Seabridge Gold Advances KSM Project in British Columbia to Largest Undeveloped Gold Reserve in the World

|

By Allen Alper Jr.

on 10/20/2015

Rudi Fronk, Chairman and CEO of Seabridge Gold (TSX: SEA), took a few moments to speak with the Metals News team about the progress they are making at the KSM gold-copper project, located in northwest British Columbia.

Said Fronk, “We founded the company in 1999, taking over a Vancouver listed shell that was sitting with about $200,000, a $0.15 share price and about 17 million shares outstanding. We initiated a business plan that was based on the belief that the price of gold was going to go a lot higher over the ensuing period, particularly compared to financial assets.”

Seabridge’s business plan has adapted well to the changing markets. He said, “Obviously, the last four years have been a difficult time in the gold market, for producers, developers and explorers. Our view is that the price of gold will go higher. In fact, we believe gold will eventually make a new high. Right now gold is facing a lot of headwinds in terms of other financial assets that are more in favor.”

Fronk and his team recently spent time at the Denver Gold Forum. He said, “The mood at the Denver Gold Forum was subdued, although I will tell you that the one on one meetings that we had with institutional fund managers were very positive, probably better than a year ago. Most of those meetings were not with traditional resource players. These were groups looking at gold and gold equities for the first time.” Fronk believes that at current levels, gold and gold equities are attractive investments. He said, “A little bit of portfolio insurance may not be a bad thing as we move forward given where financial markets sit right now.”

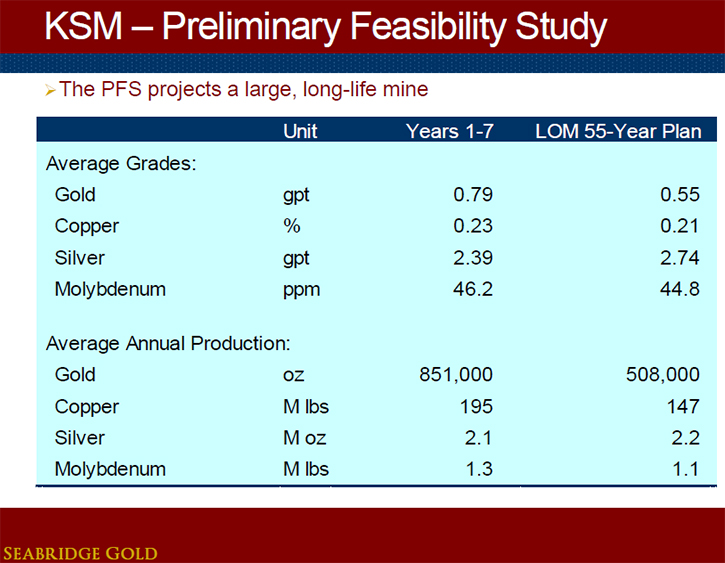

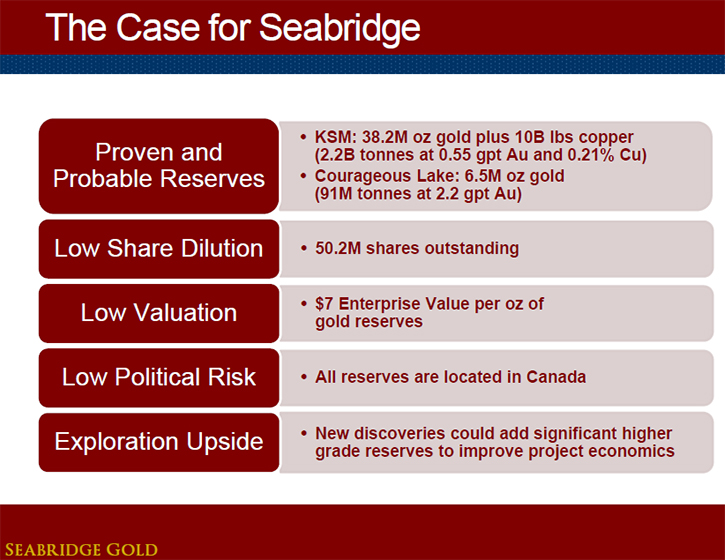

The focus of the company is on their large gold-copper project. Said Fronk, “Seabridge’s core asset is the KSM Project located in northwestern British Columbia. We have now spent $240 million dollars at KSM since 2006. KSM is now the largest undeveloped gold-copper reserve in the world as measured by reserves. We have 38 million ounces of gold reserves and ten billion pounds of copper. It is getting bigger and better with additional exploration. It is also one of the few big projects in the world today that has successfully completed the environmental assessment process and is now fully approved by the Canadian government and shovel ready for construction. Current reserves and production plans at KSM do not yet include the almost one billion tonnes of additional resources that have been added since 2013. These resource additions are at a much higher grade than our current reserves. We expect that when work has been completed to convert these resources to reserves, the project’s economics will improve.”

Ultimately, Seabridge’s goal is to partner with a major mining company to build the mine. Said Fronk, “We have made it very clear from day one that we are not mine builders. Our sweet spot is acquiring, exploring and then designing projects, not building and operating. We will need a major mining company to come in and move it forward with us in a joint venture. That is the next big step to accomplish.”

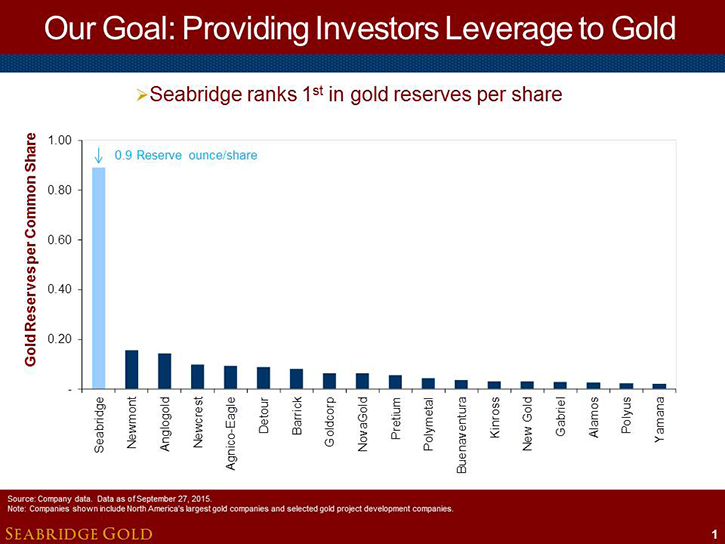

With the uncertainty in global financial markets, Fronk expects more and more investors to look at Seabridge. Fronk said, “Investors should be interested in Seabridge Gold first and foremost because of our leverage to the gold price. If you are looking for a gold stock that will provide you with the best returns in a rising gold market, just look at the track record of Seabridge. During the period from 2004 to 2007, when gold finally broke out of above $400 an ounce and went to just over $1000, our share price significantly outperformed every other gold stock on the planet as well as the price of gold. Then again, coming out of the financial crisis in 2008, from that period until 2010, our stock again significantly outperformed other gold equities. During each of these two periods, our stock essentially went from $5 or $6 a share to the high $30s. We see no reason that if we see a significant move in gold from current levels, that our shares won’t once again provide superior leverage to gold. In fact, our leverage to gold should be better this time around as we have significantly increased our gold reserves and resources per share compared to last time around.”

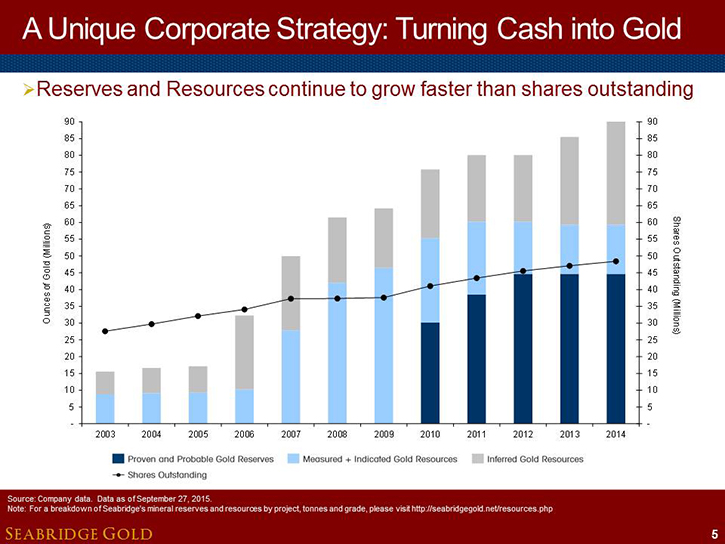

The company’s success is based on their unique philosophy. Fronk said, “From 1999 through 2002, we bought nine advanced stage projects and saw the upside in these projects, where the previous owners did not. Our business plan is to increase resources through exploration and then to convert resources to reserves through engineering and then to partner or sell our projects to companies that will take them to production.” In fact, the company sold a project to another mining company for a profit not long ago. Fronk said, “We sold a project to Newmont and Fresnillo for a profit of US$30 million dollars during the last run up in gold.”

Their belief in a rising gold price is what drives their decision making. Fronk said, “Our industry is good at turning gold into cash which is probably the right emphasis for producers right now. We turn cash into gold holdings because we think gold is ultimately more valuable than cash.” To that end, the Seabridge Gold team thinks in terms of how much gold they have in the ground for each and every share outstanding. Fronk said, “In terms of reserves, we have 9/10ths of an ounce of gold in the ground for every share. That is 5-10 times more gold ownership per share than any other gold company. When the next move up in the gold price finally comes, investors will be looking for gold ownership, not cashed up treasuries.”

While other companies stepped on the brakes, Seabridge continued its exploration spending, taking advantage of lower costs. “During the environmental assessment of KSM, we elected to continue exploration at KSM … looking for higher grade zones.” Said Fronk, “Since 2012, we have added two new zones at KSM, Deep Kerr and Lower Iron Cap. Collectively we have added about one billion tonnes to the projects resources containing over 11 million ounces of gold and 10 billion pounds of copper. Most importantly, these new resources are at a much higher grade than our existing reserves. These discoveries, along with the project’s environmental approvals, should strengthen our hand in securing a joint venture partner. Although market conditions remain challenging for the major mining companies, we aren’t asking them to make a $5 billion dollar commitment to build the mine now, but we are looking for a major mining company to take the next steps necessary to come to a construction decision in a reasonable time period. We have 10 of the largest mining companies in the world under confidentiality agreements looking at this opportunity. However, deal terms trump timing. If we cannot secure a partner at this time, we will continue to improve the quality of KSM through additional exploration and engineering. In the meantime, we will continue to spend our money very carefully. I would challenge any company to match our success in limiting equity dilution while continuing to grow reserves and resources.”

Summary:

Seabridge Gold is currently advancing the KSM gold-copper project located in northwestern British Columbia, with the goal to partner with a major mining company to move the project to the next stage. With gold in the ground for each and every investor in the company, Seabridge is in a unique position to attract shareholders.

http://seabridgegold.net/

106 Front Street East

Suite 400

Toronto, Ontario M5A 1E1

Canada

Tel: 416.367.9292 416.367.9292 416.367.9292

Fax: 416.367.2711

info@seabridgegold.net

|

|