Barkerville Gold Mines Ltd. (TSXV: BGM): Accomplished Team Exploring and Developing One of the Most Well-Endowed Gold Land Packages in British Columbia; Interview with Jason Kosec, VP of Corporate Development

|

By Allen Alper Jr., President, Metals News Inc.

on 5/6/2019

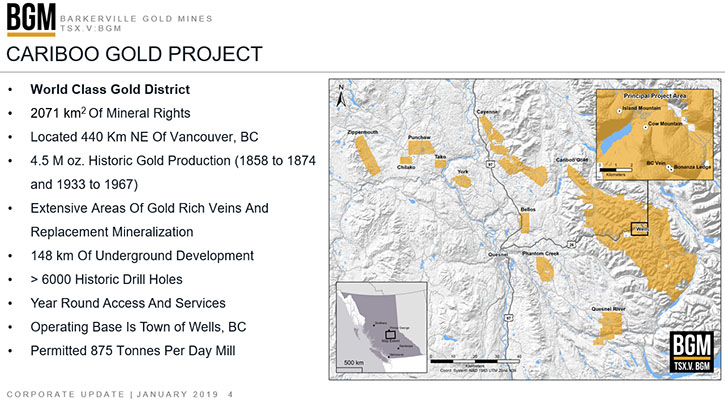

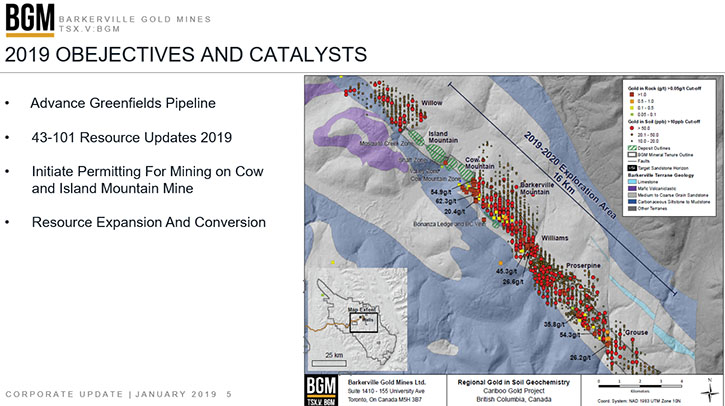

Barkerville Gold Mines Ltd. (TSXV: BGM) is focused on developing its extensive mineral rights package, located in the historical Cariboo Mining District of central British Columbia. Barkerville’s Cariboo Gold Project mineral tenures cover 2,039 square kilometres; along a strike length of 67 kilometres, which includes several past producing placer and hard rock mines, making it one of the most well-endowed land packages in British Columbia. At the 2019 Vancouver Resource Investment Conference, we learned from Jason Kosec, VP of Corporate Development of Barkerville Gold Mines, that after about 30,000 meters of drilling, they have successfully unlocked the fundamental structural controls of the gold mineralization and have come up with a genetic model that increased their hit rate from 10% to about 95%. This allows the Company to allocate capital in a very productive fashion and maximize return for shareholders. According to Mr. Kosec, their cost per discoverable ounce is one of the lowest in the industry. Plans for 2019 include a fully funded $23.7 million drilling program, with monthly drill results.

Jason Kosec, VP of Corporate Development, Barkerville Gold Mines at VRIC.

Allen Alper Jr.: This is Allen Alper Jr., President of Metals News. We're here at VRIC 2019. I'm interviewing Jason Kosec, who is the VP of Corporate Development of Barkerville Gold Mines. Could you give us and our readers/investors an overview of what you guys are doing?

Jason Kosec: Perfect. Thank you very much for your introduction, Allen. We are currently a development and mining exploration company located in central British Columbia, 440 kilometers as the crow flies from Vancouver. The site can be accessed by an all-season road from Quesnel. It is a historical mining camp. It was the third largest placer district in North America. It was discovered in 1858. There are three and a half million ounces of placer production, all within our main claim block and only 1.2 million in hard rock production.

One of the reasons we came to be involved in this project is that these are district sized land packages that have a current resource. They're in a well-endowed, safe jurisdiction. The terrain is well-endowed, with a lot of gold potential and a lot of historical production.

The land package was very fragmented at the start. It was held by 86 different land holders. So no one could really understand what the fundamental controls of mineralization are.

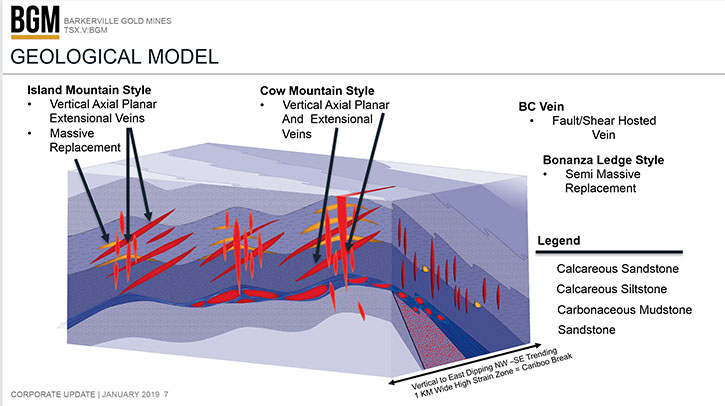

So when we took over the project in 2016, our first mandate, as the exploration team, was to figure out what's going on because no one has really understood it since its inception in 1860. We came up with a model. It took us about a year and about 30,000 meters of drilling. But after we came up with the model, our hit rate went from 10% to about 95%.

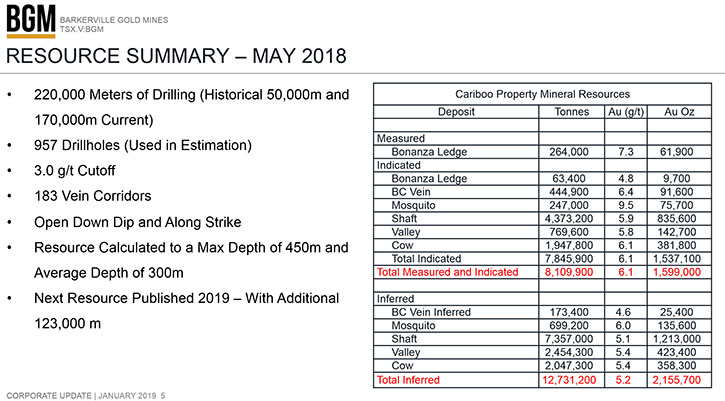

It allows us to allocate capital in a very productive fashion, so we can maximize return for shareholders. Our cost per discoverable ounce is the lowest in the industry, it's about 17-20 dollars an ounce. We saw, after putting this model together that these veins continue to about 900 meters at depth. The current resource is only to an average of three hundred and fifty meters and on a strike length of two and a half kilometers.

We saw a real growth potential. Growing this thing above the ten million ounce mark, within our land package, is completely feasible over the next two to three years.

Some of the important things we've done since our takeover are: We've done some small scale test mining. We've run 120,000 tons from our Bonanza Ledge test mine. We have a 100% owned QR mill, which is located 110 kilometers away. This small scale production allowed us to really understand the geometries of the ore body, the dilution that will factor in, recoveries, and ground supports. So it will add to the robustness of our PEA and feasibility.

What people can see, going forward over the next year, is basically monthly drill results. The drilling program we have planned this year is 23.7 million. We're fully financed for that. We have 52 million dollars in the bank. The drilling this year will be resource expansion and conversion. Along with that, we'll have a new 43101 resource coming out in Q2 this year, from 2018 drilling. There are 123,000 meters drilled in 2018. The resource that is coming out in Q1 2019 will be a lot of resource conversion because we wanted to get as much as we could of the M&I category so we could feed the feasibility and start the permit application for the larger project on Callen Island.

So since we've taken over, we've substantially de-risked the asset.

Allen Alper Jr.: Excellent. Tell us a bit more about your Management Team and share structure.

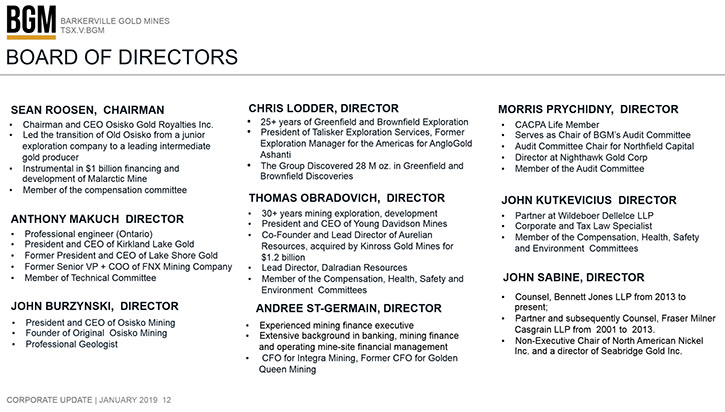

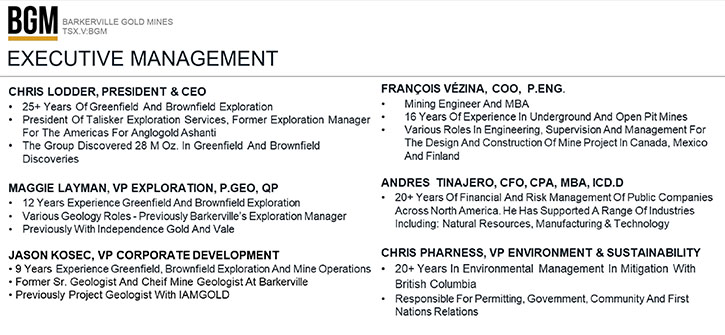

Jason Kosec: Sean Roosen is our Chairman. He was the founder of Malarctic, which he bought for $88,888 and sold for $4.2 billion to Yamana and Agnico, returning $3.2 billion to his shareholders. John Burzynski was also his partner in that project, as he was the Vice President of Corporate Development. Tony Makuch is the President and CEO of Kirkland Lake Gold. Chris Lodder, our President and CEO is probably one of the best explorationists of his time. He's found over 28 million ounces of greenfield discoveries, with the Anglogold Gold, Ashanti Group. Tom Obradovich was one of the founders of Aurelian, which is Forte Don Norte, which was sold for $1.2 billion to Kinross, also founder of the Young Davidson and Dalradian. Andree St. Germain is with Integra. Morris Prychidny is with Northfield Capital, which is a big mining finance group.

On our Management Team, we have Chris Lodder, we have Maggie Layman who's the vice-president of exploration. She spent time with Inco and Independence Gold. I've pretty much worked everywhere with IAMGOLD. We discovered the Cote Gold Project in 2009 and we sold it to IM Gold for $680 million. I was then with IAMGold for six years and then switched over when the Osisko Group came in.

Francois Vézina is our COO. He is one of the builders of Malartic. He was also with Agnico Eagle. Andres Tinajero was with Sprott, he's our CFO. And Chris Pharness is our VP Environment and Scalability, who spent numerous years working with First Nations, doing environmental impacts, throughout British Columbia.

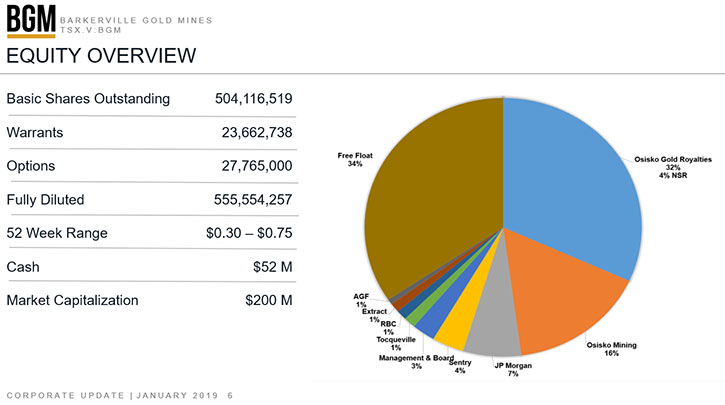

Our share structure; we’re 32% held by Osisko Gold Royalties, 16% by Osisko Mining, there's a four percent NSR on the project. JP Morgan now owns seven percent. Century owns 4%. Borden Management owns three and a half. Tocqueville, RBC and Oppenheimer Extract all own one percent each. So it's a very, very strong share structure, 52 million dollars in the bank and very strong management team. We have basically the mining hall of fame on our Board. It checks all the criteria for people, who dabble in the junior mining space.

We like to think of ourselves as not a real junior company because of our Management team, our position and our world class asset.

Allen Alper Jr.: What are the primary reasons our high-net-worth readers/investors should consider investing in BGM?

Jason Kosec: The main reasons are we've substantially de-risked the project. It's very simple metallurgy. We have a proven track record of building mines on time and returning shareholder money. Currently we're trading at about $20 on an EV ounce basis. People can make real money, right now in the current market, which isn't the best market, ounces are getting bought for about $100 to $120. Like I said we're at $20. So you know there's some serious torque that you can make on that, if the market changes and I wish I could predict where the equity market was going, except I can't. Back in 2011, 2012 ounces were being bought for $200.

So I think there's substantial upside, with minimal risk on the downside, as we've removed all of the headwinds over the last two years of us getting involved in it.

Allen Alper Jr.: Is there anything else you'd like to add?

Jason Kosec: Thank you for interviewing us for Metals News.

If anyone wants to contact me and needs more information, feel free to contact me at jkosec@barkervillegold.com, or I can be reached at 250-552-7424.

Allen Alper Jr.: Thank you very much for all of your information. You have an impressive amount of talent in Barkerville Gold Mines. We’ll publish your press releases as they come out, so our readers/investors can follow your progress.

http://barkervillegold.com/

Jason Kosec

Vice President Corporate Development

1(250)552-7424 (Mobile)

JKosec@barkervillegold.com

|

|