Orocobre Ltd (ASX: ORE, TSX: ORL). a Leading Lithium Company Operating in South America’s ‘Lithium Triangle’

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 8/26/2016

Dr. Allen Alper, Editor-in-chief of Metals News, interviewed Andrew Barber, Investor Relations Manager at Orocobre Ltd (ASX: ORE, TSX: ORL). Orocobre is a leading company operating in South America’s ‘Lithium Triangle’, a region that boasts one of the largest reserves of lithium in the world. It has established a substantial presence in Argentina by construction of large scale lithium and boron projects and facilities.

About the Company

Orocobre Ltd.is dual listed on the Toronto Stock Exchange under the symbol "ORL", and on the Australian Securities Exchange under the symbol "ORE".

The company is also listed in the S&P/ASX All Australian 200 Index that contains large and small Australian domiciled companies. Its Olaroz Lithium facility built at its flagship Salar de Olaroz resource in Argentina is the first large scale de-novo brine based lithium project in more than two decades.

Management background

Mr. Robert Hubbard is the Non-Executive Chairman of Orocobre who has been working for the company as a Director since November 2012. He has over two decades of experience working for PricewaterhouseCoopers. During his tenure at PwC, he served as auditor and adviser for leading resource companies based in Australia with activities in different regions in Australia, West Africa, Papua New Guinea, and South America.

Apart from Orocobre, Mr. Hubbard also holds the position of a non-executive Director in different commercial and community focused organizations. At the present, he is the Chairman of Opera Queensland, Council member of the University of the Sunshine Coast, and a Director of JK Tech Pty Ltd. He is also Chairman of Central Petroleum Limited and non-executive Director of Adelaide Bank Limited, Bendigo, Primary Health Care Limited.

Mr. Richard P. Seville is the Managing Director and CEO of Orocobre. He is geotechnical engineer and a mining geologist having more than three decades of experience in the minerals sector, covering mine development, exploration, and mine operations. He has a considerable corporate experience, including holding C-level positions of Operations Director and/or CEO in ASX/AIM listed mining companies

Mr. John W. Gibson Jr. is also a Non-Executive Director at Orocobre. He is well-known in the energy technology industry with more than 25 years of experience in global energy sector. He has served as CEO of Tervita Corporation – a Canadian environmental and oil field service company - and is at the moment serving as Director of the company. Before joining Tervita, he had served as CEO of a large software company whose clients includes oil and gas companies, and also President of Halliburton’s Energy Services Group.

Mr. Federico Nicholson is also a Non-Executive Director at Orocobre. Previously he had served as the V.P. of the Argentine Industrial Union (UIA), which is the country’s leading advocacy group for businesses, from 1999 to 2013. Currently he is serving as President of the Argentine North Regional Sugar Centre. He also occupies the position of First V.P. of CEADS (Consejo Empresario Argentino para el Desarrollo Sustentable) that is an Argentinean local division of WBCSD (World Business Council for Sustainable Development). Other than that he is also a member of the board of many different organizations in Argentina.

Overview of operations

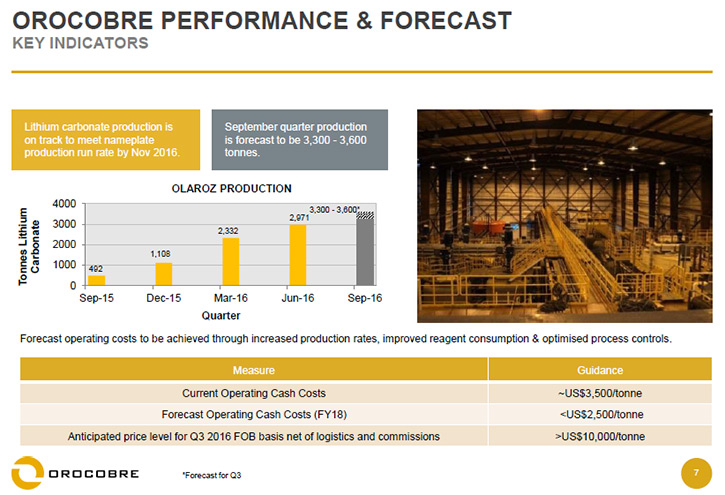

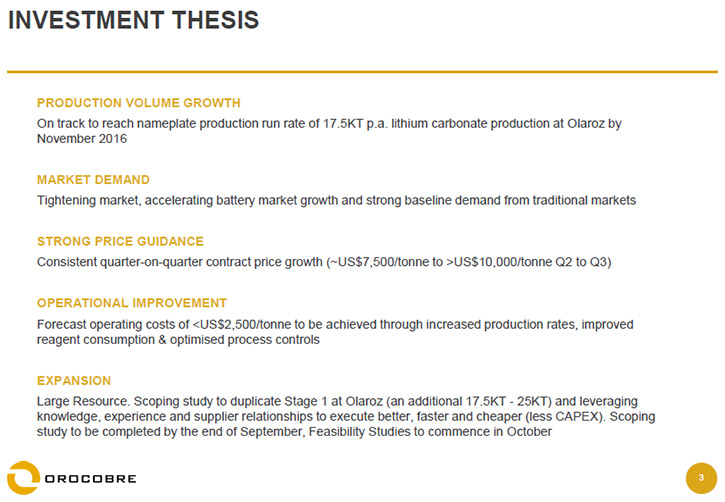

Talking about operations of the company, Mr. Barber said that Orocobre is the newest supplier of lithium carbonate across the world. It operates through its Salar de Olaroz facility. After years of planning, development, construction, and commissioning, the Facility has come to a stage where it is increasing its lithium carbonate production and will reach nameplate capacity of 17,500tpa by the end of 2016.

According to Mr. Barber, Olaroz contains a JORC/NI43-101 compliant, low-cost, high quality, and long life resource. It has a verified resource of 6.4 Mt LCE that is capable of sustaining continuous production for over forty years.

More than 50% of the world’s lithium supply comes from lithium brines in a region known as the ‘Lithium Triangle’. The area encompasses mountainous regions in Argentina, Bolivia, and Chile. Supply of lithium from this region greatly altered the global lithium market that resulted in closure of a number of mineral conversion plants in China, Russia, and the US.

Lithium brine bodies are found in salt lakes. They are formed in the basins underneath the water where lithium leached from surrounding rocks gets trapped and evaporates. Lithium is extracted using a technique where brines are pumped into a series of evaporation ponds. The process crystallizes other salts and thereby leaving lithium-rich liquor that is further processed for impurity removal and finally converted into lithium carbonate. Most of the lithium extracted from brines is used for batteries and chemical purposes with the rest used in technical applications.

At the moment, an exchange traded market doesn’t exist for lithium chemicals. Customers and the producers negotiate the prices. That said, prices quoted for lithium used for chemicals is correlated with the same trend as lithium carbonate prices.

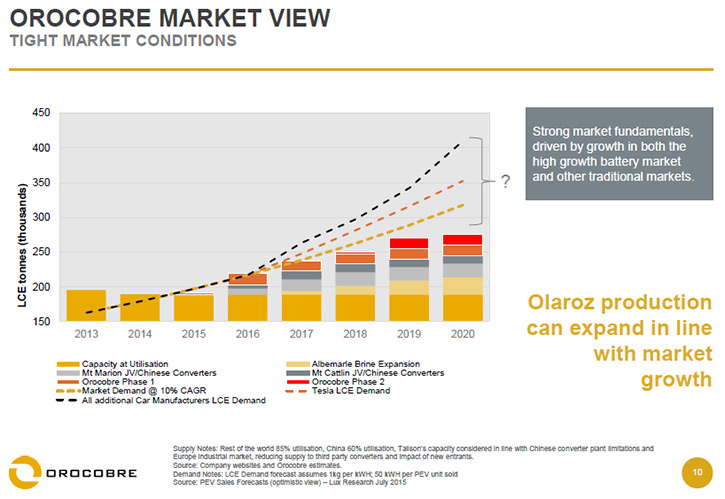

Growth in the sector

Mr. Barber said that his company believes that the medium-term demand for lithium in the coming years will be more strongly influenced by battery applications in North America, Europe and Asia, while its supply will be dominated by Argentina, Chile, China, and Australia. He said there is a need for significant increase in brine-based production and mineral conversion plants in Asia to meet the growing demands of the lithium market.

Lithium has a number of uses in different sectors, such as automobile, IT, transportation, and others. It is used to make batteries that power cars, scooters, bikes, forklifts, busses, power tools, cell phones, laptops, and many other items. Latest applications of lithium include use in electric cars, energy generation, and grid energy storage. Due to its wide scale use, it is expected that lithium will experience a remarkable increase in demand and prices in the coming decade.

The developments are expected to occur in accordance with the expanding lithium market, which in 2015 stood at US$23.6 billion and is expected to be US$34.3 billion by the end of this decade, according to a Citi Research (Citigroup).

Recent Initiatives

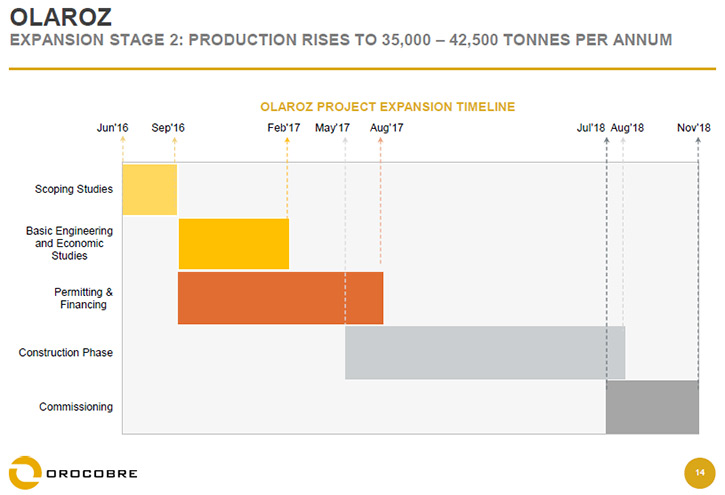

Talking about recent developments at Orocobre, Mr. Barber said that his company had received expressions of interest from different parties for expansion of Phase II of its Olaroz project. This shows the confidence of the market for enhanced potential of the Olaroz resource as well as expected growth profile of the lithium market.

Managing Director Richard Seville had commented on this program by saying that he was delighted to have completed this stage of the program, which produced a Measured and Indicated Resource of 6.4 million tonnes of lithium carbonate. This was more than a fourfold increase of the previous Inferred Resource of 1.5 million tones. The company’s original 2008 drilling program highlighted the challenges of assessing these immature, soft sediment salars, typical of Argentina. He said that they have developed “state of the art” techniques to collect the quality of data necessary for a resource estimate at these confidence levels.

Mr. Seville further added that the grade of the company’s resources, even using no grade cut-off, is high and reduces capital costs of ponds as less evaporation time is required. The large, broad surface area of the Olaroz salar, and consistently high grades at depth, give us confidence that attractive grades will be maintained over time in a potential production scenario. The resource attributes, together with the quality of the data, gave the company a great deal of confidence in the results, and clearly differentiates it from other projects.

Mr. Barber stated that Orocobre will examine all possibilities when making plans for expansion of Phase II over the next year. His company is continuing to evaluate its options and conduct research about possible expansion of not only Olaroz, but development of its other lithium assets in Argentina. He said that the Board of Directors of the company will pursue all those opportunities that will add shareholder value in an efficient and effective manner.

According to Mr. Barber the Olaroz facility took off as a joint venture between Toyota Tsusho Corporation and a Government of Jujuy owned mining investment firm. He said that the sheer size of the Olaroz resource in Argentina in addition to sustainable business practices supports the potential for prospective expansion plans.

Mr. Barber stated that Orocobre solidified its base in northern Argentina in 2012 with the Borax Argentina deal. Borax Argentina, he said, owns one of the rare and significant mineral deposits in the world where large quantities of borate can be found. In addition, Borax Argentina also possesses a considerable quantity of estimated mineralization with long life output.

Beyond its current operations, Mr. Barber said that Orocobre is also positioned for considerable growth by development of its Salar de Cauchari property, the expansion potential of Salar de Olaroz, and through the development of its lithium and borates projects in the Northwestern region of Argentina.

http://www.orocobre.com/

PO Box 1946

Milton QLD 4064

Phone: +61 7 3871 3985

Fax: +61 7 3720 8988

Email: mail@orocobre.com

|

|