Goldcorp Inc. (TSX: G, NYSE: GG): A Leading Gold Producer; Interview with Todd White, COO

|

By Allen Alper, Jr., President of Metals News

on 3/22/2017

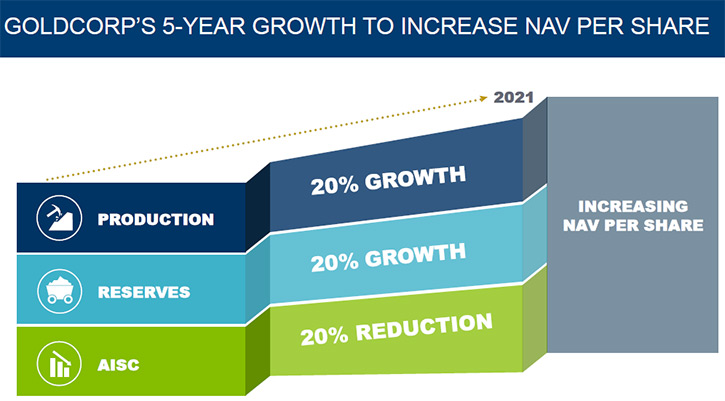

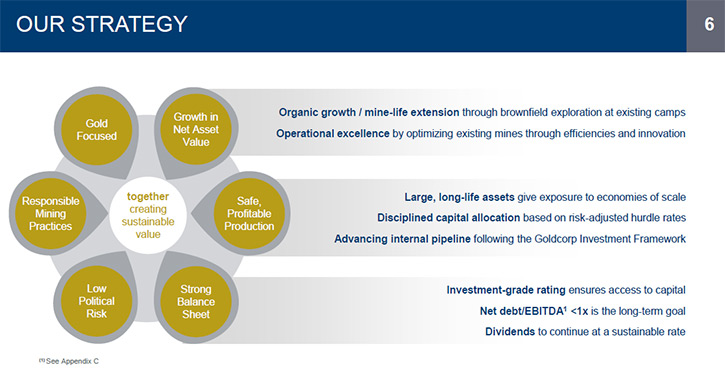

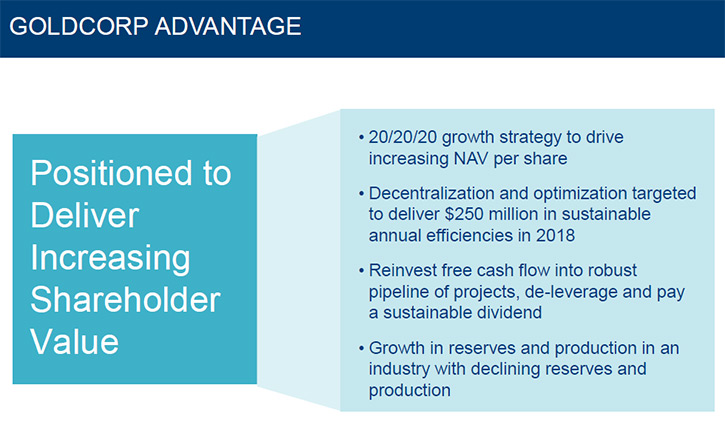

Goldcorp Inc. (TSX: G, NYSE: GG) is a leading gold producer, focused on responsible mining practices and delivering long-term value with safe, low-cost production from a high-quality portfolio of mines throughout the Americas. We learned from Todd White, the COO of Goldcorp, the company set up a very exciting "20/20/20" strategy over the next five-year period: to achieve 20% growth in production, 20% increase in reserves, and a 20% reduction in cost. Goldcorp actively invests in innovation to improve safety and reduce costs as well as their environmental footprint. In the current environment, where we see the trajectory of gold on the uptick, Goldcorp is well positioned in the senior gold market.

PDAC 2017: Todd White, COO of Goldcorp. Allen Alper Jr.

Allen Alper Jr: This is Allen Alper Jr,

President of Metals News, interviewing Todd White, who's the COO of Goldcorp. We're here at PDAC 2017.

Todd, would you like to tell our readers/investors a little bit about yourself and how you find the current environment at Gold Corp, and the conference?

Todd White: I've been in the industry for about 25 years now. I started my career in the gold fields of Nevada. From there, back in 1998, I embarked on an international career. I went to Indonesia, was involved in the construction and operation of the Batu Hijau mine for Newmont Mining. Then I went to Latin America, spent a lot of time in Peru and other countries in Latin America. I also have some experience both in Australia and the African continent. I spent a fair amount of time around the world in the gold mining industry. I haven't worked in other mining industries. About two and a half years ago, after 21 years at Newmont, I came to Goldcorp, and it's been great.

Allen Alper Jr: What's Goldcorp most excited about right now?

Todd White: We're excited because we have a strategy in front of us that is 20% growth over the next five year period in production. 20% increase in reserves, as well as a 20% reduction in cost. We're very excited that our portfolio is set up well. Particularly in this environment, where we see the trajectory of gold on the uptick. We're well-positioned in the senior gold market, so we're very excited about our 20, 20, 20 strategy.

Allen Alper Jr: What are you doing to implement this strategy?

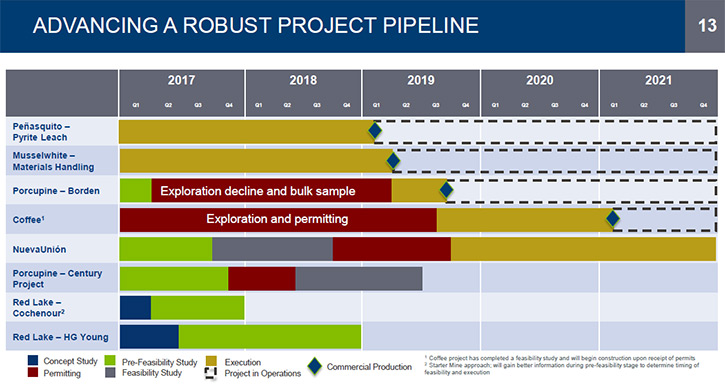

Todd White: The keys to that are a couple of our Brownfield expansion projects. One is our pyrite leach project at our Peñasquito Mine in Mexico, which is recovering gold from pyrite that's currently in the tailing stream. I see it as scavenging the final bits of metal out of that. Second is investments we've made in the Canadian portfolio for increasing production at our Musselwhite Mine through an internal winze. And we are most excited about our large, almost 5 million oz resource at the Porcupine Mine, which we're calling Century. After a century of mining in Porcupine, it's a bit of a resurgence of the Porcupine Camp when we are talking about a large open pit. I would say it’s very similar to the Detour and the Canadian Malartic sort of deposits, and I think that you're starting to see a lot of this in the old Canadian mining camps. This resurgence based on high volume, open pits, as opposed to the underground, narrow vein, high grade.

Allen Alper Jr: What does the mine life look like at Porcupine?

Todd White: The mine life there, in the undergrounds, is almost always difficult to say, because of the fact that these reserves just keep going and going and going. But certainly with Century, we see this as potential for another 25-30 years with Porcupine when Century comes online. We're in the pre-feasibility stage now. That's a large resurgence of the Porcupine camp.

Todd White: Last year we closed a transaction on Kaminak in the Yukon. We see Yukon as a very, very prospective area, a target rich environment. It's one of these scenarios, where we have so many opportunities there, beyond just the initial 2.5 million ounces of reserves at the Coffee project, which we’re in the process of permitting 60,000 hectares, very little of it has actually been tested on surface. Everywhere we're testing, its gold anomalies and many of them haven't even been followed up yet. It is our major emphasis in our exploration program right now.

Allen Alper Jr: The mining industry has been coming off some really tough times. Could you talk about how you overcame those, and what that did to Goldcorp?

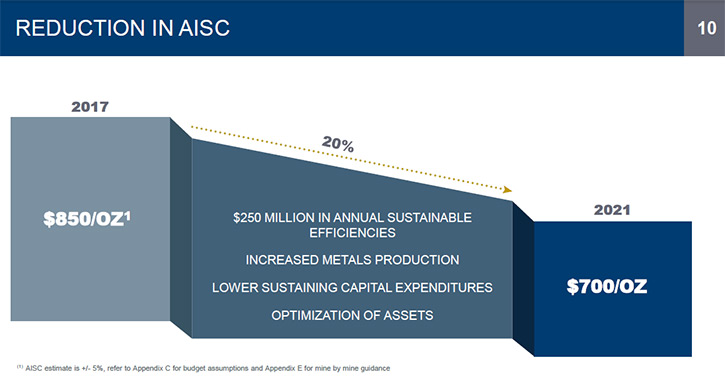

Todd White: Gold prices were down at the time we were in a major capital build with the Cerro Negro mine in Argentina as well as the Éléonore Mine up in Northern Quebec. Now we have very young assets relative to some of the other senior golds out there. Peñasquito is still relatively young too. I think when you can bring younger assets into the portfolio, in the timing we see now, as they ramp up to full production; I think we came out of it OK. Now that we've come through the capital spend, and we're in the ramp up of these mines, we're emphasizing cost cutting. We see a trajectory of our cost down 20% in the next five years. Going from more or less $850 All in Sustaining Costs last year, to about $700 an ounce in 2021. We have an upward trajectory on production, downward trajectory on costs. That generates a lot of buzz for us.

Allen Alper Jr: What do you see now as the biggest challenges you face and what are you doing to smooth those over?

Todd White: I think the major challenge for any gold company is always the reserve base. So, it's the future beyond the five years that we see in front of us. If you look at the gold industry in general, reserves across the board are declining, as opposed to increasing. One of the things we think about is partnerships. You may have heard Dave Garofalo, our CEO, speak about partnerships with our peers in the industry, to share the risk, share the cost, but also bring together very competent technical minds from a couple of companies to address some of the challenges with large scale, undeveloped deposits that are out there. We're really focused on the partnership aspect.

Secondly, we're looking at investments in innovation, which allow us to reduce our costs, reduce our environmental footprint, whether water or energy. Which we see as big challenges to overcome. Particularly on some of these large scale deposits. We're very focused on water efficiency, directly related to our tailings management strategies. Tailings are one of the big legacies we have, but it's our number one use of water in the operations.

Clearly in the regulatory environment, from a social-community-environmental angle, water's a very significant concern. We're developing breakthrough technology in how we manage our tailings on large scale projects. Filtered tailings work well on our smaller scale, high-grade underground deposits, which may be two to eight thousand tons a day of processing. When we look at the large scale +100 thousand ton projects, we're trying to advance the technology to the point where we get the economies of scale. Filtered tailings technology out-competes traditional slurried tailings from a capital and optics perspective. We're partnered with some very credible people within the industry on this. Which, again, I think goes with our theme of partnership. I think in our industry, we need more partnerships, because I don't think any of us can go this alone and really make the step changes that we need to make a strong future pipeline become a reality.

Allen Alper Jr: What do you see that future pipeline being? What are the future requirements for gold?

Todd White: I think we will always have a component of our portfolio that's going to be underground focused. But they're deeper. The deeper we go, we need to be much more efficient. Ventilation is probably one of our number one costs in the underground environment. Particularly the deeper you go, you're pushing more and more air down. One of the things we've done, that I'm incredibly excited about, is with our new Bordon project, which is 120 kilometers from the Porcupine camp. We've made a decision to go forward with a fully battery powered electric mining fleet in that mine. I'm not aware of anyone else in the world that's done a complete fleet like this. But we have a bit of an advantage, because of the fact that it's a brand new operation. When we deploy a complete battery-electric fleet, obviously the diesel emissions are lower, the heat generation is lower, all of this relates to lower ventilation. We think that the next generation of underground mining is going to be done with battery-electric equipment, autonomous equipment. This is a lot of what we're focused on for our underground portfolio.

Conversely in the large scale open pit, I think it comes down to efficient energy and water. I talked about the tailings, but we're also working very hard on next generation grinding circuits. We're targeting design of new circuits that are safe, somewhere between 30%-40% less energy use than a traditional sag and ball mill circuit.

So when we combine the filter technology, which is about an 80% reduction in water, and we combine that with a step change in our grinding circuits of 30% - 40% energy reduction, clearly both of those bring our cost structure down on these big deposits and allow us to improve the economics. That's really, key for us going forward. We could continue to build these large scale deposits as they've always been built, but I just don't think that's good enough for us. That's where we're focused. That was one of the big catalysts for the DISRUPTMINING, event as well. I was a judge on Sunday night with respect to that event. To really try to spur some of that innovation.

Allen Alper Jr: I'm hearing a lot of things. So you're looking at clean energy, efficiency, safety ... Elaborate a little bit more on what's behind the technology. I hear the technology, I hear what you’re doing, but I also want to hear a little bit more about the motivation. Why you're picking these technologies? What they're bringing? How they're de-risking the venture?

Todd White: Absolutely. You touched on it. Culturally for Goldcorp, our culture is very much around people. I think you hear a lot of people talk about that, but clearly, when we think about the people and we think about the safety aspects, we think about innovation. Goldcorp is a very innovative company to begin with. What I'm trying to do is accelerate that pace. To me, it comes down to when we talk about our partnerships with governments, or our partnerships with communities, our partnerships with our employees, to be completely frank, I think all of these things we're talking about lead to a much better outcome for the whole. To me I think it's driven by a company culture that looks at the long term, understands what it takes, what the expectations are out there now from those groups and I believe that we're building the next generation of mines. To me that's the big driver of our company culture. We take a longer term view, but we're also very innovative, committed to our people, committed to our communities because we see this as a long term business proposition and not a short term one.

Allen Alper Jr: Thank you very much. How long have you been involved in PDAC and coming to the show?

Todd White: Certainly since I've been with Goldcorp. We're a platinum sponsor. I think we've been in that level for a number of years. It's interesting to watch the ebb and flow of the show over time. This one is a good one. People are enthusiastic. I think there's a lot of opportunity out here.

Allen Alper Jr: Metals News has been a PDAC media partner for about 15 years now and you are right. I think this show is a good one. Thank you very much for your time. I appreciate the opportunity.

Todd White: Thank you. Allen, it was nice meeting you.

|

|