Pacific Empire Minerals Corp. (TSXV: PEMC): Prospect Generator, Focused on Discovery of Gold-Rich Copper Deposits in British Columbia, Interview with Brad Peters, President and CEO

|

By Allen Alper Jr., President, Metals News

on 8/14/2018

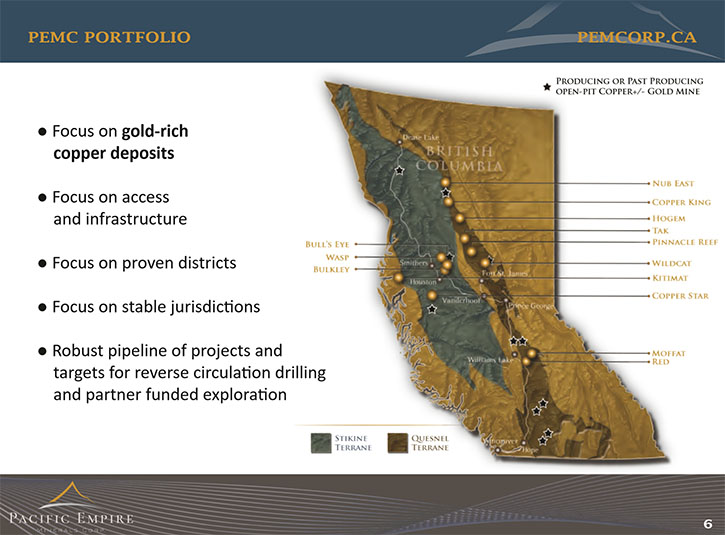

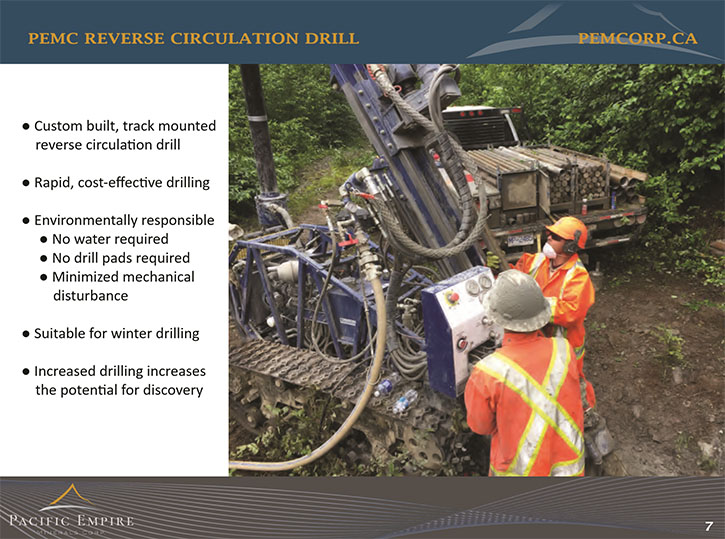

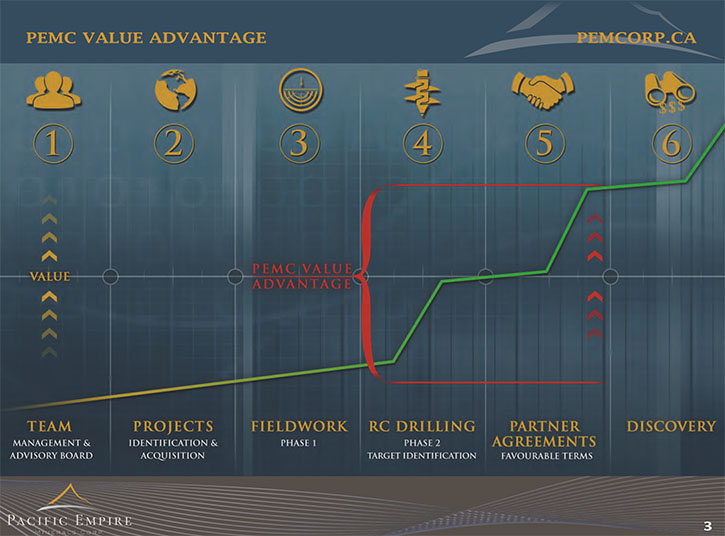

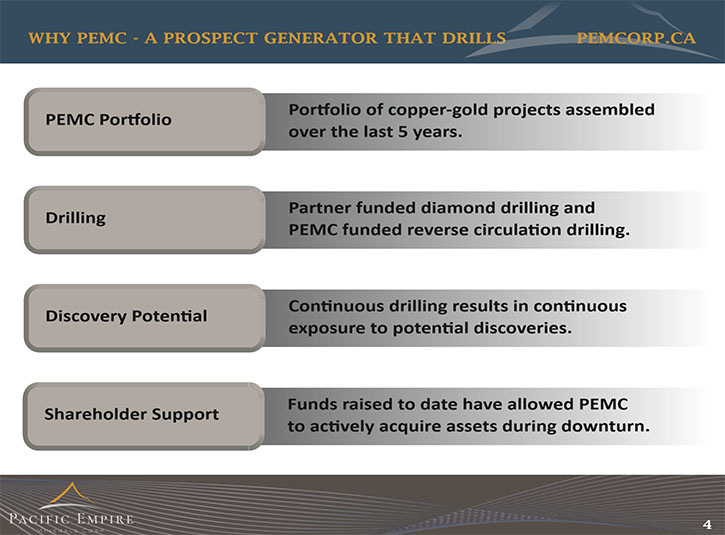

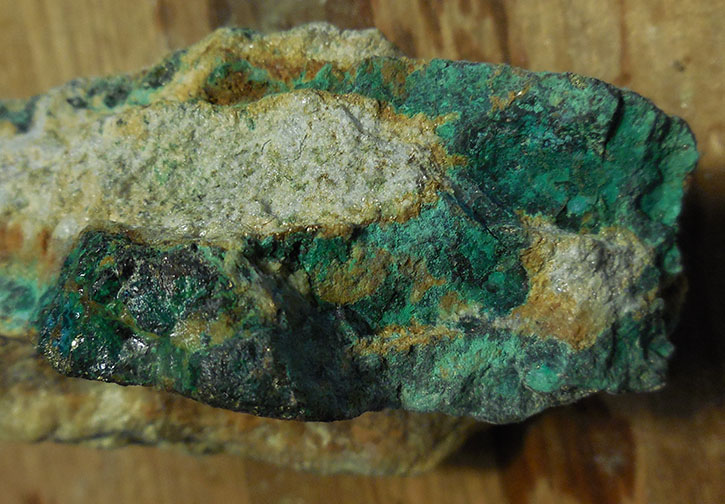

Pacific Empire Minerals Corp. (TSXV: PEMC) is a hybrid prospect generator company, focused on the discovery of gold-rich copper deposits in British Columbia. By integrating the project generator business model, with low-cost reverse circulation drilling, the company is able to leverage its portfolio by identifying and focusing on the highest quality projects for partnerships and advancement. While at the Sprott Natural Resource Symposium in Vancouver, Canada, we learned from Brad Peters, President and CEO of Pacific Empire, that they focus on mining-friendly, infrastructure-ready areas, within British Columbia, where there is a lot of public data available, in terms of assessment reports, previous drilling, radiometrics, and magnetics. By analyzing this historical data together with their own initial exploration, Pacific Empire is able to identify targets ideally suited for reverse circulation drilling. We learned from Mr. Peters, that Pacific Empire currently has 14 projects in the portfolio, two of which are currently under option. Plans for this year include testing six to eight of the projects, with the company's own reverse circulation drill. Mr. Peters sees a positive future for copper with renewable energy, with the global infrastructure build-out playing a significant role.

Pacific Empire’s Reverse Circulation Drill in the Field

Pacific Empire Minerals Corp. – IP Survey and Target Area at the Copper King Property

Allen Alper Jr.: This is Allen Alper Jr., President of Metals News, interviewing Brad Peters, who is President of Pacific Empire. We are at the Sprott Natural Resource Symposium in Vancouver, Canada. All the companies here have been personally vetted by Rick Rule. Brad, why don't you tell us, our readers/investors, a bit about your company and how you have come to sit here at the Sprott Natural Resource Symposium?

Brad Peters: Thank you Allen, I appreciate the opportunity. We started out in 2013 as a private prospect generator, with support from Rick Rule as well as David Elliott at Haywood. Since that time, we have pursued copper opportunities aggressively in British Columbia. Over the last five years, we were able to assemble a portfolio of gold-rich copper prospects while employing the prospect generator business model. In March of 2018, we completed our initial public offering by raising two million dollars at 20 cents. Following this, we purchased our own reverse circulation drill and have now been drill-testing targets, within our portfolio, for several months. Rick invited us to attend the show this week.

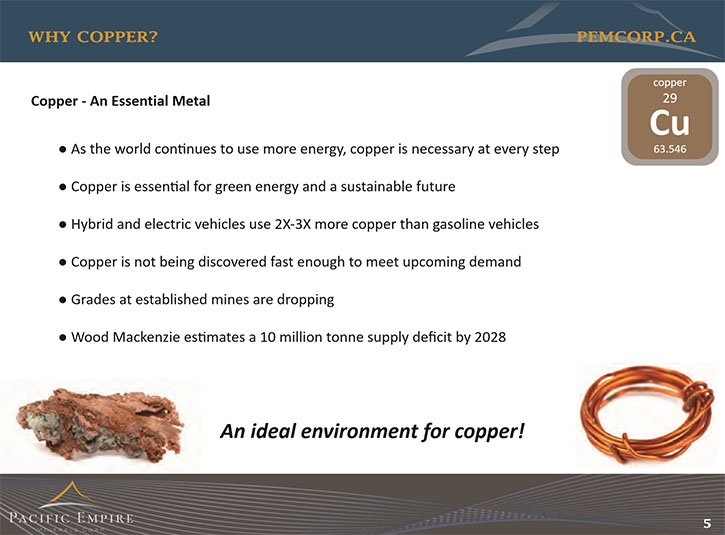

Allen Alper Jr.: Copper is a really exciting metal right now. I think there was a keynote on it just the other day. They were talking about how important copper is. I think they were saying that just last year China installed enough solar and wind capacity that was equivalent to 53 nuclear power plants. There was going to be a huge amount of copper involved in that. That was just what they did last year. So the demand for copper is going to be explosive. Why don't you tell me, what do you think about the demand for copper? What are you looking at as far as copper projects? Also, tell me about metals and locations.

Brad Peters: Since our inception in 2013 we have always been focused on copper. We've always believed that copper is the metal of the future and that is why we have remained focused on copper. No matter what metal has been in vogue we have always stayed focused on copper. When copper projects were on sale or when others weren't interested in copper, we remained aggressive. We really do believe in the growth potential for copper due to the continued growth of renewable energy technologies, and the infrastructure build-out globally. To that extent, in British Columbia, we have focused on jurisdictions and areas where it is feasible to develop and build copper mines.

We focus on areas with access and infrastructure. We are always looking for areas with power, water and rail, while taking into consideration the ability to develop a copper mine in certain areas. That means we are generally in areas that are topographically subdued because we believe that if we are successful in identifying economic zones of copper mineralization it is important to demonstrate that the location is suitable for continued development.

Allen Alper Jr.: So you're looking for mining-friendly, infrastructure-ready areas within Canada?

Brad Peters: Yes, specifically within British Columbia, at this time, because we are actively looking for porphyry copper projects with significant gold credits.

Allen Alper Jr.: In one of the sessions a couple days ago they were saying, they liked gold projects as long as they had copper.

Brad Peters: That's right. And interestingly enough, the world's largest gold deposits are copper mines.

Allen Alper Jr.: Tell us a little bit more about your philosophy and how you go about looking for projects?

Brad Peters: We start at a very high level. We look at the regional magnetics, known districts with producing or past producing copper mines and work out from there. Ideally we try and stake open ground, but that has become a little more difficult in the last couple of years. The best place to start is with British Columbia’s large public data base, with assessment reports, previous drilling, radiometrics, magnetics.

We bring all of the available public data together and compile it with our own data. We look at logistics, infrastructure and physiography to determine if the area is suitable for development of a copper project. We believe in drilling as early and often as possible to reach a decision point on a project. In the end we believe exploration is a numbers game. In order to maximize our exposure to discovery, it is critical that we drill-test as many projects as possible, in a cost effective manner that is consistent with the prospect generator business model.

Allen Alper Jr.: Tell us what are your current projects?

Brad Peters: Currently we have 14 projects in the portfolio, two of which are currently under option. One of the projects, currently under option, is the Stars Property, which is under option to ML Gold Corp. Recently they have resumed diamond drilling, with a Phase 2 drill program. We look forward to results over the next several weeks. ML Gold optioned the project from us in November of 2017 and completed an initial diamond drill program in January of 2018, which was highlighted by Hole #4, which ran 205 metres at .45% copper.

For those projects, in our portfolio, that are not currently under option, we intend to test six to eight of those with the Company’s reverse circulation drill this year. We've already tested two projects and we're currently on our third project. The initial project we tested was the Red Project. We've moved on to the Wildcat Project, which is near Mount Milligan. We're currently at the Kitimat Project, which is close to the town of Kitimat in west central British Columbia. From there we'll move up to the Toodoggone area and take advantage of the warm weather. Once our projects in that region are completed, we'll move south through British Colombia, staying ahead of the snow.

Allen Alper Jr.: Now, you mentioned the partner model. Is that what you're going to try to leverage? Are you going to try to partner with joint ventures to minimize dilution?

Brad Peters: Absolutely and the key word you mentioned was leverage. That's a critical component of why we decided to purchase a reverse circulation drill and do the drilling in-house. In addition to giving us greater control over operating costs, our primary objective is to advance our projects beyond the stage of traditional prospect generators, which we believe will lead to greater leverage and greater options. Leverage is an important component of any negotiation and drilling can provide us with leverage. Drilling can also provide us with options. For example, if we drill a project and the results are such that the market is willing to give us five million dollars to park two diamond rigs on it, then that may be a situation where we would consider a spin-out.

If not suitable for a spin-out, but results are still positive, we would then approach potential partners, such as the copper majors, as there are a number of copper miners in British Columbia looking for copper.

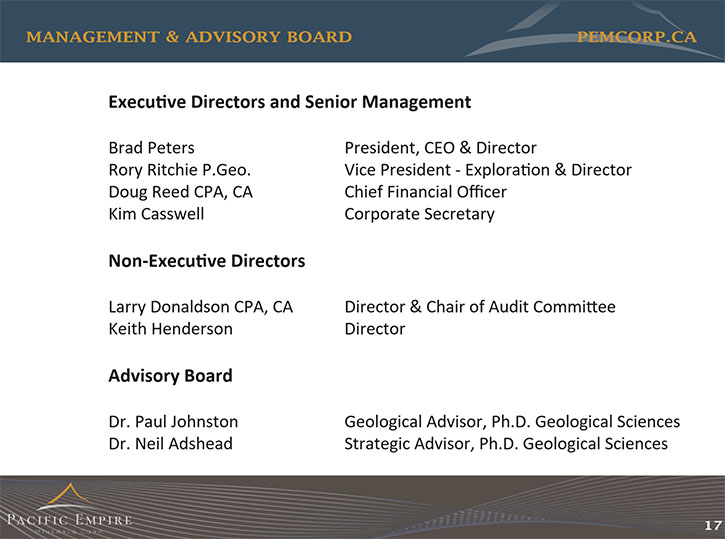

Allen Alper Jr.: Tell us a little bit about your management team.

Brad Peters: The two founders of the Company are myself and Mr. Rory Ritchie. Rory is our Vice President of Exploration. We started the company together in 2013 and continued building the company over the next several years. In 2017 we began assembling our Board of Directors, in anticipation of going public. We added Keith Henderson, who has 20 years of experience in the mining business and Larry Donaldson as directors. Larry serves as Chair of the Audit Committee and has been with the Strategic Metals Group, as the Chief Financial Officer. As a result, Larry is very familiar with the prospect generator business model.

Since 2014, we have had Seabord Services Corp. assisting with our backend support, by providing Corporate Secretary, Chief Financial Officer, accounting and public company requirements. We've assembled an advisory board, which consists of, Dr. Neil Adshead and Dr. Paul Johnson. Neil Adshead was previously with Sprott and assists with and advises on strategic business opportunities. Paul Johnson is a geologic advisor. He was previously with Teck, as their special projects and porphyry geologist for the Americas.

Allen Alper Jr.: What do you think are your main concerns and how are you doing to try to address those?

Brad Peters: For, us our main concern is always operating cost. We've always prided ourselves on maintaining a low burn rate, while being able to explore actively and be aggressive. Now that we own a drill, our primary objective is to continue to keep drill costs low and to continue reducing drill costs.

Allen Alper Jr.: How do you make sure that you're minimizing the number of dry holes?

Brad Peters: To minimize the number of dry holes, it's important that all of our projects and all of our targets are in areas that truly have potential to have an ore hole. We work from a known. We do not step out into the unknown and start drilling mystery holes. We work on selecting targets and projects that are within existing jurisdictions, either close to existing mines, but in areas where there's a little bit of cover. Areas of cover have traditionally been a barrier to exploration because prospecting, with a diamond drill, in areas of cover, is prohibitively expensive. This is where we see an opportunity, with reverse circulation drilling. We understand that dry holes are a part of exploration, but by drilling early and often we can rapidly reach a decision point. By reaching a decision point as rapidly as possible our focus and resources can be continuously refined to focus on the most favourable targets.

Allen Alper Jr.: What are the primary reasons our high-net-worth readers/investors should consider investing in Pacific Empire Minerals Corp?

Brad Peters: I think there're three reasons. Firstly, copper and gold. Copper investors are savvy investors , who understand that going forward there's a tremendous opportunity for copper. Although copper is our focus, we prefer projects with significant gold credits.

Reason number two is the prospect generator business model. I think it's a fantastic business model for our sector, in that prospect generators tend to be very, very good stewards of capital. They respect shareholders' capital and they do their best to deploy that capital in an efficient manner. There are a number of prospect generators that do it in slightly different ways.

The third and most critical reason for investors to consider Pacific Empire is that we are a prospect generator that drills. That gives us the opportunity to advance our portfolio at a rapid pace, to rapidly test targets and identify which are the best targets for advancement.

If projects don't work out, we move on, while continuously replenishing the portfolio. We added five projects this year already. We are always looking to add more projects and as long as we keep the portfolio full, keep permitting projects, we will have projects that are ready to drill. Shareholders can look at our company and they know that we will always be drilling. We're continuously drilling, continuously testing projects all through the summer, fall, spring and we're looking to add project that are suitable for winter drilling as well.

Allen Alper Jr.: A lot of times investors hear the word drilling and they think high costs. Why isn't that the case?

Brad Peters: Traditionally diamond drilling is high cost. We use a reverse circulation drill which is much smaller than most diamond drills and drills much faster. Although we don’t get drill core, we do get a sample of homogenized chips and powder which is suitable to on-site screening with our XRF analyzer. By combining reverse circulation drilling with XRF analysis drilling, costs are dramatically reduced. Having a dedicated crew that is highly skilled, highly motivated on board to keep the drill moving further, reduces our drill costs.

Allen Alper Jr.: Okay, so if I'm hearing this right, what you're saying is RC drilling is much cheaper because you're able to do it more quickly. It's not using as much fuel. And the downside is that you're not getting a core. You're just finding copper.

Brad Peters: Exactly, time is money. The more rapidly we can determine whether or not there is copper, the sooner we can allocate resources appropriately.

Allen Alper Jr.: So what do you lose other than a core sample? And the ability to have some cute looking stuff at a core shaft?

Brad Peters: At our stage I don't think we really lose anything. What we are looking for is copper. You do lose some of the ability to measure orientation of veins, some structures, but again, we're looking for porphyry deposits. We're not looking for vein-controlled gold. When we're looking for porphyry deposits, RC drilling is perfect for that application using copper as our pathfinder.

Allen Alper Jr.: Okay. I learned something. Thank you. Do you have anything else you'd like to add in summary?

Brad Peters: Currently we have two ongoing drill programs, a partner-funded drill program and our own drill program and we continue to drill up until the end of the season and continue to replenish the portfolio and start up again next year.

Allen Alper Jr.: Thank you very much for your interesting description of your business model and your exploration techniques. It is all thought out brilliantly to the smallest detail. I’m impressed and I’m not easily impressed.

Brad Peters: Thank you for the opportunity.

https://pemcorp.ca/

Brad Peters

President and Chief Executive Officer

Pacific Empire Minerals Corp.

Tel: +1-604-356-6246

brad@pemcorp.ca

|

|