Mark Haywood, President & CEO, EDM Resources Inc. (TSX-V: EDM) Discusses its Nova Scotia based Scotia Zinc, Lead & Gypsum Mine; Comprehensive Offtake, US$24M Debt Project Finance Package, Commercial Production Next Year, Very Robust, Near-Term, Cash-Flow Opportunity

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 7/22/2022

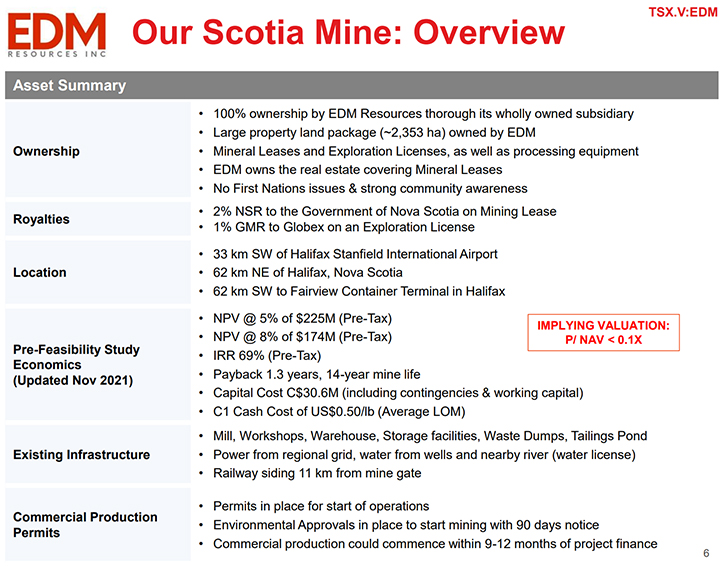

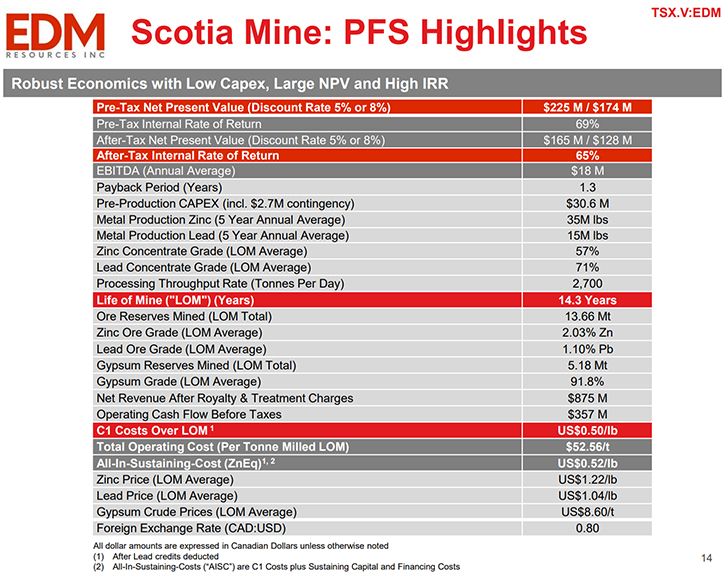

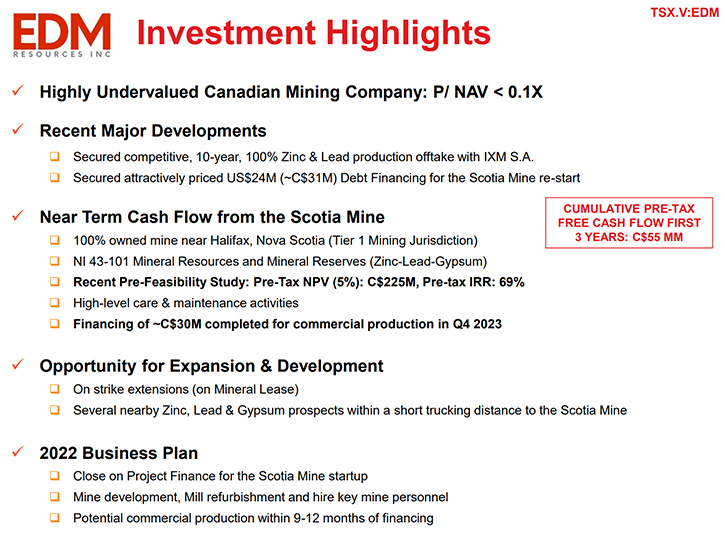

We spoke with Mark Haywood, President & CEO of EDM Resources Inc. (TSX-V: EDM) a Canadian exploration and mining company that has full ownership of the Scotia Zinc-Lead-Gypsum Mine and related facilities, near Halifax, Nova Scotia, Canada. The mine presents a near-term, cash-flow opportunity, and a significant opportunity for expansion and development. A recent Pre-Feasibility Study (November 2021) showed pre-tax NPV (5%) of C$225M, a pre-tax IRR of 69% and cumulative Pre-tax Free Cashflow for the first 3 years of production of C$55M. Plans for 2022, include closing on Project Finance for the Scotia Mine startup, and then mine development, mill refurbishment and hiring key mine personnel, with the mine restart scheduled for Q4 2023. In addition, EDM holds several prospective exploration licenses, near the Scotia Mine and in the surrounding regions of Nova Scotia.

EDM Resources Inc.

Dr. Allen Alper:

This is Dr. Allen Alper, Editor-in-Chief of Metals News, talking with Mark Haywood, who is the President & CEO of EDM Resources. Mark, could you give us an overview of your Company and what differentiates it from others?

Mark Haywood:

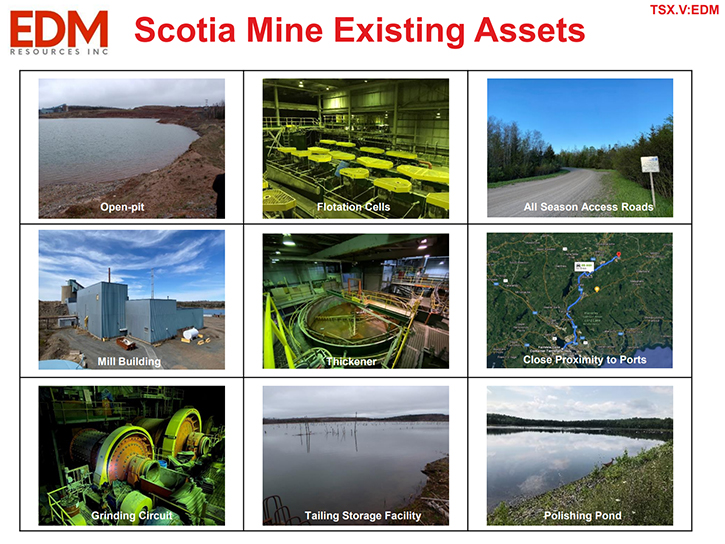

We are a Canadian owned mining and development Company, based in in Halifax, Nova Scotia. We have a permitted open-pit operation, just outside of Halifax, for which, on June 29, 2022, we announced a full offtake and debt financing package that would see the mine go into commercial production next year.

Dr. Allen Alper:

That's fantastic. Could you tell us more details of the project, the reserves, resources and how you’re going to go into mining, also a little bit about your study, on the financials?

Mark Haywood:

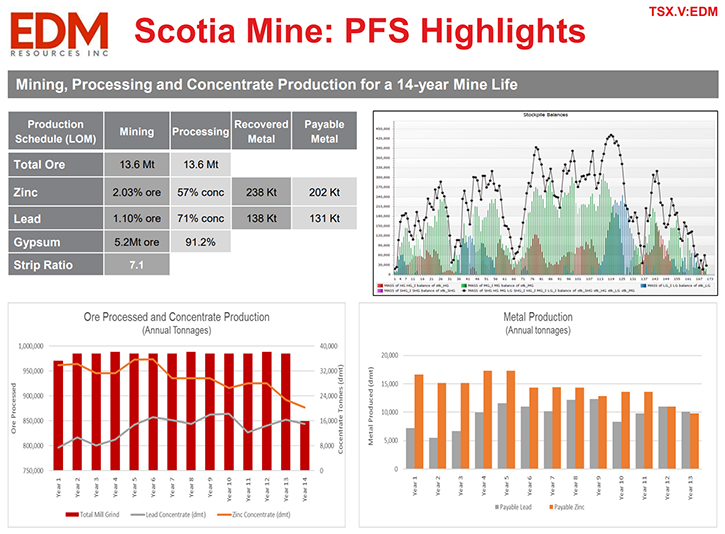

The project is located just near the airport in Halifax. It's 62 kilometers from Halifax City Center. Logistics are world class: we're on an all-season provincial highway and we have a permitted base metals operation, with an additional gypsum revenue stream. We have a very large 43-101 Mineral Resource, of approximately 25 million tonnes Measured & Indicated, and another 5 million tonnes of Inferred material. Plus, we also have 5 million tonnes of Gypsum Resource. More importantly, we have 13 million tonnes of 3.09% ZnEq. Proven and Probable 43-101 Mineral Reserves.

Gypsum is used in the construction industry, and Zinc and Lead, are both used in a variety of industries, with Zinc having recently being officially designated as a critical mineral in both Canada and the US. Therefore, we are in a great spot for owning a permitted, shovel ready, operation in Canada, which is now fully financed, and expected to produce in demand, critical metals.

As mentioned, we have an open pit operation, with a 14-year mine life, which will bring considerable revenue to the province of Nova Scotia, in terms of taxes and royalties, but also a considerable number of jobs in Atlantic Canada.

The mine is strictly an open pit operation, with expected cash flows of between C$20 to C$40 million, per year, for the entire 14-year mine life. The mine is already built, is permitted and ready to go. Since we extended the mine life with our Pre-Feasibility Study (“PFS”), we have to do more permits in the future, but for the moment we are focused on the already permitted, ready to go mining operation. Which is rather unique, especially in today’s overall tough permitting environment, anywhere in North America.

Our website is www.EDMresources.com. On it, we have extensive information on the Scotia Mine Project and its background and history, our Technical Reports, and our financials. The main things that the Company has been working on, for the last three years, are validating the Mineral Resource that led to the first ever NI 43-101 Mineral Reserves and the first ever Pre-Feasibility Study on the project. We also updated the PFS and published that in November of 2021, which demonstrated even more robust economics for the Scotia Mine. These studies have been done by well-known, technical, independent experts: Ausenco, SRK, MineTech and so forth. Hence, we are very confident in the economics, presented in these Technical Reports. And so is our offtake partner – IXM SA, who did extensive technical due diligence on the Project.

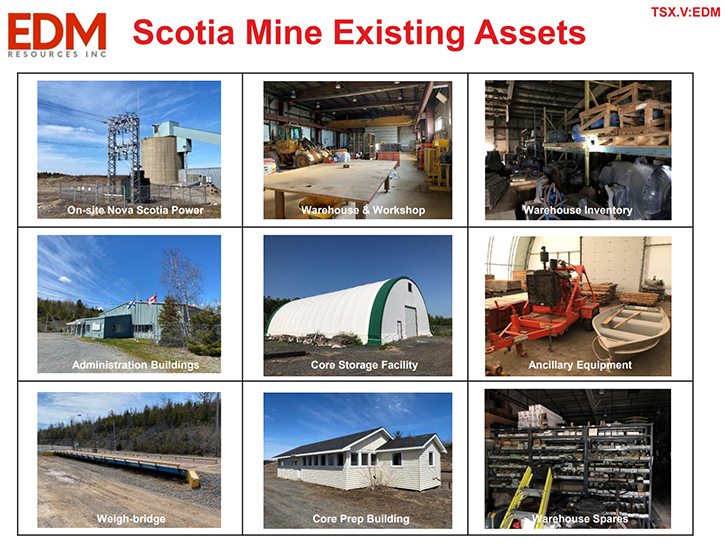

As a reminder, the November 2021 PFS determined a Pre-Tax NPV, at 5% discount rate of C$225 million, and a 69% IRR. These are fantastic economics, more so, having in mind the relatively low capex required to restart operations – approximately C$31 million, contingencies included. The main reasons for low capex and hence high IRR are: existing, well-maintained facilities on site, the existing mining permits and of course the status of the project – shovel ready.

The Project has a very low C1 cash cost (over the mine life), which is roughly US$0.50 per pound. Which means that, in the current state of commodity prices for zinc, lead and gypsum, the Project has very, very healthy margins. On the back of our latest Pre-Feasibility Study, we were able to engage in extensive and detailed negotiations, with top commodity trading houses and other finance groups and we’re very happy to have signed a comprehensive and advantageous offtake and debt finance, packed with IXM SA, a leading commodity trader.

After extensive due diligence, discussions, and many rounds of negotiations, we have signed the arrangement, with IXM that essentially provides C$31 million worth of project finance, to fully finance the Scotia Mine Project. In exchange, we committed to a 10-year offtake agreement, for 100% of the Zinc and Lead concentrates, from the Scotia Mine. We are very happy with this partnership and IXM is very happy as well.

With the execution of the IXM agreement, we are on the path to commercial production. We plan to commence mining, in April of 2023 and commercial production in Q4 of 2023. Being relatively close to commercial production, means we’re bound to take advantage of the current high (and expected to remain elevated) metal prices.

Dr. Allen Alper:

Well, that’s fantastic! You have a great project, low capital cost and a very rapid payback. My understanding is that it's less than two years. Is that correct? It's a very robust project!

Mark Haywood:

Exactly. It’s a very short payback period, of under 2 years. The very short payback period (especially when compared to the expected life of mine, of 14 years) was one of the features that made the debt financing package attractive, to both IXM and to us. Scotia Mine has a long, open pit mine life, with a considerable amount of work and supporting work, done by our technical team, which means the project has been considerably de-risked.

Speaking of our financing and offtake partnership, with IXM – it’s worth mentioning another very important feature, benefiting our current shareholders – it is a large, non-dilutive, cleverly structured, optimally priced project finance. It has no attached warrants or any other hidden fees. The overall cost is a little over 10% per year, which is very competitive, in today’s rising rates environment and, more so, for a junior mining company.

Nevertheless, we do plan on raising additional capital, to strengthen our balance sheet, as we move into commercial production. Timing – sometime over the next six months; depending on the market conditions and on the opportunities, coming across. Most of this additional capital will probably be in the form of “flow-through shares”, a benefit available to Canadian exploration and development companies like EDM.

Depending on the future market conditions, we might raise so called “hard dollars” capital, but we are in no rush for that. Our immediate steps are; getting the message to the markets, explaining the strong economics behind the Scotia Mine project and how we plan on attaining these numbers and hopefully improve the share price and the implicit market capitalization.

Over the last years, we have been diligently working behind the scenes, de-risking the project, conducting two very detailed Pre-Feasibility studies, working with the community and the Nova Scotia Government, to move the project along, and creating an enterprise value in excess of C$200 million. Yet, the Company’s valuation, in the markets, is orders of magnitude below that – roughly 10% of the current NPV. In other words, EDM is currently trading around 0.1x NAV, whereas the comparable base metals companies trade at 0.5-0.6x NAV.

Closing this gap, lowering this delta between our NAV multiple and the market multiple is where the value lies, with current and new investors. Most other companies mention being undervalued. I have yet to see a fully financed, permitted, first world jurisdiction, expected to be in commercial production, within one year, that is currently trading at 0.1 NAV.

Dr. Allen Alper:

It sounds like it will be a very good opportunity for investors.

Mark Haywood:

Exactly! You can rarely see an already permitted and financed operation that trades at the discount that we are trading at. Plus, this project is scheduled to go into commercial production in 9-12 months, for approximately C$31M, not the next 5 to 10 years, at the cost of C$300M, like you see in some of our peers. We do have the ability to start, and ship concentrate quite quickly, if everything goes well, but we have been conservative in our estimates and hence we communicated to the markets that we plan to be in commercial production by Q4 2023.

How so fast you might ask? Well, we are not changing any of the Mill processes and methods at all. We are just basically improving and bringing the existing Mill, up to today’s operating standards. And this fast path to production means an opportunity for jobs, for people of Nova Scotia and for revenue to the province of Nova Scotia via royalties and taxes.

Dr. Allen Alper:

That sounds excellent!

Mark Haywood:

Yes indeed. One other point I wanted to address is that we are taking Environmental and Social Governance (“ESG”) very seriously. We view this approach as an avenue to creating additional stellar value, for all our stakeholders. We are currently looking at a green energy approach, to power our operations at the Scotia Mine, which will not only be good for the environment, but also reduce our operating costs and potentially lengthen the mine life, to more than the current 14-years. It’s all about upside for us, for our shareholders and for our stakeholders alike.

Continuing on the topic of the future of the Scotia Mine and the future of the Company: we have some major catalysts coming up. The mine financing was a major milestone. The next one is moving the mining equipment and fleet on site. I am happy to report we have a great equipment financing deal, with Caterpillar, and we expect to commence mining operations in Q2 of 2023. An additional and equally important milestone is refurbishing and upgrading the Mill, with the view of processing ore and being in commercial production by Q4 2023.

We have a few other earlier stage base metals prospects in Nova Scotia. After the Scotia Mine would have already generated sufficient cash flow, a medium-term milestone would be, to spend some of these internally generated funds, in aggressively exploring and potentially developing these other properties.

Which explains our Company name and our Company vision: “EDM – Explore Develop Mine”. We have the “M” now, this is the “Mining” operation that's going to generate the cash to successfully deliver on the other two: “Exploration” and “Development”.

Dr. Allen Alper:

That sounds excellent! Could you tell our readers/investors a little bit more on their uses of Zinc, etc.?

Mark Haywood:

Zinc is an abundant metal. It's the twenty-fourth most abundant element in the Earth's crust. One of zinc’s most exceptional qualities is its natural capacity to protect steel from corrosion. When left unprotected, steel will corrode, in almost any environment. Zinc coatings protect steel, by providing a physical barrier, as well as cathodic protection for the underlying steel. Zinc is also common and essential to all life. All living things from the tiniest micro-organisms to humans require zinc to live, as it helps with specific metabolic processes. Additionally, Zinc is found in a number of products we use daily, such as cosmetics, tires, cold remedies, baby creams to prevent diaper rash, treatments for sunburns, and sunscreens. In fact, Zinc oxide blocks more UV rays than any other single ingredient used in sunscreen. In Agriculture, Zinc is used to increase crop yields and crop quality. In Human Health, Zinc is an essential nutrient in human development and disease prevention.

More importantly, Zinc is a key component in the Green Energy transition (and hence was recently designated as a critical mineral) and is extensively used in rechargeable batteries, energy storage,

vehicle electrification (EV), and overall renewable energy.

Dr. Allen Alper:

That sounds excellent! Zinc has great potential.

Mark Haywood:

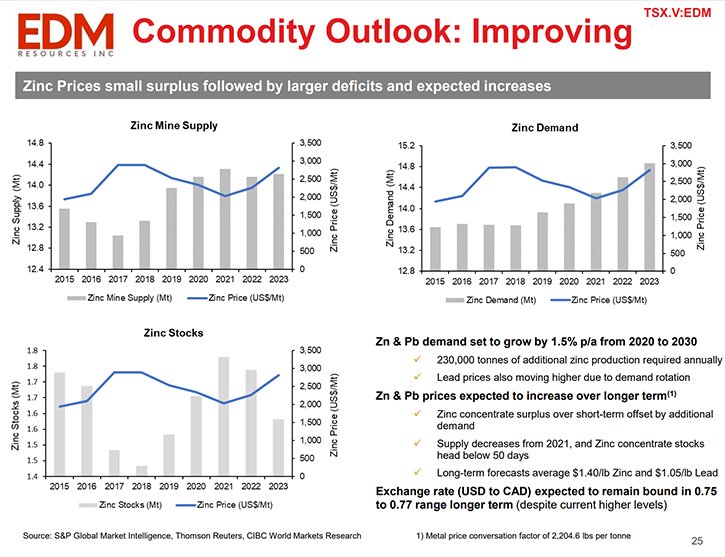

Yes, great potential. The renewed focus on the EV and Green transition, is one of the reasons Zinc prices have steadily increased over the last two years, culminating in a 15-year high in Q2 2022. And while commodity prices have pulled back since, we expect elevated commodity prices for the medium to long term.

Dr. Allen Alper:

Sounds excellent! Could you tell our readers/ investors a little bit about yourself, your Management Team and Board?

Mark Haywood:

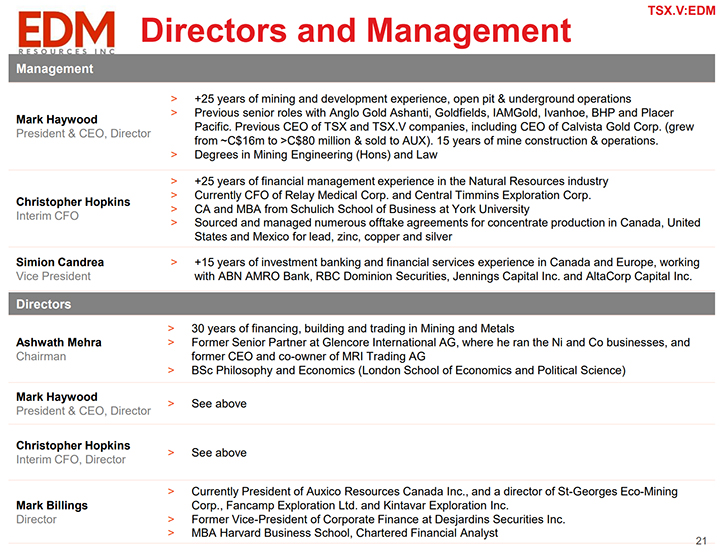

I am President & CEO and one of the Directors of the Corporation. My background is mining and law. I have over 25 years in the industry, building and operating mines. I've been Chief Mining Engineer, Mine Manager and General Manager of several mines throughout the world. I've also been running publicly traded Canadian mining and exploration Companies for many years in Canada as well.

On June 28, 2022, we announced the appointment of Chris Hopkins, as Interim CFO. Chris is already an insider of the Company, serving as a Director since 2017. He has over 25 years of financial management experience, in the natural resources industry. He has been the CFO of a number of other public companies as well. He also has experience, with offtake and concentrate production, in Canada and the US and Mexico. We are presently recruiting a full time CFO.

Moving on to the Board, our Chairman is Ashwath Mehra. He is a proven Mining and Commodities entrepreneur, having over 30 years of founding and building metals trading and mining companies. He has been a senior partner with Glencore and a former owner of a metals trading company, called MRI. Our fourth Director is Mark Billings, he's also been in the mining industry for quite some time. He's a Director of several companies as well, including Auxico, St. George's and Fancamp. Mark has an MBA from Harvard Business School and is a CFA charter holder. In closing, we have a great Board and an experienced Management Team.

As we are financed now and are moving into production. We are going to expand the Corporation and the mine site Team: we are looking for a full time CFO, as I mentioned. We are also about to begin the recruitment of key operational personnel, General Manager, Mill Manager, and a number of other operational staff. In total, the mine site has around about 150 full time people. Although we have a good technical group, on deck right now, engineers and geologists and environmental people, we have more to build out, over the next 12 months or so.

Dr. Allen Alper:

You have a great background, and your Board does too. Great experience! Sounds excellent!

Mark Haywood:

As an investor, one of the key things you want in a mining company, you want to know that the Team has done this before and has actual mining experience. That's really where our Board and Management Team sits. We actually are mining people and we're running a mining company and putting yet another mine into production.

Dr. Allen Alper:

Well, you have a very experienced Team. You've done it before and can do it again. So that's great!

Mark Haywood:

Yes, and I have to say, Nova Scotia is a wonderful province to have an operation like this. A very supportive government, very supportive stakeholders, near the mine as well. First Nations have been supportive too. It's been a historical mine, so the community's used to having this operation here, although it has been on care and maintenance for over 10 years. It's a good community and we intend to employ many people from that community, including First Nations, including people near the mine, training and getting them involved in a long-term project like this.

Dr. Allen Alper:

That’s great. This next year is going to be a very exciting time for your shareholders and stakeholders, that’s excellent!

Mark Haywood:

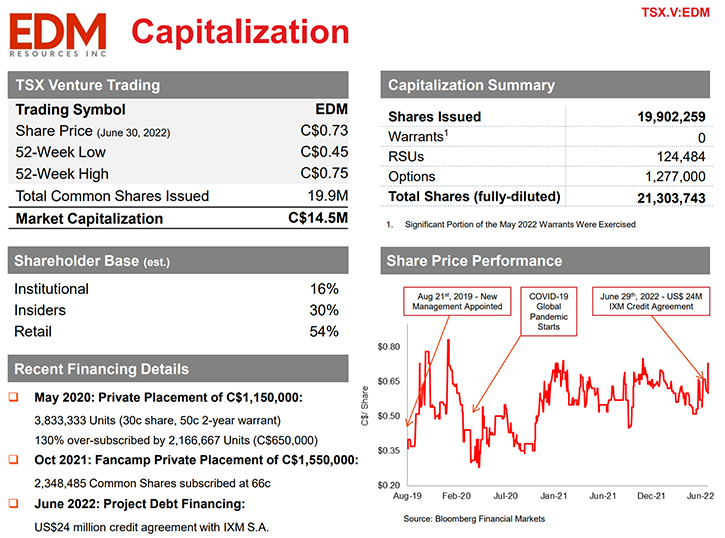

We are listed on the TSX Venture Exchange, one of the world’s premier exchanges for Mining and Natural Resources stocks. Canadian and international investor have relied on the very high listing and disclosure standards of the TSX V, for decades now.

We encourage your readers to review our website – www.EDMresources.com – to learn more about our Company, to dive into our Technical Reports and to reach out to us with any questions or inquiries.

We plan on having open days and investors & research analysts Scotia Mine site visits, in the coming months and showcase, to current and prospective investors, the excellent infrastructure we have on site, the well-maintained state of the Mill and just how easy is to get to and from the Mine – from Halifax and from anywhere in Canada or North America, one other reason to back up the claim that we are considerably undervalued.

Following the long and extremely detailed offtake and debt finance negotiations, which culminated, with securing the US$24 million financing package with IXM, we will start, probably next month, an aggressive marketing campaign, in Canada and internationally, to promote the Company, to explain the plans for the next 12 months and to demonstrate the merits of an investment in EDM. Hence, I would encourage your readers to take a position in the Company now, before the world truly notices and understands we have a fully financed and permitted mining operation in Canada, trading at 10% of the NAV! Time to act!

Dr. Allen Alper:

Well, that sounds great! You've mentioned about your share and capital structure. Could you summarize it? I noticed too that Management and Board are committed to the Company and have skin in the game.

Mark Haywood:

Yes, I and we, the entire Team, have quite a bit of skin in the game – close to 20% – and these positions represent shares that we acquired and paid for in the market, past financings or warrant exercises. In terms of capital structure, currently we have just under 20 million shares outstanding, 1.2 million options and no warrants.

So, the Company owns permitted and financed mining operations worth north of C$200 million and the Company has almost 20 million shares outstanding, which are currently trading around 70-75 cents, whereas the NAV per share is around C$10 per share. This is an amazingly undervalued stock, which represents tremendous upside value. As I said moments ago, it’s time to act and it’s time to take a position in EDM!

We have a tight capital structure, we don't need to raise a lot of additional capital (we will do a small financing, a royalty or equivalent structure over the next six months, which is part of one of the conditions in the debt financing) and we’re poised to be cash flowing by Q4 2023. In addition, we have an AGM on August 30th, 2022, seeking approval for the debt financing package, on which I expect our shareholders to fully support our strategic plan.

We're very pleased with the Company’s developments and considering all the factors in the world today, and the general sentiment in the markets right now, I believe this is very positive news for prospective investors to become part of that EDM growth story.

Dr. Allen Alper:

Well, Mark, those are very compelling reasons for our readers/investors to consider investing in EDM Resources. You have a great property and a great location, and you'll soon be within a year of generating cash flow. You have a very impressive, robust, pre-feasibility study and great backing, by the government. You'll have a great offtake and great financing and minimal need to raise additional cash.

Mark Haywood:

That's great Allen, thank you very much for the opportunity to showcase EDM and the great prospects we have at our Scotia Mine in Nova Scotia. I hope we can get the message out there jointly and look forward to getting the Scotia Mine in production next year and declaring commercial production, in Q4 2023. Thank you!

https://www.EDMresources.com/

Mark Haywood

President & Chief Executive Officer

+1 (902) 482 4481

info@EDMresources.com

|

|