Transition Metals Corp (XTM -TSX.V): A Canadian-Based, Multi-Commodity Project Generator, Interview with Scott McLean, President and CEO

|

By Allen Alper Jr., President, Metals News

on 9/17/2018

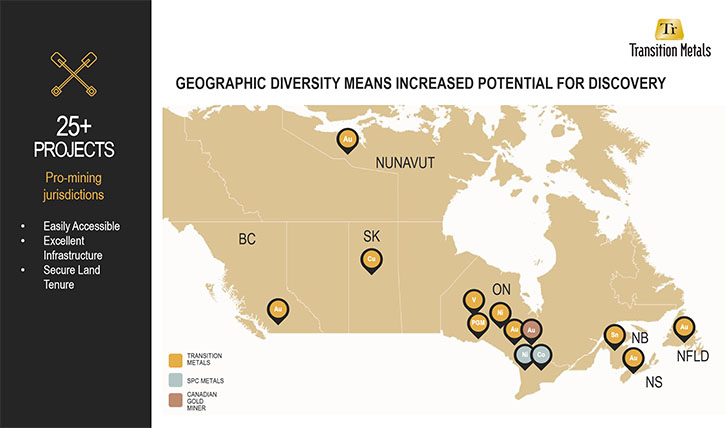

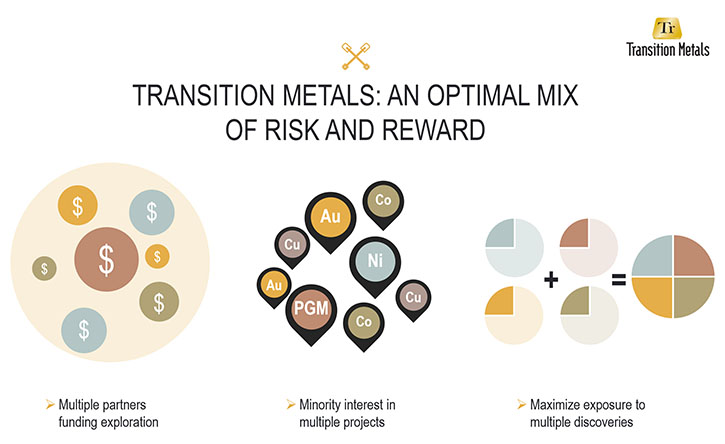

Transition Metals Corp (XTM -TSX.V) is a Canadian-based, multi-commodity project generator that specializes in converting new exploration ideas into discoveries. Transition uses the project generator business model to acquire and advance multiple exploration projects simultaneously, thereby maximizing shareholder exposure to discovery and capital gain. Joint venture partners earn an interest in the projects by funding a portion of higher-risk drilling and exploration, allowing Transition to conserve capital and minimize shareholder’s equity dilution. The company has an expanding portfolio that currently includes more than 25 gold, copper, nickel and platinum projects, primarily in Ontario, Nunavut, British Columbia, Saskatchewan and the maritime provinces.

While at the Sprott Natural Resource Symposium, in Vancouver, Canada, we learned from Scott McLean, President and CEO of Transition Metals that Rick Rule is their biggest shareholder, holding about 15% of the stock. The company's main project is the Sunday Lake PGM joint venture with North American Palladium where they have several intersections of about 40 meters of approximately four grams per tonne platinum and palladium. Transition also owns 40% of the Canadian Gold Miner that is exploring the South Kirkland project in the heart of the Abitibi, and 29% of SPC Metals that is exploring the Aer-Kidd project and Lockerby East nickel cobalt PGM projects in Sudbury.

Sunday Lake PGM Project

Allen Alper Jr: This is Allen Alper Jr., President of Metals News, interviewing Scott McLean, who is the President and CEO of Transition Metals. We're at the Sprott Natural Resource Symposium, in Vancouver, Canada.

Everyone here has been vetted by Rick Rule, so, Transition Metals is one of Rick Rule's favorite companies. Scott, why don't you tell us, our readers/investors, a bit about yourself, and a bit about Transition Metals?

Scott McLean: I’m a geologist at heart and been in the business for over 30 years. I worked for big corporations such as Falconbridge and Xstrata Nickel before branching out on my own in late 2007 and started building junior companies.

We run a prospect generator business model. We have many projects across the country being worked by partners and we also spin assets out into subsidiaries, drive those private companies public, and then hopefully provide a share dividend back to shareholders. Rick likes our company because it follows a project generator business model.

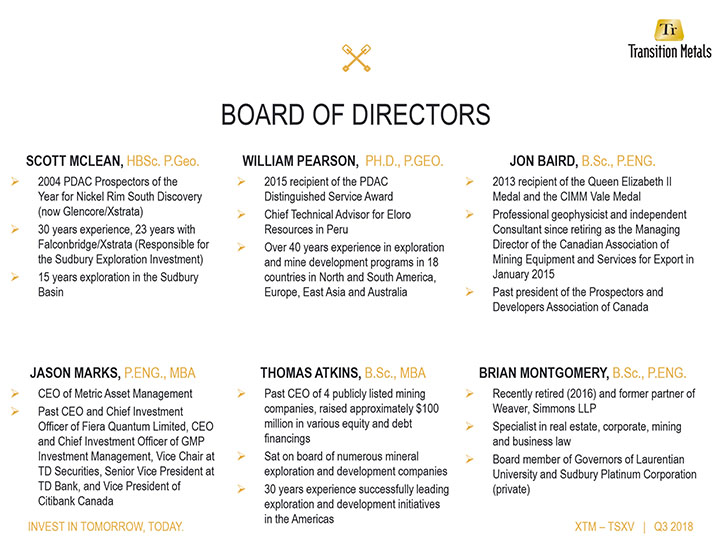

We're a very strong technical team with a good track record of discovery. Members of our team have been awarded the Prospector of the Year Award from PDAC in the past and the team also recently won The Ontario Discoverers of the Year for our Sunday Lake Project near Thunder Bay.

Rick likes to follow strong technical teams. He's now our biggest shareholder holding 15% of the stock.

Allen Alper Jr: Tell us a bit more about your projects.

Scott McLean: There's a lot going on for a small company. We have numerous projects, some are available for option, some are already optioned to other parties. We often have equity holdings in the companies that own the projects and we also have associated companies, or subsidiaries.

I will break our enterprise it into those 3 bundles; the parent company is Transition Metals which is publicly traded and it has spun out SPC Metals and Canadian Gold Miner both of which are currently private. The main project in Transition Metals is our Sunday Lake PGM discovery, where we have a number of intersections up to 40 meters of about four grams per tonne platinum, plus palladium. North American palladium is currently earning-in a 75% interest in that project by spending four and a half million and paying three and a half million in cash. We have a 25% free carried interest in the project to the completion of a feasibility study.

A few years ago, we founded Canadian Gold Miner, a company focused on only gold exploration in the Abitibi Greenstone Belt. Transition currently owns 40% of the stock. Our key project is called South Kirkland, a 120 km square property located 10 km south of the Cadillac Larder Break and covering >20 km strike length along the Lincoln-Nipissing Break. There are dozens of gold mineralized zones at surface and historical mining shafts, pits and underground workings. Canadian Gold Miner’s work to date has prioritize the character controls for larger scale gold systems.

Our other associated company is SPC Metals. SPC is an energy metals-focused company in the Sudbury Mining Camp. As many know, Sudbury is a world-class mining area with over 1.6 billion tonnes of past production, reserves & resources since 1883 from 56 mines. The camp currently has 11 active mines.

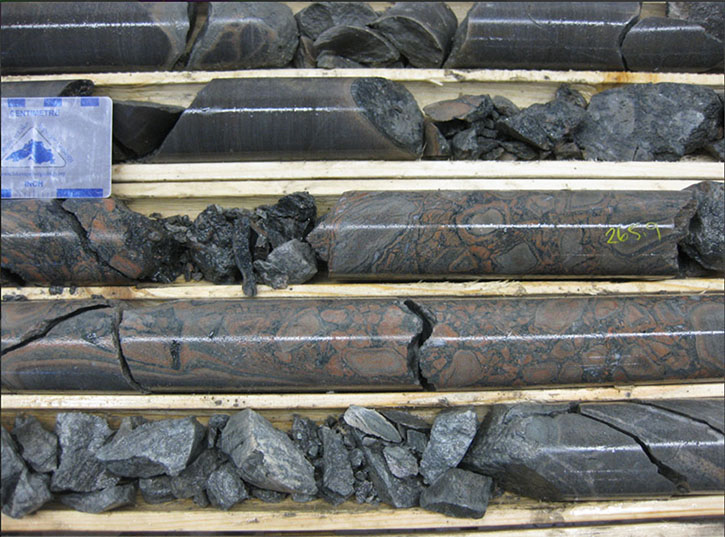

Our key project in SPC is our Aer-Kidd Project. It's a brownfields exploration project, sandwiched between two mines on the Worthington Offset Dyke. We're drilling down below historic workings, looking for a large nickel-copper-cobalt-PGM deposit.

The other project in SPC Metals is Lockerby East which hosts 10 million tonnes of resources of about 0.7% nickel equivalent.

Allen Alper Jr: What do you see as your next steps?

Scott McLean: Currently, we're focused on trying to get the share value up to its proper valuation. If you look at the value of our investments that we hold, in four different companies, the value of those shares is worth more than the whole market cap of the company.

So, demonstrably Transition is a good buy today. If you buy Transition Metals today, you effectively are purchasing the value of our investments and everything else, our cash, our number of projects, our agreements all come along for free.

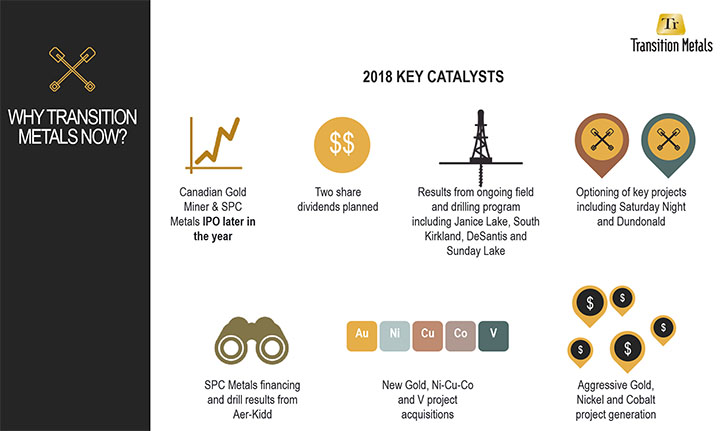

In terms of the catalysts we see going forward, we plan to take our associated companies public. By doing that, we hope to be able to provide a share dividend and return capital back to the shareholders of Transition.

We're currently drilling at Aer Kidd and intend to drill in the fall at South Kirkland. I’m hopeful North American Palladium will fire up Sunday Lake again this fall. With all the drilling activity over the coming months, we’re focused on generating strong news flow.

As a project generator, we sell or partner projects and we therefore need to keep the pipeline full by bringing new projects in, we've been focused on that this year and have picked up 11 new projects. If you look at our total bundle of projects we have now, about 50% of them are hedged to gold. 40% are in the nickel-copper-cobalt-PGM realm, and we have 10% that we classify as "other" that include things like vanadium and tin.

Allen Alper Jr: Are you focused in a specific location?

Scott McLean: We're diversified across Canada in seven different jurisdictions. The main nexus of our projects is in Ontario, where we have 26 projects that we're involved in. We're also in Newfoundland, Nova Scotia, New Brunswick, Saskatchewan, and BC. We've worked in Canada for our whole careers. We're very comfortable here and we've been able to develop strong projects. Canada is stable and has a great mineral bounty.

Allen Alper Jr: Nice stable mining jurisdictions.

Allen Alper Jr: Tell us a little more about your management team. Obviously, you have quite a depth and breadth.

Scott McLean: I've been in the exploration business for over 30 years with success in base metals, nickel, copper, cobalt, and gold. The other three principal executives within the three companies, are Greg Collins, Grant Moore, and Tom Hart. All are professional geologists with a specific expertise in various areas.

Tom is our gold expert, yet his breadth of knowledge is far broader. Grant is our nickel, copper, PGM expert, with a real focus in Sudbury, and Greg has worked in many jurisdictions around the world, and is a real motivator for field programs and with expertise in base metals and gold.

Three of us worked together at Falconbridge and had a good working relationship with good track records of discovery. We've been able to bring that team outside the larger corporation and build a new company around it.

Allen Alper Jr: What are the primary reasons our high-net-worth readers/investors should consider investing in your company?

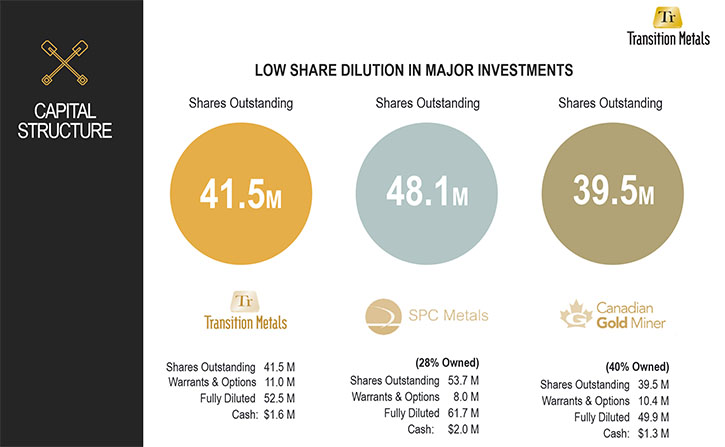

Scott McLean: There're a few reasons. We're demonstrably a good buy and we have a great share structure in Transition Metals. Since going public in 2011, we've only ever had to raise $5 million and we created all this great opportunity with very little equity dilution. In addition, we have a good management team, a track record of discovery, cash in hand, and lots of projects being advanced by partner funding.

Allen Alper Jr: Tell us more about your share structure, and a bit about your Insider investors.

Scott McLean: We have 40 million shares outstanding. Each of our Spin, where we look to dilute on the equity, also have about 40 million shares in each.

In terms of investors in Transition Metals, the largest shareholder is one of Rick Rule's funds. In terms of the Insiders, I own 8% of the company, other insiders own a total of about 15% of the company.

Another individual that helped found the company is David Elliott. David is a mentor of mine and a good friend. He's one of the principal founders of Haywood Securities, and he brings a great knowledge of capital markets and financing to the group. His ownership is about 10%.

Allen Alper Jr: Other than the current market climate, what do you think are the major issues that you're trying to address now? And what are you doing to address those?

Scott McLean: We've seen exploration spending collapse over the last number of years. In fact, I think it's down about $15 billion over the last five years, and down 50% over the last 10 years. That's resulted in a real decline in discoveries, and as we go forward, that's going to become more and more prevalent, create a supply problem in the industry, and we'll start to see commodity prices turn around.

We're really bullish on nickel. We see nickel bifurcating in price, to a C2, laterite nickel being worth one price, and high purity nickel from sulfide sources, C1 nickel, being worth a significant premium over that. So we're anxious to see that move ahead.

Another challenge in the industry is the retail market has really dried up. We've seen a huge movement to crypto currency, blockchain, and cannabis. That's taken a lot of the speculation money out of our industry, and into those sectors. In a little over two years, we've seen the major gold producers, increase their market cap, on average by about 60%. Blockchain-crypto stocks, however is up about 850% and cannabis stocks are up close to 5,200% over that same period. When those bubbles start to dissipate, we hope to see that money come back into our sector. Having said that, if you look around the room, most of the investors that understand mining are getting older. The demographics are changing and as people age they are more reluctant to invest in junior mining.

We have to find ways to target thirty and forty something professionals, with cash on hand, interested in more risky investments like this. That's something that we're trying to address. Obviously, at this forum, we're not seeing the traffic that we used to. That's partly due to the retail markets, but we don't see a lot of young people here, either. We have to market to them a little bit better, to be able to excite them about the things we're doing.

Allen Alper Jr: Is there anything else you'd like to add, in summary?

Scott McLean: In summary, we have a well-managed company. We keep costs well under control, and I can't profess enough about what good buy this stock is, at these prices. As I mentioned earlier, you buy it today, you're effectively buying the investments we hold, and everything else in the company comes along for free. We hope to be rewarding our shareholders some time later this year with share dividends out of some of these investments we expect to have continued positive drilling results.

Allen Alper Jr: Certainly, the market's at the right point to invest. You want to buy low.

Scott McLean: I don't think there's much more downward pressure on our stock. In my opinion, we are scratching the bottom.

Allen Alper Jr: Rick Rule was saying that investor sentiment, is at its lowest possible point. I think that if investor sentiment can't get any lower, this might be the right time to buy.

Scott McLean: Rick’s made a lot of money over the years and has a good feel for the Markets and investment in the resource sector.

Allen Alper Jr: Thank you for the interview.

Scott McLean: Thank you for the opportunity

http://www.transitionmetalscorp.com/

Scott McLean

President and CEO

Transition Metals Corp.

Tel: (705) 669-1777

info@transitionmetalscorp.com

|

|