Gran Colombia Gold Corp. (TSX: GCM, OTCQX: TPRFF}: Leading High-Grade Mid-Tier Gold Producer and Silver Producer in Colombia; Interview with Mike Davies, CFO

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 7/3/2019

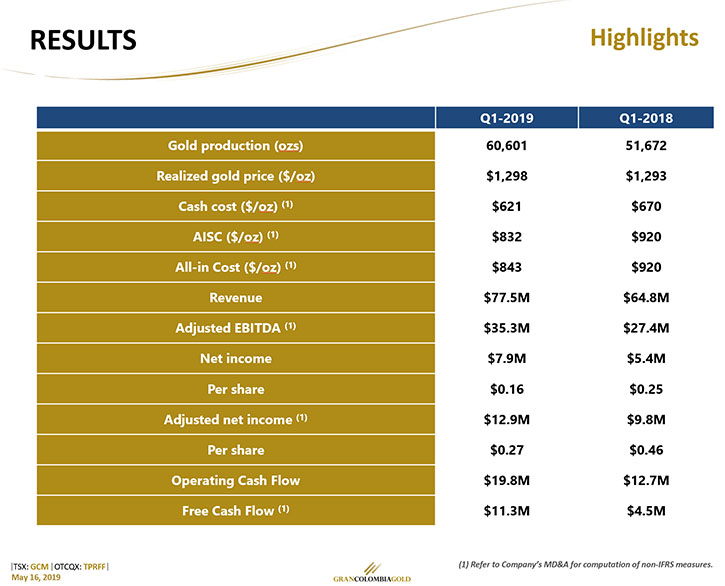

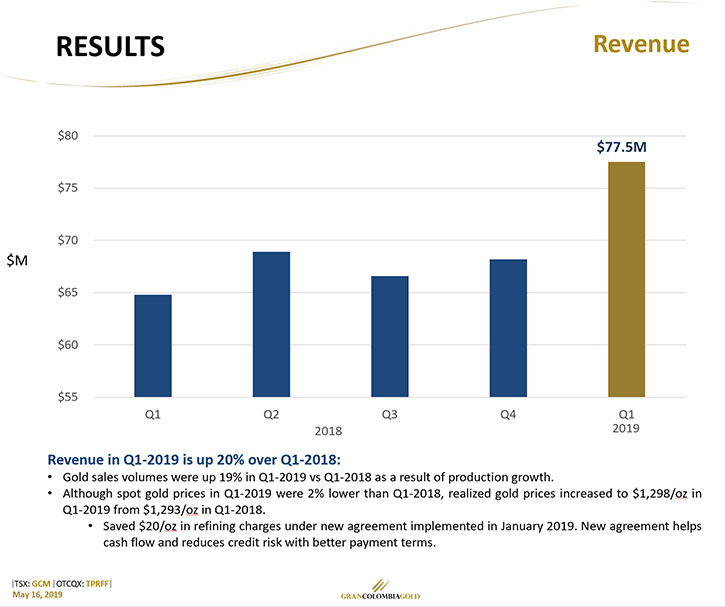

Gran Colombia Gold Corp. (TSX: GCM, OTCQX: TPRFF) is an emerging mid-tier gold and silver producer and the leading underground high-grade gold producer in Colombia, with several mines in operation at its Segovia and Marmato Operations. We learned from Mike Davies, Chief Financial Officer of Gran Colombia Gold, that in the last quarter, the Company demonstrated excellent performance, setting a new gold production record of 60,601 ounces, and continuing the strong performance in April and May on track for a 240,000 ounces a year, way above the last year's numbers. With all-in sustaining cost at $832 an ounce, in the first quarter, the Company's revenues hit $77.5 million. Plans for 2019 include further optimizations as well as exploration drilling to expand the resource, all funded by the current gold production.

Gran Colombia Gold Corp.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Mike Davies, who is CFO of Gran Colombia Gold. Mike, I wonder if you could tell our viewers what differentiates Gran Colombia Gold from others. Could you also update them on the excellent performance that Gran Colombia Gold has had in this past quarter.

Mike Davies: Absolutely! Gran Colombia Gold is an emerging mid-tier gold producer. We're the leading underground high-grade gold producer in Colombia. Our primary operations are in Segovia. We also have a very exciting project moving forward this year at Marmato, which adds tremendous valuation to Gran Colombia. But, we continue to be under-valued versus our peers, from a number of different perspectives. We are currently trading in about the $4.50 Canadian range. We have three analysts now following us. Two of them have target prices of $6.00 Canadian, a third one has $5.40 Canadian at this time. That provides some external validation of what we have been saying about the potential re-rating of our share price going forward as we execute our strategy.

We did have a very good first quarter this year. We set a new gold production record. We produced 60,601 ounces. Since then, we've reported continued strong production in April and May, currently putting us on a 240,000 ounce run rate. Our trailing 12-months gold production at the end of May stands at 230,000 ounces. Both those numbers are well above the 218,000 ounces that we produced in 2018 and above our guidance for the year, the upper end of which was 225,000 ounces.

But the story isn't just stocked with gold production. Very important in mining these days is the generation of cash. With our all-in sustaining cost at $832 an ounce in the first quarter and revenues hitting $77.5 million, our adjusted EBITDA came in at $35 million for the first quarter. That’s well above the $27 million we had in the first quarter a year ago. Our adjusted net income came in at almost $13 million. Operating cash flow hit almost $20 million and our free cash flow, which is allowing us to put some cash on the balance sheet and repay our debt, was $11.3 million.

So financial results from operations continue to perform well and our balance sheet continues to be strong as our debt is coming down, with the quarterly repayments of our gold notes and now stands at $78.5 million. We have cash at the end of March of $40 million, up from just under $36 million that we had at the end of 2018.

Business continues to be very healthy, with the recent strengthening in gold and our continuation of production and keeping control of our costs. We do expect to have some solid results over the balance of this year.

Dr. Allen Alper: That's excellent. That's great news for your investors and your shareholders. That's really excellent performance. Could you tell our readers/investors more about your capital structure?

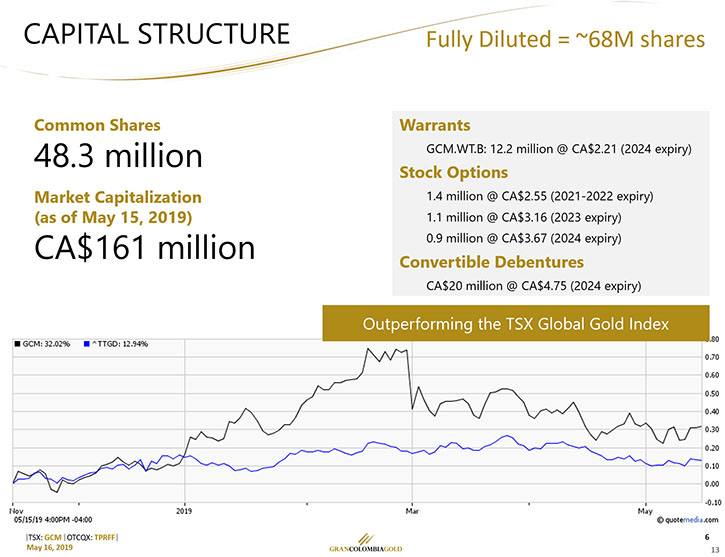

Mike Davies: Certainly. At the moment, we have just over 48 million shares outstanding and a market cap that's above $200 million Canadian. We have some warrants that are currently in the money, 12 million warrants at $2.21 that are listed on the exchange and trading. We have stock options and some convertible debentures that we issued in April, with a strike price at $4.75. All that brings us to a fully diluted share count of something in the order of 68 million shares.

From a debt perspective, we have $78.5 million gold notes. And another $20 million Canadian of Convertible Debentures due in 2024, that we issued in April of this year, the proceeds of which have been set aside to fund an acceleration of our exploration program at Segovia.

Dr. Allen Alper: That sounds excellent. Could you elaborate a little bit on your plans for 2019?

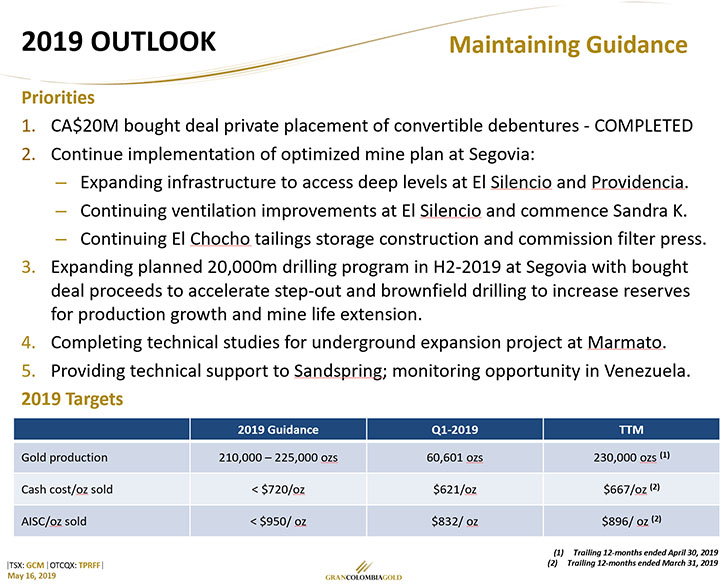

Mike Davies: We're trending with production certainly above the high end of our gold production guidance for the year. Cash costs and all in costs through the first quarter are below our annual guidance for the year.

Our primary focus this year is the continuation of the optimization of our operations in Segovia. The expansion of operations to include further development of the three mines that we're currently operating. In addition to that, we have planned a 20,000 meters drill program this year, funded by operating cash flow. The recent convertible debenture financing has added sufficient funds that now we should be able to achieve a total of 100,000 meters of drilling over 2019 and 2020, with the additional proceeds and our operating cash flow.

Our goal for our exploration program is to accelerate the step out and brownfield drilling that we are doing in Segovia. We are currently mining only three of 27 known veins with historical mining information available to us in that title.

So we are looking for production growth through increased reserves and also for mine life extension, with that accelerated drilling program.

At the same time, in parallel, we are also doing some further work and technical studies at our Marmato project, where we are looking at an underground expansion. The objective being to round out a technical study by the end of this year, so that we can take that project to the next step.

As we announced during the course of this year, we have added a little bit to our investment in Sandspring Resources, which is moving forward, not only with their Toroparu Project in Guyana, but the Chicharron Project that they acquired in 2018 in our Segovia title in Colombia. We currently hold just under 20% of their shares and have some warrants and some subscription rights that would increase our fully diluted account to about 31%. So, continue to monitor things in Sandspring as they move along.

Dr. Allen Alper: That's excellent. Great performance and continued improvements. That's very good. Could you highlight the 2019 targets for gold production, cash costs, et cetera?

Gran Colombia Gold Corp.

Mike Davies: For this year, we've set our guidance back in March, with gold production ranging between 210,000 and 225,000 ounces. Our trailing 12 months, based on what we've done so far, is about 230,000. So we're certainly operating above our guidance. As we have in the last couple of years, we'll wait until we report our mid-year production in July to assess the trend this year and make any amendments to our guidance, once we see how things are forming up.

Our cash costs in the first quarter were $621 an ounce. Our guidance for the year is below $720. The first quarter really benefited from some higher-grade material that we achieved at Segovia. Segovia hit an all-time record, from during our ownership dating back to 2010, a low cash cost of $570 an ounce just in those operations in the first quarter. We continue to benefit from the high-grade nature of our material and controlling on costs. Our all in sustaining costs guidance for this year is that it will remain below $950 a year. Q1 was $832. Trailing 12 months at the end of March was $896. So we again continued to manage our costs as we move forward to ensure that we are sustaining a decent pre-cash flow for servicing our debt.

Dr. Allen Alper: That sounds excellent. Could you refresh our long term readers/investors’ memories and tell our many new readers/investors about your background and your Team’s?

Mike Davies: Our Company was founded by Serafino Iacono and Miguel de la Campa back in 2010. They are two gentlemen that have considerable years of experience starting-up companies, raising funds and growing assets for shareholders.

Lombardo Paredes, our CEO, joined in 2014. He deserves the lion’s share of the credit, for executing the implementation the plans at Segovia that have led to the improvements in our production, costs and EBITDA.

I'm the CFO of the Company. I've been involved, since we started the Company in 2010, with a background in corporate finance and public companies to support the team in Colombia as we move ahead.

Our head of exploration is Alessandro Cecchi. He has considerable experience in South America and now particularly in Colombia, leading the programs both at Segovia and Marmato.

Dr. Allen Alper: All of you have excellent backgrounds and excellent track records. The whole team can be proud of your projects and the results you're achieving.

Mike Davies: Yeah, thank you.

Dr. Allen Alper: Mike, could you tell our readers/investors the primary reasons they should consider investing in your Company?

Mike Davies: I think there are a couple of things. One is the re-rating potential, the valuation opportunity that exists, within our current share price, relative to where our peers are and where the analysts believe our shares should be trading, based on what we have at the moment. I think the quality of the assets, both Segovia, which is high-grade and has been recognized as one of the top five highest grade underground producing gold mines in the world, in the last two years, certainly speaks to the quality of the asset and the production and cash flows it has been generating the last couple of years.

I think the Marmato project, which is now starting to move forward, looking at the underground expansion, for which we believe we are getting no valuation at the moment, potentially will help us get additional value created for our shareholders as we complete the studies this year and start to bring that project to life, with the intention that we go from the 230,000 ounces a year we're producing right now to something closer to 400,000 ounces in a couple of years’ time, as we continue to grow this Company through our pipeline of projects.

Dr. Allen Alper: Those are excellent reasons for our readers/investors to consider investing in Gran Colombia Gold. Mike, is there anything else you would like to add?

Mike Davies: No, I appreciate the opportunity today to share more information about the Company with you and Metals News. It continues to be an exciting time, not only for the Company, but for the gold market in general. The price movement we've seen, in the last few weeks, is giving some validation to people in the market, who believe the gold price should be higher than where it has been. I think it affords good opportunity for Companies like Gran Colombia to grow and provide good values for shareholders through their performance.

Dr. Allen Alper: That's excellent. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

http://www.grancolombiagold.com/

Mike Davies

Chief Financial Officer

(416) 360-4653

investorrelations@grancolombiagold.com

|

|