Eskay Mining, a junior exploration company based in Toronto, Canada, is identifying gold, silver and copper targets at their Eskay Creek properties in British Colombia, Canada.

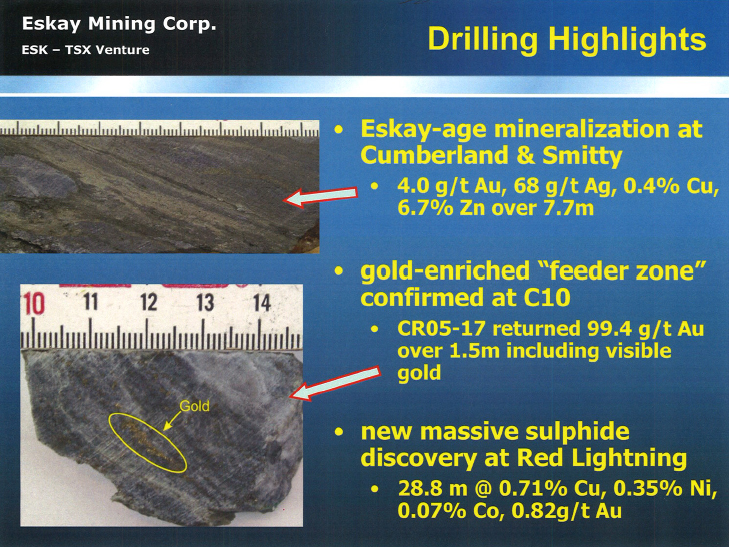

Eskay Mining, a venture company focused on gold exploration in Canada, has moved their company forward despite a tough market. Hugh M. (Mac) Balkam, President and CEO of Eskay Mining said, “The market for junior resource companies is not great, but you've seen what Seabridge and Pretium are doing in the discovery space. We have 120,000 acres next to them. We have five to seven potential known projects and several concept projects, on the one set of grounds. We have concluded that our ground hasn't been explored as a major company would have explored, based on a system of work. We are finding three ounces of gold per ton in both the drills and on the surface but never had systematic drilling to outline the resources. Importantly, the majority of our drilling has been shallow by today’s standards. We now have a good sense of where we are going as a company. We possess great exploration targets to follow up on and drill deeper. In order to move forward, we are seeking a joint venture partner to provide the proper funding that this property deserves. Management decided it was not going up to our properties with a small amount of money and hurting the project by trying to excite the market with a minor drill program.

Eskay's priority is to obtain a joint venture partner for the purpose of developing their properties at Eskay Creek to their fullest potential. Mac Balkam stated recently, “We are actively talking to companies about the potential to enter into a significant joint venture agreement. It is well known that in this market, you can't raise money without massive dilution to shareholders. A project of this magnitude needs funding enough to prove up several of our theories. As a corporation, Eskay is in good shape as we don't have a big monthly burn rate for fancy offices or personnel. Our exploration focus this past couple of years has been to complete the 80% earn in interest from St Andrew Goldfields on the northern part of our project. At this time, it appears Eskay is about $25K short of the necessary $4,000,000 in exploration expenditures as per the agreement but I’m hopeful we can work the situation to both companies benefit. .” Once the earn-in is completed, it is anticipated that the two companies will enter into an 80-20 Joint Venture going forward. Further expenditures on the ground would be shared in that ratio. If St Andrew Goldfields (SAS) chooses not to participate, they will be diluted down on their interest. SAS holds a 2%NSR on its ground which may be purchased by Eskay for $4 million.

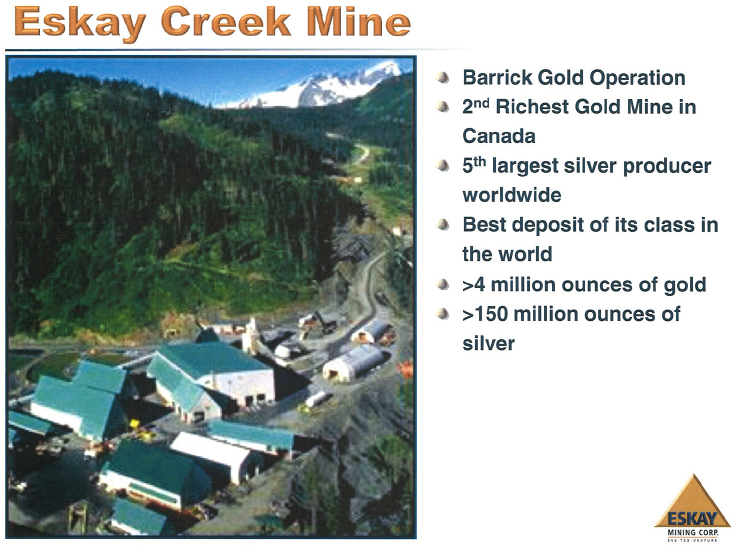

Some Interesting Facts on the Eskay Creek Mine which is Owned by Barrick Gold and Closed in 2008

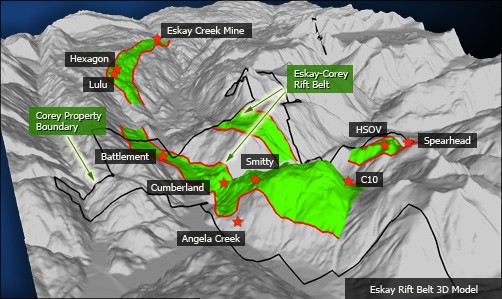

Despite the challenges of the market, Balkam believes there are good reasons to invest in Eskay. Balkam advised, “One of the first reasons to invest is the safety of Canada as a mining jurisdiction. Secondly, we are surrounded by probably 100 plus million ounces of gold. This does not include the many ounces produced from the Eskay Creek Mine. That whole area up there has not been thoroughly worked. There are so many opportunities in this area. Witness the success of our neighbors, Seabridge Gold (SEA-T and Pretium Resources (PVG-T). Both companies have major discoveries in rock types never worked on our ground. It is our opinion that at such time as larger companies review our data and see the opportunity, we will have a serious partner. Eskay Creek was discovered in the late 1980’s and put into production and mined until 2008. Eskay holds ground within a kilometer of that mine and 30 kilometers south. Our data package is massive. Some of our selective reports are exhibited on the company website. However, we have now incorporated this data into a 3D model for interested parties to view.” The third huge benefit of Eskay is the recent plan to build new North West hydro lines going into the area. Power is a necessary component of operation of mines. Balkam stated, “In sum, these are pretty big items. We've expended over $4 million on this project in the last few years of difficult times. There is ample data for a senior company to review. Eskay would also entertain a combination with a much stronger player that would allow our shareholders to move forward. The important piece of the puzzle for Balkam and his team is to have partners with both expertise in this area and capital, or access to Capital. We currently have 91 million shares outstanding. Very few warrants are outstanding and management/ consultant options are less than 5 million with the cheapest exercise price of 20 Cents. . It's really a pretty low float project with a great shareholder base. With a market capitalization of less than $10 million, Eskay appears to be a low cap company with high opportunity. Finally, Eskay has filed assessment work to place the projects in good standing for another nine years. ”

Balkam believed enough in the Eskay project to come out of retirement in 2009 to take over the company board and move the company forward. At the time, he believed that surrounding the former Eskay Creek mine was fortunate for a company. Then the proximity to Seabridge was a huge plus, but when Bob Quartermain formed a new company called Pretium Resources to develop the Brucejack Lake deposit of Silver Standard, he believed Eskay’s fortunes would turn. Balkam says “With Pretium's Brucejack deposit at a total proven and probable resource of 10 million ounces of gold at a grade of 16 grams per ton that gets folks attention. Pretium is not even talking about their low-grade Snowfield deposit which adjoins a piece of Eskay’s ground. In days gone by, you'd have what I’ve heard called closeology where if your company possessed land beside a major play, you would get attention. Why does closeology not appear to work anymore? Someone told me, you find gold near old mines, well, Eskay is certainly in the right neighborhood.” Said Balkam, “Add in the Seabridge claims of over 40 million of ounces of gold plus copper at their KSM project, you start to talk about a lot of metals in the ground. It's just unbelievable. Seabridge recently announced a new discovery not far from our eastern border. We have geological work just west of this discovery which was never followed upon. They believed that if they drilled deeper below their high tonnage, low grade deposit, they would come up with Pretium type material. Based on their drilling, they may be onto something bigger and with high grade. They are drilling these 800 meter holes based on geophysical targets. . We have big geophysical targets, too, but ours are at 300 meters. Their theory about deep drilling makes a lot of sense to us and they proved it. . The speculation for us is basically that we would have a deposit buried beneath several projects on our property. Most of our drill holes are less than 100 meters. We dream about drilling some deep holes under already known metal values. ”

Eskay’s web site (www.eskaymining.com) contains a host of geological reports including the 2011 deep geophysical project which the company would like to act upon

The last new discovery, styled the Red Lightening zone, has only had about 7 shallow drill holes. The best drill hole came in about 28 meters of .71% copper, .35%Ni, .07% Co and .82 G gold. That hole was never pushed very hard because it came out in the fall of 2008 when the world was falling apart. What really gets interesting in this area is that another zone discovered in about 1991, but never explored, styled the GLJ zone, had reported assays of over 3 ounces gold and up to 3% copper. Interestingly, it was never worked. A recent deep geophysical project over this whole area is yet to be followed up. As a company, Eskay now has three times the amount of property and it is a better story today than it was in 2006 -2008 with much higher stock prices, and yet this is where we are. I always like to say, it is what it is.” Despite the challenges with the market, Balkam has put his own investment dollars and time into Eskay. He said, “I personally own about 6% of the company. There are not many entrepreneurs that can say that about their companies. Few have put in the time and the money that I have. This project ruined a great retirement; time will tell if I’m on the right track. The opportunity is there. However, since the 2008 stock market collapse, investment managers like to hide their picks behind resources and reserves but that also will change and blue sky like Eskay will get attention.”

What is different now for Eskay is the attention being paid to Canada and to North West British Columbia. A recent in depth report on the North West British Columbia area has been written by Lawrence Roulston and can be found on his Resource Opportunities web site. Interested parties can email Mr. Roulston for a copy of his reports.

In reflection, the major projects in Eskay’s area have been known in various detail for up to fifty years. Many companies worked on these projects until the right management, with the right time in the market cycle, made the right moves to create shareholder value. Balkam believes his team is in the right place at the right time and success will come to Eskay Mining Corp very soon.

With a good location in Canada, notable neighbors and new hydroelectric lines, Eskay Mining may offer investors a positive opportunity in the future.

http://eskaymining.com/

Eskay Mining Corporation

360 Bay Street, Ste 500

Toronto, Ontario M5H 2V6 Canada

Tel: 416.907.6151

info@eskaymining.com