Stan Bharti, Forbes & Manhattan Founder Shares Expertise on State of the Market, Positions Company for Growth

|

By

on 5/4/2015

Stan Bharti, the Founder and Executive Chairman of Forbes of Manhattan, a private merchant bank, shared his view of the mining sector and the company’s philosophy in a recent interview with Metals News.

Stan Bharti, the Founder and Executive Chairman of Forbes of Manhattan, a private merchant bank, shared his view of the mining sector and the company’s philosophy in a recent interview with Metals News.

Mr. Bharti said, “First of all, when you look at the mining industry, we have had maybe six or seven, maybe ten, very good years. Starting in 2003, other than a tiny dip in 2008, we haven’t looked back. I think we are due for a good correction, a timely correction, and we are seeing that correction now. I think this correction is going to last for a while. We saw a long bull cycle and this correction could last three or four years because here’s what happened: from 2003 to 2012 so much money went into resources. Unfortunately, a lot of money went into speculative resources, but the results haven’t come through. So, the money that was behind the resources is somewhat frustrated.”

In addition to the challenges with the junior mining companies, Mr. Bharti sees a change with the international markets that will lead to a rally. He said, “The second thing is that, like in China, the world is reevaluating. So, I’m looking at a slowdown in the resource sector into 2016 or 2017. I think the second leg of this bull market will be bigger than the first. We think that gold at $2000 was high. I think it is going to go much higher. We saw copper at four dollars. I think we will see copper at six or seven dollars a pound. I see nickel going back to twenty dollars a pound. I see oil getting one hundred forty or one hundred fifty dollars a barrel. We are going to have a huge boom in commodities, I’m guessing from 2016 or 2017 for four or five years. We are going to have a very good cycle.”

To get this cycle started, Mr. Bharti believes growth in certain international sectors will push it forward. He said, “I think the engine that will drive this cycle of growth is not so much China, but it will be India and Africa. Latin America has had its share of investments over the last ten or fifteen years and they have so much money, but Africa is really getting itself together now. I see huge potential there for growth. I see India as the driving force behind that growth. The new Prime Minister seems very pro-business and he is getting rid of corruption and cleaning up the country. These are all very good signs. I see great potential there. That is my view of the resource industry. Within the resource industry, one of the areas that is most exciting is precious metals, which is always exciting.”

Mr. Bharti believes that fiscal issues may drive commodities into higher price brackets. He said, “There is no way we can live in a no interest rate environment or a negative interest environment and imply that we aren’t printing money. It has to imply that. When we are printing money it basically means that we are destroying the wealth of the seniors and their pension plans. Ultimately, that always leads to inflation. We will see precious metals in 2017 and 2018 go really high. I see silver going to over fifty dollars an ounce.”

Another area where Bharti sees upcoming growth is in agriculture. He said, “I also see agriculture soaring. There is only so much arable land left. Today, it is not a possibility to burn trees down to get more land. That means land will get more expensive as well as the nutrients that will help the land, like potash. You will also see that energy for land will get more expensive. Energy will come back because the population will continue to grow. People need energy. Oil is here to stay as a while. Some of the other units will come into play. These areas will empower the next cycle. Africa is still a big player. The problem has always been political issues and corruption, but that is changing.”

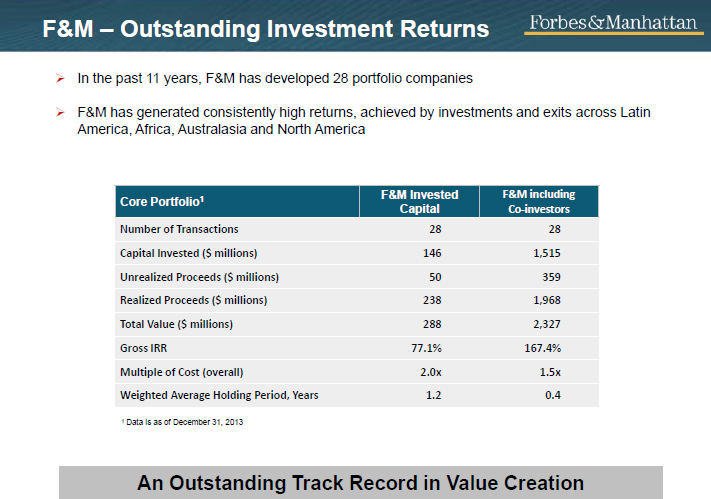

Bharti’s company continues to find options in the markets. Said Bharti, “How does Forbes of Manhattan fit in? In 2001, when we started this business our philosophy was to find good assets and sell them to majors. Two years ago, we sold Avion. We built it and sold it for $500 million dollars in a country where there had been a coup. Before that, we sold Desert Sun and Crocodile Gold. If you look at the track record, we have sold eight to ten billion dollars of assets after building them up from scratch. If you had invested in all Forbes deals at the beginning, the return would have been 50% annually. No one else can boast this type of return.

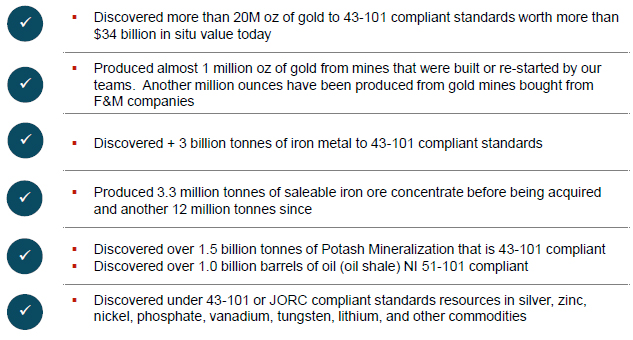

Forbes & Manhattan Accomplishments in the last ten years:

Going forward, we are focused on the following key assets:

- 1. We have a gold asset in Brazil and we have seven million ounces as well as a feasibility that will come out. We have a new management team to run this project through to production.

- 2. In the agricultural space, we have Brazil Potash with two big PE funds that are behind it. It is our plan to keep it private for now.

- 3. We have two companies, Aberdeen and Sullivan that are investment vehicles with close to $60 million in cash and assets.

For more information on Forbes of Manhattan, visit their website at www.forbesmanhattan.com.

|

|