Interview with Craig Alford, CEO and Director of Oroplata Resources (OTC: ORRP) Rapidly Developing a Very Large Lithium Brine Target in Railroad Valley, Nevada

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 7/21/2016

Oroplata Resources Inc. (OTC: ORRP) is rapidly developing a very large lithium brine target in Railroad

Valley, Nevada, first identified as lithium rich by the USGS roughly 20 years ago. The company plans to

produce battery grade lithium carbonate using a low cost, low environmental impact method of lithium

extraction. Craig Alford, CEO and Director of Oroplata Resources, believes that they have one of the best

closed basins in the state and they will use the best drill techniques and the best science to bring up an

amazing resource. The company's stock is getting a lot of traction as the result of environmental

awareness and social acceptance of clean energy solutions. Mr. Alford stated that the American lithium

market is going to be the highest growth market in the world for a while and Oroplata Resources will become

a substantial, profitable US-based lithium producer.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-chief of Metals News, interviewing Craig Alford,

who is CEO and director of Oroplata Resources Incorporated. Could you tell me a little bit about your

company and what you are doing?

Craig Alford: Yes, Oroplata Resources is a pretty new company, reinventing ourselves in the

lithium space. We believe we have some exciting targets in the Southwest U.S. particularly the Railroad

Valley target where we have a large land position. It's all come on pretty suddenly, in terms of the last

year or so, spurred on by the ever increasing lithium market demands. We believe the Southwest U.S. will

represent one of the highest growth-rate Lithium markets in the world, with a number of companies, like

Tesla and Faraday operating there and we have, of course, our own automakers like Ford, GM, devoting so

much towards the electric vehicle market.

Dr. Allen Alper: That sounds great. Could you tell me a bit about the property you will acquire in

Nevada?

Craig Alford: Okay. Our VP exploration, Greg Kuzma, and I worked together in Argentina. I've

worked in Chile. We’ve both seen the giant salars that produce lithium brines in in South America, within

the arid high plateau. I've been to many of the famous Salars there, and what I see in Southwest, US, is

that exact same depositional setting, the same arid trapped basins. The same indications that we have very

good potential lithium traps, and obviously there is one Lithium producer in Nevada at Clayton Valley.

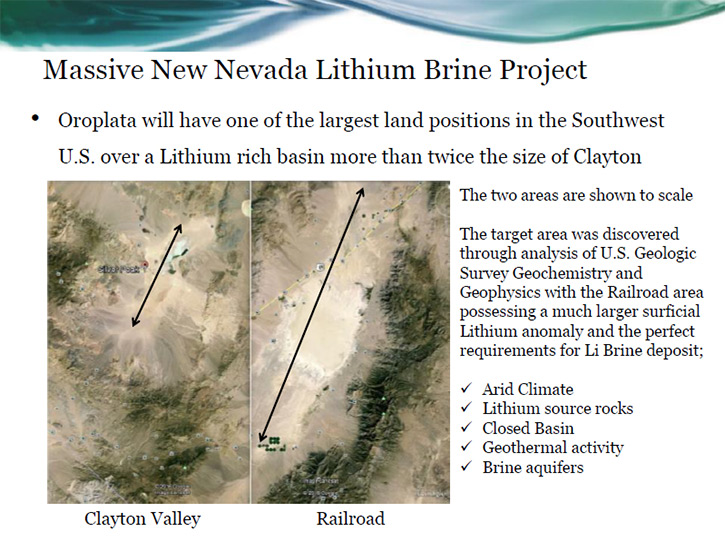

In looking at Clayton Valley, I believe it's not a unique situation. There are many others to be

discovered, and turning our eyes to Railroad Valley was done for a number of reasons. It obviously is an

excellent trap, it's one of the longest topographical closed basins in Nevada. It's actually over one

hundred miles north-south, and twenty-five to fifteen miles east-west, it's actually up there if you

compare it against the size of some of the South American Salars.

It stands out quite predominantly as a target of interest. The surrounding mountain masses are

dominated by Tertiary aged volcanics, which again is a clue that these lithium source rocks have been

providing lithium into the basin for potentially millions of years. So we definitely needed to check it

out. In looking at the USGS data base, particularly some of the dry sediment and water sampling, done over

the last forty years, we saw there was a strong lithium presence at Railroad Valley. It's almost a bulls

eye target over the project area.

Dr. Allen Alper: That sounds very good. Could you tell me a bit more about your plans, at Oroplata

Resources, going forward this year, and next?

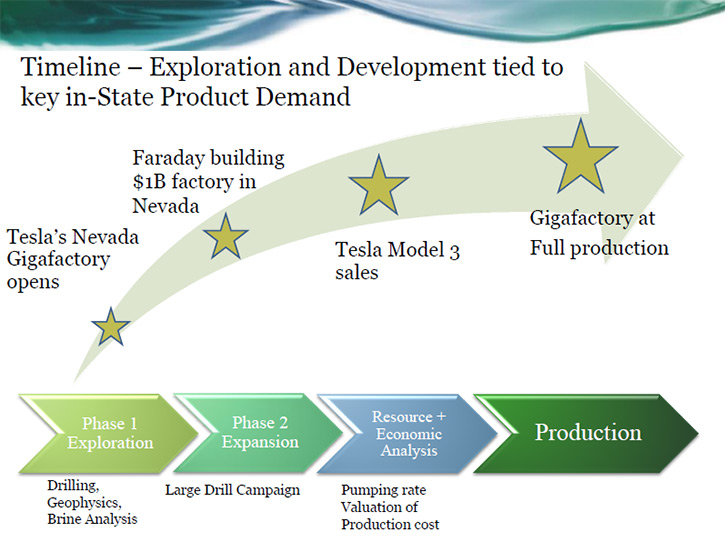

Craig Alford: We are currently in the funding phase of our program. However, we've already been

drawing up a drill program. In truth, we've looked at the competitors in the area, and in the space, and

we'd like to approach this with good science, and good methodology. We're actually trying to think ahead

and do things right, not destroy formations or mud up possible aquifers, so we really are paying attention

to how we are going to, not only drill, but test the brines, because that's another tricky situation, doing

proper testing of your brines. We also need some good temperature readings, as there may be a geothermal

element that may kick up the lithium in the brines. We want to think and do some good science before we run

ahead. We definitely have plans to drill, likely, in September, and it's going to be exciting.

Dr. Allen Alper: Good. That sounds great. Could you tell me a little bit about your background? I

know you have a great background, great experience, so I think our readers would like to know more about

it.

Craig Alford: Yeah sure. I've been lucky enough to start my career in the eighties and see the

world open up with the fall of the former Soviet Union. Many North American companies began conducting more

worldwide exploration than previously had been done. So for the last thirty years or so I've actually

worked throughout South America, throughout Africa, throughout Asia, within Australia and of course back

here in North America. I've worked all over, for a number of companies, and with several different

commodities, as well.

I've had fantastic exposure to some of the best mineralized districts in the world, and it's always

great to come back home and see the analogies, and mentally bring the methodology, the models and apply

them back here. I think that works very well for Nevada, maybe Arizona and parts of California. We are

going to see a renaissance in Lithium production here that formerly was done in Chile, Argentina, and

perhaps Bolivia. Bolivia may still come online, but we don't know, politically, it's still a bit unstable.

It's an exciting time for Lithium. I'm really happy to have gotten such great worldwide exposure in my

career.

Dr. Allen Alper: That is excellent. Could you tell me a bit more about the team?

Craig Alford: We have a great team. We have Greg Kuzma and myself, leading the geologic thought,

for now. Greg and I worked together contemporaneously at Teck Resources, he was based in the Reno office.

He was also in Argentina and in Chile, for a time, that's actually where we met, originally. Greg has spent

a lot of years in the Great Basin, in Nevada. He's conducted forty to fifty large drill programs

throughout his career, in Nevada alone. He has great first-hand knowledge of just about every formation.

Whereas, I often tend to be maybe more of a macroscopic kind of guy, Greg compliments my experience by

bringing it down to formational levels and knowing every basin, and person in Nevada. It's very helpful.

Dr. Allen Alper: That's excellent. It's good to have someone to work with you know and who has great

experience.

Craig Alford: Yeah. We're adding to our team. We're going to make some announcements soon about

new members coming in advisory positions, as well as new board members. I think it's going to be a real eye

opener for a lot of people because of who is stepping in with us. We do have our eyes on other areas, other

basins. It's going to be an exciting, probably nine months, for us, as we get going and for interested

readers and followers that watch our news releases.

Dr. Allen Alper: That sounds very good. Could you tell me a bit about your board, and your

investors?

Craig Alford: Our investors… I kind of have to admit, it shocked me the response we got out of

the gate, when we announced the acquisition. Our volume has been tremendous. Obviously there are people who

know me, and have followed me in the past here in the States, and maybe they have been buying. We seem now

to have a large following. It's amazing to see the positive response we've had for the news that we've put

out so far, it's been about thirty days, and we've seen tremendous stock movement and volume. There are a

lot of people who now understand the Lithium space. They get very excited when I walk through the strategic

methods of what we are doing, as well as the core project at Railroad Valley.

Dr. Allen Alper: That sounds excellent. Could you tell me a little bit about your share structure,

capital structure?

Craig Alford: Currently we have forty million shares outstanding. Twenty-five million in a

restricted block that management holds, and there are fifteen million in the float.

Dr. Allen Alper: Okay. What is your market cap at the present?

Craig Alford: About sixty million.

Dr. Allen Alper: For a very young company you are doing very well. You are doing all the right

things.

Craig Alford: The stock is getting a lot of traction, obviously. We believe that's a result of

the general social acceptance of where we are going with electric cars. Everybody is more conscious of the

environment. I think this is becoming more of a social issue, now the people are excepting it, as opposed

to a financial issue, i.e., the comparison with the oil prices verses electric cars.

Dr. Allen Alper: Could you elaborate a bit more on what's driving the market, the forecast,

batteries and automobiles?

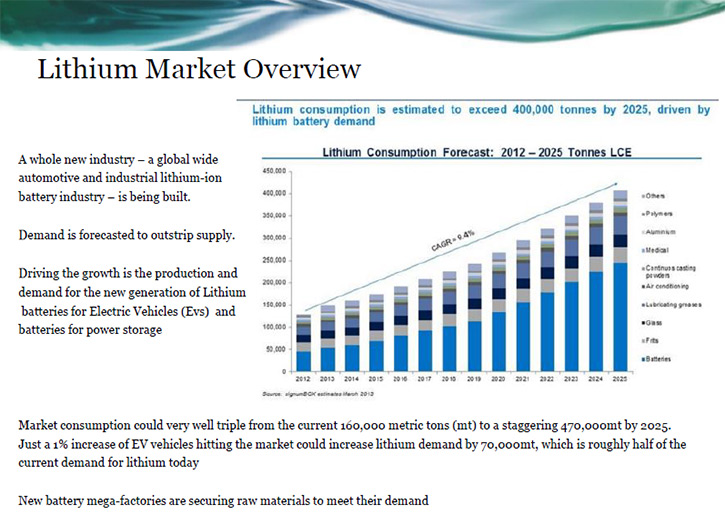

Craig Alford: Lithium currently has its uses in various industries. However, the greatest growth

in demand predicted over the next decade will be the growth in the electric vehicle market. Tesla is

opening its Gigafactory this month, here in Nevada, and the current number of new models of cars that it's

producing will actually require the worlds’ entire production of lithium. The excitement over their T3

model has really gripped the consumer. Companies like Ford, Chevy and GM have responded in the electric

vehicle market. Ford has devoted four point five billion to electric vehicles.

GM now has more than half its designers working on it. Others like Volkswagen, Chevy and now the

Faraday plant in Las Vegas will be producing electric vehicles. I think we are seeing a tipping point,

where in the next few years we're going to see common usage of electric vehicles, worldwide.

Some governments like California have come out with legislation, where they have sort of mandated

the use of alternative fuel vehicles on the road.

There'll be all sorts of new standards, by 2025, in the United States, Europe. Goldman Sachs

published a report titled, “What if I told you”. One of their key highlights is, “What if I told you

lithium would be the new gasoline?” There's a link on our website to the Goldman Sachs article.

I think it will also be the social issues that will change the consumer rather than a pure necessity to

change. A love for the idea of a vehicle with such a low environmental impact. So, I think we are going to

see a massive demand for Lithium.

Dr. Allen Alper: That sounds pretty good to me. I love that statement, lithium is the new gasoline.

There's no doubt about all the pollution a gasoline vehicle causes.

Craig Alford: The government of China is now considering California-like legislation, mandating a

certain percentage of electric vehicle use. China is plagued with some very polluted cityscapes. I have

spent a lot of time in Beijing and Shanghai and the smog can be horrible.

There are also incentives with government rebates for people to switch from their gas vehicles to electric.

I think we are going to see this happen pretty fast. It wouldn't surprise me if the big oil companies,

watching the major car plants producing the new fleet of electric vehicles, are having some board meetings

to see about getting into the lithium space. That's going to start some real market excitement, when that

starts happening.

Dr. Allen Alper: That's excellent. By the way, I looked at your website it's a beautiful website.

Craig Alford: Thank you.

Dr. Allen Alper: Could you tell me the primary reasons why our high-net-worth investors should

invest in your company?

Craig Alford: I think we have one of the best closed basins in the state. It's comparable in size

to the Salar de Atacama in Chile. There are a number of Lithium companies that have taken off, like

Orocobre, and their market caps now are in the range of a billion. Orocobre is going to produce from an

area much smaller in size than our target. So I think we have a very amazing target. The drilling will bear

out the concentrations of lithium and the size that we are going to see. We have also watched companies,

like Pure Energy Minerals come in and very rapidly bring up an inferred resource nearly up to a million

tons of Lithium. Oroplata will be employing the best drill techniques, and our best science to do just

that, bring up an amazing resource.

I would add, when you ask the question, "Why high-net-worth people would want to invest in Oroplata

Resources," we are probably one of the only US listed companies that has a presence in the Lithium space. I

hate to kind of sound like I'm being a bit cheesy here, but you know when Trump says, "Let's make America

great again." That is essentially what this industry will do. It will curb our need for imported oil. In

producing lithium batteries on a large scale and at a cost that most consumers can afford, it will make

this industry the envy of the world. We're going to be part of a new industry, that didn't exist five or 10

years ago. The Tesla Gigafactory opens in July, there will be many jobs created there, and we want to be a

part of that supply chain. I have called it a renaissance, but it's more of a revolution in how we think

about powering vehicles and our homes, using technology that literally leaves no carbon footprint.

When you look at the geographic market demand for Lithium, we'll be right in the middle of it, in the state

of Nevada. Both Clinton and Trump talking about putting certain trade barriers up, we don't know whether

that will happen or not, but certainly I would think that the Gigafactories that are in the United States,

would want to have a reliable supplier of lithium carbonate. It makes sense to have a supplier in the US,

as opposed to having to import it from overseas.

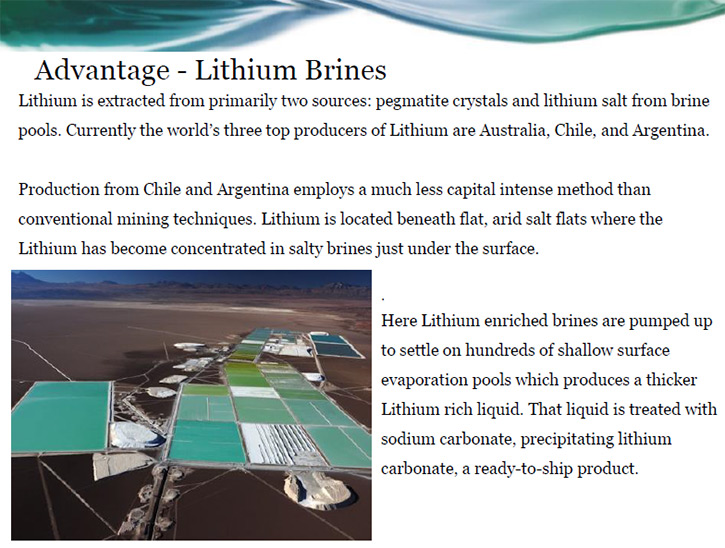

There are two techniques to extract lithium from the world. One, is the conventional mining style

for the ancient lithium spodumene deposits. However this is very capital intensive and the exploration for

such deposits is pricey and takes a fair amount of time to build up a reserve. The other is the Lithium

Brine extraction method, which is much less capital intensive and can build up reserves faster. To meet the

Lithium demands in the next four years, the brines deposits are going to be the ones that are going to be

able to do it.

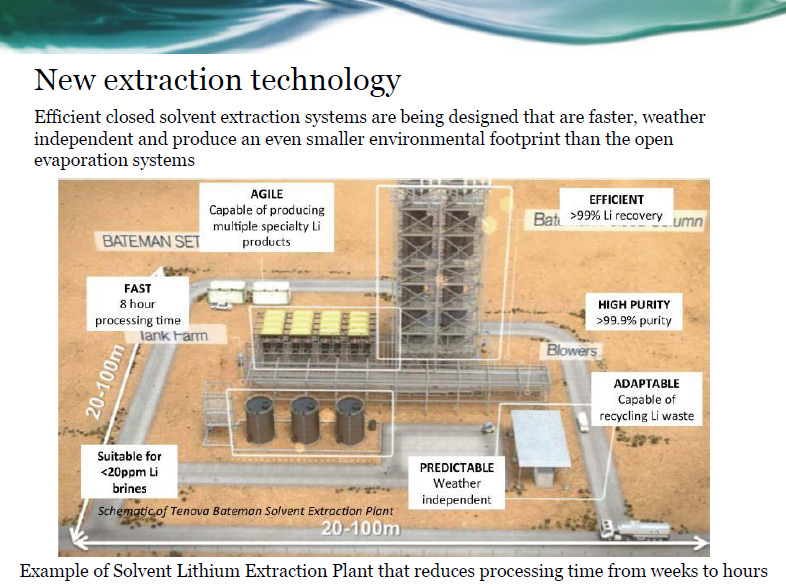

Within Brine production, there are basically two methods of extraction. Typically used is the classic

evaporitic model, which has a low environmental impact. Essentially you are employing lined football sized

fields and letting the water evaporate out, leaving behind its solid contents, like lithium. There's

another newer faster and more weather independent method of solvent extraction, and your waste product is

water, which you can pump back into the valleys. So it's not only a green technology in terms of its end

product, but it's a pretty green, low environmental impact production method.

Dr. Allen Alper: That sounds excellent. Is your company going to go into manufacturing the

carbonate?

Craig Alford: The product from the brine, is a lithium carbonate. The lithium is mixed,

eventually with a soda ash and the end product is the desired product for the battery makers, lithium

carbonate. It's really nice to actually have that symbiosis where we are producing the very thing they need

- battery grade lithium carbonate.

Dr. Allen Alper: You said something about, the differential in capex between the brines and

spodumene; could you elaborate a little bit on that?

Craig Alford: Within the conventional mining method, where you have to build a mine and mill, the

capex is typically going to be at three hundred million plus, depending on the size of your mine. Working

through regulations and permitting also take time, so that kind of development from project to mine usually

happens over a decade, and probably runs at the end of the day to around the five hundred million level.

Whereas the brine deposit methodology is much less capital intensive, particularly when it comes to

production, your raw product is essentially water, there is no underground mine or open pit, you're just

pumping out mineral laden water onto the flat fields.

Of course, topographically you're already in a flat basin, so it's not very difficult to create a

large flat trapped pond. You basically just have to line it. You can actually go to Google Earth, take a

look at the Clayton Valley or the Salar de Atacama in Chile, and you can zoom in on these large evaporitic

pools. This is a very cheap method of production. You cannot compare it at all with the capital

expenditures of a large mining and milling operation.

Dr. Allen Alper: That sounds excellent. I'm very impressed with how fast you are pulling this all

together.

Craig Alford: For about the last eight to nine months, I have met some people and we've discussed

targets. Our target selection was dwindled down to a few basins, so, yes, we still have our eyes on some

targets, but we really believe that the Railroad Valley could be something that definitely competes with

anything I've seen in Chile, and Argentina.

The Railroad Valley is a huge basin that used to have in it a large lake of approximately five

hundred and fifty square miles, and that since has evaporated, so we have a great potential for lithium

concentration. I'm quite excited

The Valley is huge compared to the Clayton Valley. If we had selected to target the Clayton Valley we would

have only been able to get a small land position, and perhaps not in the central axis of the basin itself,

so I like our land position, and it's going to be an amazing time if we can pull out a large resource

there.

Dr. Allen Alper: That's great. Is there anything else that you would like to add?

Craig Alford: There are a lot of articles, currently about lithium, as well as its demand. I

would recommend that any investor should do some internet searches on both the products and the coming

demand; I don't want them to miss out on the revolution. It's going to be quite exciting. It's going to be

a homegrown business, here, with Tesla, Faraday, and the big American car makers. We are going to see a lot

of attention and growth in this area of the Southwest US.

Dr. Allen Alper: That's really great. It's nice to hear encouraging news about the US, and the US

manufacturing, and the US concern for the environment, and how well positioned the US is.

Craig Alford: Yes, I think both our company, Oroplata Resources and the U.S. itself will

certainly have the distinct first mover advantage.

Dr. Allen Alper: That was excellent. You fellows have done excellent work. That's really good.

Craig Alford: Thank you, its been great to be able to discuss the project.

Dr. Allen Alper: At some time I'd like to get together and meet you all. It sounds like you're doing

the right thing, and doing very well at it.

http://www.oroplataresourcesinc.com/

Craig Alford

B.Sc., M.Sc.(Hons) P.Geo.

CEO/Director

Email: craig.alford@oroplataresourcesinc.com

Phone: +1-702-318-7218

Address:

Oroplata Resources, Inc.

170 S Green Valley Parkway, Suite 300

Henderson, NV

89012

|

|