Energy Fuels Inc. (NYSE MKT: UUUU; TSX: EFR) Currently Producing Conventional and ISR Uranium at White Mesa Mill in Utah and Nichols Ranch ISR Facility in Wyoming

|

By Allen Alper Jr.

on 1/2/2016

Curtis Moore, Vice President of Marketing and Corporate Development, discusses how well positioned Energy Fuels has become with a strong balance sheet, significant organic growth potential, and ISR and conventional uranium production.

Mr. Moore took the time to update Metals News readers on the progress that the company has made during the last several years and how they have become the fastest growing uranium producer in the U.S.

Mr. Moore said, “The biggest thing that has happened to Energy Fuels over the last two years is that we acquired a company called Uranerz Energy Corporation in June 2015. That acquisition gave us in-situ production in our portfolio. Previous to the Uranerz acquisition, we only produced uranium using conventional techniques. Now we have both types of production in our portfolio.”

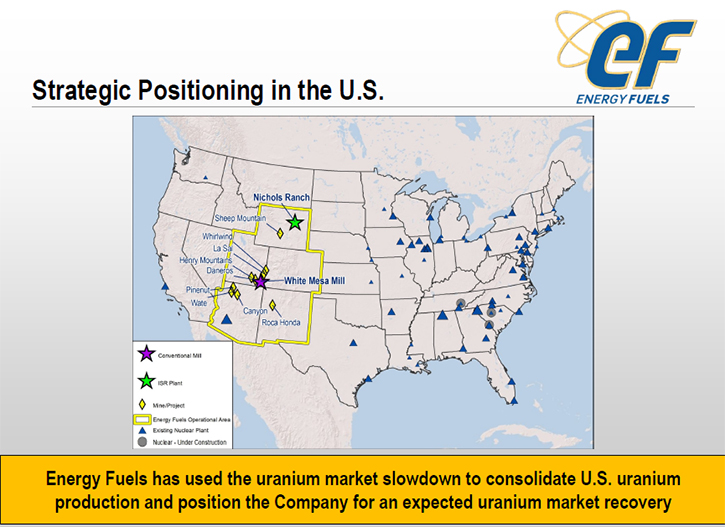

ISR production has opened several doors of opportunity for the company. Mr. Moore said, “We still focus on the United States, but now we have both conventional production and ISR production in our portfolio, which should make us more attractive to global utilities. We are one of only three companies in the entire world that have both ISR and conventional uranium production, the others being Cameco and Areva. I think it is pretty clear that Energy Fuels is emerging as the dominant uranium producer in the United States. We are continuing to grow. We are continuing to expand production at our Nichols Ranch ISR facility in Wyoming. We are operating the White Mesa Mill, which is the only conventional uranium mill in the United States. We are developing a new mine in northern Arizona called the Canyon Mine, which is a very, very high grade uranium mine with grades that exceed one percent U3O8. We are very excited about the prospects moving forward into 2016.”

There is great optimism at the company and several executives recently bought over 1 million shares of stock representing over 2% of the shares outstanding. Mr. Moore said, “Insider buying of the magnitude we are seeing in our company should be telling. We are very optimistic about the long term future of this company. The reason I think that people should be interested in Energy Fuels is, number one, we are a uranium producer. We are actually putting uranium in the can right now, and we are selling our product to utilities around the world. There are some other names out there that have good projects, but it is a whole different story to be actually putting uranium in the can and delivering it to customers. We have production capabilities, both on the ISR side and on the conventional side. I think it also needs to be emphasized that we own the only conventional uranium mill in the United States, the White Mason Mill in southeast Utah. If anybody has conventional ore that they need to process, it has to come to us. Either we will mill our own material or people will pay us a fee to mill theirs. That places us in a highly strategic position, being the only conventional producer in the U.S., the largest nuclear market in the world.”

Prices continue to be a factor for the company as well as the mining sector as a whole. Mr. Moore said, “Aside from our actual production capabilities, I think that the differentiator for energy fuels is leverage to rising uranium prices, optionality to rising uranium prices. What I mean by that is that as uranium prices increase – and we have seen them increase over the last couple of years – Energy Fuels will have some of the best leverage to those prices. Not only will we see increased revenues from our existing production, but we have the capacity to bring on significantly more production and realize additional revenues. Our White Mesa Mill has a licensed capacity to produce 8 million pounds of uranium per year. Our Nichols Ranch Processing Facility has a licensed capacity to produce 2 million pounds of uranium per year. We are going to produce about 900,000 pounds in 2016. So, while we are a major producer today, we have a lot of excess capacity we can utilize and bring online over the next few years.”

While the company is moving ahead in production, there are challenges with the overall direction of the uranium prices. Mr. Moore said, “Uranium prices are our biggest challenge. Not a lot of people make a lot of money at the current price. Market risk is our biggest challenge.”

Mr. Moore does believe that the prices will increase considerably in the future. He said, “There are a lot of reasons to believe they will increase in the future. China is building out a big nuclear program, and it is bigger than most people think. They will possibly have three times more nuclear generating capacity in five years versus what they have now. Japan is restarting their nuclear reactors as well. They restarted 2 units last year, and they will start two more reactors in the next month or two. They may restart six or eight this year. The United States has five units under construction right now and TVA is getting ready to start a new reactor in the first part of 2016. This will be the first new reactor in the U.S. in 20 years.”

The company believes it is well positioned to benefit from a rebound in uranium prices. Mr. Moore said, “We expect to average about $58 per pound for our contracted material in 2016, which is well above today’s spot price in the mid-$30’s. However, when you look at exposure to rising uranium prices, we have considerable quantities of uncommitted potential production. Energy Fuels has excellent exposure to spot prices since we can bring so much capacity online.”

Part of the plan for the company has been to acquire and merge with other companies. Mr. Moore said, “Energy Fuels has been a lead consolidator in the United States. We acquired Denison Mines’ U.S. assets and Titan Uranium in 2012, Strathmore Minerals in 2013, and Uranerz Energy Corporation in 2015. We are always looking for good deals, and we are of course known as the main U.S. consolidator. The low price environment of the past few years has actually been a great opportunity for us. In 2016, we are looking to expand production at Nichols Ranch. We are developing the Canyon Mine in Arizona. By Q3 we should be at depth on the ore body and perform some underground drilling to better delineate, and hopefully expand, the known resource. 2016 should be a great year for us.”

http://www.energyfuels.com

Energy Fuels Inc.

Victory Building, 18th Floor

80 Richmond St. West

Toronto, Ontario M5H 2A4

General Information:

U.S. Office

Energy Fuels Resources (US) Inc.

225 Union Blvd., Suite 600

Lakewood, Colorado, 80228

General & Investor Information:

Curtis H. Moore

Tel: 303.974.2140 303.974.2140 303.974.2140

Fax: 303.974.2141

Toll Free: 1.888.864.2125 1.888.864.2125 FREE 1.888.864.2125 FREE

E-mail: investorinfo@energyfuels.com

|

|