Rubicon Minerals Corporation (TSX: RMX | OTCQX: RBYCF): Advanced Gold Developer Company, in the Prolific Red Lake Gold District in Ontario, Canada; Interview with George Ogilvie, P.Eng., President& CEO

|

By

on 5/25/2020

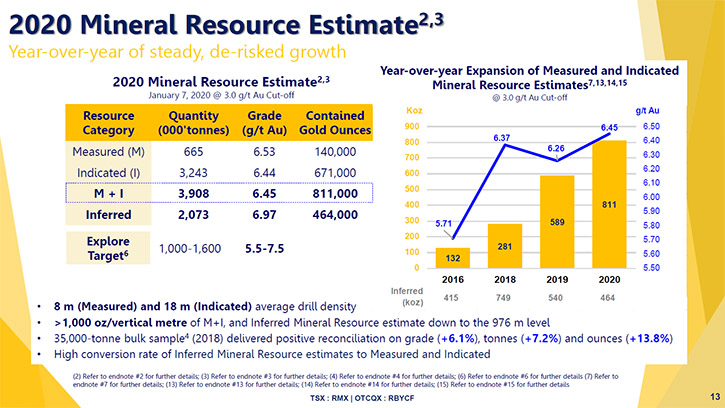

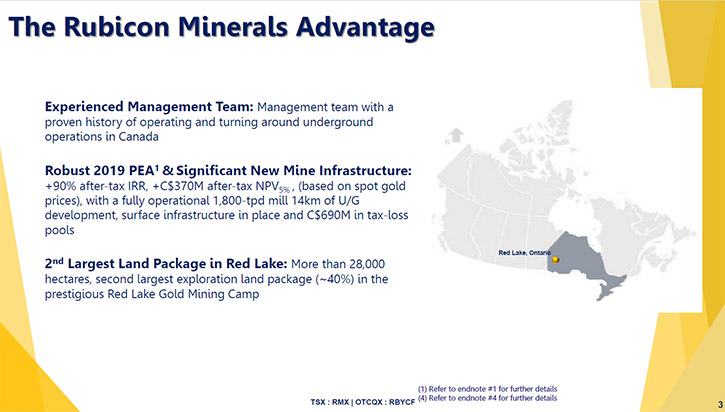

Rubicon Minerals Corporation (TSX: RMX | OTCQX: RBYCF) is an advanced gold developer that owns the Phoenix Gold Project, located in the prolific Red Lake gold district in northwestern Ontario, Canada. We learned from George Ogilvie, P.Eng. President, CEO, and Director of Rubicon Minerals, that they have a compliant NI 43-101 resource, with 811,000 ounces of measured and indicated, with a gold grade in the ground of 6.45 grams per tonne, and a 1,800 tonne per day metric mill ready to go. In addition, the project has 464,000 ounces of inferred gold, with a grade slightly below 7 grams per tonne. Plans for 2020 include completing the feasibility study in the second half of the year that will show robust economics at conservative gold prices. At the end of 2020, Rubicon plans to announce the project financing to take the mine forward, quickly, to commercial production.

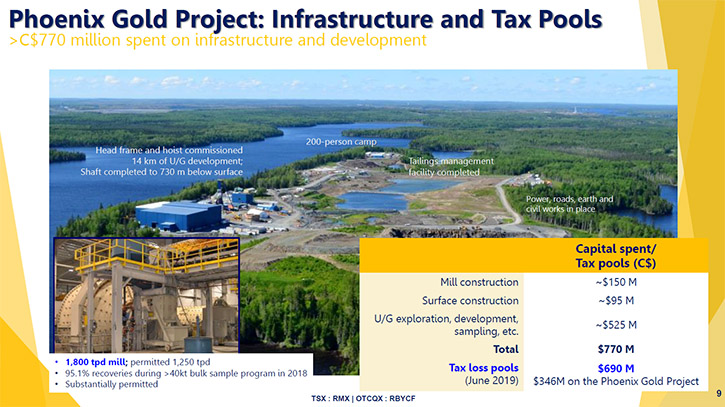

Phoenix Gold Project Site - Overhead view

Phoenix Gold Project

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing George Ogilvie, who is President and CEO of Rubicon Minerals. George, could you give our readers/investors an overview of Rubicon Minerals and also what differentiates Rubicon Minerals from others?

George Ogilvie: Thank you, Al. Rubicon Minerals controls 28,000 hectares of land in the prestigious Red Lake gold mining camp. We have a project in Red Lake, which is known as the Phoenix Gold Project. Essentially over the last five or six years, the mine has been built. It is permitted. We have a 1,800 tonne per day metric mill, which is ready to go. Over the course of the last three years, we've been conducting infill drilling and growing the resource. So today we have a compliant NI 43-101 resource with 811,000 ounces of measured and indicated, with a gold grade in the ground of 6.45 grams per tonne. Behind that, we have 464,000 ounces of inferred material, with a grade just slightly below seven grams per tonne.

The Company is now in the process of undertaking a feasibility study, which will come out to the markets in the second half of this year. Based on a preliminary economic assessment that we put out last year, we believe the feasibility study could potentially show robust economics, at conservative gold prices, and that we will have a commercially viable mine on our hands. At that point in time, at the end of the year, we hope to complete the project financing to take the mine forward to commercial production, which we can do in very short order.

Mill

I think what differentiates Rubicon, from your other typical advanced exploration stories, is that we already have the mine built, in place and permitted. Over and above the permitted mill, we have a 720-meter-deep shaft, with a full production hoisting system. We have 14,000 meters of development, within the mine. We have a 200-man camp on site. There's a 14 KVA electrical line right into the mine site, with two 5 KVA power cables going underground. We're 14 kilometers outside of the prestigious Red Lake mining community, which has been there for over 80 years with 30 million ounces of gold having come out of that camp.

Dr. Allen Alper: That sounds excellent. Could you tell our readers/investors, your primary objectives for 2020 and going into 2021?

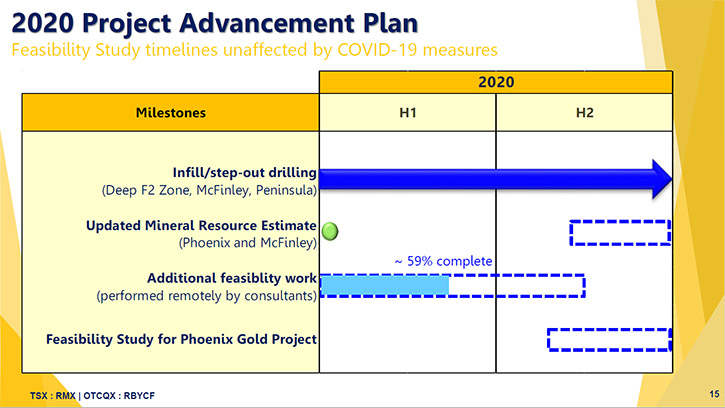

George Ogilvie: The resource that I previously mentioned came out in January of this year. That resource was cut off last year in September of 2019. Since October of last year, we've actually been undertaking infill drilling, into an area in the mine, where we currently have about 190,000 ounces of inferred material. As of last week, that infill drilling was completed and we announced to the market the final exploration results from the infill drilling. All of those assays have been handed over to our consultant, who is conducting the feasibility study and a NI 43-101 Mineral resource update.

We believe we should be able to convert, at a minimum, 100,000 ounces of inferred material, over into the measured and indicated category, which will then take the resource well north of 911,000 ounces of M&I, and that could be utilized in the feasibility study to eventually convert over into mineable reserves, which Rubicon 1.0 never had in the past. The mine was built on the back of three preliminary economic assessments, with no feasibility study, which we will have later this year. Previously there were no reserves.

So that leads into our next key objective this year, which is to produce a feasibility study, which should be out into the market sometime around September of this year. Lastly, now that the infill drilling has been completed on the Phoenix deposit for this year, we've turned our attention to some close proximity targets, which are within 500 meters of our mine infrastructure and mill. We intend to release the exploration results on those targets, which are known as McFinley and the Pen zone, over the coming quarters. The goal with McFinley would be to produce a 43-101 compliant resource by the end of this calendar year and then for the Pen zone, put something out in the first quarter of 2021.

Dr. Allen Alper: Well, that sounds excellent. Could you tell our readers/investors a little bit about your share and capital structure?

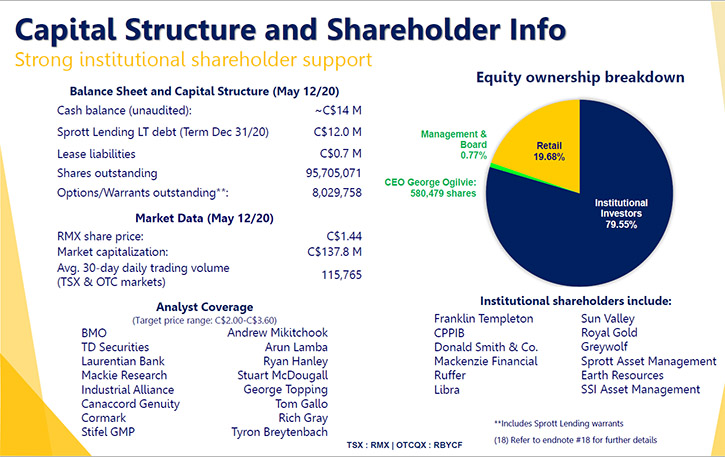

George Ogilvie: Yes. Today we currently have 95 million shares issued. The current share price this morning at market opening was C$1.48 Canadian, which means the Company has approximately C$135 million market capitalization. Over and above the shares issued, we have approximately 8 million stock options and warrants, which have a weighted average price of C$1.37 Canadian. So the stock options and warrants are now in the money. On a fully diluted basis, we have approximately 104 million shares issued and outstanding.

I think it's important to bring up here, Al, that when we restructured this Company, approximately three and a half years ago, I put in C$500,000 of my own money at a price then of C$1.33. I've continued to put in additional monies over the last three and a bit years with another C$250,000. So today I have C$750,000 of my own money invested at a weighted average price of C$1.32.

Dr. Allen Alper: Well, it's nice to hear that you are committed to the Company, have confidence in the Company, and that you have skin in the game. So that's excellent. Could you tell our readers/investors some of your significant institutional shareholders?

George Ogilvie: Absolutely. When we restructured Rubicon, three and a half years ago, we refinanced the Company and we raised approximately C$45 million at that time. A lot of the institutions, which supported us at that time, still today remain long-term shareholders of Rubicon. So we have Franklin Templeton, our largest shareholder, controlling just over 11% of the Company. We have the Canadian Pension Plan Investment Board, who controls approximately 10% of the Company. Other institutional shareholders that we have would be Sun Valley. We also have Mackenzie. These are institutions, which normally you wouldn't see in a registry for a junior exploration company. They would be more at home on the registry of mid-tier and senior companies. So I think that sends out a very strong message to potential investors in the Company that we have very strong institutional shareholder support from quality names.

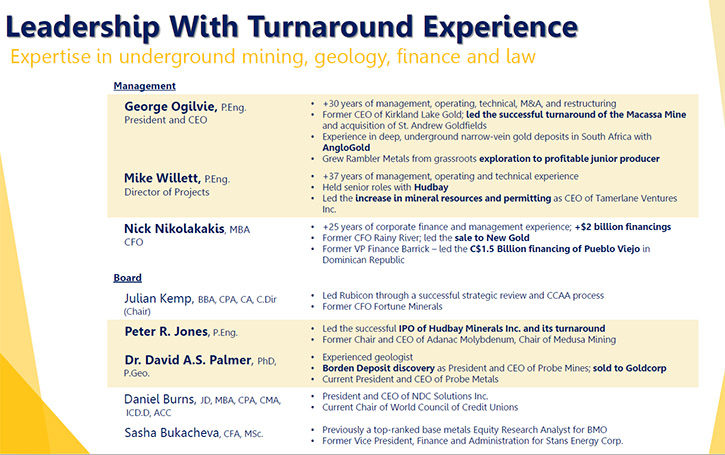

Dr. Allen Alper: That sounds excellent. Could you tell our readers/investors about your background? I know it's excellent. Also about some of your key members of your Team and Board?

George Ogilvie: Certainly. I'm originally from Glasgow in Scotland. I graduated from Strathclyde University in Glasgow in 1989, with a mining degree. At that point in time, I went off to South Africa to work for AngloGold in the ultra-deep gold mines of the Witwatersrand Basin. I cut my teeth on some of the most physically challenging and toughest environmental mines in the world. I was quite successful there. In 1997, I was transferred to Anglo Base Metals. At that time, they owned Hudson Bay Mining and Smelting with operations in Northern Manitoba. So I moved my family up to the North of Canada, where I spent approximately another eight years working for Anglo Base Metals in ever-increasing management positions.

By 2004, I resigned from the Anglo group of companies and went to work for Dynatec and FNX with Terry MacGibbon in the Sudbury nickel camp, bringing some of the old Inco mines back into production, such as McCreedy West and Levack. I spent six months out at Podolsky and was involved in the shaft sinking there, as Manager of the project. Then by 2007, I ran across a gentleman by the name of Harry Dobson, who's a mining entrepreneur. He founded Yorkton Securities many years ago. Harry, like myself, is a Scotsman and he asked me to move out to St. John's, Newfoundland and start up a small junior company there known as Rambler Metals and Mining. They had a former producing copper mine, which had been dormant for 20 years. Over a period of about three and a half years, we got the mine de-watered. We got it permitted. We got the financing in place. We did all the technical studies and we put it into production. At least for the first three years of its commercial life, it was profitable and generating free cash flows.

Harry, at that time, as well as being the Chairman of Rambler, was also the Chairman of Kirkland Lake Gold. He had asked me to go in there in 2013 in the fall. I went in there and we completely restructured that Company, by bringing in Eric Sprott, as the non-executive Chairman. We added new members to the Board. We brought in a new Management Team and over a period of three years, we took the market cap of Kirkland Lake Gold from approximately C$250 million to C$1.5 billion. We also did the acquisition of St Andrew Goldfields. Following my exiting the Company, obviously Kirkland Lake Gold has gone on from strength to strength, with the acquisition of Fosterville and then more recently Detour Gold and is now, I believe, a C$15 billion market cap company. I joined Rubicon in late 2016 and we're now well on the track to turning around Rubicon. Although we've seen some uplift in our share price of late, I believe the Company is still significantly undervalued compared to its peer group.

As far as my team is concerned, I have two other key executives. Mike Willett is a professional engineer like myself, with over 40 years of experience in the mining space, in all disciplines. So he's been in production, he's been a C-suite executive. He's been a consultant, so a good all-rounder to have out at the site in Red Lake. My second-in-charge, my Chief Financial Officer, Nick Nikolakakis, is an ex-Placer Dome, Barrick senior executive. He has over 25 years of experience in the industry, with myself and has raised over $3 billion in the capital markets. So we're a very experienced senior management team, with almost a hundred years of mining experience behind us, managing Mines and generating return on investments for our shareholders.

Dr. Allen Alper: You and your team have an outstanding background. That's excellent! Could you tell our readers/investors the primary reasons they should consider investing in Rubicon Minerals?

George Ogilvie: Gold is a key commodity today. I think everybody can see that based on the macroeconomics. There's a lot of money, which is now being printed. I believe that we are going to see continued debasement of fiat currencies, including the US dollar. And essentially that means that the purchasing power of the US dollar on a go-forward basis and all other currencies is going to significantly diminish. So I think any investors, who are looking at their own portfolio, want to be thinking about how they can preserve their wealth or even grow it. And I do believe that gold can actually preserve wealth and also can protect investors’ portfolios in times of crisis. So I would certainly say to your readers/investors that they should be considering gold as part of their investment.

Now, when you start to think about gold equities, I also believe that junior companies represent the highest likelihood of return for investors. Certainly they can invest in the Seniors, but they're not going to see two, three, maybe even 10, 20 times their money, whereas there are opportunities like that in the junior space, if you can identify the right companies. Importantly, you want to be thinking about Management Teams. What are Management Teams that have track records of delivering success for the shareholders? After the Management Team, you want to be thinking about where these mines are located? Are they in jurisdictions where the government tomorrow could perhaps nationalize or possess or try and take the asset from the Company? I think with Rubicon being in Canada in the prestigious Red Lake gold mining camp, it's obviously a Tier 1, very safe jurisdiction, from a geopolitical and a socioeconomic perspective.

Phoenix Gold Project

I think the other key point for Rubicon is that we're very close to production. So with a feasibility study out before the end of the year, project financing in place for under C$100,000,000, we can put this mine into commercial production in 2021, going into 2022, and generate significant returns for our shareholders or anybody considering investing in the Company.

Dr. Allen Alper: That sounds excellent. Is there anything else you'd like to add, George?

George Ogilvie: Just to thank you for interviewing Rubicon Minerals Corporation for Metals News.

Dr. Allen Alper: I’ve enjoyed talking with you as always. You’ve made excellent progress. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

Disclosure: the Alper family owns Rubicon Minerals Stock.

https://www.rubiconminerals.com

RUBICON MINERALS CORPORATION

George Ogilvie, P.Eng.

President, CEO, and Director

Investor Relations: +1 (416) 766-2804 or toll-free +1 (844) 818-1776

Email: ir@rubiconminerals.com

|

|