Dr. David Webb, President & CEO, Sixty North Gold Mining Ltd. (CSE: SXTY; FKT: 2F4; OTC-Pink: SXNTF) Discusses Restarting the High-Grade Past Producing Mon Mine in the Prolific Yellowknife Gold Camp.

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 12/15/2021

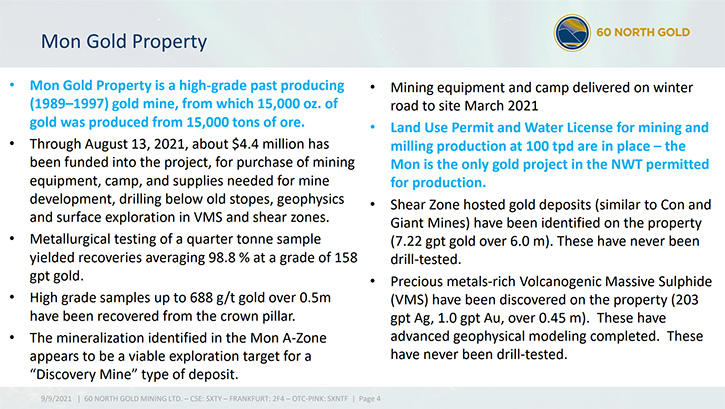

We spoke with Dr. David Webb, President & CEO of Sixty North Gold Mining Ltd. (CSE: SXTY; FKT: 2F4; OTC-Pink: SXNTF). Sixty North Gold Mining is focused on restarting the high-grade, past producing Mon Mine, 40 km north of Yellowknife, NWT, within the prolific Yellowknife Gold Camp. The Board of Directors has recently approved the 2022 development plan that includes significant expanding of the underground development, from 213m above mean sea level (AMSL) to elevation 177m AMSL, to open up an expected 30,000 tonnes of vein, below the previous stopes (that had produced 15,000 tonnes at 30 gpt from 15 vertical metres to elevation 225m AMSL). Next, they plan to initiate preliminary work to develop the next level, below this, to elevation 165m AMSL (another 45m below the current development), targeting an additional 25,000 tonnes of vein. Additionally, the Company will build winter road and other necessary equipment to enable milling at 100tpd.

Sixty North Gold Mining Ltd.

Dr. Allen Alper:

This is Dr. Allen Alper, Editor-in-Chief of Metals News, talking with Dr. Dave Webb, who is President and CEO of Sixty North Gold Mine, Ltd. Dave, the last time we spoke was early this year. I was hoping you could give us an overview of your Company, tell us what differentiates your Company from others and tell us what has been happening in 2021 and your plans for 2022?

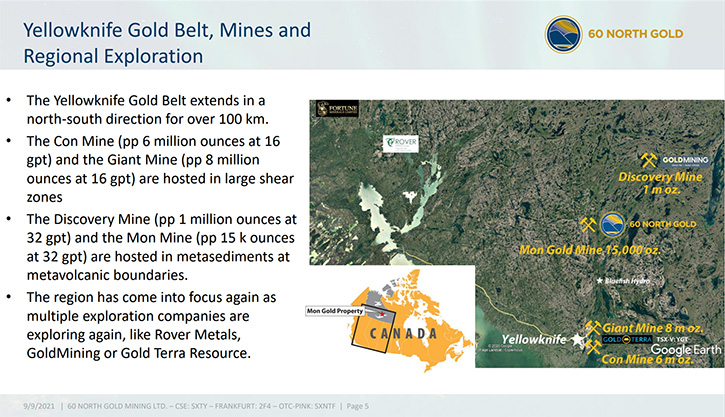

Dr. Dave Webb:Sixty North Gold Mining Ltd. is a junior mining company that has focused not on the exploration for gold, but rather for the development of it. It’s rather unique in that we're falling back to the way things were done 50, 60 years ago. My reference for that is we're operating in the Yellowknife Gold Belt in Northwest Territories Canada, and that was really anchored by the three big mines in the area. That's the Con Mine, at the south end of the Belt, and it started in 1937 at 100 tons per day.

The Giant Mine was a little bit of a latecomer, it started in 1948 at 235 tons a day, although it took two years to attain that capacity. And up at the north end of the belt, roughly 90 kilometers away, was the Discovery Mine that started at 100 tons a day in 1949. The Mon Property, which is our focus, was discovered in 1937 by a Cominco, when they made their discovery in Yellowknife, and they were looking to see what else existed in the belt. They saw the quartz vein there; it has spectacular grades, many samples over hundreds of grams of gold per ton and they sunk a shaft on it. So they trenched, sunk a shaft, did some sub drifting and just couldn't find the down-dip extension of the vein.

Many drill programs later, with intercepts here and there, the story was put together. It's actually a folded quartz vein, folded into a horseshoe shape, and in 1989, the first ramp was put into the mineralization and some tonnage (2,300 tonnes) was taken out. It had graded about 26 grams of gold per ton, in the sampling, and that was processed in Yellowknife. That was followed up by another mining campaign, taking out about 12,000 tons, at about 30 grams of gold per ton, and that was processed on site.

We had found that when you process yourself, the grade tends to go up. If you ship it to a custom mill grade seems to go down for some mysterious reason. What we've done is, given that only a small volume of the vein was mined, we're going to ramp down underneath it and continue mining it. No need to put drill holes into explore for it, we have drill holes, we know where it is, we have the mining equipment and we're permitted for mining and milling on the property. That's what our plan was.

In 2021, we moved all of our equipment onto the property. Our fuel, our explosives, camps, mining equipment. We opened up an old adit to the side of the hill, and we refurbished about 125 meters of ramp to get down underneath the old, stoped areas. So we're set to continue doing that and extracting and developing stopes and extracting mineralization.

Dr. Allen Alper:

Well, that sounds excellent. It sounds like you've made great progress this past year, in a difficult year. That was excellent!

Dr. Dave Webb:

It was indeed very difficult, both moving people around and now more so, that they can't get on airplanes, without having their vaccine certificates in Canada and not everybody does. The Northwest Territories, with its high percentage of First Nations people, tends to be a little bit more sensitive, just because of the remoteness and inability to service smaller communities. They actually had a hard border set up, and you could not get in unless you were an essential service worker or resident and fully vaccinated.

Dr. Allen Alper:

Yes. I'm very impressed with the progress you made in that difficult time, and it is still, as you said, a very difficult period. I hope this will finally get ahead of COVID. It has really been a disaster for everyone!

Dr. Dave Webb:

Well, we've certainly learned ways to operate around it. The supply chain, of course, was disrupted, with people not showing up for work. One issue we had, in particular, was as we were mining, we use ANFO loading hose, just a five-eighth inch plastic tube that hooks up to our explosive loader, where we can pneumatically blow little prills of explosives into the drill holes that we have. You'd imagine that, yes, any old plastic hose might do, but when you're dealing with explosives, it has to be anti-static. You can imagine why. The manufacturer for that stopped manufacturing in February of 2021, and you just could not find the supplies. So we had friends over at Fortune Minerals send us some that they had and other associates that we had down in North Bay could draw it out of their warehouses. But you could not buy it from the explosive suppliers.

Dr. Allen Alper:

Well, I'm glad that you were creative and able to figure out how to move forward, Dave, could you tell us the primary goals for 2022?

Dr. Dave Webb:

Our plan is to advance our development to access approximately 30,000 tons of the vein material. I'm avoiding using the word “ore” because that would require a feasibility study and we do not have a feasibility study, so we'll call it “vein material”. The previous vein material had been pulled out of the stopes above us, at 30 grams of gold per ton, and we are mining in the same vein, just another 20 meters of elevation, with historic drill holes that demonstrate the vein is there. The vein is there with gold, and we intend to develop the stopes and commence mining.

The purpose of that is to get it prepared, so that we can feed our 100 ton per day mill, which we are in the process of assembling. Our metallurgist is out acquiring components for, us so that we can get this all put together and that will allow us to process at 100 tons a day. Presumably, what we hope to have coming out at one ounce per ton, but we can't certify that or verify what the historic grades were.

Dr. Allen Alper:

That sounds excellent. Dave, could you tell our readers/investors about your background, your Team, your Board?

Dr. Dave Webb:

I'll start with the Board because they're the new guys here on this property. John Campbell is our Chairman and he's also the CFO of the Company. I am the President and CEO of the Company, but I am not on the Board. The balance of the Board includes several accountants, geologists, and a retired mining engineer. So, we have the gray hair and have done this sort of stuff in the past, but it's heavily weighted on the financial side. There are three chartered accountants on the Board.

The operating side of the Company is New Discovery Mines Ltd. That's a private Company, who is vending this project. Gerry Hess and I are the only two Directors of the Company, so we own that and we're vending that to Sixty North. But our Operations Team included an early 70s-year-old Mine Manager, who's from Saskatchewan, an Assistant Mine Manager, I guess he's in his 60s. A Team of younger people, in their late 30s, to do the mining side of it.

We have history, not only in the Northwest Territories and underground mining, but Rod Mackay, our Mine Manager, had worked up at Tyhee and was Assistant Mine Manager there. Gerry Hess, my partner, in New Discovery Mines, was the former Mine Manager on this property, when it was first put into production in the early 1990s. So “been there, done that” and we're just doing it again, using better equipment. And of course, our support staff is slightly younger than we are, just by necessity.

Dr. Allen Alper:

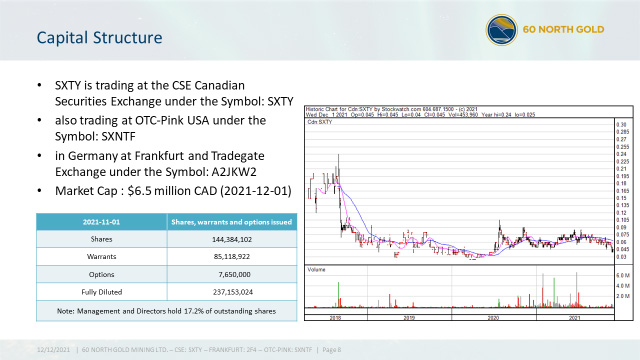

It sounds great. It sounds like you have a very experienced, knowledgeable, diversified Team, so that's excellent. Dave, could you tell us a little bit about your share and capital structure?

Dr. Dave Webb:

That one I'd have to look up and read it to you. But you could pull that down from our website and get it as current as possible. We have a total market cap of about $6 million Canadian, and the assets include about $2 million worth of mining equipment. The property, which will be wholly owned, once the vesting is executed, which should happen in the next six months. Most of it is owned by insiders and Management, so that would include the Directors I mentioned, plus two outside investors who are very heavily involved in what we're doing.

Dr. Allen Alper:

Well, it's good to see that Management has skin in the game and is invested in the project and believe in the project.

Dr. Dave Webb:

Yeah, the Management and Directors control about 17%, and another 20% is with an investor group and an individual. On vesting New Discovery Mines Ltd, which is myself and Gerry Hess, we’ll receive a 25% equity interest in the Company. So, we'll be comfortably over 50% owned, by a very small group of insiders.

Dr. Allen Alper:

Well, it shows that you, the Management and the Board are deeply confident in the Company and willing to put their own money on the line, which is great. Could you tell our readers/ investors the primary reasons they should consider investing in Sixty North Gold Mining, Ltd.?

Dr. Dave Webb:

The reasons that I would highlight to friends and family, are that we're not out exploring hoping to find something. We've decided to go into a place that has past production history. We have all our permits, let's remove that risk from the scene. In short order, we should be mining gold bearing rock, which at some point could be called ore should it meet some criteria that 43-101 stipulates.

We will be pouring gold bricks. We have a mill lined up. We've done the metallurgical work, the test work, and we have the past production history. We know what works up there. We have poured gold bricks up on site and people can do their own calculations that if we're doing it at 100 tons a day, which is what we're permitted to operate at, that's what we operated at in the past. The historic grade from this property is one ounce per ton.

Although we have no ore on site, I can say that the Con Mine, the Discovery Mine and the Giant Mine, the three really large past producers, never had any ore on their startup, either. The first ore reserve, from the Con Mine, came out one year after production (85,000 tons at o.85 opt gold). The Con Mine produced six million ounces of gold, at a half ounce average grade. The Giant Mine produced eight million ounces at a half ounce average grade and the Discovery Mine produced one million ounces of gold, at one-ounce average grade. So, it's high-grade. Historically, these deposits exist and have been known to exist for many decades. We just have another one.

Dr. Allen Alper:

Well, that sounds excellent! That's great! It's great to have an experienced Team know what they're doing and are ready to do it again. Perfect! Is there anything else you'd like to add, Dave?

Dr. Dave Webb:

Well, there's a question that some people raise about remoteness, and I've tried to address that. Having worked in many places in the world, I've worked in outer Mongolia and put a mine and mill into production out there. This isn't a remote area when you can hop in your car, and you can drive to it. It's not remote if, except for COVID times, you could hop on a plane in Vancouver, fly up to Yellowknife, grab a charter flight to the property, visit it, be back to Yellowknife in the afternoon and hop on a commercial flight and fly back to Vancouver and have dinner, that's not remote.

When we need to call for assistance or order a plane or something, and you can pull out your cell phone to do that, that's not remote. That's one thing I want to address. People here in the Northwest Territories, and certainly it's in our name, Sixty North Gold Mining. We're at the road's end. We have an international airport near us. We have a hydroelectric power plant 25 kilometers south of us. We have winter road access to bring our supplies in. It's quite efficient and a very cost-effective way of operating.

Dr. Allen Alper:

That sounds excellent! We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://www.sixtynorthgold.com/

David Webb,

President & Chief Executive Officer

604-818-1400

|

|