Yellow Cake Uranium PLC (AIM: YCA, OTC: YLLXF): Buys and Holds Physical Uranium Oxide (U3O8) and Delivers Maximum Exposure to the Expected Resurgence in the Uranium Market; Andre Liebenberg, Executive Director and CEO

|

By Allen Alper Jr., President of Metals News

on 5/17/2021

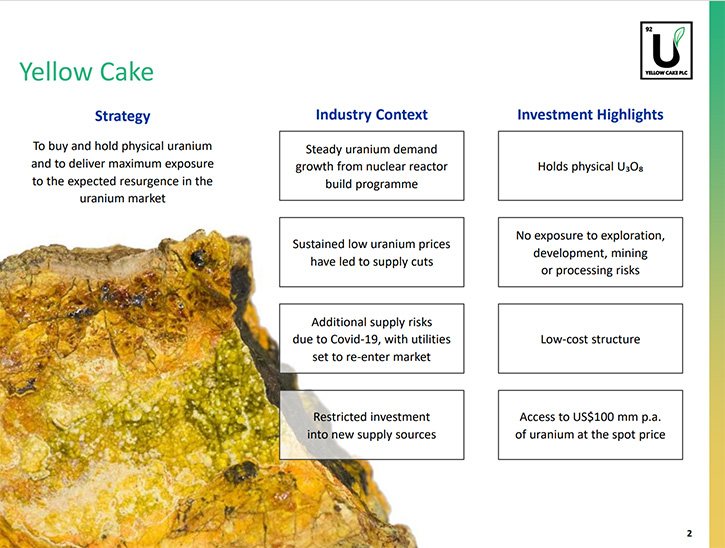

Yellow Cake Uranium (AIM: YCA) offers exposure to the uranium spot price. The Company's strategy is to buy and hold physical uranium oxide (U3O8) and to deliver maximum exposure to the expected resurgence in the uranium market. We learned from Andre Liebenberg, who is the Executive Director and CEO of Yellow Cake Uranium, that they now own about 10 million pounds of uranium that will soon grow to about 13 million pounds. The Company has recently raised $140 million and purchased $100 million worth of uranium from Kazatomprom, which will be delivered this summer.

Yellow Cake Uranium

Al Alper, Jr.:

This is Al Alper, Jr., with Metals News. I'm here interviewing Andre Liebenberg, who is the Executive Director and CEO of Yellow Cake Uranium. They're listed as YCA on the London Stock Exchange. Yellow Cake is giving investors exposure to uranium, of which they have purchased about 10 million pounds of U308. Andre, could you give us an overview of yourself and Yellow Cake?

Andre Liebenberg:Yellow Cake was founded in 2018, in order to give investors direct exposure to the uranium price. We founded Yellow Cake as we had a very simple investment case: that the combination of supply side constraints, and rising demand (together with what was a historical low uranium price) would result in a higher uranium price over time. That fundamental supply/demand story remains the case today, although the factors that have influenced it, like Covid and the growing acceptance of nuclear energy, as a route to achieve zero emissions, in line with the Paris Agreement, are different. We also benefit from a unique advantage – our long-term agreement with Kazatomprom, the world’s largest uranium producer, which gives us the right to acquire $100m of uranium every year until 2027.

So, today, we own about ten million pounds of uranium and in a few months' time, that will grow to about 13 million pounds because we have recently raised $140 million, $100 million of which will go to purchase the additional pounds from Kazatomprom and we're due to get delivery of that probably in the June to August timeframe. The way to think about our Company is, if you look at our balance sheet, (I'll talk on a pro forma basis, including the pounds that are due to be delivered). Our balance sheet is 13 million pounds of uranium and about $23 million of cash. That's it. It's a very simple structure.

We have two full-time employees. We don't have an office; we both work from home. This minimizes the cost leakage, so that investors can invest in the uranium spot price, through our share price. We have this contract with Kazatomprom, which we believe is an important contract for us, because the uranium spot market is not very deep and liquid. If we were to buy one hundred million dollars of uranium in the spot market, that would most certainly move the price quite significantly. Therefore, this contract allows us to grow the Company basically at the spot price.

My background, I've spent the last 25 years in the natural resources space. I was 15 years with BHP Billiton and subsequently in private equity. Then in early 2017 we started putting Yellow Cake together. My experience base is commodities and understanding the cyclicality of commodities and understanding the supply demand dynamic.

Al Alper, Jr.:

Could you give our readers/investors a market update on where uranium is right now?

Andre Liebenberg:

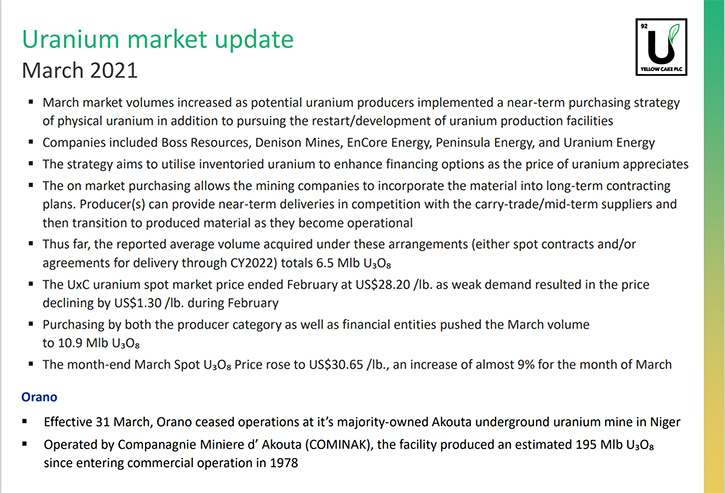

Certainly, in hindsight, looking back at last year, it was a transitional year in my mind for uranium. When we started Yellow Cake, we believed that the supply demand fundamentals were such that the price had to go up in order to induce new supply in the future and to allow existing producers to make money, when they renewed their long-term contracts with utilities. The first wave of COVID last year shone a spotlight on the supply side. Four countries produce 75% of the world's uranium, and COVID impacted three of those countries very, very quickly. About 40% of global production was impacted and we saw the uranium price react.

On the demand side, certainly electricity generated by nuclear reactors held up well. In most places, it tracked with overall demand for electricity, which was impacted by COVID because GDP was impacted. The nuclear reactors held up well.

A number of US policy issues were impacting the uranium market, since the time that we IPO’d in 2018. There was the Section 232 investigation into uranium imports into the US that transformed into the Nuclear Fuel Working Group and then, last year, the Russian Suspension Agreement was due to expire end of the year.

The Nuclear Fuel Working Group concluded its review. The Russian Suspension Agreement was extended through to 2040 under a new set of rules. Those policy issues created uncertainty for US utilities. However, they were all resolved during the course of 2020.

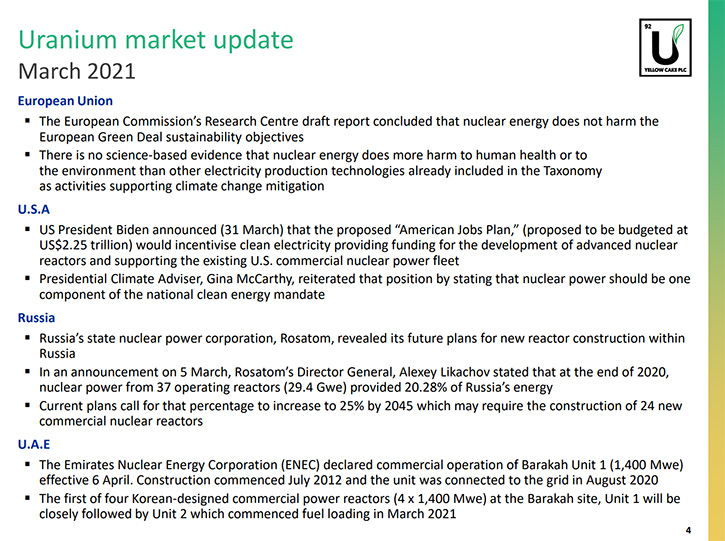

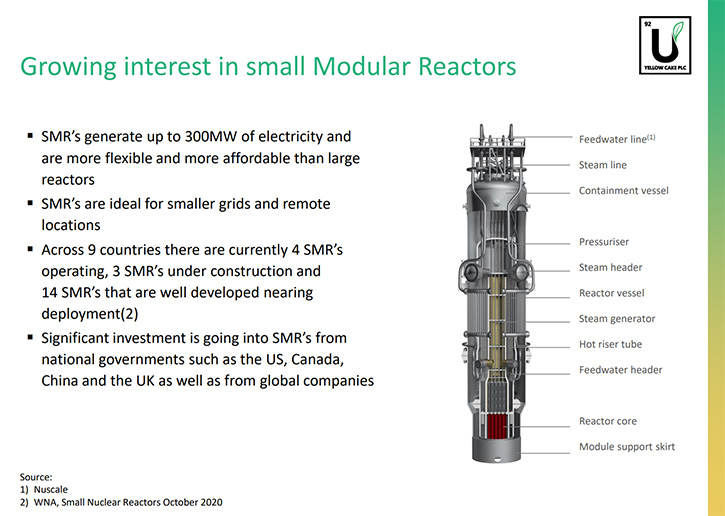

I think the final piece that really happened last year, was more of a sentiment issue. I think the sentiment towards uranium has changed and the sentiment towards nuclear power has changed. If we look at the new administration in the US, the energy policy includes nuclear. Advanced reactors and small modular reactors are part of the clean energy strategy both in the US and here in the UK.

The UK government's ten-point green plan, which came out last year, explicitly included nuclear and set aside GBP500 million for small modular reactors and advanced reactors. In the EU, we have the taxonomy establishing a list of environmentally sustainable activities. The first version of that taxonomy excluded nuclear. But very recently the Joint Research Centre of the EU, which is the scientific arm, had another look at nuclear and concluded that that nuclear doesn't cause any more harm than the other energy technologies, currently included in the taxonomy. That still has a few hurdles to go through before it is accepted, but I think that this, again, is a positive, swing for nuclear.

Then if you look at the 2050 Carbon Neutral Statement by Japan, it explicitly includes nuclear. China said they will be carbon neutral by 2060. Russia is aiming for 25% nuclear by 2045. These programs imply that nuclear will play an important role in a low carbon future. The Chinese14th five-year plan, which came out recently, talks about taking current generation of 50 gigawatts through to 70 gigawatts by 2025 and the CNNC is talking about 100 gigawatts by 2030 and 200 gigawatts by 2040.

China currently has 49 reactors operating there. It had 13 operating at the time of Fukushima, and they have 17 under construction. I think they are learning how to build these facilities on an industrial scale, learning from doing.

The four factors, which I have just mentioned, came together towards the back end of last year and we saw the response in equity markets. If you look at the equity stocks in uranium, I look at the Global X ETF and that's up 80% since the back end of October and some other companies are up to 300%.

That set the stage for us to raise money earlier this year. In February, we came to market to exercise our option, with Kazatomprom for 2021. We were hoping to raise $100 million, and I must say, the investor demand was very positive, to the point where we were able to upscale the offer to $140 million. It is clear that investors are increasingly seeing the value in uranium, understanding the fundamentals that are driving the price and like our low-cost model, combined with our unique supply agreement with Kazatomprom. At the same time as our raise, a number of other uranium companies came to market, by my calculation, since mid-Feb, we've seen around $800 million raised by uranium companies in the uranium sector, which hasn't happened for a long time.

I think the investors are seeing these factors come together, a confluence of these events and put their bets on the equity markets. But the uranium price hasn't moved. I think the driver for the next phase of the uranium price is to see the utilities come back into the long-term market and start contracting. Our expectation is that we will start to see that happen during the course of this year. Ultimately, the long-term contract price drives the spot price, not the other way around in uranium.

Al Alper, Jr.:

It's an interesting relationship there. Who is paying for uranium using the spot price?

Andre Liebenberg:

Utilities do use the spot market. They tend to purchase about 15% of their needs on the spot market, to top up inventories. Last year, Cameco purchased a significant volume on the spot market, because their two mines were shut, and they had to fulfill contractual obligations. Then there are the traders and the financial entities, like us, who purchase and hold uranium. A large component of spot market demand for uranium, last year, was driven by some producers, who were short because of production issues due to COVID and other reasons.

Al Alper, Jr.:

That's very interesting. Could you tell us about your plans for 2021? You talked a little bit about upping your inventory. What are you thinking for the rest of 2021 and beyond?

Andre Liebenberg:

For this year, because we are fully drawn down on our 2021 option, with Kazatomprom, we may not be able to purchase anymore from them. We raised $140,000,000 and we only really needed $100 million for the Kazatomprom option, plus retaining some money for working capital. Our plan is to purchase uranium in the spot market. We spent about $15 million dollars quite quickly, after that equity raise in the spot market. We are still sitting on cash and we will use that cash opportunistically to purchase additional volume.

We really have to wait and see how this year unfolds. If the market gets tighter and we trade at a big premium to net asset value, we could raise more equity. The beauty about the Kazatomprom option is that we can deploy a $100 million into purchasing uranium, I think one would struggle to spend that sort of money in the spot market. It's about using the cash that we have responsibly and then if the opportunities arise, if we do raise more money, we need to know that we can spend it if we raise it.

Al Alper, Jr.:

Your website indicates that you might have some opportunities in commodities, streaming and royalties. Could you tell us a little bit more about that?

Andre Liebenberg:

Yes, we are open to looking at royalties or streams in the uranium space, but because we're a long term, buy and hold entity, we believe in supply side discipline. I wouldn't be writing royalties on new projects because that brings new supply into the market. There are not a lot of royalty opportunities, in the uranium space. One of our large shareholders, Uranium Royalty Corporation, that's what they do, and we do have the opportunity to share opportunities with them. It's not a space where there is a plethora of growth opportunities. What we have done is, we've opened up a second storage account in France and along with our principal account in Canada, with Cameco, we've been able to enter into some location swaps. At one stage the premium for material in Canada was quite significant, it was up to $4 dollars a pound. We swapped some pounds in Canada for pounds in France and we made a million dollars, that was really nice. We look at those opportunities, but fundamentally, the core of our strategy is long-term buy and hold of physical uranium.

Al Alper, Jr.:

Could you tell our readers/investors more about your capital structure?

Andre Liebenberg:

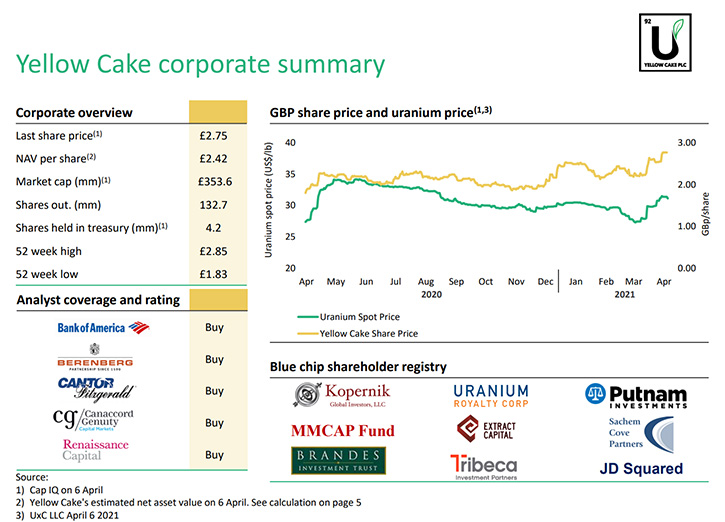

It's a very simple capital structure. We have about 129 million shares in issue and there are no options or warrants. We all equity finance our purchases, so we have no debt or hedges. It's a very, very simple, clean structure. The shares traded today at around two pounds fifty a share on the London Stock Exchange. Our net asset venue is probably around $430 million.

Al Alper, Jr.:

Who are your main investors?

Andre Liebenberg:

We have an interesting set of investors. We have generalist funds such as Kopernik and Brandes in the US, who are in our top 10. We have specialist commodity guys, a fund out of Madrid called AZVALOR. We have URC, which is a strategic investor in uranium. We have quite a big retail base here in the UK, about 22% of our register is retail.

Al Alper, Jr.:

You're listed on the London Stock Exchange; do you have any plans to expand to other markets?

Andre Liebenberg:

Our share register today is 50% North American, a market that understands uranium, and has been a big supporter of uranium equity raisings recently. For us, having a secondary listing, we need to see the benefit, because if there's no liquidity in the secondary listing, nothing happens there, and people lose interest. If we did ever think about a secondary listing or another listing, it would have to be on the back of an equity raise or something that creates liquidity in the secondary market, because otherwise it just doesn't work.

Al Alper, Jr.:

So, you wouldn't be interested in an over the counter. You'd be interested in a more significant market, correct?

Andre Liebenberg:

Correct.

Al Alper, Jr.:

Could you tell our readers/investors the primary reasons they should invest in Yellow Cake Uranium and what exposure that gives them.

Andre Liebenberg:

I touched on our core investment case earlier – our investment thesis is based on the fact we continue to believe the price of uranium will rise due to a combination of supply/demand fundamentals that are driving it. That very much remains our position today. Indeed, given covid and given the increasing acceptance that nuclear energy will play a vital role in decarbonizing the global economy, we are as confident as we have ever been in our investment thesis.

It’s also worth noting a key difference that Yellow Cake provides investors - because we are physically backed, we own physical uranium, we really provide a one-to-one leverage to the uranium price. It's a different risk reward profile, from a developer company. A developer has a geological risk, capital risk in building out the mine and permitting risk. If it all works out, the leverage there is probably three or four times to the uranium price. It's just a different risk reward. We don't offer as much upside as these other companies, but we're a safer bet because we’re physically backed.

We offer investors direct exposure to uranium. We do think that the supply demand fundamentals are such that the price will rise. I've been in the commodities or resources space for the last 25 years and at the end of the day, inducement pricing matters. Mines are wasting resources and they come to an end of their lives and then they need to be replaced. Unless the price is such that it induces new capacity, you get supply shortfalls and then you get price fly-ups. When I look at the supply demand fundamentals, we need to see a higher price to induce new capacity and many people believe that that price is $50 plus.

Al Alper, Jr.:

That's very exciting. There's a lot of emphasis right now on green energy and electric vehicles and electric batteries. How does uranium fit into that green model?

Andre Liebenberg:

It's a carbon free source of electricity. It's all well and good, having an electric car, but if it's fueled by coal-fired power station, then maybe it's not that green. I think nuclear can play well with wind and solar because it runs baseload 24/7. It's a complementary technology to the other zero carbon technologies.

Al Alper, Jr.:

So, uranium's always producing power, where solar is going to be down at night and wind is only generating if the wind is blowing, and there's this huge demand for electric batteries. When you think about it, you're exactly right. What's happening is, if anything, all you're doing right now is changing where the smog is being created that's no longer created in the city, it's now created next to the coal-powered power plant.

Andre Liebenberg:

I think in the US for the first time, nuclear recently overtook coal as a generation source for a period of time. Here in the UK, I think we had a short period of time, where there's been no coal-fired generation, so these changes are happening.

Al Alper, Jr.:

I don't think it applies to uranium, exactly, but nuclear is changing quite a bit. There's now a nuclear power plant on Mars.

Andre Liebenberg:

Which is really interesting.

Al Alper, Jr.:

Let me be specific, the Mars rover that they just put up has a nuclear power plant that's going to last 14 years to power it.

Andre Liebenberg:

Indeed, and there are a lot of submarines and ships that have nuclear propulsion.

Al Alper, Jr.:

Do you think that's going to impact the market?

Andre Liebenberg:

I don't know about Mars, but certainly I think the small modular reactors will impact the market, because they're easier to fabricate, they're cheaper to build, therefore the financing cost is lower, and you can distribute them. So, yes, I think we're not there yet on the technology. We'll probably see the commercial side of that towards the end of this decade. But, you know, again, if you look at hydrogen and hydrogen economy, then those reactors, can play a very interesting role.

Al Alper, Jr.:

Yeah, that's a changing world. Do you have anything else you'd like to add?

Andre Liebenberg:

No, I think we've pretty much covered it. It's a very simple Company and a very simple structure. It allows investors to take a view on the uranium price. We think the structural dynamics are such that the uranium prices are going to go up.

Al Alper, Jr.:

What's the best way for the US investor to take advantage of Yellow Cake Uranium?

Andre Liebenberg:

In the US we are on the OTC: YLLXF

Al Alper, Jr.:

Well, thank you very much for your insight.

https://www.yellowcakeplc.com/

Yellow Cake plc

Andre Liebenberg, CEO

Tel: +44 (0) 153 488 5200

|

|