Interview with Elmer Stewart, President and CEO of Copper Fox (TSXV: CUU) (OTC Pink: CPFXF)

|

By Allen Alper Jr., President, Metals News Inc.

on 5/24/2019

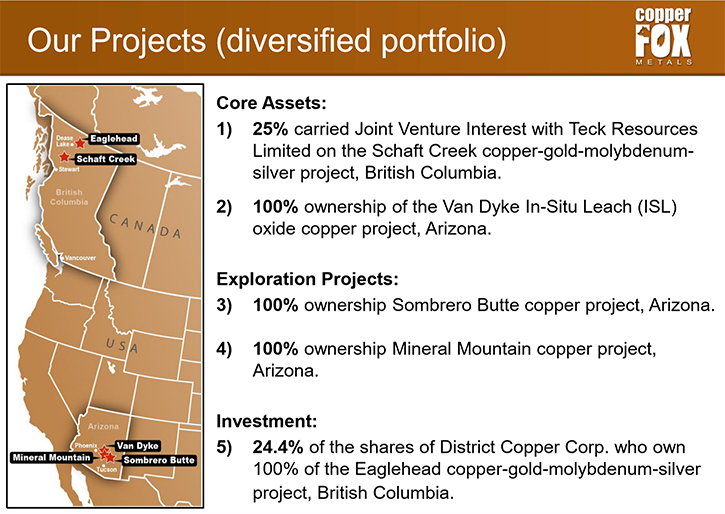

Copper Fox Metals Inc. (TSXV: CUU) (OTC Pink: CPFXF) is focused on the exploration and development of copper properties in Canada and the United States. At PDAC 2019, we learned from Elmer Stewart, President and CEO of Copper Fox, that they have four copper projects and a significant investment in a publically traded company that spans the copper space from early stage exploration to very advanced development stage projects. Their flagship project is the 25% interest in the Schaft Creek Joint Venture on the Schaft Creek copper-gold-molybdenum-silver deposit, with Teck Resources Limited, located in northwestern British Columbia, where the joint venture is working toward enhancing the value of the project. Copper Fox’s goal is to sell its 25% interest in the Schaft creek project. According to Mr. Stewart, the insiders own 57% of the Company, and their major shareholder is a strong supporter. Mr. Stewart, a strong believer in the future of the copper industry, commented that it looks like the industry is on the emerging edge of a significant supply deficit due to a number of operational issues, compounded by experts forecasting that by 2035, approximately 200 currently operating copper mines will be closed.

Elmer Stewart, President and CEO of Copper Fox at PDAC 2019

Copper Fox Metals Inc.

Allen Alper Jr: This is Allen Alper Jr., President of Metals News, here at PDAC 2019, interviewing Elmer Stewart, President and CEO of Copper Fox. Would you like to start by telling us at Metals News and our readers/investors a bit more about yourself and your background?

Elmer Stewart: I have a Master of Science Degree in Geology with approximately 45 years of domestic and international exploration experience in uranium, gold, copper, rare earth metals, lead and zinc. My experience ranges from grassroots exploration discoveries, project development studies up to and including construction and operating experience in open pit and underground mines in Canada and abroad.

Allen Alper Jr: Tell me more about Copper Fox.

Elmer Stewart: Copper Fox is specifically designed to explore for copper deposits and started in 2002 with the Schaft Creek Project. In 2009, management changed and the new Board adopted a strategy to diversify away from a one project company to decrease shareholder risk. Copper Fox now has working interests in four projects and a significant equity ownership in a public company, when combined provides exposure that spans the copper industry from exploration all the way through to advanced projects like Schaft Creek.

Allen Alper Jr: What's your favorite property right now?

Elmer Stewart: My favorite property is the 25% interest in Schaft Creek; it is the most advanced and the one that is closest to allowing Copper Fox to complete its business strategy. Our strategy consists of acquiring exploration stage projects, complete the exploration and development work necessary to attract a partner to carry the project forward like our Schaft Creek Joint Venture with the final objective of selling the asset. Our purchase of the Van Dyke project is an example of this strategy. Copper Fox spent eight million dollars on drilling, metallurgical studies and a maiden Resource Estimate that resulted in completion of the 2015 Preliminary Economic Assessment; a National Instrument 43-101 Technical Report, that indicated a discounted value after tax of $US149 million. Our niche is exploration and early stage development to advance projects to the stage where the project becomes of interest to copper producers.

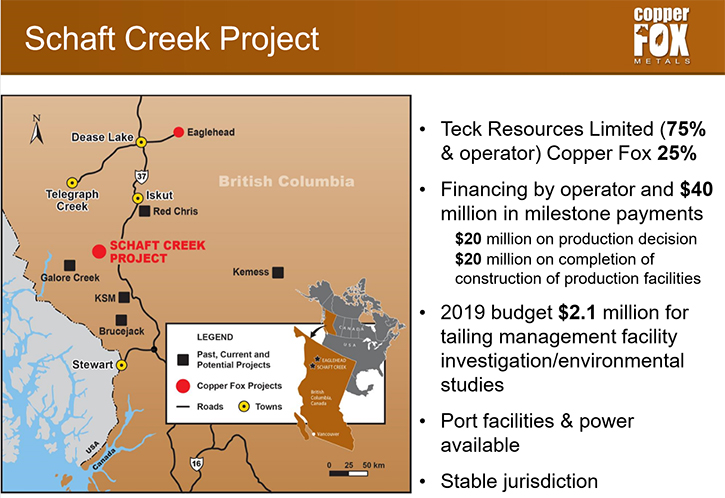

Allen Alper Jr: What’s Teck doing now at Schaft Creek?

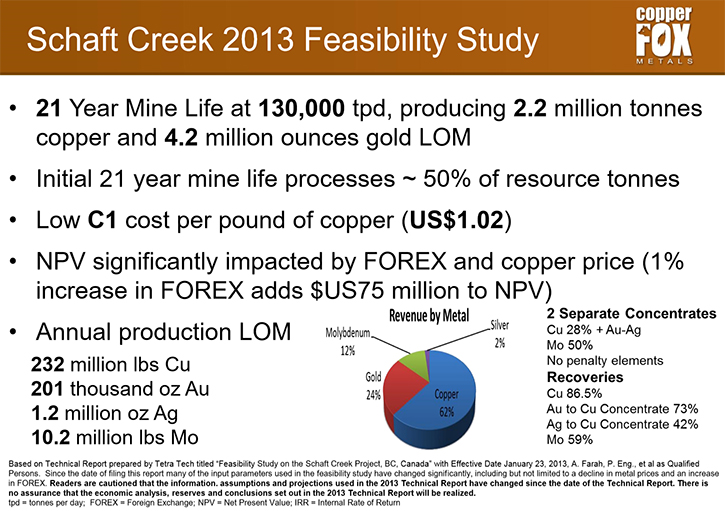

Elmer Stewart: Teck is the Operator of the Schaft Creek Joint Venture. The joint venture is working on defining the path to value. In 2013, Copper Fox completed a Feasibility Study, on a truck and shovel open pit operation with a 130,000 tonnes per day throughput base case. Many things have changed since 2013. In 2018, the Joint Venture completed trade-off studies on several different scenarios with the objective of identifying the scenario that, with additional work, maximizes the value of the project. Although the results of the 2018 work program have not been finalized, the SCJV has increased the budget in 2019 to $2.1 million to complete a more in-depth analysis of the scenario selected by the 2018 work program.

Since completion of the 2013 Feasibility Study, the copper industry has seen reduced operating and capital costs, technological advancements and a significant change in the Canadian to United States foreign exchange rate that would impact the value of the Schaft Creek project. The 2019 work is designed to complete the next phase of the work required to keep advancing the project along the path to value to the point where hopefully a production decision is made. Our exit strategy at that point in time, would be to sell our interest in the project.

Allen Alper Jr: At Schaft Creek, what do the measured and indicated resources look like right now?

Elmer Stewart: It's interesting. Copper Fox completed a Resource Estimate in 2012 to support the Feasibility Study. Teck as Operator of the Schaft Creek Joint Venture updated the Resource Statement and reported in 2018 that the measured and indicated resource categories in both estimates are essentially the same.

Allen Alper Jr: Right.

Elmer Stewart: They're almost one and the same. The Resource Estimate the joint venture reported in 2018 has the benefit of an updated geological model to constrain the resource better. It included the results of the drilling completed in 2013.

Allen Alper Jr: What are the next steps there?

Elmer Stewart: Compile the results of the 2018 program and then determine next steps, which include investigating the geotechnical characteristics of a possible new tailings location and more in-depth desktop studies to further optimize the project. These desktop studies are time consuming, very detailed in scope and are required to move the project to the next stage. This year, the joint venture is strengthening the Project Management Team for the Schaft Creek Project.

Allen Alper Jr: That's excellent! Very good. Tell us more about your Management team.

Elmer Stewart: Copper Fox’s Management team consists primarily of myself and the CFO. In 2013, when Copper Fox completed the Schaft Creek Joint Venture with Teck, Copper Fox saw that there was a slowdown coming in the industry, so we reduced our technical staff. Since 2013, we have maintained good relationships with these former employees and exclusively use them to complete project due diligence. This is essentially the same team that completed the Feasibility Study for Schaft Creek in 2013. If we staff up, I would want to bring these people back; although we have no plans right now for additional staffing.

Allen Alper Jr: What does your share structure look like?

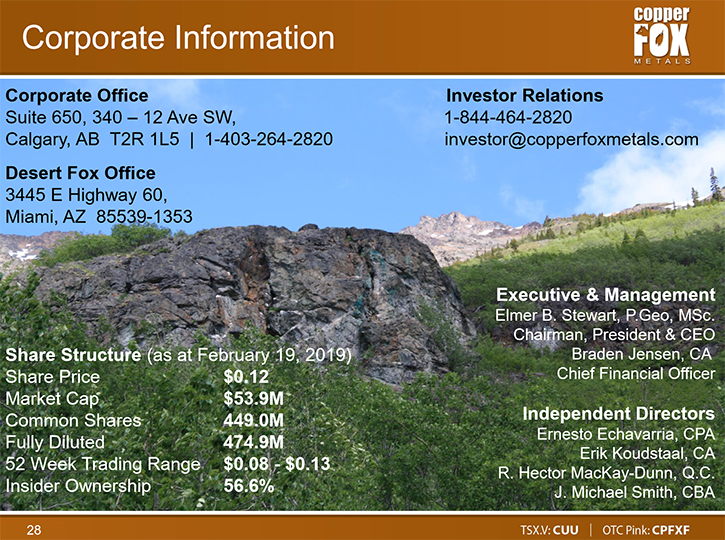

Elmer Stewart: About 57% of the shares are owned by the insiders. The rest is held by approximately 4,000 shareholders based on our last survey. Copper Fox has about 460 million shares out, and there's a history behind the current share structure. But it works well; our major shareholder is a strong supporter of the Company, and always participates in financings.

Allen Alper Jr: You have a lot of skin in the game.

Elmer Stewart: Yes. Both Management and Insiders have a lot of skin in the game because we believe in our strategy and our asset portfolio. Our strategy is to acquire, explore and develop a project and then sell our interest, because our end audience is copper producers we know what they're looking for in a project. Our approach to project exploration and development is very cautious and conservative because the producers know the end game better than anybody.

Allen Alper Jr: It seems like you're doing a lot to minimize dilution of your stock.

Elmer Stewart: That's correct. We're very cautious about the share capital. We announce a private placement to our shareholders, knowing exactly the funds needed for the year. We do this for our shareholders, because of the low risk, high reward for Copper Fox right now. We want our shareholders to have the option to participate and if they decide to pass, then we will look at bringing in new shareholders.

Allen Alper Jr: What are the main reasons that investors should be looking at Copper Fox right now?

Elmer Stewart: Copper Fox is only focused in the copper space in North America in proven mining districts and stable geopolitical jurisdictions. We have a broad range of exploration to advanced development stage projects, several of which have resource statements that contain a significant amount of metal and Teck; a major mining company managing the Schaft Creek project, all of which I think is very compelling. The amounts of copper-gold-silver-molybdenum metal we have in resource categories for our projects, sums to a very large holding of all four commodities.

The other thing is, I think we're coming into a new copper cycle similar to 2009 after the debacle of 2008, when everything was down. The forward projections of a decreasing supply and an increasing demand for copper, should push the prices higher. Higher prices allow mining lower-grade material. A little more difficult, little costlier; but provides some supply relief until more deposits are found and developed. That's the crux the industry has now. Exploration expenditures are increasing, but the number of new discoveries is declining at a very rapid rate.

Ultimately, we think there's going to be a copper crunch coming. Some of the people out there are forecasting that 200 existing copper mines will be shut down by the year 2035. That gives you 16 years, which means12 mines have to be brought on stream each year, just to replace those 200 mines. Assuming these mines do shut down, the industry does not have the advanced stage projects to replace these mines. The lead time required to get a project into production is eight to ten years which delays new copper coming into the supply chain; and that is assuming once you're past the feasibility study, there is regulatory, environmental and social support for the project. It has to be done right, for society to have enough copper to meet its demands and based on what I have just described, I see a supply crunch coming.

Allen Alper Jr: Yes. Most of the experts are saying the demand on copper is increasing. What is your take on it?

Elmer Stewart: I think it is. I like to use a two percent per annum increase. Some people like to use three percent, other people are really bullish on six percent. Just to quantify what that means; if copper consumption were 23 million tonnes last year at a two percent annual increase that requires 460,000 new tonnes of copper. That is a big, big mine. If it's six percent growth, it means you have to have 1.5 million tonnes of new copper coming on line each year just to meet demand growth. There is not a mine in the world that produces that much copper. Even Escondida can't do that. It gives you an indication of the issue facing the copper industry going forward from a supply side perspective. The demand side's going to take care of itself. The green initiative, infrastructure growth and replacement, world economic growth, whatever. It's the supply side that's going to be the big issue going forward. I think that's going to be sooner than later.

Allen Alper Jr: Is there anything else you'd like to add?

Elmer Stewart: Just to thank you for interviewing Copper Fox Metals for Metals News. We're going to continue moving our strategy forward. We have a great basket of assets, a significant amount of metal in the ground, a major mining company as Operator of our most advanced project and are well positioned to take advantage of the next commodity cycle.

Allen Alper Jr: Thank you very much. It's an exciting story. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

Elmer B. Stewart

President and Chief Executive Officer

For additional information contact:

Lynn Ball: investor@copperfoxmetals.com

(844) 464-2820 or (403) 264-2820

|

|