Idaho Champion Gold Mines Canada Inc. (CSE: ITKO): Highly Prospective Gold Exploration in Idaho USA; Interview with Jonathan Buick, the President and CEO

|

By Allen Alper Jr., President, Metals News

on 2/20/2019

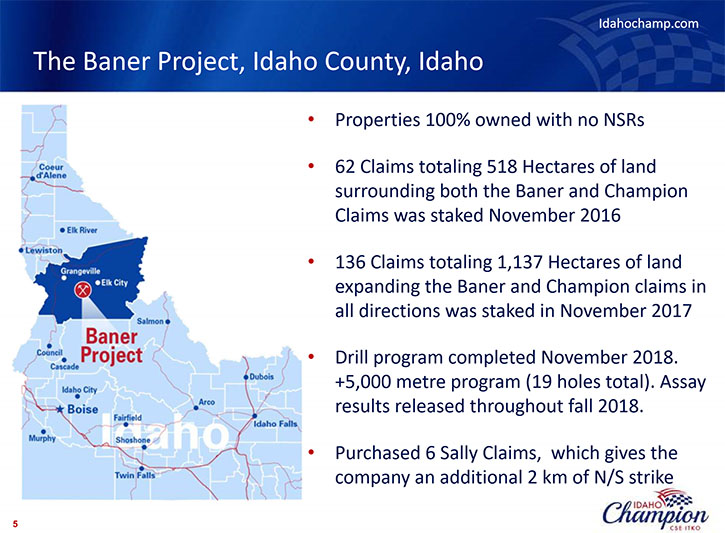

Idaho Champion Gold Mines Canada Inc. (CSE: ITKO) is a discovery-focused gold exploration company that is committed to advancing its 100% owned, highly prospective, mineral properties, located in Idaho, USA. The Baner Project is in Idaho County, the Champagne Project is located in Butte County, near Arco, and four cobalt properties in Lemhi County, in the Idaho Cobalt Belt. At the 2019 Vancouver Resource Investment Conference, we learned from Jonathan Buick, the President and CEO of Idaho Champion Gold Mines, that they are a new company that started trading at the end of September of last year and their flagship project is the Baner gold project in Elk City, where they have made a discovery, during their 19-hole drilling program in October. Mr. Buick is confident that this could be a significant global resource. We learned from Mr. Buick that management owns 55% of the company, with large key shareholders. Idaho Champion Gold Mines is now looking to divest its cobalt properties to fund its gold exploration without dilution. Starting in the spring, the company will be doing a minimum of 3,000 meters up to 5,000 meters of drilling, depending on the transaction of cobalt.

Jonathan Buick, President and CEO of Idaho Champion Gold Mines, at the 2019 Vancouver Resource Investment Conference

Allen Alper Jr.: This is Allen Alper Jr., President of Metals News. I'm here at the Vancouver Research Investment Conference 2019, and I'm interviewing Jonathan Buick, who is the President and CEO of Idaho Champion Gold Mines.

Could you give us and our readers/investors an overview of Idaho Champion Gold Mines?

Jonathan Buick: Sure. We are a newly listed company on the Canadian Securities Exchange. Our ticker symbol is ITKO, I for Idaho, TKO for knockout, like a champion. We started trading at the end of September of last year. Our flagship project is the Baner project. It is a gold project in Elk City, which is in Idaho County. It's the project that we bought from a family that had control of the project since 1892. We bought that in the fall of 2016 and we immediately applied for a drill permit and last June we started the initial drill program on that ground.

The reason we picked up the Baner was that, in the 1920s, the patriarch of the family had put in eleven adits and was pulling out two-thirds of an ounce of gold as well as silver, and we were very excited by that. We also did a regional look, and Elk City, from 1860 to 1910, had alluvial mining of a million-and-a-half ounces on a creek that flows from south to north, just to the west of our project. The key for our geologists was it was in flake, which could not have traveled far. Based on our sampling program and the topography, our geologists were pretty confident that our project was the source of that gold.

We did a 19-hole program this past June through the end of October. We've made a discovery. We have a 500 meter north-south by 200 meter strike length with good grade. The most important aspect of that whole drill program was that we averaged over 100 meters of oxidization in each hole, which certainly will help with the metallurgy, should a decision be made to mine it.

We also have picked up six claims to the northeast of us, so we have an additional 2 kilometers strike. We're quite confident within the Baner project that we would have a significant global resource, coming down to time and money to drill that out. So, we've made the discovery and we're very excited about it.

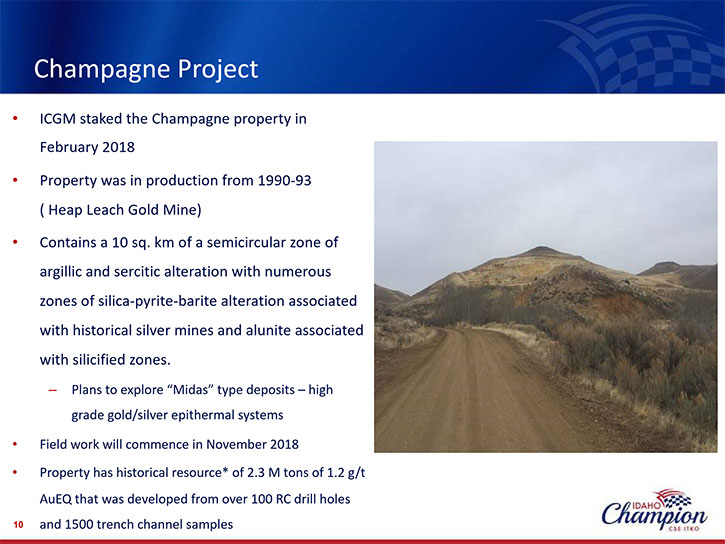

We also have a second gold project called the Champagne. It is a past producing, open pit, Heap Leach that was in production with Bema gold in the early '90s. It produced about 25,000 ounces a year. They then made a discovery in South America and moved south, so we picked that up and we believe that there is a heavily enriched, epithermal system underneath and we're doing some grassroots exploration on that.

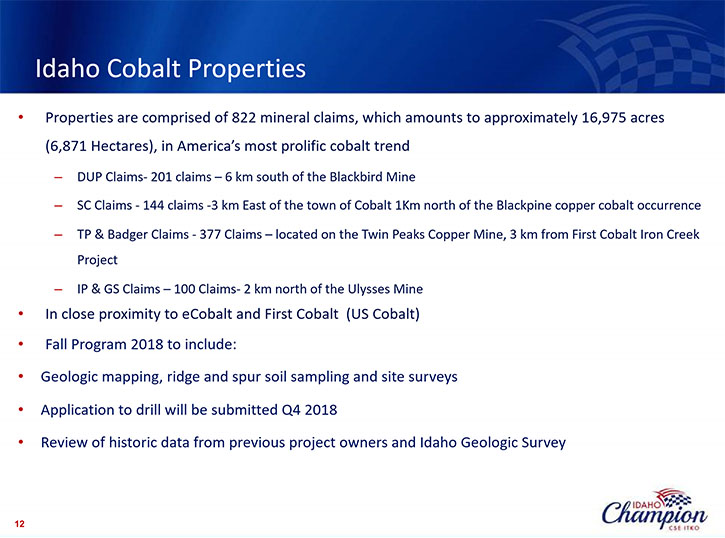

In addition to the two gold projects, we also have one of the largest land packages in the Idaho cobalt belt. We have four distinct cobalt projects. We picked those up as a life jacket, should we not be successful with the discovery at Baner. Now that we've been successful at Baner, we're in conversations with third parties, looking to either divest JV or have some form of transaction that will allow us to fund our gold exploration, with no dilution at the corporate level.

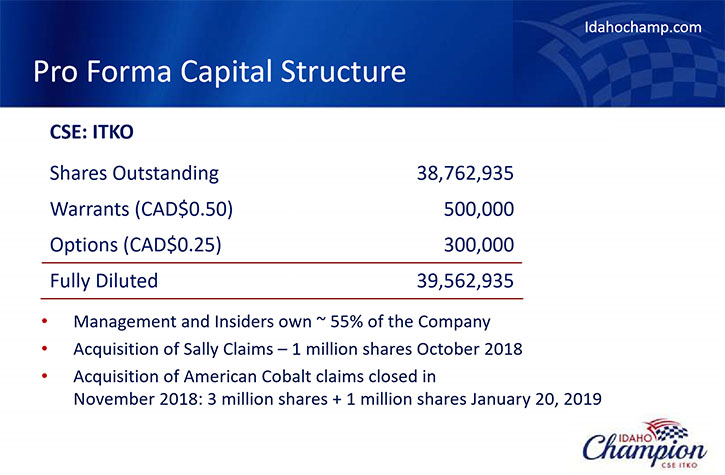

Management are investors. We own 55% of the company. We've written meaningful checks. We're partnered with our shareholders. The difference between us and them is that we have a three-year lockup where they have the ability to come and go, and I think as a result of that we've been able to attract good investors.

Allen Alper Jr.: Can you tell us a bit about yourself and your Management Team?

Jonathan Buick: Sure. My background is corporate finance. My advisory firm is called Harp Capital and in my career I've raised over $400 million for natural resource projects. The reason we started Idaho Champion is that in the last seven years we had six projects that were at binding agreement ready to be signed and all for different reasons, all six turned down the opportunity to sign that transaction and within three months all six came back and said, “We'd really like to do that deal.” We were too vulnerable as an advisor on those types of transactions that we thought it was better for us to put our own capital at risk and become the person that says yes or no to a deal as opposed to somebody who's a third party to a deal.

So we looked globally at over 250 projects. We were able to find Baner. We think Idaho is the best jurisdiction in the U.S. We think geologically it is just as strong an opportunity as Nevada. We think Idaho is where Nevada was thirty years ago, it's just a matter of people coming in and picking up projects. That certainly has been validated in the last two years. Integra Gold sold the Lamaque, they could've gone anywhere in the world, they picked up a project and came into Idaho. Last year we saw Barrick put $50 million into Midas Gold, validating the jurisdiction and the ability to move projects forward. There's continuous mining in the state of Idaho since 1860. They're a community that understands mining and they're pro-mining. They want to see development. So, we're keen to see that happen.

The rest of my Management Team, my geologist is a University of Wyoming grad. He splits his time between Elk City and Denver. He's worked in Idaho for the last 18 years. He's been a part of multiple discoveries and he's certainly a guy, with boots on the ground and great relationships with the different agencies.

Allen Alper Jr.: Could you tell us a little bit about your share structure?

Jonathan Buick: Sure. We have 40 million shares. There're no warrants, no options. Every share has been paid for. Management owns 55% with large key shareholders. About 80% of the stock is in friendly hands. We did a reverse takeover, so two million shares of that 40 million were with the shell, but at much higher prices, so we don't see a lot of selling that would come out of that. We think with good news and expanding on the discovery, we'll have lots of upside, lots of blue sky.

Allen Alper Jr.: So, you have a lot of skin in the game?

Jonathan Buick: Management's put $1.2 million U.S. in. So, a lot of skin. Everything's relative, but for us it's meaningful and this is a wealth creating opportunity. We're not looking for a flip or a trade. That's why we've agreed to a three-year lockup, and we believe this is an opportunity to be in a great jurisdiction, known mining code, with very little political risk, with an opportunity to take advantage of a rising gold market. We also have a OTC-QB listing coming. We expect to be dual listed in the next 30 to 60 days.

Allen Alper Jr.: Do you have a plan to avoid dilution?

Jonathan Buick: The cobalt is certainly a plus to avoid dilution. We have active groups looking at trying to take our cobalt land package and our goal is to do that with cash and/or shares, not just shares. We need to expand on our discovery and so we want to do that in the least dilutive form as possible. So we would be looking to monetize the cobalt to do that.

Allen Alper Jr.: Sounds good. What do you look at as the largest challenges you're going to face?

Jonathan Buick: I would say the largest challenge right now is that the junior resource business has been in nuclear winter for the last seven years. There have been lots of other sectors, whether it's crypto or marijuana that has taken a lot of the high risk investors out of the game. My hope is that they've made their money in those other sectors and when the resource market comes back, they'll be ready to come back and invest in good companies. We think we have a good management team. We have good assets in a good jurisdiction. It's an unknown story. It's a new listing, a new discovery, in ground that's never been drilled, and we think there's lots of opportunity for wealth creation.

Allen Alper Jr.: I think you just answered my next question. That was going to be, “What are the main reasons that someone would want to invest in Idaho Champion gold mines?”

Jonathan Buick: Sure. When you come to a conference like we're at today there're a lot of stories that have been around for a long time. This is a project that had never been drilled or had modern exploration. We did sampling across the project. We did an IP program, we've done a drill program that shows we have a discovery. It's my job to be able to expand on that discovery through further drilling. We intend to drill 3,000-5,000 meters this year at the Baner. We'll also be doing some grassroots at Champagne. And so we'll have lots of news flow in the coming months and we think that it's an ideal time, as an investor, to be looking at a company that's unknown. We're not on the radar of anybody and it's my job now, in the first six months of 2019, to get on the radar. And certainly an interview like this would help.

Allen Alper Jr.: Well, thank you very much. Tell me a bit more about Idaho and why you like Idaho as an area. And tell us a little bit about permitting.

Jonathan Buick: Sure. Idaho, as a jurisdiction, has had continuous mining since the 1860s. There's active mining in different parts of the state. You have the Silver Valley on the Coeur d'Alene. You also have a big phosphate camp, down in the southeast near the Utah border. You have mining activity in and around Boise. Also in Lemhi County now there's eCobalt, we think will be the next producing cobalt project in North America. That's in Idaho. You have the Governor of the state, who for the last year-and-a-half has been going to New York, Chicago, Boston, and Toronto promoting mining, with junior resource companies. They're showing they're open for business.

Everybody always talks about permitting as the boogieman. From when we submitted our permit we had the final permit approved in 11 months and everybody had been telling me it would take three years. With the add-on program, we've already received the permit for phase two. So that was a very quick turnaround because we already had the original exploration permit we were able to make some adjustments to that and filed it for us to continue to drill next year. So, permitting for us, because we're in exploration, is different than if we were trying to put in a mine. At this stage of our company, the permitting process has been very good. The U.S. Forest Service and BLM have been very supportive of our initiatives.

Elk City itself is a mining town. Between 1860 and 1910 a million-and-a-half ounces were taken, alluvially, at the creek just adjacent to our project. But globally, within that area there have been over three million ounces mined there. It's an active camp. Endomines, which is a Finnish mining and exploration company, just paid $32 million U.S. dollars for a project called the Friday, which is five miles south of us. They've driven in their ramp and now they're building their mill, so it's a very engaged ongoing activity, within the community. They see the job creation happening there, and it's important for us. Our two young geologists are Idaho grads. Our heavy equipment operator's from Idaho. We buy our diesel in town. We rent a cabin in town. So we're making a difference in the community and we want to try to hire as many locals as we can.

Allen Alper Jr.: Tell us a little bit about the infrastructure there.

Jonathan Buick: Infrastructure, we have highways all the way to Elk City. We are about six miles, as the crow flies, southwest of Elk City. We take highway for half of that drive and then we use forest roads. So, the area where we are was timbered in the '60s, so there's a big infrastructure of roads in and around off the highway, but it's a paved highway right to Elk City, so we're three miles from there. We have power lines that go through our project area, so infrastructure-wise it's an ideal situation.

Allen Alper Jr.: Excellent! So what are your next steps?

Jonathan Buick: Our next steps are to monetize the cobalt and then we will be drilling. Starting in the spring, we will be doing a minimum of 3,000 meters up to 5,000 meters depending on the transaction on the cobalt. But we will have lots of news flow from sampling that's been done over the winter as well as metallurgical work on the bulk sample we took out of Baner, so we'll have lots of activity. The next real opportunity for us as a company is to expand on that original discovery area, which will require drilling, and that's what we'll be doing.

Allen Alper Jr.: Have you an estimated plan on your exploration budget?

Jonathan Buick: That's still being worked on because we just finished drilling and we actually just released the last sets of results. Our technical team's currently reviewing that, but I would expect our budget would be $1.5 to $2 million U.S.

Allen Alper Jr.: Okay. Is there anything else you'd like to add?

Jonathan Buick: I’d like to thank you for interviewing us for Metals News. Put us on your watch list. Our ticker symbol is ITKO. I think you'll be happy with the progress. Look at the presentation on our website, I believe in being accountable to the investor. We have what we refer to as a report card for all the things that we said we were going to do. You'll see one slide where it shows all the things that we promised to deliver on in 2018 and what we did and how we did it. The next slide after that is our report, for which you can hold us accountable in 2019. So, you can see our plan and each of the projects and what we're going to do and then you can tell me if I'm doing it right or wrong.

Allen Alper Jr.: Thank you for a very interesting insight into your exploration and mining process. Absolutely excellent! We’ll publish your press releases as they come out so our readers/investors can follow your progress.

http://www.idahochamp.com/

Jonathan Buick, President and CEO

Nicholas Konkin, Marketing and Communications

Phone: (416) 477 7771ext 205,

email: nkonkin@idahochamp.com

|

|