James Sykes, CEO and Director BASELODE Energy Corp. (TSXV: FIND, OTCQB: BSENF) Discusses Exploration of Approximately 227,000 hectares in the Athabasca Basin Area, Northern Saskatchewan, Canada

|

By

on 3/12/2022

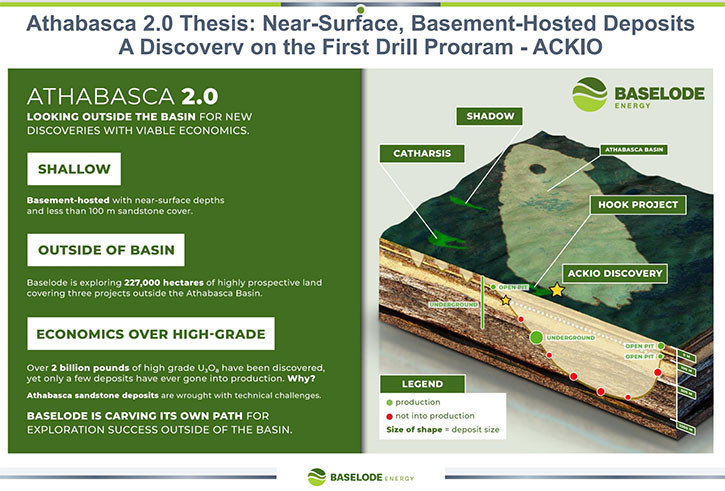

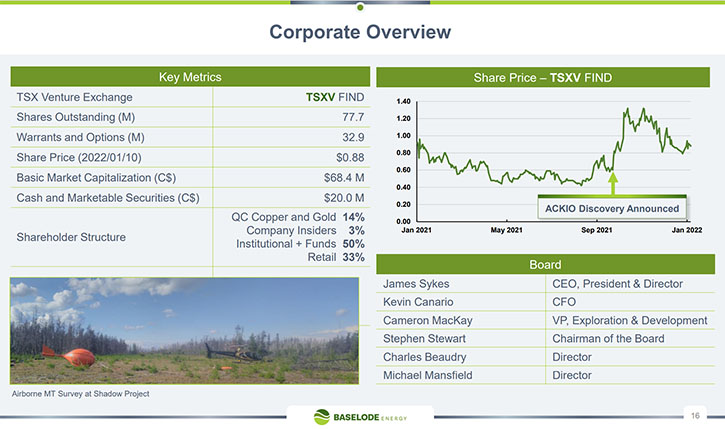

We spoke with James Sykes, who is CEO and Director of BASELODE Energy Corp. (TSXV: FIND, OTCQB: BSENF). BASELODE currently controls 100% of approximately 227,000 hectares for exploration in the Athabasca Basin area, northern Saskatchewan, Canada. The land package is free of any option agreements or underlying royalties. As part of the Company's Athabasca 2.0 exploration strategy, of looking outside the Basin for new discoveries with viable economics, BASELODE has recently made a new high-grade uranium discovery called ACKIO zone. ACKIO is located on the Company's wholly owned Hook project, 30 km east of well-established infrastructure including an all-season road and powerline. The Company has started a 10,000 metres diamond drilling program in Q1 2022. The Company is fully-funded, with over $20M in the treasury, and tight capital structure, with ~20% controlled by insiders.

Dr. Allen Alper:

This is Dr. Allen Alper, Editor-in-Chief of Metals News, talking with James Sykes, who is CEO and Director of BASELODE Energy Corporation. James, could you give our readers and investors an overview of your Company and what differentiates your Company from others?

James Sykes:

We are a brand-new Company, we listed publicly in June of 2020. Within that time frame, we have staked three projects. We have 227,000 hectares of prospective land for uranium and rare earth element exploration in the Athabasca Basin area, northern Saskatchewan. The thing that really differentiates us from a lot of our peers is that when we initiated this Company, we came in with a game plan really set in stone. A lot of people can come in and say, oh yeah, we're exploring for uranium. Yeah, that's fair enough. Or we hope to make an intersection. Yep, fair enough.

We came into this, with a specific target model in mind, what we call the Athabasca 2.0 Strategy. We are specifically looking for near-surface, high-grade uranium deposits that are amenable to open pit mining methodologies and that are all within an acceptable distance of infrastructure including roads, power lines, and especially in proximity to a uranium mill that's already established. That was our strategy going forward. That's exactly what we're looking for. We sat back and we looked at the Athabasca Basin from afar, looked at all the potential structures and what really makes these things tick. Especially, with my experience, 15 years in the Athabasca, and my colleague Cameron MacKay, who also has worked on uranium deposits, we were able to identify the projects that we believe have the right structures to host mineralization.

In the Company’s first drill program, and the first on the Hook project in over 40 years, we intersected uranium mineralization. We discovered the ACKIO zone, which basically adheres to everything that we were looking for, with the Athabasca 2.0 strategy. We're very happy, having achieved success in a short time frame.

Dr. Allen Alper:

Well, that sounds excellent. Could you give me more details about what you have found and what your plans are?

James Sykes:

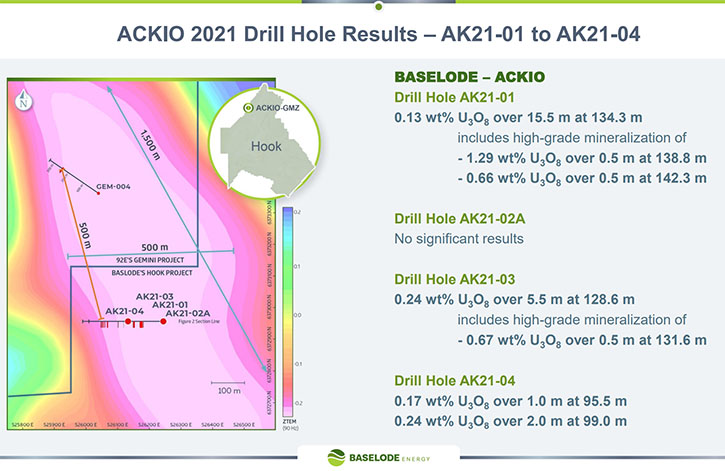

We're only four holes (~1,600 m) into the ACKIO discovery. We were drilling it between September and October of last year. We had to stop due to weather conditions and lack of daylight hours to continue a helicopter-supported project, but we also had to plan a camp and logistics going forward. Three of four drill holes intersected uranium mineralization, and two have identified high-grade uranium. We are defining high-grade, as anything greater than 0.5 weight percent U3O8. In our first drill hole, we intersected a half meter sample that returned 1.29 weight percent U3O8. That is your typical Athabasca uranium grade. However, our drill hole intercept was 15.5 m of 0.13 wt. % U3O8, which is a very encouraging start on a discovery. This intersection produces a GT (grade x thickness) of 2. If you look at other deposits around the Athabasca Basin, there are a number of deposits that have 2 GT, within a mineral resource estimate, and those drill holes are within 5 to 25 meters of extremely high-grade uranium, i.e., 10 meters at 10%, which is what everybody's always looking for. We think that possibility exists at ACKIO.

Looking at the ACKIO drill core, the alteration is very similar to other well-known, basement hosted, uranium deposits, especially those I've seen firsthand, such as Hathor’s (now Rio Tinto’s) Roughrider and NexGen’s Arrow uranium deposits. We're seeing a lot of alteration, probably the biggest alteration envelope I’ve ever seen. ACKIO is clearly indicative of a massive hydrothermal fluid plumbing system and we know it’s fertile, with uranium. We believe it’s only a matter of time until we intersect something much larger, something Cameco’s McArthur River worthy.

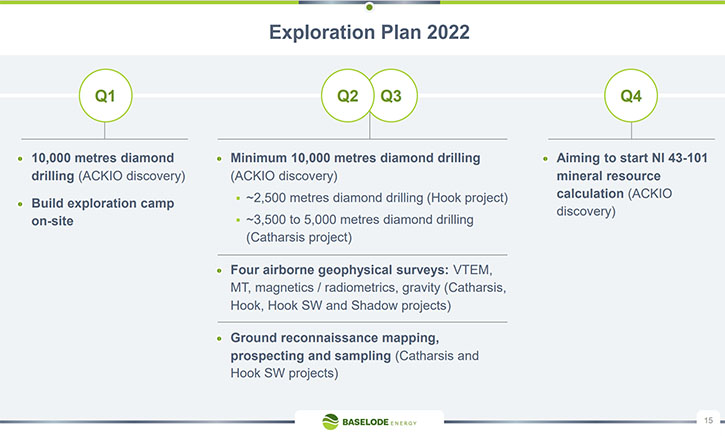

Our strategy, moving ACKIO forward, is to drill, drill and drill. We recently reported (see Baselode news release on February 9, 2022) that we’ve started a 10,000-meter diamond drilling program. Heading into the summer, we will continue, with the same strategy, but for a much longer duration. We're fully-funded and budgeted for 30,000 meters of diamond drilling, in the summer, giving ACKIO 40,000 metres for 2022.

If we can achieve all of this, we humbly believe that we can start work on an initial 43-101 resource estimate. The reason why we want to push for a resource is because the uranium market is extremely hot right now. To really have an impact on the Company and benefit our shareholders, we think it's value-added if we can have legitimate pounds, in the ground. That could differentiate us from our exploration peers.

Dr. Allen Alper:

Well, that sounds excellent, it sounds like 2022 is going to be extremely exciting and rewarding time for your stakeholders and shareholders.

James Sykes:

We hope so. That's the plan. They've been very patient with us. A lot of these guys have followed my career for a number of years, and I don't like to disappoint. Success is how we like to reward them.

Dr. Allen Alper:

Well, that sounds excellent. James, could you tell our readers/investors, I know you have a great career, great record of success, but tell us a little bit more about your background and your Team and your Board.

James Sykes:

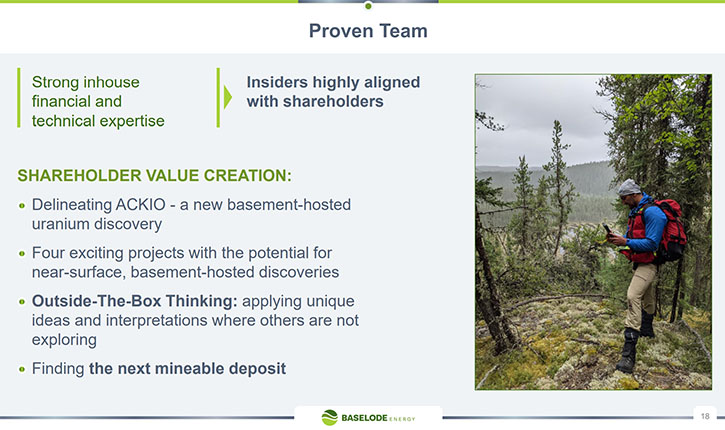

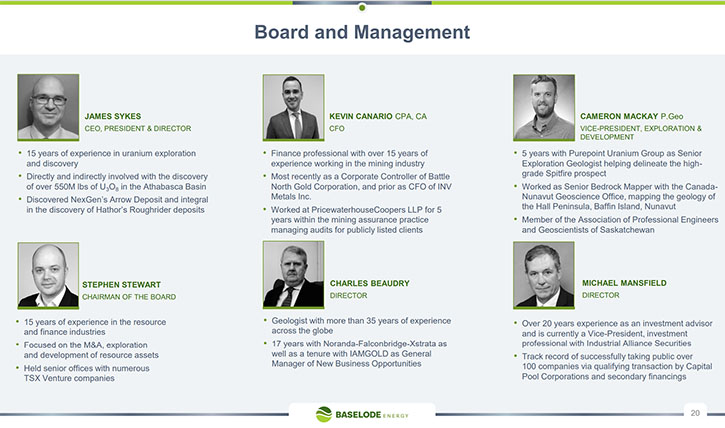

I've been exploring the Athabasca since 2006, touching on 16 years this year. I've been part of a number of successes, directly and indirectly attributing to about 550 million pounds of uranium discovery. I don't think there's anybody, outside of the big companies, outside of Cameco or Orano, who can also make such a claim, throughout their career. I’m very fortunate to have had some amazing mentors, to have seen uranium in different systems, and to have worked on a few early-stage uranium discoveries. I’ve been able to apply what I’ve seen and learned to areas that people have never considered to explore, with considerable success, whether they have been massive discoveries or simply little showings that won’t ever be mined. I can find uranium!

I’ve been growing and learning, with each passing year. I think the Company is in very good hands and we've proven that. The first project that we drilled, we made a discovery. Can't complain about that!

Cameron MacKay, we promoted to VP in December of last year. He also has a lot of experience in uranium exploration. He was previously working with Purepoint Uranium Group and working on their Spitfire zone, along with some other discoveries on their projects. Cameron is very strong technically. He’s a smarter geologist than I am and a very brilliant man.

Our Board: Stephen Stewart, who is the founder of the Company, also the founder of the Ore Group of Companies, which is an umbrella group of six different exploration companies, Baselode being one amongst them. Stephen has a wealth of knowledge, within the market space and has a lot of contacts. He's very wise and I really enjoy working with him. We mesh together, nicely and I look forward to continuing our relationship for many years to come. Another Director, Charles Beaudry, is a geologist, with 30 to 40 years’ experience. He's been part of several discoveries across Canada and with a variety of commodities. He’s previously worked in the Athabasca Basin; therefore uranium exploration is not new to him. I have a lot of respect for Charles, as he definitely sees things very clearly and he has a great eye for picking out projects that could be very successful.

QC Copper and Gold, with their Opemiska Deposit, is a prime example of what Charles and Stephen bring to the Team. They looked at it, with a new perspective and said, “we can turn this around and we can turn this into an open pit”. Our people, from the technical experts to the Board, create a phenomenal Team.

Dr. Allen Alper:

That sounds like a great Team and a Team that knows how to work together.

James Sykes:

It creates shareholder value for everybody involved.

Dr. Allen Alper:

Well, that's excellent! James, could you also tell us a little bit about your share and capital structure?

James Sykes:

We have less than 80 million shares outstanding, about 110 million fully diluted, therefore approximately 30 million, in options and warrants as well. Very tightly held! Approximately 14%, or 11 million shares, are held by QC Copper and Gold, who was the parent Company that helped us list publicly. Nearly 33% of our shares are held by retail investors; these are people who have followed my career and have confidence in the Company. I like to suggest that they have already benefited. The remainder, ~50%, is held by institutions.

We have $20 million in the bank, which is a fantastic position to have, and approximately $8 million of that is in Flow-Through commitments that we have to spend this year. This means Baselode has to have an active 2022, which will benefit our shareholders. This also means that we’ve got $12 million as hard dollars that we have no timeframes to commit to spending those funds. Our market cap is above 50 million. Our share price has been holding quite well, which we're very happy about. When we originally listed, we were a $0.10 Company. After making the ACKIO Discovery, we peaked upwards to about $1.50. We've had significant returns on investment already. We've raised about $30 million in total and every time we have done a financing, we have always done it at higher prices, so our shareholders on each placement, have never been disappointed, with these raises. We're excited to reward our shareholders, moving forward and we honestly believe that we will achieve new share price highs this year.

Dr. Allen Alper:

That's excellent. It's great to see your Company, with such an excellent cash position, to have the funding to move your project along and drill and then explore and discover more uranium. Well, that's excellent, and it's nice to see that Management is aligned with the shareholders. Could you just say a few words about the uranium market and how exciting it is?

James Sykes:

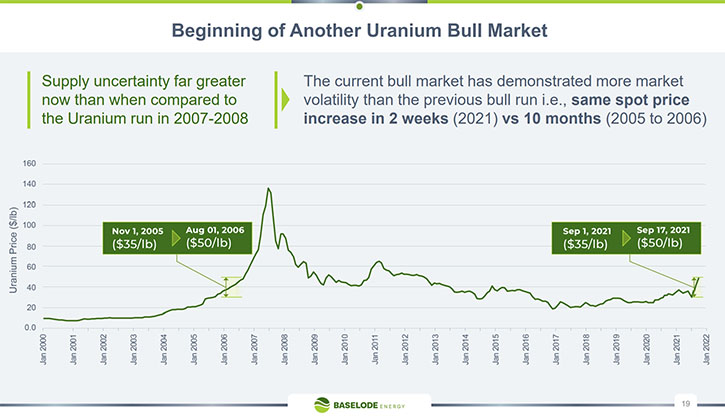

The uranium and nuclear energy market is absolutely exciting right now. If you look at everything that's happening around the world, everyone's talking about an energy crises, especially if you look at what's going on in Europe. They are seeing all time high, residential energy costs. With the way that the world is going and everyone saying, “We need electric vehicles. We need clean energy sources”. Well, there's nothing better than nuclear energy as far as a green, nonpolluting, baseload energy source. It has the greatest output. It’s always on when you need it. And despite public perception of a few incidents throughout history, it’s by far one of the safest forms of energy production.

When you consider the amount of energy that is produced from nuclear energy could have a huge footprint. Truthfully, it doesn’t. A 1 GW capacity nuclear plant, would have a much smaller footprint than 1 GW capacity of both solar or wind energy. Even on the mining side of things, uranium mine footprints are very small. Nuclear energy is the way to go. With governments mandating these CO2 restrictions, this is now the time for nuclear energy to really take hold and to prove that it is what we need to move humanity forward. Overpopulation is not going anywhere, technological advances continue. And if you look around at the number of electrical applications that we use today, there are far more today than there were 10 years ago. Everything nowadays, you have to plug in. As soon as you start plugging all these things in, you're drawing off the grid, you need more energy. Simply put, humanity’s necessity for more and more energy is not going to phase away any time soon. It’s growing yearly. We need more energy, therefore, we shouldn’t be excluding nuclear power from the equation.

Dr. Allen Alper:

Sounds like a great future for uranium and nuclear energy, for how it fits in the drive for green energy and a decrease in carbon dioxide emissions. James, could you tell our readers/investors the primary reasons they should consider investing in Baselode Energy Corp.?

James Sykes:

We have tons of room to grow and increase shareholder wealth. We believe that our share price will be valued at much higher prices, especially if we start intersecting much higher grades of uranium or just broader intercepts. We think that will reward our shareholders. However, to make this happen, I think we probably have one of the best Management Teams, and I think we've proven that, with the ACKIO discovery. We’ve successfully raised significant funds, without suffering a lot of dilution. We’ve been able to focus on putting our funds into the ground, efficiently and effectively.

I think we're definitely primed for success, and we have a full year of some pretty serious and aggressive exploration planned. We do plan to drill additional geophysical targets on the Hook project, which hosts ACKIO. Some of these targets share geophysical similarities with the ACKIO discovery. We hope we can find more uranium mineralization on Hook.

However, we also have the Catharsis Project, which we will be advancing this summer. That is very exciting for us, as it has a lot of geophysical and structural similarities to other Athabasca basement-hosted uranium deposits. We are currently completing an airborne VTEM survey over Catharsis. Those results, combined with the airborne gravity results from last year, will provide us the targets that we will drill this summer. We’re planning for between 2,500 to 5,000 m of diamond drilling, this year on Catharsis. The eastern side of Catharsis hosts numerous historic high-grade uranium showings. We plan to revisit those areas, to learn more about the project as a whole, and hopefully delineate those showings into something much larger. We also discovered high-grade rare earth elements in outcrop on the project last year. The trend was continuous for more than 100 m and was quite thick. We’ll put more effort into delineating that trend as well. A surface rare earth discovery, within trucking distance from a processing plant in Saskatoon, would be an amazing asset and value-added to the Company.

Lots of catalysts in 2022, for us to continue growing the Baselode story. If we’re successful on any of these exploration programs, this will be a monumental year for the Company. As we continue to grow ACKIO, we remain positive that we’ll be working towards an NI 43-101 resource estimate, by the end of the year. This will differentiate us from our peers.

The example I like to give is this: if we have a 25-million-pound deposit at ACKIO, which is not a lot, to be honest, but if you consider it could be an open pit, this enhances the economics of the discovery. Assuming a $40/pound uranium valuation, that's a billion-dollar in-situ value right there. If the Company is valued at a quarter of that, USD$250 million, and we have about 110 million shares fully diluted, you're looking at a share price of USD$2.50, or CAD$3.20. That's a three to four times return on investment from today’s share price. That is why we’re excited. That is why we think investors should be paying attention to Baselode. We have the Team, the Discovery, and the cash position to hopefully make this all happen. Another discovery on the Hook project, or even down at Catharsis, will also positively influence our share price.

Dr. Allen Alper:

That sounds excellent, those sound like very compelling reasons for readers/investors to consider investing in in your Company. So that's great! Is there anything else you'd like to say, James?

James Sykes:

No, I think we've covered a lot of the bases, the important facts and the potential future. I believe we're one of the best uranium exploration companies in the Athabasca Basin area. We like to educate our investor group and the general market. You can go to the Ore Group’s YouTube channel (https://www.youtube.com/channel/UCM9WVfeCJdrS29dZzFrpH5w) and review our videos. We've received a lot of positive feedback about these. We go above and beyond a simple news release. We go into much greater detail and provide a lot of visuals and understanding about what the results really mean.

We're very transparent in the way that we send the message out to the investment community. We're not holding anything back. We like the investors to know why we are doing what we're doing, how we're doing it, what we're doing and what we expect to see. Then when we have results, we like to really give a deep interpretation of these. We like to educate.

Dr. Allen Alper:

That sounds excellent! That's really a great service to your readers and to your shareholders. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://baselode.com/

James Sykes, CEO, President and Director

jsykes@uraniumgeologist.com

info@baselode.com

|

|