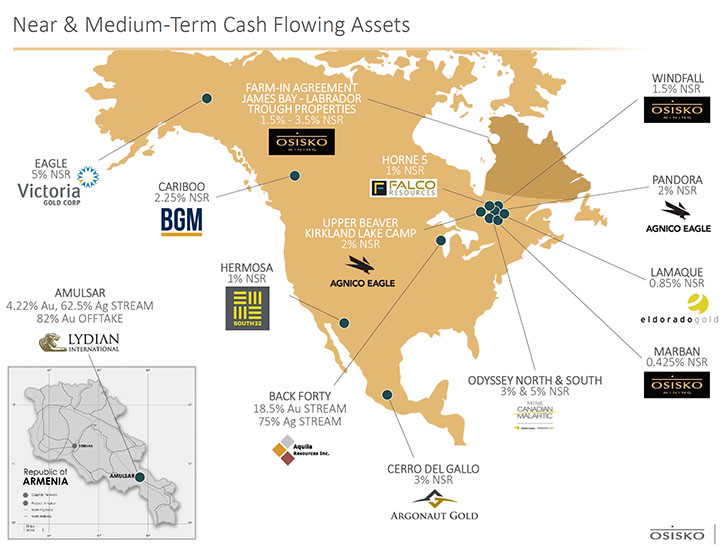

Osisko Gold Royalties Ltd (TSX & NYSE: OR) is an intermediate, precious metal, royalty company, with a North American focused portfolio of over 130 royalties, streams and precious metal offtakes. Osisko Gold Royalties offers investors the unique opportunity to participate in the success of world-class gold mines, such as Canadian Malartic and Éléonore, two of the most precious royalty assets in the sector, with long mine lives and strong potential for growth. According to Vincent Metcalfe, VP of Investor Relations, with Osisko Gold Royalties, the current market provides a lot of different opportunities to do deals on longer term type projects for a reasonable price. We learned from Mr. Metcalfe, that Osisko's business model utilizes two different approaches to royalty business: the first approach is traditional streaming and royalty deals with near-term and in-production companies, the second approach is called the accelerator model that deals with longer-term opportunities, like exploration and permitting stage projects. The accelerator model allows for organic growth and better return on investment.

Vincent Metcalfe, VP of Investor Relations, Osisko Gold Royalties at the Sprott Natural Resource Symposium

Canadian Malartic Mine - 5% NSR

Allen Alper Jr: This is Allen Alper Jr., President of Metals News, interviewing Vincent Metcalfe, who is the VP of Investor Relations, with Osisko Gold Royalties. We're here at the Sprott natural Resource Symposium in Vancouver, Canada. How's the convention going for you?

Vincent Metcalfe: Pretty good. I think it also creates good buying opportunities for a lot of different investors. I think it's important right now to be on the lookout. As a royalty company, we're also getting a lot of in-bounds from junior explorers or junior companies that are looking for some funding. From the royalties’ point of view, it's quite a good time for us to be on the hunt for new opportunities. From that point of view we're pretty happy with the current context of the mining space, but at the end of the day we would like to see a bit more strength on the commodity front.

Allen Alper Jr: Now you're a partner with the show, all the companies here are vetted by Rick Rule. I don't even have to say that about Osisko Gold Royalties. You're unquestionable. Your reputation goes without question. Why don't you tell us, our readers/investors how you've been weathering this market and what your strategy is for the upcoming market turn?

Vincent Metcalfe: We actually like this market a lot because it provides a lot of different opportunities to do deals on longer-term type projects for a reasonable price. At the moment we see a lot of opportunities. We like to focus on Canada. We think Canada still has a lot of opportunities. We like the metal endowment. We like the safety of the low geopolitical risks. So for us, we really like the current format of what we're doing.

We have two different ways of doing business in the royalty business. We have the traditional streaming and royalty business, in which we compete, on a daily basis, with our bigger peers for near term or in production opportunities. But we also have what we call our accelerator model, which deals with longer term opportunities, where we'll put a small amount of money on the equity front and a small amount of money on a royalty, on rights for future streams into a project and help those projects go from the exploration phase, through the permitting, through the technical studies, through the construction phases and hopefully get a better return by doing that.

We are very good at doing that because of our background, because we have built mines, because we've discovered mines. I think that gives us a bit of an edge. It allows us to grow organically as well because we're doing a lot of these small deals, but we're taking future rights on these assets. What I mean by organic is maybe three, four years from now those projects will give us future opportunities, which we already have rights to.

Allen Alper Jr: Can you tell us about some of the companies, with which you're currently working?

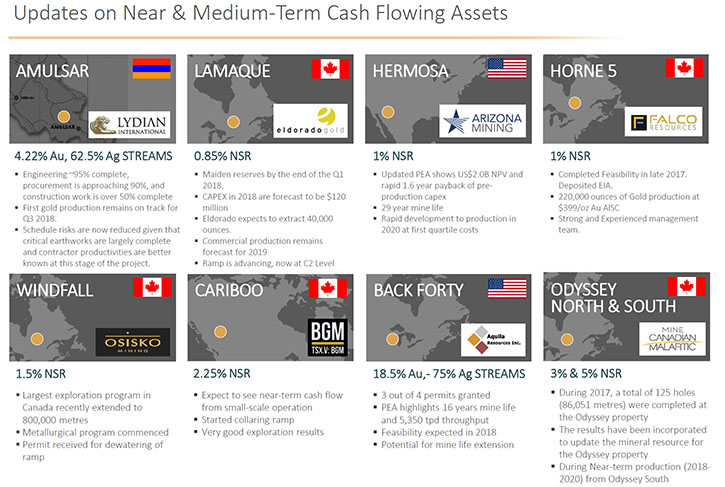

Vincent Metcalfe: Under the accelerator model, we have four companies that are also in house. We have Osisko Mining, which is developing the Windfall Project. We have Barkerville, which is developing the Cariboo Project in B.C. We have Falco Resources, which is developing the Horne 5 Deposit in Rouyn-Noranda. We also have Osisko Metals, who's our base metal company. That company focused on the Bathurst Mining Camp, out east and also on the Pine Point. They just bought Pine Point in the Northwest Territories. On those assets, we have either royalties or we just completed a $180 million dollar stream with Falco Resources.

From that perspective these are some of our recent deals on the accelerator model. On our traditional business, last year, we bought the Orion Mine Finance portfolio for $1.1 billion. We also brought streams on the Gibraltar Mine that's operated by Taseko. Recently this year, we bought a royalty on Victoria Gold, the Eagle Project.

So we've had a very, very busy couple of years, that's for sure.

Allen Alper Jr: When you have a stream on a company, what type of support or help can you give that company?

Vincent Metcalfe: It really depends on the company. For example, when we think the management team in place is doing very well and they don't need any help, we actually let them execute. In cases where we think that we could offer support or offer certain views, we sit down with the company and say, "We have metallurgists. We have mining engineers. We have geologists. Do you want us to give you some additional views on the project?" We try to work with our partners to make sure that if they do have lacks, within their team that we can help them supervise or offer some other type of additional help.

Allen Alper Jr: What are your next steps?

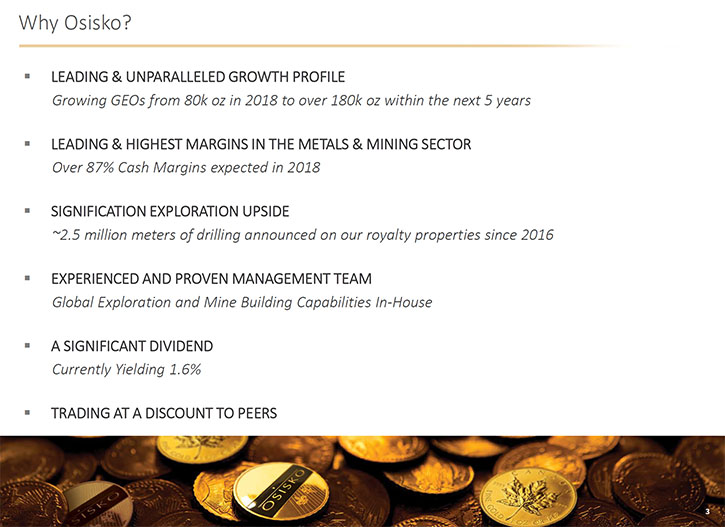

Vincent Metcalfe: Right now I would say it's a great opportunity for the investors. We trade about 1.1 times NAV versus our peers, which are all between 1.6 and two times on NAV. There's a big value gap and that's where lies the opportunity for investors at the moment. There's a possibility that value gap will be bridged over the next couple of years because our portfolio right now is very very new. As it matures, and is de-risked, we'll see that valuation upgrade happen naturally. There's definitely a buying option on that front because even if we don't do anything we're going from about 80,000 GEOs of production this year to 180,000 by 2023, and it's fully funded with our current capital structure in place.

Allen Alper Jr: Do you think that's one of the main reasons that high-net-worth readers/investors should look at Osisko Gold Royalties as an investment? Are there other reasons?

Vincent Metcalfe: Definitely. I think being Canadian focused, being precious metals focused, predominately we're about 84% gold and silver. We have the highest margins in the industry. We're getting about 87% cash margins from our royalty and our streaming portfolio. From that perspective we have a very compelling story.

Allen Alper Jr: What do you think of as your major concerns and what are you doing to address those and make sure that they don't become an issue?

Vincent Metcalfe: As a royalty company, you do the investment and you're somewhat dependent on the operators. Right now the way we control risk is making sure that we invest in projects that we think can go forward. After a while you have to let the operators do their thing. I think that's important, but if certain operators require additional help we offer that, we're definitely proactive on that front.

Allen Alper Jr: Can you tell us a bit about management?

Vincent Metcalfe: Obviously we have a pretty strong management team. We've built the largest Canadian gold mine, in operation, at the moment Canadian Malartic. We could pull on various different skills. Sean and John, John is President of Osisko Mining, but also sits on our board. They have one of the best relationships with investors and institutional clients so they're able to leverage those relationships with future equity fundings and making sure that we're properly funded for the future.

Then we have a lot of people in-house like Bryan Coates, Luc Lessard, Elif Lévesque, who've come from the Cambior side of things, who are more on the building side and construction front. That's where the strength of an Osisko is. We have a lot of different people that we can pull to make all our deals successful and make sure that we operate a good business.

It's the same on the geology side. We have the team from Virginia Mines that was headed by André Gaumond. They're all in our offices as well, so we're able to pull on all types of different operators, management teams.

Allen Alper Jr: Is there anything else you'd like to add in summary?

Éléonore Mine – 2.2-3.5% NSR

Vincent Metcalfe: It's important for us to stay Canadian focused. Mining is pretty hard, so we want to make sure we take all the variables out of the equation. One way is to make sure we’re in a safe jurisdiction, with a great operator. Those are the first steps we need to take when we're looking at a new opportunity.

Allen Alper Jr: Sounds very good. Thank you very much for your insights.

Vincent Metcalfe: Thank you for the interview.

http://osiskogr.com/en/

1100, av. des Canadiens-de-Montreal

Suite 300, P.O. Box 211

Montreal, QC, H3B 2S2

Tel : 1 (514) 940 0670

Fax : 1 (514) 940 0669

info@osiskogr.com

|

|