Lomiko Metals Inc. (TSX-V: LMR, LMRMF, FSE: DH8B): Preparing to Supply the New Demand for Graphite in Li-Ion Batteries, Interview with Paul Gill, CEO

|

By Allen Alper Jr. President, Metals News

on 2/8/2019

Lomiko Metals Inc. (TSX-V: LMR, LMRMF, FSE: DH8B): Preparing to Supply the New Demand for Graphite in Li-Ion Batteries, Interview with Paul Gill, CEO

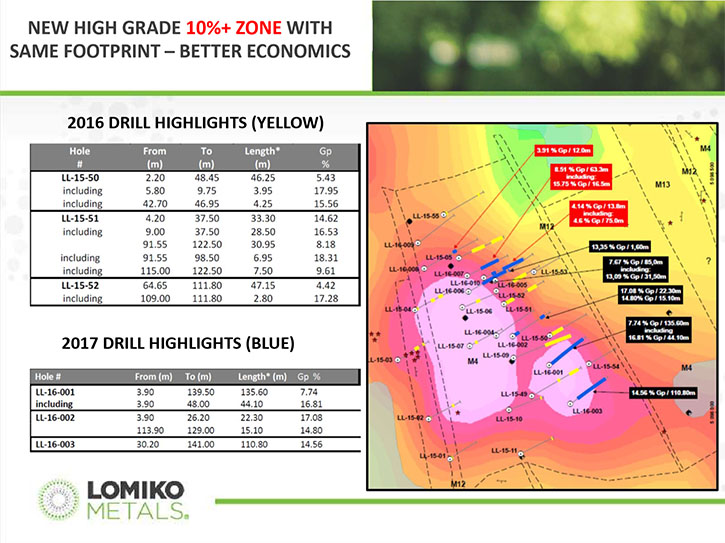

Lomiko Metals Inc. (TSX-V: LMR, LMRMF, FSE: DH8B) is a Canadian-based, exploration-stage company, that discovered high-grade graphite at its La Loutre Property in Quebec and is working toward a Pre-Economic Assessment (PEA) that will increase its current indicated resource of 4.1 Mt of 6.5% Cg to over 10 Mt of 10%+ Cg. We learned from Paul Gill, the CEO of Lomiko Metals, that they have raised funds and are drilling. About 30% of the deposit is large flake, 30% is intermediate sized, between 80 and 50, and the rest of it is fine grain, all of which is usable in various industries. According to Mr. Gill, this is a great market for graphite and Lomiko Metals is currently one of the most developed graphite juniors in the world. Recently, Simon Moores, of Benchmark Minerals, appeared before a Senate Committee on the Supply and Demand of Critical Battery Materials Lithium, Graphite, Cobalt and Nickel.

Allen Alper Jr.: This is Al Alper Jr. with Metals News. We're here at the Vancouver Resource Investment Conference 2019 in Vancouver, Canada. I'm talking with Paul Gill, who is the CEO of Lomiko Metals. He has a graphite play in Quebec, La Loutre Flake Graphite Property. Could you give our readers/investors an overview of your property, your focus and current activities?

Paul Gill: Absolutely, Allen. Lomiko Metals trades under the TSX Venture, under the symbol LMR, and on the OTCQB, LMRMF. We're really at a very late stage of our development. The La Loutre Property has been drilled for the last three seasons, and we have an indicated resource established already of about 18 million tons of material that's about 3.5% percent graphite.

Our next step is to upgrade the grade of the resource to over 10% with our new drilling, in our new area, a very big discovery with results of 16% or 17% graphite per tonne. Now, of course these number don't mean anything to you right now but let me put it in perspective. The mine that operates right now, 53 km north-west is a 20 year mine owned by Imerys called the Lac des Iles Carbon and Graphite mine, and it operates at 7% graphite per tonne. If we can get something above 10% graphite, well, we're golden because we have the size and tonnage already. We're going to have a very good economic case for development. It's a very exciting time for the company.

Allen Alper Jr.: Tell us, what stage of development is the market in now?

Paul Gill: Well essentially, we'll be able to drill right now. We have the funds raised. We're coming into a real big bull market in electric vehicles. If you look everywhere around the world, we have electric vehicles coming online. There're a number of mega factories being built to accommodate lithium ion batteries. It's amazing.

China is going all electric, India is looking at going electric as well. Of course, we have Tesla doing stuff here. But in Germany, BMW, Volvo, and VW are all going towards electric vehicles. That's the backdrop of the market.

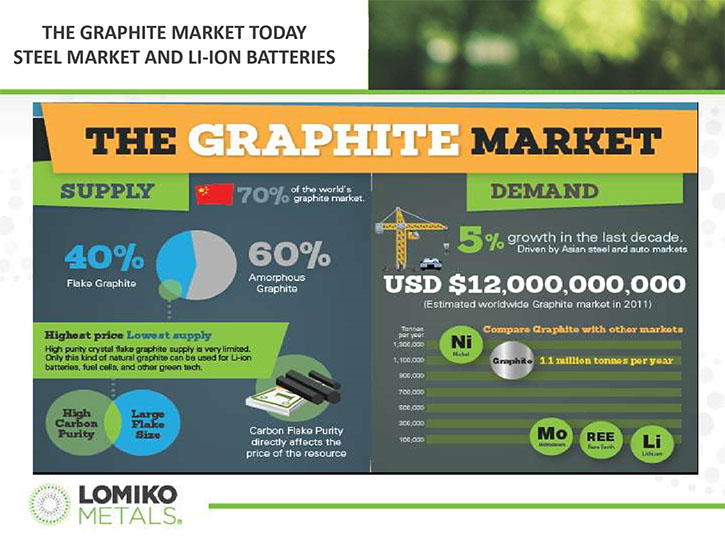

Each lithium ion battery has lithium in it, has cobalt in it, and has graphite. The key element here is that you need 15 times more graphite than lithium to make a lithium ion battery.

Allen Alper Jr.: Excellent. Tell me a little bit about the quality of the graphite. Is this a large flake graphite, or what type of graphite are you looking at?

Paul Gill: Right now, what we have is a very interesting type of deposit, hosted in a rock called marble gneiss, a granular type of deposit, in which there are little kernels of marble, and little kernels of graphite. They're all fused together. When you crush it, it separates really nicely and gives you really pure graphite flake. About 30% of it is large flake, over 50 microns, which is pretty standard when it comes to some of these deposits. 30% of it is intermediate sized, between 80 and 50. Then the rest of it is fine grain, which is also still usable and sellable.

The beautiful thing about graphite deposits is that you could sell every portion of them. Every part of it could be used in particular type of industry. The large flake, high grade graphite can be used in nuclear industry, it can be used as electric vehicle battery materials, in the anode. The 94%+ grade graphite can be used in steel making in refractories, which is a big industry, of course. You're going to see lots of rebuilding happening, and lots of development worldwide. There's a huge market for that.

Not only that, you have graphite use in lubricants, in brake shoes, a number of gaskets, and a number of other places. It's the heat resistance of graphite that is so important. You could melt steel, but graphite won't melt. That's important, and that's useful. That's why the U.S. and the European Union call it a critical element. It's a really good spot, and I think we're right at the bottom of the market right now, and ready to rock.

Allen Alper Jr.: Excellent! Can you tell us a bit more about your view on what’s happening with the demand for graphite?

Paul Gill: The demand for graphite right now is going up about 5% per year. But what's really important for everyone to understand is that China has supplied the world with graphite for the last 20 years. But every year in the last four years, they've lowered their exports, so they're not exporting as much. Why? Because they're making lithium ion batteries in China, and they're selling the batteries. Instead of exporting raw material, they're going to sell the batteries.

So, buyers outside of China, all of a sudden, have a crunch in supply in the next few years. When you have a supply crunch, and you have this demand where all these lithium ion batteries need to be made for electric vehicles, you have a perfect market. It's a great market. This is exactly what happened with lithium. Lithium had a supply crunch in Chile, and a big demand for lithium ion battery materials to be developed, and bingo, you have this huge run on lithium, where lithium went up five times in price.

If that happens with graphite, we'll see all the graphite juniors move, and we're one of the most developed graphite juniors in the world right now, with an asset that we're going to be able to develop into a valuable, valuable deposit.

Allen Alper Jr.: Great. Could you tell us a bit about yourself and your Management team?

Paul Gill: Sure. My original experience was with Norsemont Mining, which was a copper play from 2003 to 2011. We started that company at one million market cap, and had a one-person office. You had to go outside to make a phone call, it was so small. But eventually we grew. By the time we handed it off to the next management team, it was a 50 million market cap, and we had a great asset down in Peru, which we were drilling, and it was a bull market in copper.

Fast forward to 2011, all of a sudden we have a pre-economic assessment, and a bankable feasibility done. Hudbay comes in, and writes us a check for $ 500 million dollars to buy it out. That company started at five cents and ended up at $4.12. It's fantastic. That is what we hope to see with Lomiko.

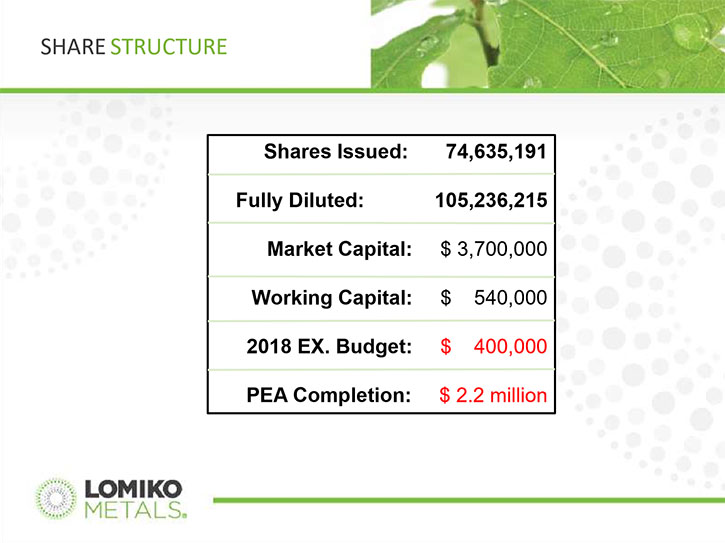

Lomiko is trading at the bottom right now, three million market cap, five cents a share Canadian, four cents a share in the U.S. It's a great opportunity right now. I don't see anything but blue sky for us in the next little while, and I think we're going to have a very big commodity run, and we're going to be part of it.

Allen Alper Jr.: Tell us more about your share structure and inside investment.

Paul Gill: At this point in time, Lomiko has 74 million shares out. It has a fully diluted, about 112 million. Most of that is owned by six or seven groups, investors that have stayed with us long-term. Owning about 10% of the company myself, and my family and friends owning another 10%, we're looking at an insider group that controls about 60% of the shares. We can grow very quickly. What we're looking for now is drilling to get results, and that's what's going to turn things around for this Company right now.

Allen Alper Jr.: Excellent! You're listed on the TSXV. Where are you along your way on your 43-101 path?

Paul Gill: Right now we've already written one resource 43-101 project report. That one's already out. Now we're about to write the second one. We have to do the drilling first. Once the drilling is done, we're off and running on the second resource, and on our way to a pre-economic assessment.

The important thing about pre-economic assessment is you could put that right into your books and say, "This is the value of that project." We anticipate the value. Some of our peers are trading at a valuation of 75 million market cap, we're at three million. We think that we will make a big impact with that new resource being written, and the pre-economic assessment being reported. We should be able to really do a 10 times return.

Allen Alper Jr.: Do you have plans for a date for that?

Paul Gill: Right now, we're looking at about May of this year. Starting now, at the Vancouver Resource Show, we're going to go on a big road show and get people to notice what we're doing, and talk about the market in graphite and lithium ion batteries in electric vehicles. It's a real educational tour. I think if people get in early, we'll make the most out of it.

Allen Alper Jr.: What do you think your exploration budget is going to look like?

Paul Gill: Right now we have 560 thousand set aside for just exploration. We're going to try to spend about 400 thousand of it this season, right now. If there's any remaining drilling required, we'll spend another 150 or so on that.

Allen Alper Jr.: What do you see as the biggest challenges that you face right now?

Paul Gill: The biggest challenge right now is that we're in a competitive market. At this point in time, it's been a bear market for resources for a long time. We just have to get out there and tell people, "Look, we're here, we're ready, we're ready for you to make money." All we can do is prepare the meal. You have to sit down and eat it. That means investors have to come down and look and see what we see. The opportunity is there, and it's the bold who will survive, and the bold who will prosper in this situation.

Allen Alper Jr.: Sounds exciting! What do you see as the main reasons investors would want to invest in Lomiko right now?

Paul Gill: Right now we're ready to drill, we're ready to prove up a resource. Secondly, beyond that, we are ready to bring that material to market. We can take that material from the property, and it's only an hour and a half to an international port, which will be able to ship it anywhere. We're at the Port of Montreal.

We have another project that's just north of us called the Imerys Carbon and Graphite, operating for 20 years. They've been doing it profitably, and they're a billion dollar company, but they're running out of ore. They need more material, and we have the material for them. We have a good opportunity right now to develop our project right to production, or even sell it during the next little while.

Allen Alper Jr.: Why don't you tell us a little bit more about the location of the property and infrastructure?

Paul Gill: It's an hour and a half drive north of Montreal, which is really great. It has water, power, and a paved highway right to the base of the property, and a gravel road up gives us complete access to the area in which we believe there would be an open pit mine. We have seen the graphite there, which is right to surface, which is perfect and good for economic development. It has high grade. We've drilled 110 and 130 meters, 7% and 14%. Really good numbers! The average mine rate there operates at 7%. Our resource is about three and a half, 4% right now, so we can upgrade that resource very quickly.

Allen Alper Jr.: Okay, it's really exciting. Do you have anything else you'd like to add?

Paul Gill: Beyond all of that, Lomiko also has technology assets, but that's for another day.

Allen Alper Jr.: Excellent. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://www.lomiko.com/

A. Paul Gill, President & CEO

604-729-5312

Email: info@lomiko.com

|

|