Do Hyung (DH) Kim, Executive Vice President and Bob Middleton, Geophysicist of NMC Resource Corporation

Introduction

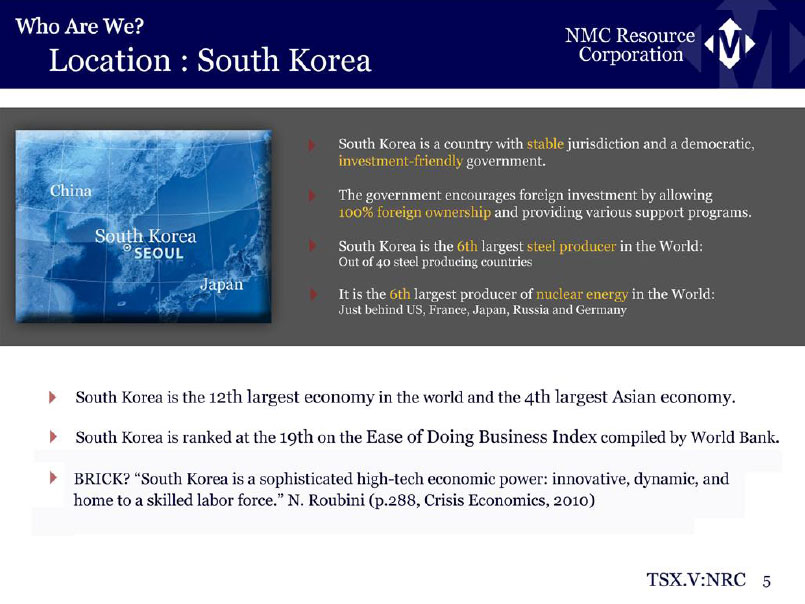

Located strategically between Japan and China, NMC Resource Corporation (NRC: TSX-V) is currently operating a producing molybdenum mine in South Korea. NRC fast-tracked mine development during the economic meltdown and commenced production in April 2010.

We recently had the opportunity to speak with Executive Vice President, Do Hyung (DH) Kim. DH Kim started out his business career at Merrill Lynch in addition to teaching business courses at Korea University.

DH Kim was also joined by the Company’s Geophysicist, Bob Middleton.

History

Though NMC Resource Corporation is a relatively young company, it is a part of Dong Won Resource Group (Dong Won) in South Korea. Dong Won has been in the mining industry for coal, oil, gas, gold and iron since 1962, so they’re not new to the game. Dong Won owns 64% of NRC.

Property & Production – Molybdenum

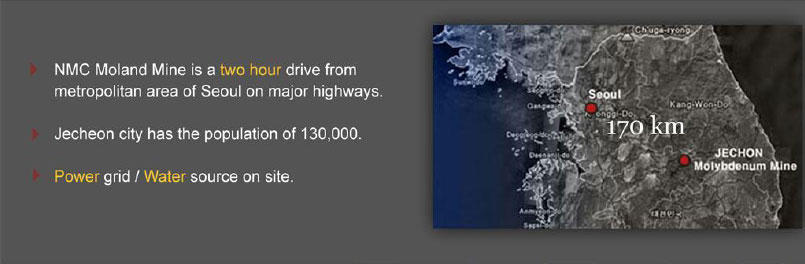

The NMC Moland Mine is located in South Korea about 170km southeast of Seoul with a good location and high-quality deposit.

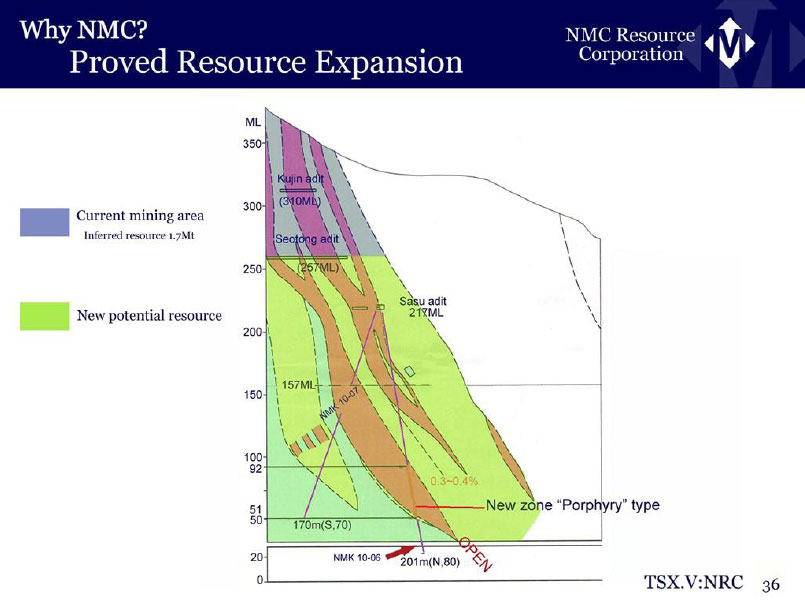

DH Kim shared, “It’s all highway to the mine site. It’s located in an old mine town, so we have very good skilled labor in the town. And it has a very good deposit; high grade—0.37% average grade. Also, recently we found a new type of deposit called silicious porphyry phase, and the average grade shows about 0.31%...”

NMC is the only producing molybdenum mine in South Korea and Japan, milling an average of 800tons of high-grade molybdenum per day.

“For the second quarter, we produced close to 200,000 pounds of molybdenum,” shared DH Kim.

When asked about the life span of the mine, DH Kim shared that though they’re not exactly sure how many years of mine life they’re looking at, they are in the process of extending the mine life as much as possible, and they’re still looking for the end of the resource area.

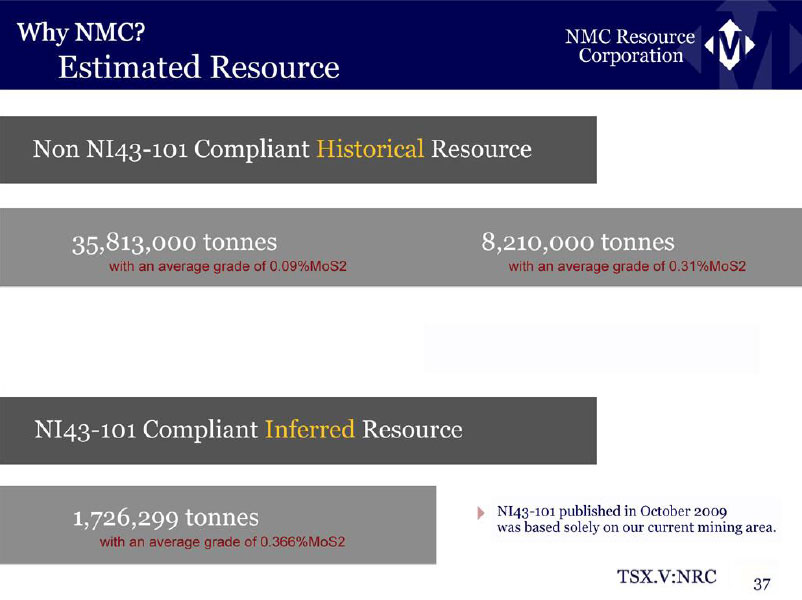

DH Kim stated. “The NI 43-101 compliant resource is only an upper body where we are currently working in terms of mining; that’s 1.7 million tons. And at this time, by finding the lower body, we basically tripled the resource area.”

Bob Middleton added, “There could very well be a global 8 million tons sitting here. So, (NMC Resource Corp) was already looking at 14 years of (mine life), but they’re only mining in the upper levels at this time. That’s where the 1.7 (million tons) resource was, but my 43-101 report estimates this could be as much as 4 million, and that was bringing it down to a year. So, below the lowest level, this is where the blue sky potential is and there are 7 holes that are going into the lab in Canada for analysis to expand the resource,” he continues, “So, you’re probably going to be looking at 14 or 15 years of production at least here…and they’re running at a lower scale because they’re playing with the grind size; they don’t want to grind too fine and waste too much energy. So, they’re grinding a coarse grind, and they’re getting 88% recovery from that. As they expand the mill in the future, it will probably go up to 96% recovery by putting in a secondary re-grind circuit.”

In regards to cost and production, DH Kim stated, “…in terms of cash cost, we are very competitive with other moly players. For the first quarter of production, we recorded cash cost US$7.23 per pound of molybdenum.”

Recent Activity

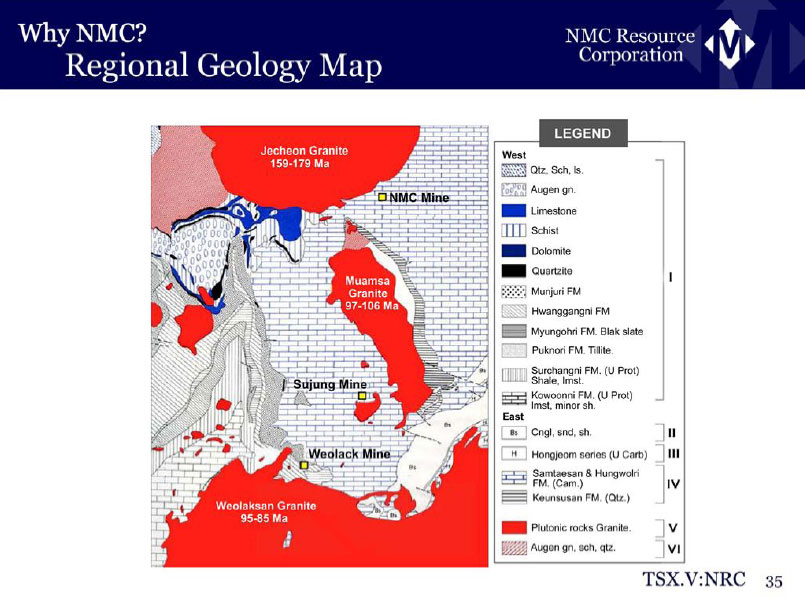

In elaborating further on NRC’s current production activity, Bob Middleton shared more about the mineralization changes and their importance to potentially improved efficiency and lowering of mining costs.

He emphasized, “…NMC Resource announced the deep drill hole that intersected a 35-meter molybdenum zone beneath the deepest level of the mine, and that is where it’s going to triple the area of ore resource potential. But what’s important is that the geological nature of the mineralization changed a bit. We’re coming out of the skarn mineralization, which they’re presently mining, into an intrusion phase. It’s a very silica-rich phase from the granite intrusion.” He continued, “These deposits are formed usually as contacts with the granite and limestone. The limestone is the host rock, and that mineralization has the potential of hosting much wider zones of mineralization which means the mining methods and the efficiency of mining will change and the cost will actually be reduced as it becomes much wider at depth.

Next Steps

In regards to what’s next for NRC, they continue to move forward to develop their resource and expand production.

DH Kim shared, “We will study production expansion plan by finding more resource below the current working area.”

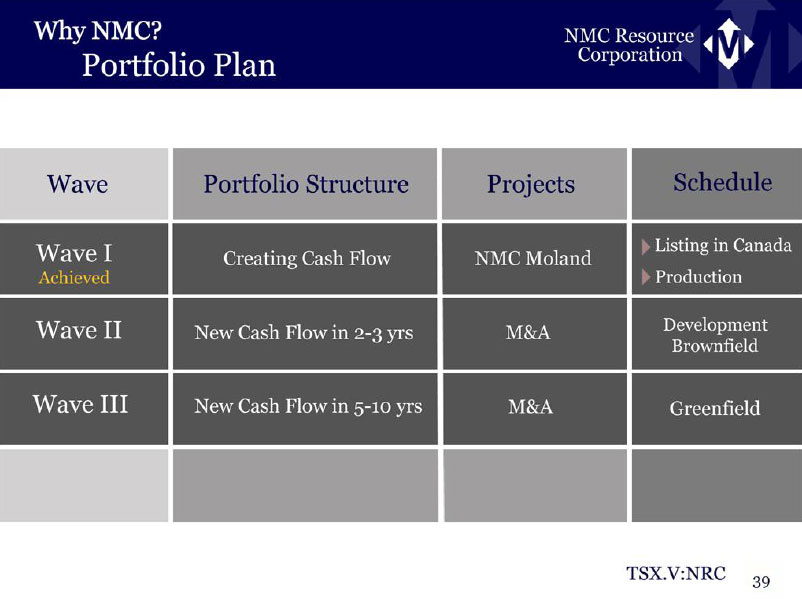

In addition to their current property, NRC is in search of other assets to acquire.

“The key is to identify some assets that we can develop and put into production for the coming 3 to 4 years, so we can have another cash flow model in the near future,” DH Kim shared, “…In terms of the kind of asset, the first priority is molybdenum because we believe that the molybdenum market is growing, and other industrial metals are good targets.”

Challenges

When asked about potential challenges NRC faces, DH Kim shared the following:

“Delivering the true value of our company to the market is our challenge. And we are new in the Canadian capital market and not many people know about us. Some people may think that this is a small deposit because we show only 1.7 million tons. Also, since we’re in production, some people think that we may not have a strong upside. However, we have a strong future value proposition. We keep expanding deposit size. We can create better cash flow by riding on the upside of moly price, and by expanding production size. Moreover, if we become successful in acquisitions, we can deliver great value to our shareholders.”

Reason to Invest

The fact that NRC may be undervalued, per Kim’s perspective, provides an interesting company for investors to evaluate. He shared, “Even though we’ve been here just for a short period of time, people do know of our existence in Canada. Because of that, if you can look at our market capitalization, it’s very much undervalued; at least from my perspective.”

For more information about NMC Resource Corp visit www.nmcresource.com.

Canada

Vancouver Office

NMC Resource Corporation

Suite 500, 666 Burrard Street

Vancouver, British Columbia, Canada

V6C 3P6

Tel: 604.643.1730

Fax: 604.642.6192

Email: communications@nmcresource.com

Korea

Seoul Office

Dong Won Building 3F, Dangjoo-dong, Jongro-gu, Seoul, Korea

Jechoen Office

292 Daejang-ri, Geumseong-myeon, Jecheon-si, Chungcheongbuk-do, Korea 390-822