CPM Group Managing Partner Speaks at Silver Summit on Outlook for Silver Market

|

By Allen Alper.

on 1/28/2014

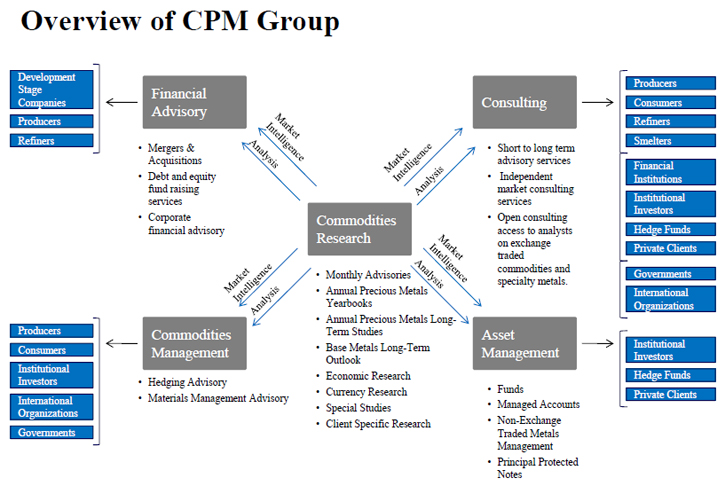

Jeffrey Christian, the Managing Partner of CPM Group, known for their analytical services, gave Metals News a preview of the information they will share at the Silver Summit. Said Christian, “CPM Group has been around for 27 years. We used to run the commodities research group at Goldman and we bought it out. We have a tremendous amount of knowledge in the precious metals markets.” The company advises businesses, institutions and high-net worth investors on the silver market. Christian said, “We do a lot of basic research. We advise central banks, investors, and users.”

CPM Group has been attending the show for about 8 years, since about 2005. Christian said, “I’m speaking at the show. I’m talking about the outlook for silver and the economy. Our outlook for the economy is that it will muddle through. We are a little concerned about the events in Washington right now. There are a lot of problems that have not been dealt with by governments like US, Japan and Europe that will continue to hang over them. Unemployment will continue to be a problem.”

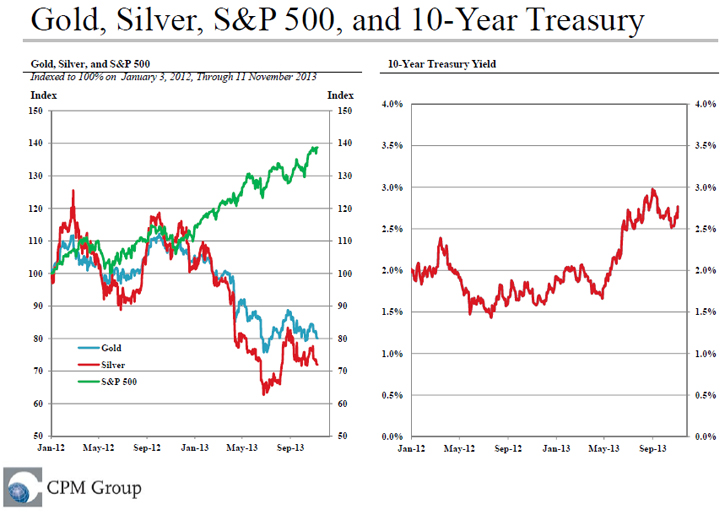

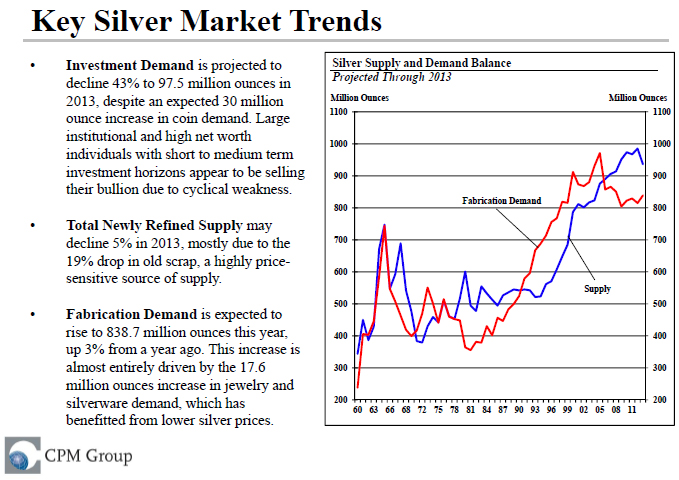

All of these issues affect the silver prices. Said Christian, “We think that silver prices may have fallen as much as they are going to fall. We expect silver to rise going into 2016, perhaps sharply, depending on what is going on in the world economy. The major problem is what we see in Washington. The problem is long term. The idea that the Congress and administration can’t get together and run the country is a long-term problem – you are already seeing the effects on the markets. You are seeing that the government can’t do what it needs to do to correct the debt solution. That stalemate is causing global investors to be concerned. That will cause issues with us being able to borrow.”

Overall, Christian believes that the government has been stalemated. He said, “If you look at the stalemated government over the last six years, that’s been a problem. We follow all precious metals. A lot of our work is in gold. We also follow base metals, energy, and agricultural commodities. We are not quite as bearish on gold as we are on silver. We are looking at a gold price that will probably run sideways, maybe up to $1450 on the high side.” The CPM team sees changes in the market in the mid-term. Said Christian, “We are looking at a consolidation period over the next few years. This depends on what happens in the global economy. There is a lot of activity in the gold futures markets. A lot of investors are getting out of gold. Over the last ten years, you have seen a lot of investors come into the gold and gold ETF market. A lot of those investors have been exiting the gold market, which accelerated during 2013.”

While the company does specialize in metals, they don’t advise their clients about mining companies. Christian said, “We follow junior and larger miners. We don’t report about them. We follow them partly because we advise a lot of them about their exposure to the market.

We also advise institutional and high net worth investors as part of our work. It is important to understand where future mine production may come from.” The reason they don’t offer advice on companies is due to their business model. Christian said, “We are not equity analysts.

We have always been pro-hedging. We will help companies to hedge their production that allows them to still benefit from price increases. What you are seeing in silver is companies that are cash starved, and the equity and debt markets are not there for them. When you do find money, they want you to hedge. As companies negotiate debt facilities to keep themselves going, we advise them on their hedge. We can do this in a way that is much better for the mining company than the bank. This is a way for them to present themselves in a more favorable light. We are very interested in royalty companies. They serve a very good function in terms of providing financing. They are also attractive to investors. If we are working with a junior mining company, if they need financing, we will advise them on a full range of financing sources. We aren’t a broker-dealer. We can introduce them to investors who may be interested in an equity position and we can talk to them about a debt position if they need it. We will also look at novel financing like a prepaid forward financing as a way to generate cash.”

According to Christian, the financing outlook is horrific. He said, “It’s worse than I’ve ever seen to get financing. It is worse than 2008, 2009. The ability to raise financing at this time is really terrible. It makes it more important for the companies and for the institutional investors. These guys have to justify the risks they are taking. It is a very hostile environment. We can advise them on this hostile market. Before you start talking to financing sources, you have to do a survey of the financing market. We do require a work fee, but we take most of our compensation on the success fee, which significantly reduces the cost.”

What are some of the larger topics that investors should consider? Christian said, “One of the big topics in the real market is that we see a large pullback of gold purchases by central banks. We think it is a price thing. With the price falling and falling persistently, they are waiting to see how far it will fall. It is a cyclical drop.”

CPM Group offers specialized research and advising for companies and investors in the precious metals markets.

For more information on their offerings, visit www.cpmgroup.com.

Contact

30 Broad

Street, 37th Fl

New York, NY 10004

T: (212) 785 8320

F: (212) 785 8325

info@cpmgroup.com

|

|