Monument Mining Limited (TSX-V: MMY, FSE: D7Q1): Objective of Becoming a Mid-Tier Multiple Mines Gold Producer; Interview with Cathy Zhai, President and CEO

|

By Allen Alper Jr., President, Metals News Inc.

on 5/14/2019

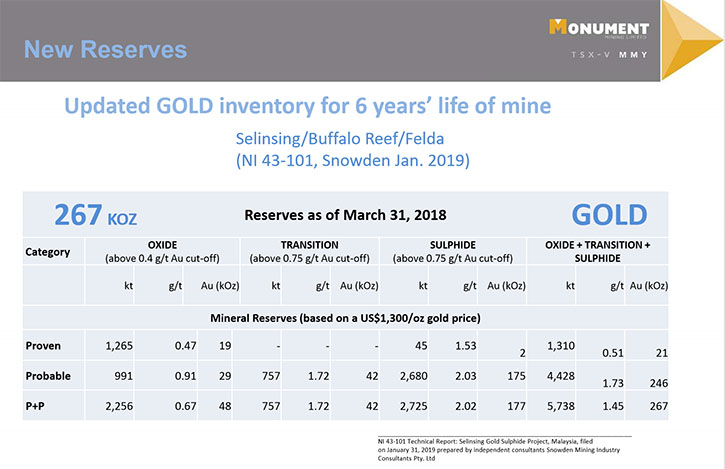

Monument Mining Limited (TSX-V: MMY, FSE: D7Q1) is an established Canadian gold producer that owns and operates the Selinsing Gold Mine in Malaysia. The team of proven mine-builders is advancing a portfolio of exploration and development projects, including the Mengapur Copper-Iron Project, in Pahang State of Malaysia, and the Murchison Gold Projects in Western Australia, towards becoming a mid-tier multiple mines gold producer. At PDAC2019, we learned from Cathy Zhai, President and CEO of Monument Mining, that the Selinsing Gold Mine has been producing for 10 years, for a total of about 280,000 ounces for gross revenue of more than $390 million, with an average cost of $476 per ounce. After Monument completes the 53 million plant extension and mine development work, the mine will have an additional 6 years of mine life on sulfide materials, which is going to generate another $100 million cashflow.

Monument Mining Limited

Allen Alper Jr: This is Allen Alper Jr., President of Metals News, here at PDAC 2019, interviewing Cathy Zhai, President and CEO of Monument Mining Limited. Could you tell us at Metals News and our readers/investors a little bit more about yourself?

Cathy Zhai: My background is in accounting. I’ve been with Monument Mining for more than 10 years, since the beginning. I was a CFO to support the CEO, President.

Allen Alper Jr: Tell us a bit about Monument and your 10 years there. Obviously you've stuck with them and grown them, so.

Cathy Zhai: Yes, Monument acquired a Malaysia primary gold asset back in 2007. We spent two years to complete the mine development, and then we built out the plant, and put it into production in, I think, October 2009. Since then, we produced gold for the past 10 years, for a total of about 280,000 ounces for gross revenue, of more than 390 million, with a cost per ounce, average of $476 dollars per ounce.

Allen Alper Jr: What does the current mine life look like?

Cathy Zhai: Well we pretty much ran out of the oxide materials. Now, we have just released a full history of what is a related study, with an additional life of mine, of six years on Sulfide materials. We should require about 53 million for the additional plant extension, including mine-development as well. We're expecting to generate a large cashflow from our operation, about 100 million with NPV 27 million.

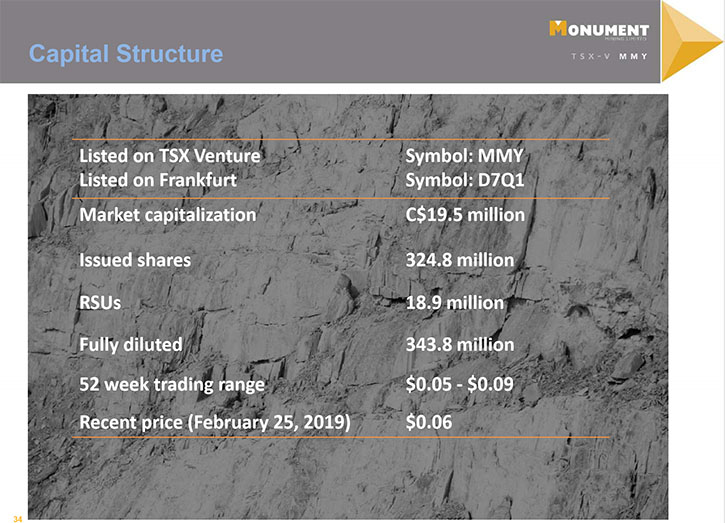

Allen Alper Jr: Tell us a little bit about your share structure and insider investments.

Cathy Zhai: Well, we have a total of about 324 million shares outstanding. The majority of them are owned by private shareholders. We do not have a large institutional and management has about 5 million shares and 18.9 million in restricted share units.

Allen Alper Jr: What are your next steps now to bring more life to the mine?

Cathy Zhai: First of all, we want to put Selinsing Sulphide project into production. That requires some funding. Secondly, we have two other projects. One is in West Australia, our Murchison project. We have a resource of 380,000 ounces. It is a very large land position, with very good potential and underground potential as well. We're going to do more regional exploration. Locally, we want to increase our gold inventory. Then, be able to put it into production, generate a second cashflow. Another project is our copper and iron project in Malaysia. We published resources statements last year, in October. We have about 90 million tons of copper at an average grade of .47. I think the copper can be a pretty attractive project for Monument as the next step. We, most likely, can get a ten year tax holiday from the Malaysia government for that project.

Allen Alper Jr: Tell us a little bit about your Management team and their expertise.

Cathy Zhai: Our Management team has been very stable. We built up a core of people for the past 11 years, and most of them are still with us, at a senior level. I think our executives are more strategic and our operation team is more boots on the ground. Very good operators. Over the past 10 years, we have increased our technical capability. We can do lots of desktop study in-house. We have a pretty strong management team.

Allen Alper Jr: So, what do you view right now, as your largest challenge, and what are you doing to address it?

Cathy Zhai: Well, I think the challenge is pretty common in the mining industry, with the scarcity of a good quality gold inventory and having to mine sulfide materials and, or low-grade materials. The strength of Monument is our assets, major assets in Malaysia, very, very low cost compared to Canada and Australia. Also our team has done lots of research on how to treat the sulfide materials and our team is quite experienced and able to adapt and carry on the new technologies.

Allen Alper Jr: Is that going to increase the cost per ounce?

Cathy Zhai: It would increase some cost per ounce, but because Malaysia is a low cost country, compared to Australia or Canada, the cost is relatively low, our feasibility study shows the average cost per ounce is 864 dollars with gold price now about 1300. I think we’ll made some pretty good profits.

Allen Alper Jr: Now, are you going to need any additional permits for this?

Cathy Zhai: No. We don't have any permitting issues.

Allen Alper Jr: So, you're fully permitted. What do you think are the main reasons investors would want to look at Monument?

Cathy Zhai: I think number one is Monument has a very good operating team and management team, experienced, committed, enthusiastic, think out of the box. That's number one. Number two, our major assets in Malaysia have very low cost and their tax holidays. Some, say for the sulfide project, we can get capital tax allowance against the total investment.

We report 53 million as CAPEX. So the first profits, up to that amount, are tax-free. Also we have government support. We have local support and Malaysia has a very good British law system, mining law, and I think it's a very established country. Of course, there is corruption, but I think Malaysia is now moving in the right direction.

Allen Alper Jr: And, you have a lot of experience dealing in Malaysia.

Cathy Zhai: Yes, I do.

Allen Alper Jr: You have been in Malaysia, with Monument, for ten years.

Cathy Zhai: More than ten years. I started with Monument before it turned into a mining company in 2001 or 2002. Then we experienced two reverse takeovers, change of business and acquisitions, development and other department expansions. Lots of things happened in the past 11 years.

Allen Alper Jr: And, some people might not be familiar with mining in Malaysia. What have you done to make it more mining-friendly?

Cathy Zhai: Well, in general, Monument started from a junior mining company, but over the past eight years, we have become a leading-edge gold producer in Malaysia and we have established standards for Malaysia in the mining industry. So we're well-known. We get lots of support.

Allen Alper Jr: You feel you have de-risked anyone else's concerns for Malaysia?

Cathy Zhai: Well there will always be a risk. We always tell our investors, "If you are afraid of risk, don't invest in mining." Mining has challenges, which we are used to. But also that opens up opportunities.

Allen Alper Jr: Is there anything else you'd like to add?

Cathy Zhai: Monument, compared to other junior companies, is quite unique. Because, we are not an exploration company, and we're not a big, large gold-producing company. We're in the middle, but we have upside potential, with exploration, and we also generate cashflow. We're operators.

Allen Alper Jr: So now, the cashflow that you're producing, are you putting that back in?

Cathy Zhai: Yes, we generate about 370 or 90 million gross revenue, and with low cost, we re-invest all the money back into our gold portfolio in Australia, and also into copper and iron project in Malaysia. We're looking for sustainable production going forward.

Allen Alper Jr: So, by doing that, you've reduced the dilution of your stock, not having to issue financing in stock. Going forward, how are you planning to finance your next 25 million market cap for the land, without significantly diluting the stocks?

Cathy Zhai: We do not see equity as an option at the moment. We think the debt financing is more attractive to shareholders, without large dilution, but I think after we unlock the value in our assets, hopefully our share price can come up and we can return value to our shareholders.

Allen Alper Jr: Well, thank you very much for an excellent interview. I think this is a good, good company. Very exciting. What's your newsfeed looking like? When will we hear more about your progress? What are the next steps that are coming?

Monument Mining Limited

Cathy Zhai: In summary; we want to bring the Selinsing sulfide project into production as soon as possible. We're ready. The Team is ready. Whenever we get funding we can start immediately. It takes 12 months, a little bit more, than we can start off to generate revenue from the sulfide project.

Allen Alper Jr: So, you're looking at 2020?

Cathy Zhai: Yes, mid-2020, subject to financing. Next, we want to do our regional exploration in Murchison. Murchison has an existing processing plant already, a small one, 260,000 ton per annum. That is designed for processing high-grade gold inventory. In Murchison, we have underground potentials. We're going to do more deep-routing to find if there's a system we should replicate. Also, for the Mengapur, Mengapur used to be a large state-owned economic scale project. We have to divide up the resource, we want to find a finance partner to work together to unlock the value.

Allen Alper Jr: Thank you very much for a very interesting interview. We look forward to seeing you back in production strongly, second half of next year. Sounds very promising.

Cathy Zhai: Thank you, Allen for interviewing us at Monument Mining for Metals News. We appreciate it.

Allen Alper Jr: We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://www.monumentmining.com/

Richard Cushing,

MMY Vancouver

T: +1-604-638-1661 x102

rcushing@monumentmining.com

|

|