Ron Tremblay, President and CEO reports - Levon Resources (TSX: LVN) Expands on Cordero Silver Project in Mexico with Acquisition of Final Claim

|

By Allen Alper.

on 1/17/2014

President and CEO of Levon Resources (TSX: LVN), Ron Tremblay, took some time to speak with Metals News about the current state of their Cordero Silver project and that overall state of the market.

Said Tremblay, “We are in very good shape, considering the market, we are sitting in the catbird seat. We have about $45 million in the bank. We have $4 million coming back from our IVA tax refund in Mexico.., We finally got the Aida claim, that is the center of our resource, that is an important piece that we needed to get. We have been dancing around it, so we are pleased to finally be able to come to an agreement because of the bad market.”

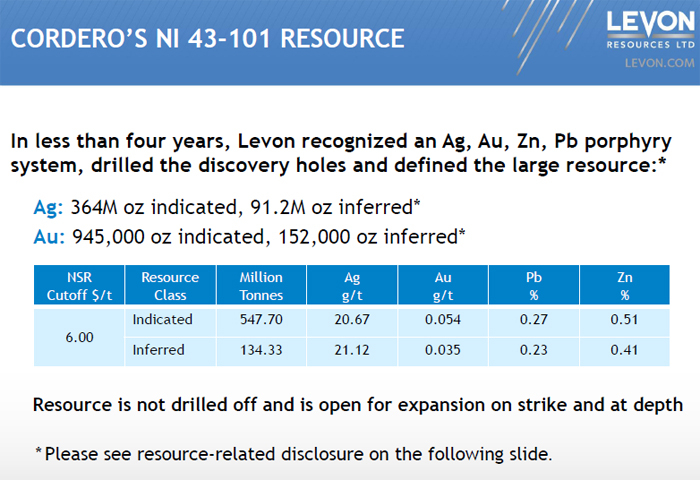

The challenging market is what allowed Levon to be able to acquire the final claim. Said Tremblay, “The bad market and low metals prices have played into our hand. We would never have been able to get that claim if the market had been like it was a few years ago. They wouldn’t even talk to us. We have begun drilling and we are planning on drilling 14,000 meters which should give us pretty good coverage over the 16 hectares of the claim. We expect to drill about 20 holes in the area, hopefully the resource extends through the claim, and it will be very positive. We will release the results in an updated resource once the drilling is completed and everything is received from the lab. Overall the company is in an excellent position even though the market continues to struggle. Said Tremblay, “We are funded and have the last claim. We own everything 100%. It will take us into the middle of February to complete the drilling. Then we will put together all the pieces into an economic model and we’ll wait to see what will happen with the metal prices. When they will change, I don’t know. I don’t know if anyone understands what is going on out there. If Bernanke can’t figure it out, we are in trouble. It absolutely makes no sense. Obviously, the price is heavily manipulated. Silver is tied to gold, so if the price of gold goes down, it all goes down. We have around 500 million ounces of silver, plus 1.2 million ounces of gold and about 7 billion pounds of zinc and 4.5 billion pounds of lead. It is a world class polymetallic system.”

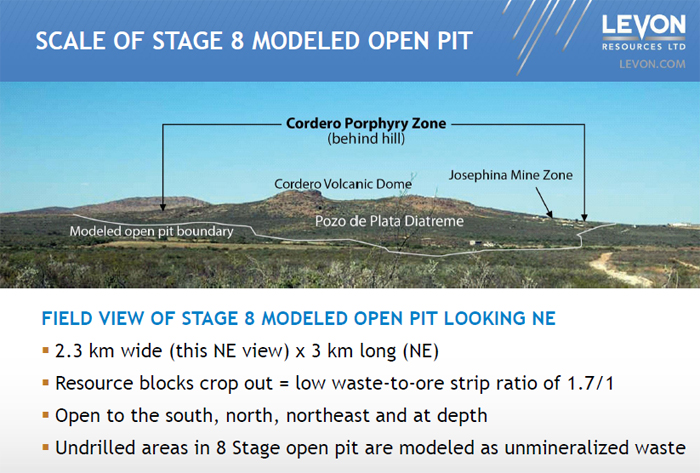

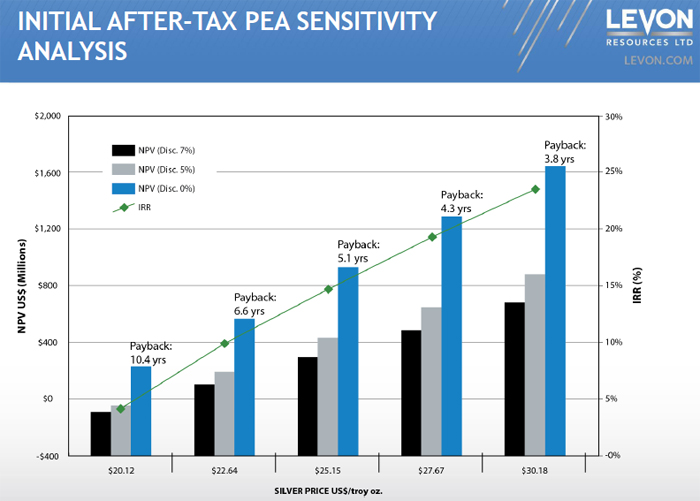

Levon has completed an economic assessment on the Cordero project, well before their final acquisition. Tremblay said, “We did our initial PEA on about 30% of the project. We wanted to show people that we could move along without the central claim. This will be an open pit project, about three km long by about 2.6 km wide and down to approximately 1000 meters in depth.”

This positive PEA, plus their solid financial position means the company is in enviable shape.

Said Tremblay, “We have no debt. We are good for ten years or longer depending on how long we want it to last. We haven’t issued any shares in two years. We are probably the only exploration company on the TSX that hasn’t issued any stock in over two years. We haven’t even tapped into the last financing yet. We still have another five million we haven’t even touched yet. We watch how we spend our money and do everything we can to get a return on it. We are spending $3 million on this program. We should hold about the same after we get the IVA Tax refund back.” With their available funding, the company has looked at other acquisitions, but hasn’t settled on any options. Tremblay said, “We have looked at a lot of companies, but a lot of them are not worth pursuing, they have made deals that are unreasonable, and we would simply be bailing them out of the mess they created. It is tough out there these days. There are all sorts of issues that operating companies face like unions, so you can’t just shut it down, and you can’t make any money.”

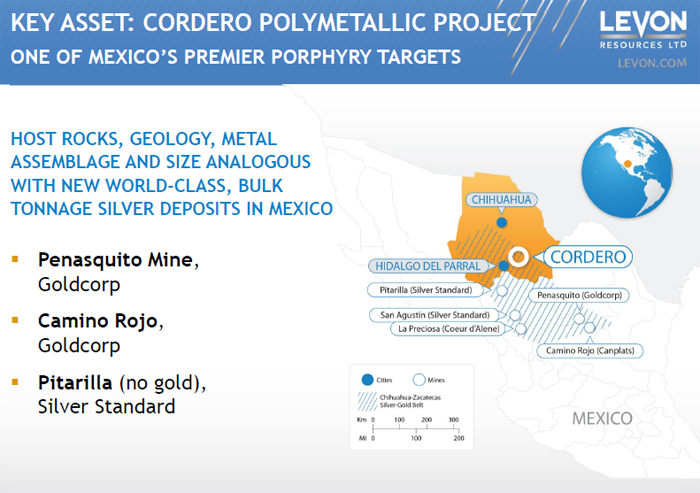

Part of Levon’s success can be attributed to the area where they are working in. Tremblay said, “We have a good location. We are in a good area that is a well-established mining area. We have the support of the local government and the state. The people want us to build a mine there. The more we drill the more the grades improve.” Ultimately, Levon’s goal is to enter into a larger deal with a company that specializes in production, an area that Tremblay and his team are not interested in venturing into. He said, “There’s only so much money we are going to spend on it. We are showing people what we’ve got. We will make sure our money lasts until we get bought out or until a JV comes along. We are not mine operators. Building a big mine requires a big management group with expertise in that area. When that time comes we’ll get together with the right people.”

Tremblay, like many other mining companies experiencing challenges in the market, are cutting back on the amount of travel they are doing. He said, “Conferences have become a business and they are a complete waste of time. The Round Up in Vancouver, the PDAC and the Silver Summit are the ones we like to attend. They can’t fill most of them up anymore.”

Why does Tremblay believe that the market is such an issue? He said, “It is a crazy world that we live in right now. There is no market economy anymore. Financial groups rape the Libor market; they make multiple billions of dollars and get a fine of $500 million dollars. What’s to stop them from doing that if all they get is a fine of 5%? Throw them in jail and see how many times they do it. There is no real penalty for doing what they do, so they do it in all of the markets, including the commodities market, which has been deadly for the companies in mining” (Libor stands for London interbank offered rate. Libor is a key benchmark rate that reflects how much it costs banks to borrow from each other. It is the reference rate for over $300tn of financial products, including: corporate loans, interest rate swaps, mortgages, credit cards, and savings accounts.)

Though policy changes and market environments are always an issue, Levon Resources sits in an enviable position with financing in place and a valuable resource.

Levon Resources Ltd.

Investor

Relations

Greg Agar

ir@levon.com

Tel: 604.682.2991

Suite 900, 570 Granville Street

Vancouver, BC V6C 3P1

Tel: 604.682.3701

Fax: 604.682.3600

|

|