Integra Resources Corp. (TSXV: ITR; OTCQX:IRRZF): Interview with Chris Gordon, Business Development, Developing Gold and Silver Deposits in Western Idaho

|

By Allen Alper Jr., President, Metals News Inc.

on 4/4/2019

Integra Resources Corp. (TSXV:ITR ; OTCQX:IRRZF) is a development-stage company, focused on advancing its DeLamar Project, consisting of the neighbouring DeLamar and Florida Mountain Gold and Silver Deposits, in the heart of the historic Owyhee County mining district, in south western Idaho. The first exploration program, in over 25 years, began on the DeLamar Project in 2018, with more than 23,000 meters drilled. The management team comprises the former executive team from Integra Gold Corp. At the PDAC2019 conference, we learned from Chris Gordon, Business Development with Integra Resources, that this year they expect to grow the resource, move a good part of the inferred to the indicated category, analyze the metallurgical studies, and, by September, do a PEA. According to Mr. Gordon, Integra is being very diligent to maintain a tight share structure and an excellent list of shareholders.

Chris Gordon, Business Development, Integra Resources at PDAC 2019

Integra Resources Corp. DeLamar Project

Allen Alper Jr: This is Allen Alper Jr., President of Metals News, here at PDAC 2019, interviewing Chris Gordon, Business Development with Integra Resources.

We've known you for a while, with a couple different hats, but let's talk about what you're doing today. You were very successful before, so there’s a high probability you will very successful again.

Chris Gordon: The key things that made us successful last time around with our Val-d’Or project in Quebec were: Great jurisdiction in Quebec, high-grade gold, an accreditive mill acquisition, past production history, and project scalability. After the sale of Integra Gold to Eldorado Gold for $600 million, we began looking for another asset with a similar profile. This led us to Integra Resources and the DeLamar Project in SW Idaho.

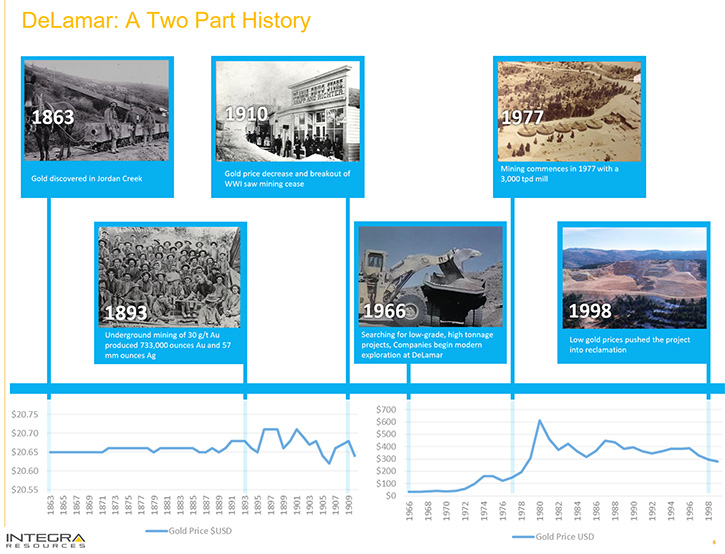

We acquired the DeLamar Project from Kinross in 2017, winning the bid, in part, due to our experience advancing brownfield projects. Right out of the gate, we released a resource estimate of three and a half million ounces of gold equivalent (with silver being the other major metal at DeLamar).

The DeLamar project is a past producer, operating from 1977 to 1998 under multiple operators, with Kinross being the miner to produce at DeLamar. In 1998, Kinross shut down DeLamar due to low gold prices (sub $300), not because they ran out of gold. Kinross reclaimed the project and maintained it for 20 years before deciding to sell it to a capable team, Integra Resources.

Allen Alper Jr: And you're the team.

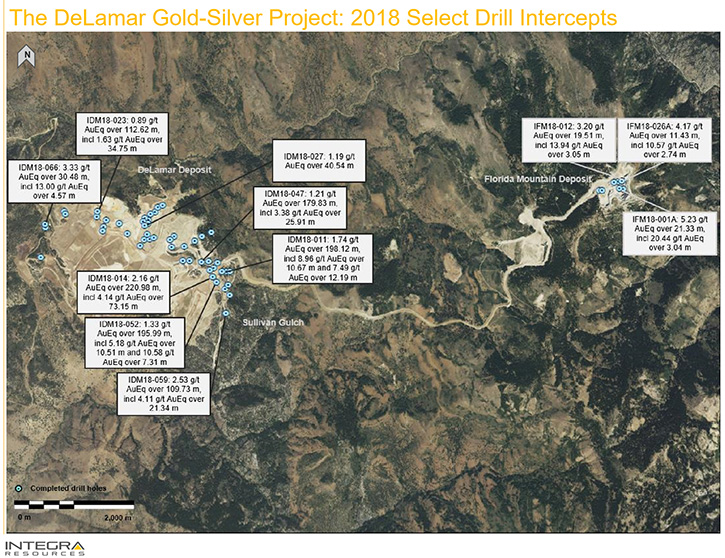

Chris Gordon: Yes, we're the team. Last year was our first real work program on the asset. As part of that 2018 exploration program, the Company drilled 23,000 m, completed extensive geophysical surveys, undertook soil sampling, and began a detailed metallurgical study of the mineralized material at DeLamar and Florida last year. The drilling identified significant mineralization below the main resource boundary (previous operators only drilled on average 120 m vertical) and, more importantly, discovered Sullivan Gulch, a previously under explored zone on the periphery of the resource envelope. Drilling at Sullivan Gulch has identified wide gold intercepts 400 m from the existing resource estimate at DeLamar.

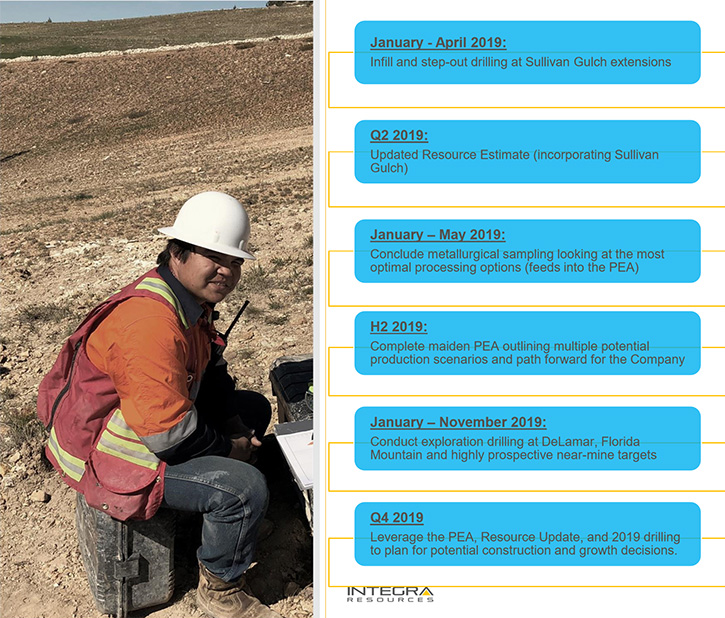

In 2019, the focus will be on the options for moving this project towards development stage. This will start with an updated resource estimate which we are targeting for mid-May. We expect to see that three and a half million ounce resource grow, as well as move a good chunk of the inferred to the indicated category.

Later this year we'll also start seeing results from our metallurgical studies that we started in the fall last year. This updated resource and understanding of metallurgy will be fed into our first Preliminary Economic Assessment, expected in September/October of this year.

Allen Alper Jr: What sets Integra apart from its peers.

Chris Gordon: Integra is a unique story in the sector. There are very few projects in the US that have a resource of this size, in a great jurisdiction – Idaho, and with a clear path forward (which will become ever clearer after the release of the PEA). With an updated resource estimate planned, along with studies to de-risk the project, the Company is looking forward to an exciting year.

This year, we are also focused on drilling potential high-grade targets at Florida Mountain. The history of DeLamar is two-fold, the more modern mining that took place from 1977 to 1998, and the first mining that took place in the area in the late 1860s to 1910s. During this first era of mining, underground miners focused on the high-grade feeder veins below DeLamar and Florida Mountain. The grades they mined were astounding, averaged 30 g/t gold and 200 oz/t silver. Enviable grades by today’s standards.

The 10,000 m of drilling planned at Florida Mountain will target the high-grade feeder veins historically mined by the old timers. We had some success drilling these veins in 2018 so we’ve allocated more meterage to Florida Mountain for this year.

Allen Alper Jr: Excellent! Tell us about your Management Team?

Chris Gordon: The management team is essentially the same team from Integra Gold. That team, from 2012 to 2017, was able to grow the Company from a market cap of $20 million to its sale for $600 million. During that stretch, we also drilled over 300,000 m and raised a $150 million. Most of that heavy lifting was done on the back of one of the worst bear markets on record in history.

The experience at Integra Gold demonstrated the team’s ability to raise capital, increase shareholder value and advance projects aggressively.

Allen Alper Jr: What type path forward will the PEA highlight?

Chris Gordon: The PEA will to outline various scenarios for moving forward, ranging from a heap leach scenario, milling scenario and hybrid scenario. We know milling works well since this is what they did when they were running the open pit operation from 1977 to 1998. During this period, they were averaging 1.2 g/t gold at the mill and 75 g/t silver. We’d expect the met testing and PEA to confirm similar numbers from a milling perspective.

Allen Alper Jr: Without diluting your stock.

Chris Gordon: Exactly. That's a good point that you bring up Allen. The last time, with a lot of the work we did, being in a horrible market, we had to rely on flow through funds. We had to raise a lot of capital between $0.20 and $0.35. Granted, every financing we ever did was at least $0.02 higher than the previous one. It was definitely a challenging market! We ended up with close to half a billion shares by the time we were bought by Eldorado Gold.

So this time around, we're being very diligent to make sure we are able to maintain a much tighter share structure. So currently we have 77 million shares issued. Market cap of 65 million ($CDN) and there is no overhang on the stock, which is phenomenal. We have an excellent list of shareholders. We have Ross Beady and Pierre Lassonde as shareholders, which are excellent guys to have behind your story. Then we have groups like, Commodity Capital, Extract, JP Morgan Asset Management, Ruffer, CQS, Earth, etc. that came into October's financing. We have a pretty enviable list of shareholders behind the story.

Allen Alper Jr: Great. So tell us a little about Management’s investment?

Chris Gordon: As far as the breakdown of the share structure of the ownership, 60% is institutional. Management and insiders have about 12% to 13%. We've put a lot of our own money into this project. We're very committed to this.

Allen Alper Jr: How is your Board of Directors?

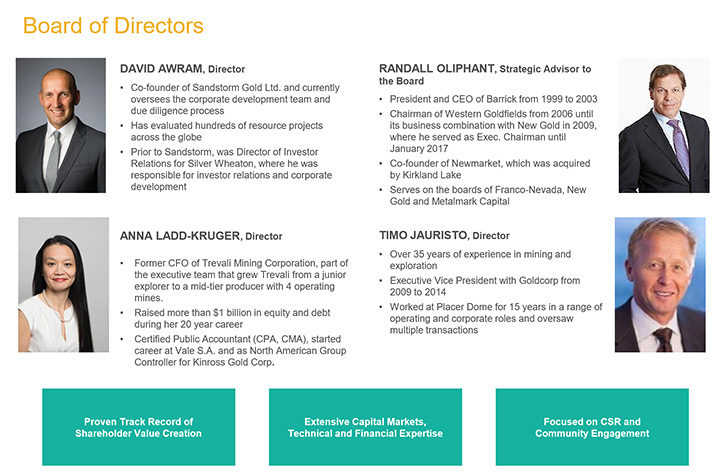

Chris Gordon: Definitely a strong board with a lot of diverse experience which is exciting. We have David Awram, co-founder of Sandstorm. We just recently added Anna Ladd-Kruger, most recently CFO of Trevali, and Timo Jauristo who held senior positions at Goldcorp and Placer. Randall Oliphant is also a strategic advisor to the Board.

Allen Alper Jr: Tell us more about Idaho?

Chris Gordon: It's obviously very important to be in a safe jurisdiction when you're looking to advance a project, and Idaho has been a great place to work. Butch Otter, former Governor of Idaho, just joined the board of First Cobalt in Idaho, and the new governor of Idaho, Brad Little, was Butch Otter’s lieutenant governor. Governor Little is pro-mining and recently passed legislation to replace onerous regulation in state government and simplify Idaho state government. The Frasier Institute ranks Idaho fifth in the US for advancing or developing mining projects

To give an example of the commitment of Idaho state legislators to mining, last year the Governor traveled to Toronto (twice) and New York with the Idaho Mining Coalition to promote mining in Idaho. The message from Idaho is clear, they are open for business as far as mining goes.

We are often asked about the project metallurgy. Historically, metallurgy has never been a problem. At the mill they were able to average 92% gold and 75% silver recoveries. Previous operators had done column leach testing on oxide material to determine the amenability of heap leaching at the project. These tests were quite successful and saw heap leach recoveries of 64% silver and 85% gold using a 2 inch crush. Integra is currently completing a thorough metallurgy program and we expect to get results back from these tests in the Spring.

The current resource estimate at the project is broken down into two distinct areas: Florida Mountain (which is located 8.5 km from DeLamar by haul road) has 870,000 ounces gold equivalent and DeLamar has 2.6 million ounces gold equivalent. At DeLamar, we’ve discovered the Sullivan Gulch zone. This zone was underexplored by previous operators and has become a game changer for Integra. Drilling in this zone is hitting wide zones of mineralization - 90 m to 200 m wide – with intercepts that are averaging two to three times the existing grade of the resource. We have now stepped out 400 m from the inferred resource at DeLamar and hit good mineralization, including 110 m at 2.53 gram per ton AuEq. So, a really big hole and a really big step out for us.

Though we planned on updating our resource estimate in Q1, the step-out hole at Sullivan Gulch convinced us to postpone the resource a few months and infill drill Sullivan Gulch in order to bring this drilling into the resource. So, we currently have one drill turning in Sullivan Gulch that will complete a 6,000 m infill drill program and bring Sullivan Gulch into the resource. This should allow us to add more ounces to our resource update, which in turn allows us to add more ounces to the PEA study, which means longer mine life and that sort of thing. So, we decided it was well worth our while to delay the PEA and the resource update by a couple of months so we can include that last step out hole. The intercepts at Sullivan Gulch are very significant and much higher grade than the average grade of the resource.

Chris Gordon: You know what, something you might want to let your readers know about is VRify, the technology idea that came out of Integra Gold. VRify allows companies to invite investors on virtual property tours, spin geological models, and provide unleveled visibility through their free app (available for both Android and for iPhones).The former Integra Gold CEO, Steve de Jong, is the Chairman of Integra Resources and the CEO VRify. VRify has become quite successful and companies like Goldcorp, Kirkland Lake, GSV are using the app to promote their projects. They now have about 75 mining companies as clients and are continuing to build aggressively. I urge everyone to go out and get the app. It allows you to take a good look at Integra for sure.

Allen Alper Jr: It's very nice.

One of the other things that's quite interesting, I had three geologists from various groups up on a property tour last November. The two key take-aways from all three geologists were: Max Baker, our VP of exploration, is a rock star and the land package, the DeLamar district, is much larger and more prospective than they realized.

In addition to the work we’ve done at DeLamar and Florida Mountain, the Company has also been active in expanding our land package in Idaho. To date, we’ve added the past producing War Eagle Mountain, one of the highest grade mines during the gold rush of the late 1800s/early 1900s, and the highly prospective Black Sheep district to the Northwest of DeLamar. We've basically taken our land package of 3500 hectares and nearly tripled that to over 9000 hectares.

So, we have a whole host of high-grade targets that we're going to be working on in the second half of 2019 which is pretty exciting. Drilling for the balance of the year will be about 10,000 m at Florida Mountain and 10,000 m at DeLamar.

Allen Alper Jr: Very exciting. Thank you for a great interview. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

Chris Gordon: Thank you for interviewing Integra Resources again for Metals News. It’s always great talking with you.

https://www.integraresources.com/

George Salamis

President, CEO, and Director

Corporate Inquiries: Chris Gordon, chris@integraresources.com

(604) 416-0576

|

|