Auriant Mining (NASDAQ: OMX) Russia’s Largest, Public, Junior Gold Producer

|

By Allen Alper Jr.

on 1/8/2015

Denis Alexandrov, CEO of Auriant Mining (NASDAQ: OMX), took time to speak with Metals News regarding the progress of the company and their gold production at the Tardan and Solcocon gold mines located in Russia. Mr. Alexandrov said, “My background is in finance. I spent five years with Price Waterhouse Coopers in Russia dealing mostly with gold mining clients and energy networks. That was the beginning of my career. Then I moved to work for Alfa Group which is one of the biggest investment groups in Russia. I moved to work with them and actually spent two years in London working as a finance controller for a major commodity trader – Crown Resources.” Denis Alexandrov, CEO of Auriant Mining (NASDAQ: OMX), took time to speak with Metals News regarding the progress of the company and their gold production at the Tardan and Solcocon gold mines located in Russia. Mr. Alexandrov said, “My background is in finance. I spent five years with Price Waterhouse Coopers in Russia dealing mostly with gold mining clients and energy networks. That was the beginning of my career. Then I moved to work for Alfa Group which is one of the biggest investment groups in Russia. I moved to work with them and actually spent two years in London working as a finance controller for a major commodity trader – Crown Resources.”

At that point, Alexandrov’s career turned towards working in gold mining, experience that would be necessary for his work with Auriant. He said, “Then I worked with Highland Gold, a major Russian listed gold miner, where I spent three years as CFO and ended up a Board member. That was a good time for gold production, from 2003 to 2006.” After working for Highland Gold, Alexandrov focused on work with private equity funds. He said, “I did a project with a small oil and gas company and then I moved on to work for a private equity fund that invested in gold mining assets in Russia. We built two gold mines and sold them and then I moved to work for A1, which is one of Russia’s largest private equity firms where I was the CFO and then became a managing director responsible for metals and mining, including Russia, Uzbekistan and some other parts of the world. As a result, I built up 15 years experience in finance and mining.”

Alexandrov’s experience with A1 led him to Auriant. He said, “From A1, I met with a shareholder, Preston Haskell, and in May, 2012, I joined the company as the CEO.” The initial work with the company was to determine where the company was in terms of strategy and assets and how to move it forward. Said Alexandrov, “At that time, it was a company that produced very little. There was one mine that still needed to be commissioned. There was a shortage of expediency and finance, and a shortage in terms of human resources, so there were a lot of issues that needed to be resolved, including formulating the company strategy and where the company was to go and how we were to get there.”

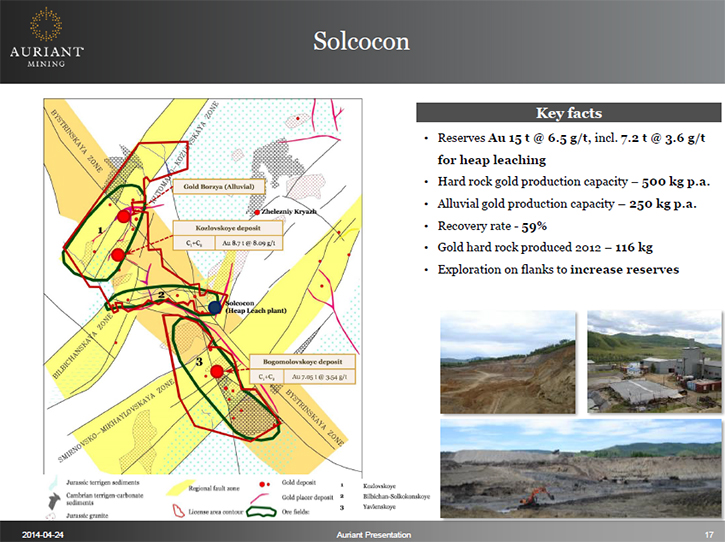

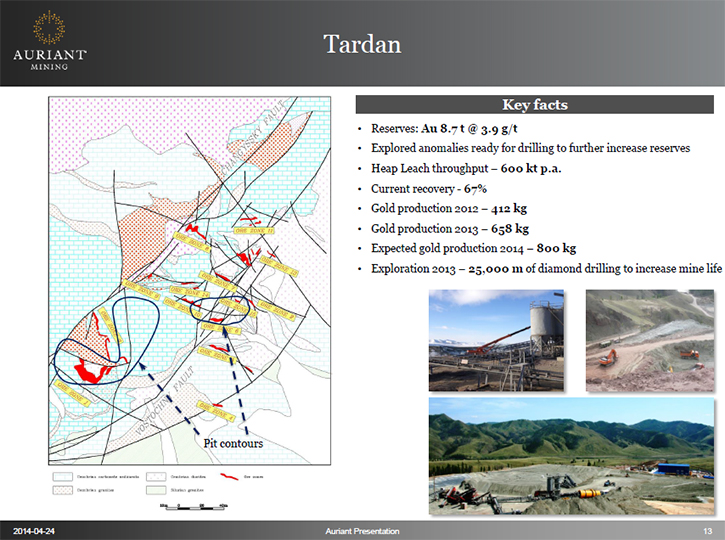

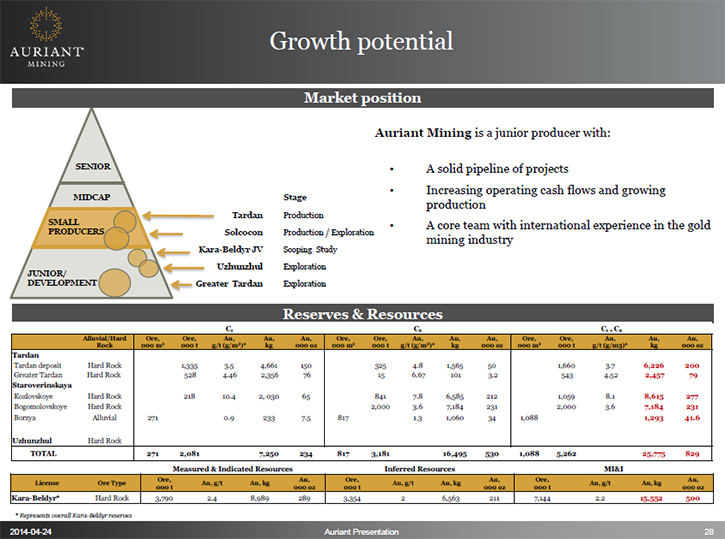

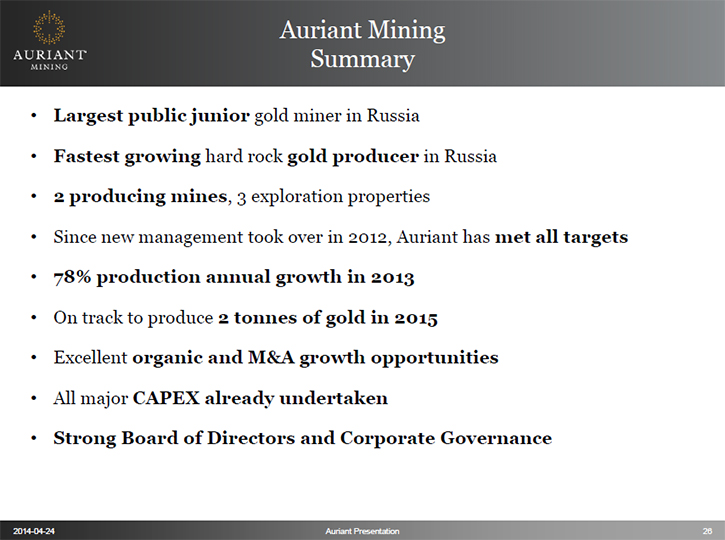

Working through these issues is what has marked Alexandrov’s tenure as the CEO. He said, “That is really how I got involved with Auriant. Auriant Mining is a junior producer. The key shareholder, Preston Haskell, is an American who used to work in Russia who is interested in gold assets. He invited me back in 2012 and at that time we didn’t know where we wanted to go or where the company wanted to go in terms of strategy and how it should be developed. After meeting, we decided that we wanted to become an intermediate gold producer and devised our strategy based on three different goals. One is to develop our flagship Tardan mine and bring it to full production. The second was to use our exploration licenses to increase the reserves and resources of the company and bring those into production. The third involved the fragmented nature of the gold mining industry in Russia. We wanted Auriant to play a consolidation role in the market so that we could be one of the top ten producers. If you look at the Russian gold industry, there are six public companies that account for 60% of the country’s gold production. The rest is produced by some 400 companies. That is where we see our potential. In terms of progressing on our strategy, we commissioned our Tardan mine in August of 2012 and started production. We are on track to achieve full production in 2016. We spent money on exploration in 2014 and were able to add 3.5 tonnes (110 koz) in reserves. We are continuing despite the dip in the gold prices.”

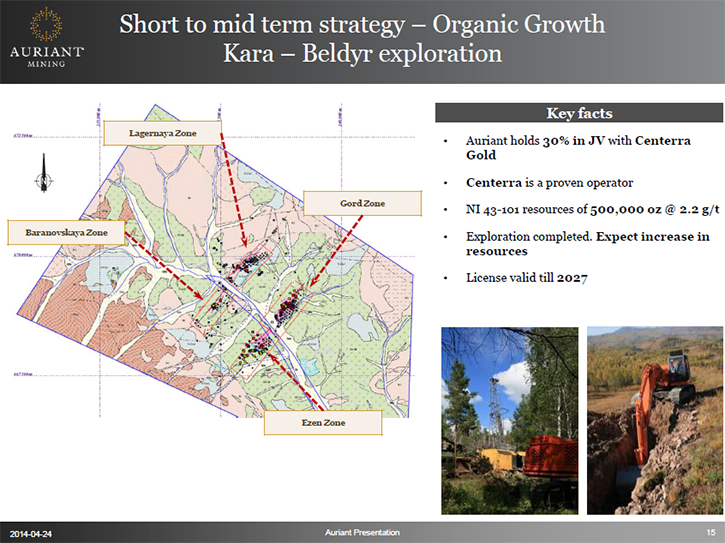

The company is also focused on mergers and acquisitions to drive profitability. Said Alexandrov, “For our M & A, we closed a deal last month where we bought out 70% of a mine for a royalty of 3.5%. That was a joint venture with Centerra Gold Inc., where they have put money into the exploration and we bought out their stake for a royalty. That deal was closed and I believe it is a very good addition to our portfolio. It is located about 200 kilometers from our existing mine, which puts it within a region. We are very well positioned to develop the mine and capture synergies with our existing mining operations in the area. This is the first example of the use of a Net Smelter Royalty in gold mining in Russia.”

Commenting on Auriant’s long term strategy Alexandrov said, “We see tremendous opportunities for gold mining in Russia. Russia has around half a billion ounces of gold in the ground and we expect that shortly it will become the world’s second largest gold producer. There are hundreds of deposits, including quite a few world class deposits, and hundreds of miners, but very few publicly listed companies. Therefore I feel, given our successful track record, we have an excellent opportunity to grow through M & A and engage in consolidation. We have set ourselves the aim of becoming an intermediate Russian gold producer in the medium term.”

Alexandrov believes that Auriant is an excellent option for investors. He said, “I think one reason is that for people who are looking for an opportunity to invest in Russian gold miners, there are only six publicly listed large gold miners. We are the largest junior gold producer, with excellent corporate governance, all the proper procedures and a very strong Board of Directors. We want to grow and see the potential for growth. We want to bring those opportunities to the market. We have a professional group of managers and mining professionals. We are of the opinion that this is an exciting jurisdiction because it is so big and growing fast. The mining environment here is very good in comparison to our peers in the region. The government has a hands-off approach to the mining sector. We are a junior so we do have a good upside for growth, but we are a producing junior. We have the cash flow to continue to grow.”

Stockholm office

Auriant Mining AB Box 55696

102 15 Stockholm, Sweden

Telephone + 46 8 624 26 80

Fax: + 46 8 624 37 20

Email: info@auriant.se

Moscow office

Vereyskaya Plaza - 1

29, Vereyskaya str., bld 154

121357, Moscow, Russia

Telephone: +7 495 660 22 20

Fax: +7 495 660 22 20 ext. 129

Email: info@auriant.ru

|

|