Interview with Joe Walsh, Managing Director of Lepidico Ltd (ASX: LPD): Objective to Become a Fully Integrated Lithium Business from Mine to Battery-Grade Lithium Chemical

|

By Allen Alper Jr., President, Metals News Inc.

on 4/11/2019

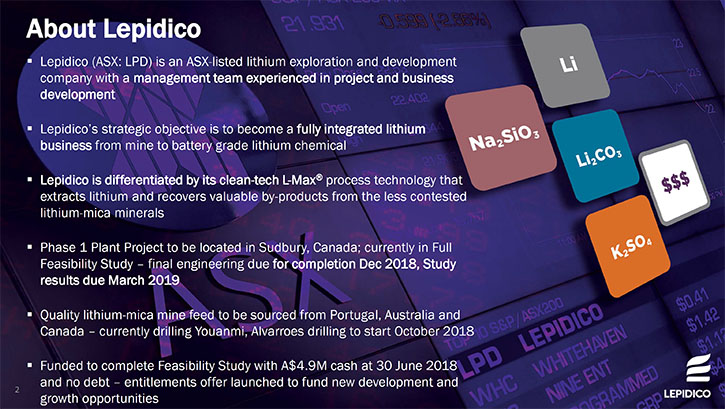

Lepidico Ltd (ASX: LPD) is a lithium exploration and development company, who's strategic objective is to become a fully integrated lithium business from mine to battery-grade lithium chemical. At PDAC2019, we learned from Joe Walsh, Managing Director of Lepidico, that Lepidico is a unique investment opportunity in the lithium space, as the 100% owner and developer of the L-Max® and LOH-MaxTM technologies, proprietary processes, which have the potential to produce commercially, either lithium hydroxide or lithium carbonate, from unconventional sources. These technologies have the potential to place Lepidico at the forefront of the lithium industry.

Joe Walsh, Managing Director of Lepidico at PDAC 2019

Allen Alper Jr: This is Allen Alper Jr., President of Metals News, here at PDAC 2019, in Toronto, interviewing Joe Walsh, who is the Managing Director of Lepidico. So Joe, why don't you tell us at Metals News and our readers/investors a bit about your background?

Joe Walsh: Certainly. I'm a mining engineer by training and I've been active in the mining space all of my working life. Out of University, I ended up in South Africa. Then I spent time in West Africa, Eastern Europe, and the Middle East, before joining an investment bank and spending ten years as a mining analyst. Subsequently I went back onto the corporate side and spent twelve years with PanAust as General Manager Corporate Development. Two years ago I joined Lepidico, as Managing Director.

Allen Alper Jr: Would you like to give us a summary of what Lepidico is all about.

Joe Walsh: Lepidico is a lithium chemical development company. Our point of difference is the fact that we have proprietary process technologies that allow us to process lithium mica and lithium phosphate minerals through to a lithium chemical, either lithium hydroxide or lithium carbonate.

Allen Alper Jr: Tell us a bit more about the benefits that that gives you.

Joe Walsh: We're operating in a relatively uncontested space, as far as the minerals are concerned. Most lithium is sourced from either brines or from spodumene, whereas Lepidico is focused on the lithium mica and phosphate minerals thanks to our proprietary chemical processes. The other advantage of our L-Max® process is that it produces a range of byproducts as well, so we expect to be competitive from a cost perspective.

Allen Alper Jr: So where are you getting your materials?

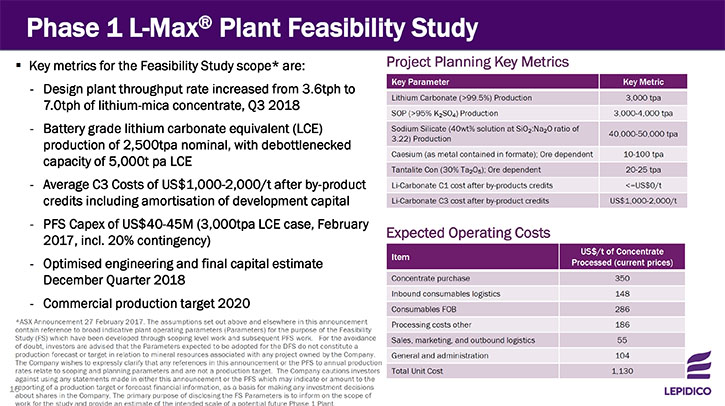

Joe Walsh: We're currently in the advanced stages of completing a feasibility study on what we call our Phase 1 Plan Project, the feed source for this is planned to be the Alvarrões lepidolite mine in northern Portugal. Alvarrões has been in production since 1992, providing relatively small quantities of lepidolite to the ceramics industry. We did our first drill program there about 18 months ago, identified an Inferred Mineral Resource, and then late last year we completed an infill drill program and are now in the final stages of a new Mineral Resource estimate.

Allen Alper Jr: Is this the type of lithium that’s used in ceramics, glass-quality, low iron?

Joe Walsh: Yes it can be. The reason for using a lithium mineral in ceramics is that it lowers the temperature, at which essential chemical reactions take place, thereby making the process less energy-intensive.

Joe Walsh: Lepidico is currently undertaking a feasibility study on expanding the Alvarrões mine and building a concentrator to produce a lepidolite concentrate, which we would then export to our L-Max® chemical plant, which is planned to be built in Sudbury, Canada. L-Max® uses a fair quantity of sulfuric acid, which is produced in significant quantities by two established nickel smelters in Sudbury. It is more cost effective from a logistics perspective to take a benign mineral concentrate to the acid than ship a hazardous chemical to mineral. Furthermore, market analysis has shown that there are markets for L-Max® byproducts – SOP fertilizer and amorphous silica – in this part of Canada.

Allen Alper Jr: Oh, okay. Well thank you very much. Tell us a little bit more about your take on lithium and supply demand requirements.

Joe Walsh: There's obviously a lot of discussion about supply-demand in the lithium space. The projections that many commentators have over the next five to ten years are really extremely compelling, with potentially a five-fold increase in demand over an eight year period from, say, 2017 to 2025, taking lithium chemical production to a million ton a year market. A lot of this forecast growth is driven by expected demand for lithium ion batteries and adoption rates for electric vehicles in particular. Over the last year or two, a lot of commentators have been progressively increasing their medium to longer term demand expectations. However, in the near term there has been concern about a significant wave of new supply coming into the market, particularly from the new spodumene mines coming into production in Western Australia.

New supply is never easy to deliver at the best of times, and I think that we will see actual supply growth lag many commentators' expectations, as new projects prove to be more challenging to finance, build, commission and ramp up. A lot of pre-development-stage projects that are being contemplated are substantial in scale, often requiring half a billion, to a billion dollars in capital. Such projects aren't going to be easy to fund or build. So I think that we will see supply generally lagging behind a lot of expectations, leading to lithium chemical prices firming again in the medium and longer term.

Allen Alper Jr: Interesting. Could you tell us about your Management Team?

Joe Walsh: Lepidico is a small company. We rely heavily on the support of an external consulting business, Strategic Metallurgy, for most of our metallurgical and technical requirements. It's that team that has developed our proprietary processes. Strategic Metallurgy owns just over 10% of Lepidico. And they have continued to support the business by way of developing new process technologies as well. We made an announcement a couple of weeks ago that we had entered into an agreement with the principals of Strategic Metallurgy for a process which we call LOH-MaxTM, a novel process which produces lithium hydroxide. LOH-MaxTM is a new proprietary process that allows lithium hydroxide to be produced directly from lithium sulfate, which is an intermediate product of many hard rock processes, including spodumene concentrate conversion plants.

Within Lepidico, our project manager is Peter Walker, who's an extremely experienced mineral processing engineer and mine operator. Shontel Norgate is our CFO, who has spent a lot of her career in the minerals space, including in development companies.

Allen Alper Jr: Very good. Tell us a little bit about your share structure.

Joe Walsh: Our two major shareholders are Galaxy Resources, an ASX listed spodumene producer, with just over 11%. Strategic Metallurgy has just over 10%. Outside of that, we have a predominantly retail register.

Allen Alper Jr: And how much management investment do you have?

Joe Walsh: Collectively, Management and Board, on a fully diluted basis, own around 13 or 14% of the company.

Allen Alper Jr: So you have your skin in the game. That’s very important!

Joe Walsh: Absolutely. Management are certainly incentivized.

Allen Alper Jr: What are the main reasons you think investors should be looking at Lepidico right now?

Joe Walsh: We are a unique investment opportunity in the lithium space. We are focused on lithium minerals that are relatively uncontested, by virtue of the fact that we have proprietary process technologies that allow us to extract lithium chemicals from those minerals. The processes are hydro-metallurgical and therefore not that energy intensive and benefit from a suite of byproducts. This means that Lepidico should be industry competitive from both a capital intensity and an operating cost perspective.

Allen Alper Jr: So do you have anything else you'd like to add?

Joe Walsh: Just to thank you for interviewing Lepidico for Metals News. We appreciate it.

Allen Alper Jr: Thank you. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

http://www.lepidico.com/

Joe Walsh

Managing Director

Lepidico Ltd

+1 647 272 5347

|

|