Interview with Claude Lemasson, President and CEO of Eastmain Resources Inc. (TSX:ER, OTCQX: EANRF): Three High-Grade Gold Assets in the James Bay Gold Camp in Quebec

|

By Allen Alper Jr., President, Metals News Inc.

on 5/3/2019

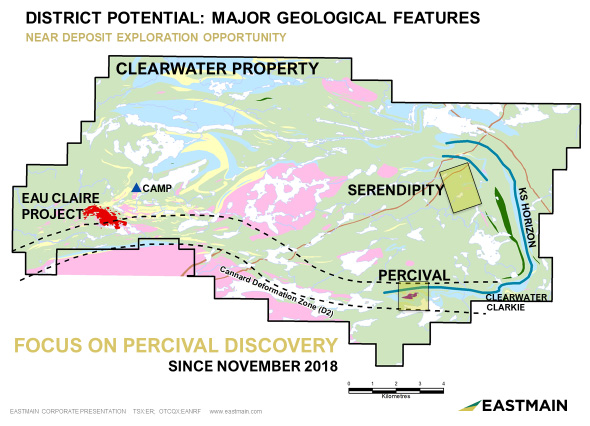

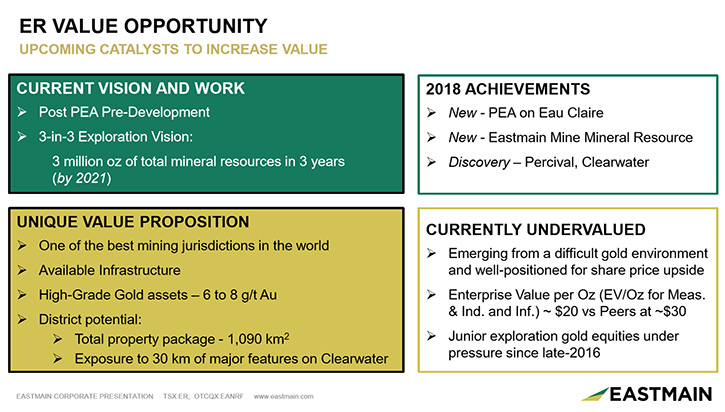

Eastmain Resources Inc. (TSX:ER, OTCQX: EANRF) is a junior Canadian exploration company, advancing three high-grade gold assets, in the emerging James Bay gold camp, in Quebec. At PDAC2019, we learned from Claude Lemasson, who is President and CEO of Eastmain Resources, that their main project is called Clearwater Property, where they have two assets, the 1.35 million-ounce Eau Claire Project, with a very robust PEA and the brand-new Percival Discovery, made in November 2018. Near term plans include exploration drilling, permitting, and completing the feasibility study by the end of 2021, to get to the development decision point.

Claude Lemasson, President and CEO of Eastmain Resources

Eastmain Resources Inc.

Allen Alper Jr: This is Allen Alper Jr., President of Metals News, here at PDAC 2019, interviewing Claude Lemasson, President and CEO of Eastmain. Could you tell us a bit about yourself, Claude?

Claude Lemasson: My background in general is as a mine building engineer, with 30 years in the mining business and 25 in gold mining specifically. Essentially, I have been involved in the whole process, right from the advanced exploration of projects to building mines and operating them, mostly within Ontario and Quebec

Allen Alper Jr: Could you give us a quick summary of Eastmain and then go into what you've done in 2018.

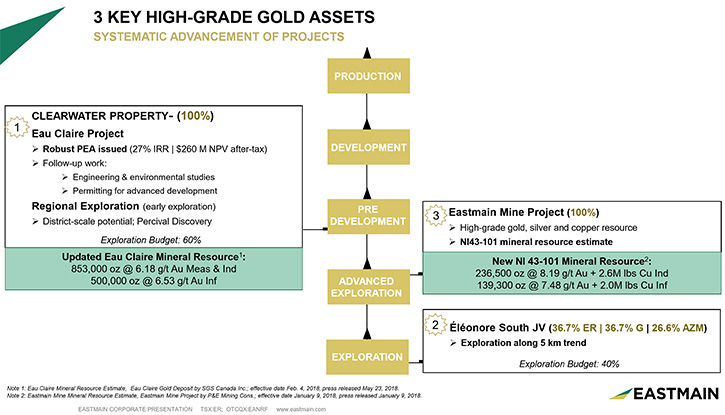

Claude Lemasson: Eastmain Resources is a junior exploration company, based in Toronto, with assets in northern Quebec, particularly James Bay, Quebec. Our assets are all high-grade gold. We currently have three active projects and out of those three projects we have an anchor project, and two discoveries.

Allen Alper Jr: So, what's been going on lately? I think we did an article last year, so we could bring everyone up to speed with an update on 2018.

Claude Lemasson: Absolutely. Clearwater continues to be our main property. On Clearwater we have two areas of focus. We have the Eau Claire Project. I'll talk a little bit about that, and then a brand-new discovery called Percival, that was announced late last year, in November 2018.

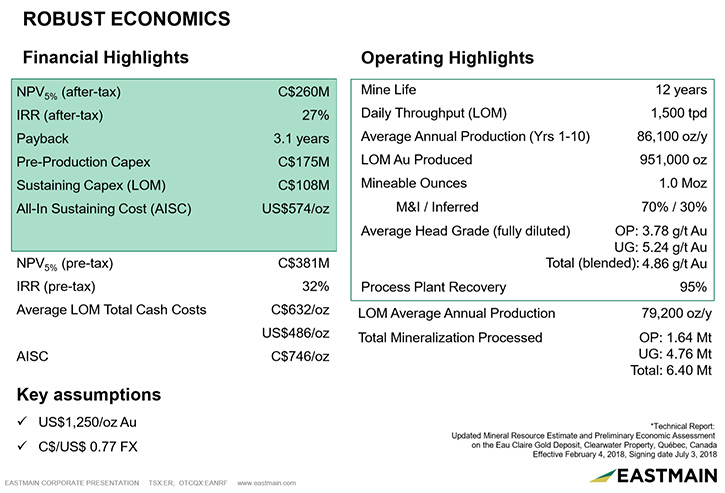

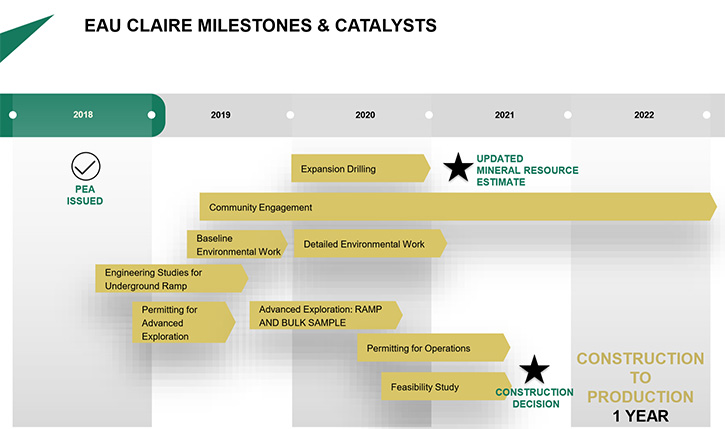

But I will back track to Eau Claire, our anchor Project. We completed a mineral resource estimate in 2017 on Eau Claire and subsequently completed a PEA (Preliminary Economic Assessment) that we issued in May 2018, with very robust economics! It illustrates a net present value of $260 million after tax and an IRR of 27% and a three year payback.

So, very solid. It's an open pit with high grades, and then we go underground, which will extend down to 860 meters via ramp. It has been very positive for the Eau Claire Project. And we are continuing to advance the technical studies, and the permitting-related activities to move the project forward towards feasibility.

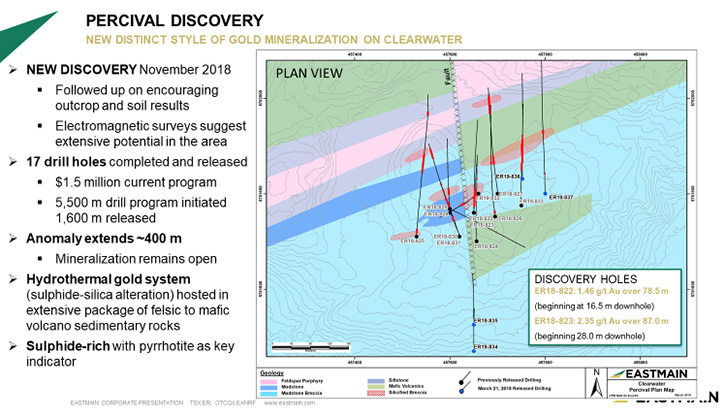

Percival is the new discovery I referred to, located 14 kilometers east of the Eau Claire Project. Percival is a brand-new discovery. We decided to look at our best exploration potential on the property and began drilling last fall. Two drill holes encountered, near surface - top 100 meters, intercepts in the range of 80 meters long of about two grams per ton. We were very excited about the good grade, especially so close to surface.

Since then, we have issued 13 more holes and we continue to drill. Results are growing and confirming the initial discovery. We are currently drilling a program of approximately 18 more holes. For the next two, three months we're going to see a steady news flow of those results being issued.

Allen Alper Jr: Excellent! Back to Eau Claire with the PEA, what does that give you, as far as measured and indicated mineral resource?

Claude Lemasson: What we have is, we started with the mineral resource estimate comprised of 853,000 ounces at 6.13 g/t Au in the measured and indicated category, and 500,000 ounces at 6.53 g/t Au in the inferred category. Out of that, the PEA establishes that we have one million ounces minable and broken down further within the minable ounces, essentially measured and indicated total approximately 700,000 ounces and approximately 300,000 are inferred.

We will eventually drill the inferred ounces to convert it prior to feasibility study, but that's more the ounces at depth and that's work to be done in and around 2020.

We want to continue our technical studies in 2019 and start some of the permitting process, which includes the baseline environmental work that we need to do. In 2020, permitting will continue, and will also include some of that deeper drilling to convert the inferred into measured and indicated. As we move down the path of permitting and initiating the feasibility study, we anticipate the study will be completed in late 2021. Following the study, we aim to target a development decision to proceed with the project.

Allen Alper Jr: Very good. Tell us more about Percival. What are your next steps there? Do you have some news coming out?

Claude Lemasson: We made the discovery with the initial 11 holes that we drilled late last year, in a roughly 250 meter by 250 meter plan around the two discovery holes. With the currently drilling, we are now expanding the size of the discovery to 800 meters by 600 meters, and seeing encouraging results.

Some of the completed electromagnetic and geophysical work is helping to guide the drilling. As a result, we are continuing to grow and expand the footprint of the discovery. The target for this year is to complete this winter campaign, regroup, and then come back in the field in summer, and then in the fall, and do a much larger program to continue expanding the footprint again eastwards, along the KS Horizon. Preliminarily, we are proposing approximately 40 to 50 holes in the summer and fall to continue extending the discovery, particularly to the east. The results, of this flown electromagnetic survey, illustrate a 14 kilometer long horizon that lights up. Followed up by some ground geophysics and the drilling at Percival, we are eager to continue exploring the Knight-Serendipity Volcano-Sedimentary Horizon.

Claude Lemasson: The slide above shows the KS Horizon, which begins at Percival at the bottom center of the page. As we move east, across the horizon, the geological feature curves to the north towards Serendipity. This is where we are going to do more work later this year, building on the potential illustrated in our ground geophysics and the VTEM flown surveys.

While looking for the gold, we look at sulphides and we follow pyrrhotite. Pyrrhotite is a good guide, helping to guide drilling along that corridor. What we can see on the plan view above are our drill holes, with the intercepts in red. Most of the intercepts coincide with the red-orange colored areas that are indicative of the sulphide breccias.

And that means high sulfides, pyrrhotite, which indicates this is where we should be drilling.

Allen Alper Jr: Very exciting! Tell us a little bit more about your Management Team and then your share structure?

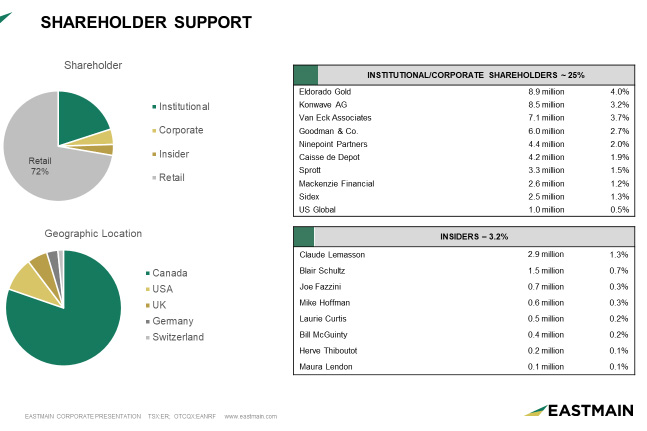

Claude Lemasson: The team was put together about three years ago, when I took over the Company. Alison Dwoskin for our investor relations, and Joe Fazzini as our CFO and Corporate Development have been with us from day one. On the exploration side, we have a Vice President Exploration, Bill McGuinty and right under him we have an Exploration Manager in Quebec, named Carl Corriveau. So, this is our main team.

Below that, we have a whole bunch of different geologists and other staff, field staff that are directly on-site, where we're doing some of our work and some of our drilling.

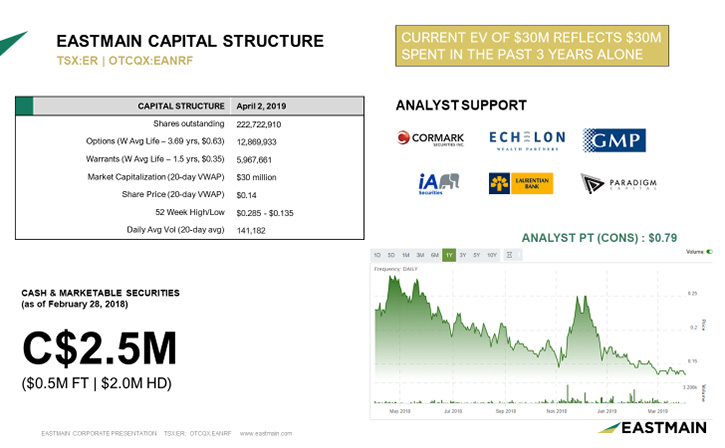

As far as share structure, we are on the main board in Toronto, on the TSX under the symbol ER, and we're also on the OTCQX, under the symbol EANRF. We have about 222 million shares with pretty good daily liquidity. We trade right now around 200,000 shares per day. We have $2 million in the bank that has already funded the majority of our current drill programs.

Allen Alper Jr: Sounds good. Tell us a bit about management investment.

Claude Lemasson: We are fairly heavy on the retail. About 72% are retail investors. We also have some very strong institutional investors, and management has been buying into the company on a regular basis, when we are not blacked out, on the open market or participating in financings. Insiders own about 3% of share ownership.

Personally, I own 1.3% of the company and I continue to buy, when not blacked out. My intention is to continue buying into the company, especially at these valuation levels that are extremely low. As we all know, it's been a very tough gold market for the last few years, and we are seeing signs now of institutional investors coming back to gold. That's a very good sign for us. Valuations are amazingly low, and we believe it is a great opportunity to enter into a gold play at low levels.

Allen Alper Jr: What would you say is the biggest challenge that you're facing right now and what are you doing to address it?

Claude Lemasson: From a technical perspective, we are exploring to build a satellite to Eau Claire and prove the district potential of our Clearwater property. We believe that the KS Horizon is a key to that goal. While focusing on the exploration, we find challenges, within the low equity valuations, within the market, and we will inevitably raise money at these levels.

But meanwhile we're executing on fairly lean budgets, with what we have and we're doing very well at that.

Allen Alper Jr: So, what steps are you taking to raise money and still minimize dilution?

Claude Lemasson: One of the steps we take as a Canadian company with Canadian Properties, particularly in Quebec, is to take advantage of the extra credit benefits. Rather than raise what we call hard dollars, or regular dollars, a large portion of what we raise is by way of flow-through financings, meaning we are able to raise at higher prices because of the associated tax credits for spending the money in Canada and again within the province. Specifically, as an exploration company, we are able to raise more money, with less dilution by raising flow-through funds. As a result, we like to earmark about three quarters of our financings to flow-through, and the balance in hard dollars.

Allen Alper Jr: Flow-through is great if you are exploring! Excellent! What would you say are the main reasons that investors should be looking closely at Eastmain right now?

Claude Lemasson: Well, we're very well-positioned. First of all, we have high-grade gold projects; to us, that is an essential advantage. The high-grades are important for our future open pit and underground scenario at Eau Clare, as we think the gold market is going to turn around and prices will improve. For fund managers and interested shareholders, it is a great time to position in, ahead of the gold rally.

A major advantage is the jurisdiction we are in. We are in Quebec, in James Bay, which is very safe politically. We have a very supportive government and local communities to work with. In addition, the area has great infrastructure, with road access into our properties, nearby hydro-power and access to land at local air strips. So, all-in-all a great setup in an enviable location.

We have three key assets that are at different stages, including the Eau Claire Project, which is now headed towards feasibility study. On top of that, we have two discoveries on two different properties, within close proximity of each other.

We are very excited about the potential around the discoveries and believe Eastmain is a great gold play.

Allen Alper Jr: Just to summarize, you have a great management team. You have high-grade. You're in a great location and you're moving forward and advancing. When you put out these next-step studies, they should also revalue your company.

Claude Lemasson: That's exactly the idea. Just to give you an example, our current stock price in Canadian on the TSX is 14 cents. Our six sell-side analysts have a price target consensus of 79 cents meaning a potential upside of 460%.

Allen Alper Jr: Very good. Do you have anything else you'd like to add in summary?

Claude Lemasson: I would like to thank you and your readers/investors for their interest in our Company. We welcome questions from anybody, who is interested in investing in high-grade gold. Thank you for interviewing Eastmain for Metals News.

Allen Alper Jr: Thank you. We’ll publish your press releases as they come out, so our readers/investors can follow your progress.

Disclosure: The Alper family owns Eastmain Resources stock.

http://www.eastmain.com/

Claude Lemasson, President and CEO

+1 647-347-3765

lemasson@eastmain.com

Alison Dwoskin, Manager, Investor Relations

+1 647-347-3735

dwoskin@eastmain.com

|

|